Industrial Films Market Size and Forecast 2025 to 2034

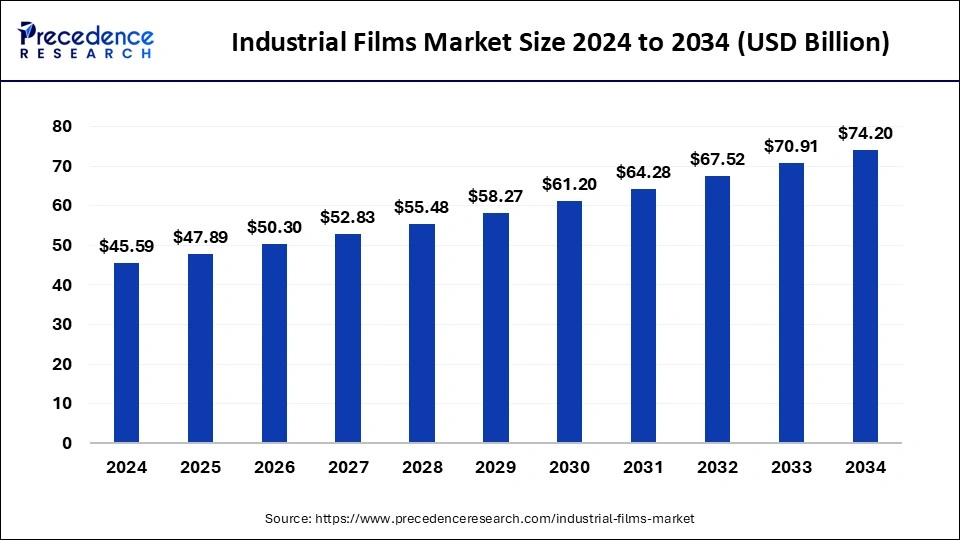

The global industrial films market size was estimated at USD 45.59 billion in 2024 and is predicted to increase from USD 47.89 billion in 2025 to approximately USD 74.20 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034.

Industrial Films Market Key Takeaways

- The global industrial films market was valued at USD 45.59 billion in 2024.

- It is projected to reach USD 74.20 billion by 2034.

- The market is expected to grow at a CAGR of 4.99% from 2025 to 2034.

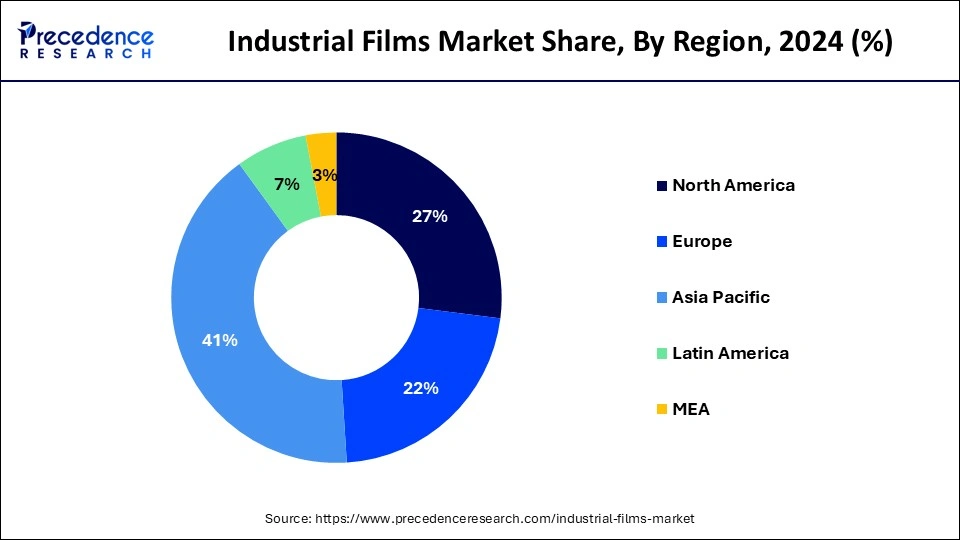

- Asia Pacific dominated the industrial film market with revenue share of 41% in 2024.

