Industrial Packaging Market Size and Forecast 2025 to 2034

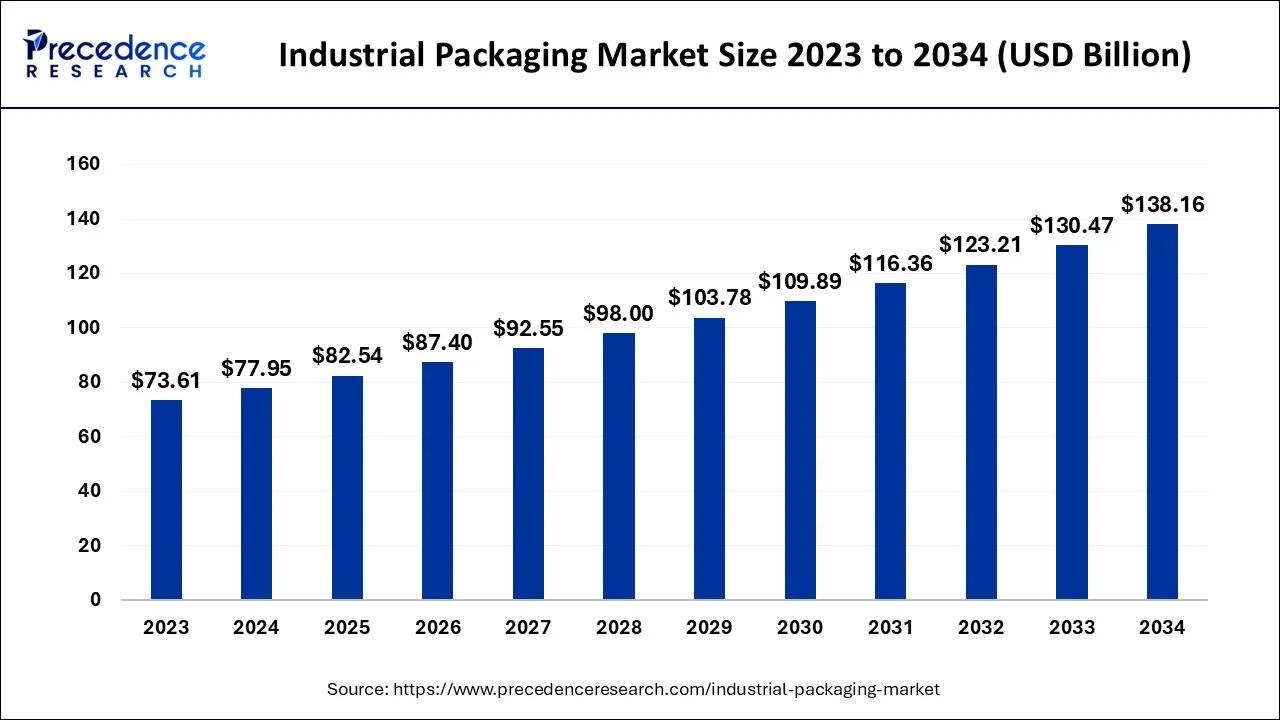

The global industrial packaging market size was valued at USD 77.95 billion in 2024 and is anticipated to reach around USD 138.16 billion by 2034, expanding at a CAGR of 5.89% over the forecast period 2025 to 2034.

Industrial Packaging Market Key Takeaways

- In terms of revenue, the industrial packaging market is valued at $82.54 billion in 2025.

- It is projected to reach $138.16 billion by 2034.

- The industrial packaging market is expected to grow at a CAGR of 5.89% from 2025 to 2034.

- North America generated the maximum market share in 2024.

- Asia Pacific is predicted to expand at the fastest CAGR between 2025 and 2034.

- By product, the corrugated boxes segment is expected to register a significant increase during the forecast period. Whereas the intermediate bulk containers segment will maintain its growth during the period analyzed.

- By material, the metal segment will acquire a significant share of the market. On the other hand, the plastic material segment will continue to grow significantly in upcoming years.

- By end-users, the food & beverage segment is expected to experience a noticeable increase during the forecast period.

Market Overview

The industrial packaging market refers to the global market for packaging materials and solutions used for industrial applications. This includes packaging solutions used to transport and protect goods during manufacturing, storage, and distribution. The industrial packaging market includes a wide range of packaging materials and products, such as plastic bags, containers, drums, pallets, crates, and boxes. These packaging solutions are used across different industries, such as food and beverage, pharmaceuticals, chemicals, construction, and automotive, among others.

- A global market leader, Mondi released its financial report for the year 2022. In June 2022, the company completed its sales of 615 million Euros for sustainable packaging solutions specially designed for personal care components. In the same year, Mondi acquired Duino Mill near Italy with a production plan of 4,20,000 tones per annum of high-quality corrugated packaging.

- Headquartered in New Jersey, Sigma Plastic Group is the leading market player in the industrial packaging market. For the year 2022, the company's peak revenue was $2.4 billion.

- According to the report published by All County Recycling, the United States consumes approximately 80 billion corrugated cartons in one year. At the same time, the country is focused on recycling corrugated cartons. Used corrugated cartons are recycled into cereal boxes and new cardboard.

- The corrugated industry has predicted a spike of 3-% in the demand for corrugated boxes from 2022 to 2025. The increased demand is attributed to rising consumer preferences and an increasing focus on sustainability in packaging solutions. The sharp spike is observed to boost the market of corrugated boxes in the industrial packaging industry.

Industrial Packaging Market Growth Factors

The industrial packaging market is expected to grow during the forecast period owing to the generating trends in the packaging industry including digital printing and customized packaging. In addition, the rising demand for sustainable and reusable packaging solutions from the electronics industry is another factor to supplement the overall growth of the industrial packaging market. For instance, in November 2022, Sony announced the utilization of plastic packaging for small electronic devices. The company has also announced to start using natural blend material for packaging.

In addition, governments around the world are implementing regulations to ensure that industrial packaging materials are safe for consumers and the environment. These regulations are observed to boost the production of industrial packaging in a sustainable way. Along with the rising demand for sustainable packaging solutions from multiple industries, technological advancements in packaging solutions are observed to fuel the market's growth. Technological advancements have led to the development of new packaging materials, such as biodegradable and compostable materials, which are environmentally friendly and have better properties than traditional packaging materials.

Trends

- Increasing demand for sustainable and eco-friendly packaging solutions due to rising environmental concerns and adoption of recyclable and biodegradable materials drives the growth of the market.

- Integration of AI in automation and enhancing operational efficiency to reduce errors and improve quality control drives the demand.

- Brands are leveraging packaging as a marketing tool, like designing customized packaging options and integration of interactive features.

- Smart and active packaging solution adoption, like real-time monitoring, consumer engagement, and shelf-life extension.

- Rapid industrialization and economic growth in different region drives the increasing demand for industrial packaging solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 77.95 Billion |

| Market Size in 2025 | USD 82.54 Billion |

| Market Size by 2034 | USD 138.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.89% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Material and By End-Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing advancements in packaging technology

The global packaging market is witnessing exemplary innovation. Smart packaging technology, 3D printing for packaging, active packaging and nanotechnology are a few recently