- North America is expected to expand at a rapid pace during the forecast period.

- By type, the linear low-density polyethylene (LLDPE) segment accounted for the dominating share of the market in 2024.

- By type, the low-density polyethylene (LDPE) segment is expected to witness significant growth in the market during the forecast period.

- By end user, the agriculture segment held the largest segment of the market in 2024.

- By end user, the industrial packaging segment is expected to grow significantly during the forecast period.

Asia Pacific Industrial Films Market Size and Growth 2025 to 2034

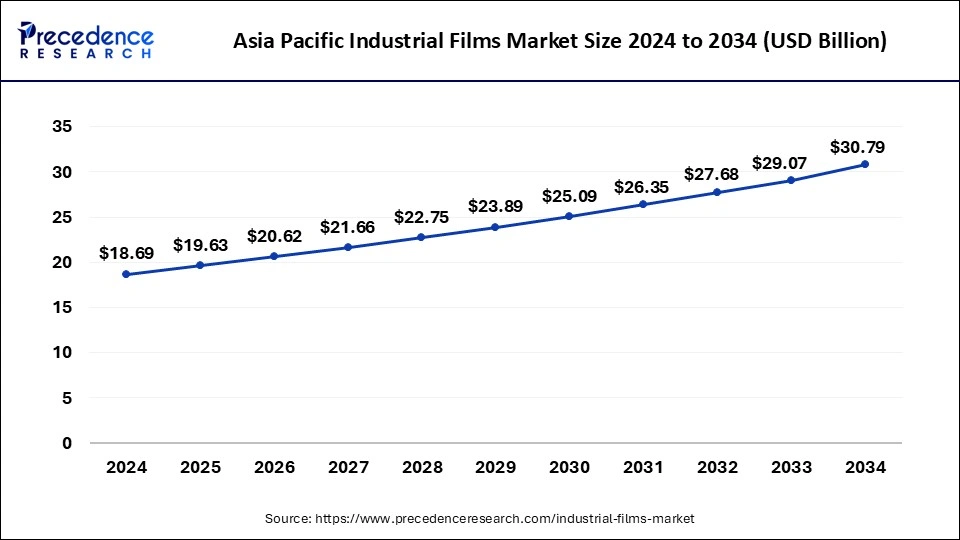

The Asia Pacific industrial films market size surpassed USD 17.80 billion in 2023 and is projected to attain around USD 29.43 billion by 2033, poised to grow at a CAGR of 5.15% from 2025 to 2034.

Asia Pacific held the dominant share of the industrial films market in 2024 and is expected to witness further growth during the forecast period. The region is observed to witness prolific growth during the forecast period owing to the increasing presence of major manufacturing hubs, increasing use of films for insulation purposes in the construction industry, the rising progress of industrialization, and the rise in economic growth are expected to contribute towards the growth of the market.

Additionally, the industrial films market has experienced an increasing demand for industrial films from developing countries such as China and India for agricultural purposes, which is anticipated to drive market growth in the region. Silo bags, silage sheets, mulch film, solarization film, and others are the different types of films used in agriculture to enhance crop productivity and achieve greater efficiency. Furthermore, the robust growth of the e-commerce sector is fuelling the demand for cost-effective and sustainable packaging materials. Thus, this is expected to propel the market growth in the region during the forecast period.

- According to the India Brand Equity Foundation (IBEF), Foodgrain production in India touched 330.5 million metric tonnes (MT) in 2022-23. India is the world's 2nd largest producer of food grains, fruits, and vegetables and the 2nd largest exporter of sugar. Factors such as rising population expansion coupled with the rising income levels in rural and urban areas have contributed to an increase in the demand for agricultural products across the nation.

North America is expected to expand at a rapid pace in the industrial films market during the forecast period. The growth of the region is attributed to the presence of medical and healthcare infrastructure; industrial films are widely used in medical packaging, such as medical device packaging, sterile barrier systems, pharmaceutical packaging, and others. The use of these films ensures the sterility and safety of medical products. In addition, rising building & construction activities and the growth of the industrial packaging industries are significantly increasing the demand for industrial films in the region. Several key market players are investing in research and development to manufacture sustainable industrial films to meet the increasing demand from numerous end-user industries.

Market Overview

Industrial films are specialized plastics and are extensively used in a wide range of applications across various sectors, such as packaging, construction, agriculture, medical healthcare, and electronics. Industrial films are made from polyethylene terephthalate (PET), polyvinyl chloride (PVC), polypropylene (PP), polyethylene (PE), and other polymers, offering excellent and unique properties to meet industrial requirements.

Industrial films can be tailored according to the need and are highly resistant to chemical and harsh environmental conditions. Industrial films are cost-effective and lightweight, making them a suitable choice for various applications in industries. Industrial films can also be recyclable, which makes them a sustainable and environmentally friendly choice.

Industrial Films Market Growth Factors

- Continuous innovation in film manufacturing technologies enhances product performance and expands application areas.

- Development of high-performance materials such as multi-layer films, barrier films, and conductive films.

- Integration of advanced production techniques, such as nanotechnology and precision coating, to improve film quality and functionality.

- Increasing use of industrial films in sectors like automotive, packaging, construction, agriculture, and electronics.

- Rising demand for durable and high-strength films for protective and functional purposes in various industrial applications.

- Expansion of the electronics and semiconductor industries, where films are used for insulation, protection, and as substrates.

- Development of eco-friendly films made from renewable resources to reduce environmental impact.

- Implementation of stringent environmental regulations encouraging the adoption of sustainable practices in film manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 47.89 Billion |

| Market Size by 2034 | USD 74.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand from the agriculture industry

The growing demand from the agriculture industry is expected to boost the growth of the industrial films market during the forecast period. The rising use of silo bags, bale silage, mulch and fumigation film, greenhouse and tunnel film, and silage clamp films reduce the requirement for chemical fertilizers, herbicides, and pesticides which significantly enhances the crop productivity through more varieties, higher yields, and disease control. In addition, the rapid population growth is likely to propel the growth of the agriculture industry, which in turn increases the use of industrial films in agriculture. Thereby driving the market's expansion in the coming years.

Restraint

Increasing risk of environmental damage

The increasing risk of environmental damage is anticipated to hamper the industrial films market growth. Industrial films are not biodegradable and can create pollution if they are not disposed of properly, which results in environmental damage. It is difficult to recycle industrial films if they are not clean and dry. In addition, these films can be punctured or torn easily, can be complex to work with, and require specialized tools for cutting and shaping, which may limit the adoption and expansion of the global industrial films market.

Opportunity

Growing demand for bi-axially oriented plastic films

The rising demand for bi-axially oriented plastic films is projected to offer significant growth opportunities to the industrial films market during the forecast period. The industrial films market has witnessed the increasing usage of bi-axially oriented plastic films in the packaging industry. BOPP films are one of the fastest-growing types of film and are well known for their durability, moisture resistance, strength, and transparency. BOPP Films is gaining momentum in food packaging industries globally owing to its superior moisture barrier properties, high clarity and graphic reproduction, seal ability, and extended shelf-life.

In food and beverage packaging, BOPP film is used to create different types of packaging, such as vacuum pouches, stand-up pouches, and side-gusseted bags. This packaging protects food and beverage products from damage during transportation and storage. BOPP film has a wide range of applications across many different industries, including food & beverage packaging, labeling and branding, laminating, tamper evident films, personal care product packaging, medical packaging, adhesive tape, agricultural films, and others. Thereby driving the industrial films market growth.

- In August 2023, Toppan, Mitsui Chemicals Tohcello, and Mitsui Chemicals are the three Tokyo-based plastics companies that announced the launch of a pilot program to test a new technology for recycling printed biaxially oriented polypropylene (BOPP) film back into new flexible packaging material.

Type Insights

The linear low-density polyethylene (LLDPE) segment accounted for the dominating share of the industrial films market in 2024 due to its higher tensile strength. LLDPE Film is a versatile material and is well known for its excellent flexibility and toughness. Linear low-density polyethylene is widely used in various applications across several industries, such as food packaging, agricultural films, industrial packaging, and consumer product packaging, to protect from moisture, oxygen, and contaminants.

The low-density polyethylene (LDPE) segment is expected to witness significant growth in the industrial films market during the forecast period. Low-density polyethylene (LDPE) is extensively used due to its good clarity, chemical resistance properties, excellent moisture barriers, and superior flexibility. LDPE is commonly used in packaging, food & beverage, agriculture, and construction industries for various applications. Low-density polyethylene is often chosen for applications such as shipping sacks, construction and agricultural films, mattress bags, liners, grocery bags, and others. Such supportive factors driving the growth of the industrial films market in the coming years.

End-user Insights

The agriculture segment held the largest segment of the industrial films market in 2024, owing to the increasing usage of industrial films for agricultural purposes. Industrial films provide a sustainable and cost-effective solution for boosting crop yields and safeguarding crops from harsh or severe weather conditions. Farmers are widely adopting these films, which makes them a crucial component of modern agriculture practices. Industrial films have several applications to increase efficiency and crop productivity in the agriculture industry for farming and gardening, which include a greenhouse, silage, mulching, small tunnels, and others. Thus bolstering the segment's growth.

The industrial packaging segment is expected to grow significantly in the industrial films market during the forecast period. The increasing demand for packaged food products is expected to spur the demand for industrial films in the packaging industry. Industrial films are lightweight, cost-effective, and easy to transport and store, making them an ideal choice for packaging. Industrial films offer better flexibility and durability compared to conventional packaging. Industrial films are built with enhanced properties and offer high performance in terms of strength, durability, and chemical stability, along with continuous improvement in material technology, which is propelling the segment's growth.

- In March 2024, TOPPAN announced the launch of the Indian production of BOPP-based GL-SP barrier film for sustainable packaging. The film enables the creation of structures for dry product packaging. This innovative product, created in collaboration with India-based TOPPAN Speciality Films (TSF), utilizes biaxially oriented polypropylene (BOPP) as its substrate

Industrial Films Market Companies

- Cosmo Films Ltd

- Dunmore

- Inteplast Group

- Jindal Poly Films

- Kolon Industries

- Berry Global Inc.

- Dupont Teijin Films

- Jindal Poly Films

- SKC Co. Ltd.

- Toray Industries Inc.

- Toyobo Co. Ltd.

- Unitika Ltd.

- Mitsui Chemicals Tohcello.Inc

- Polyplex

- Raven Industries Inc.

- Saint-Gobain Performance Plastics

- Sigma Plastics Group

- Solvay

- Toyobo Co. LTD

- Treofan Group

- Trioplast Industrier AB

Recent Developments

- In April 2022, Raven Engineered Films announced its acquisition by Industrial Opportunity Partners, enabling the company to advance technological innovations in Sioux Falls polymer film and sheeting solutions.

- In February 2024, Dhunseri Ventures opened a new polyester film manufacturing plant in eastern India, with a capacity to produce 52,000 tonnes per annum. The plant, which involved an investment of Rs 570 crores, aims to meet the increasing demands of the packaging and industrial sectors.

- In April 2023, Berry Global Group Inc. initiated a significant expansion of its key stretch film manufacturing facility in Lewisburg, Tennessee. This expansion, encompassing 25,000 square feet, is strategically aimed at accommodating the surging demand for Berry's top-quality sustainable stretch films.

- In December 2022, Toray Industries Inc., a manufacturer of advanced materials, films, resins, chemicals, and carbon fibers, announced its development of eco-friendly PET (polyethylene terephthalate) sheets providing excellent applicability and adhesion for the water-based solvent-free coatings while eliminating the solvent derived emission of carbon dioxide.

Segments Covered in the Report

By Type

- Linear Low-density Polyethylene (LLDPE)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyamide

- Others

By End-user

- Agriculture

- Industrial Packaging

- Building & Construction

- Healthcare

- Transportation

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting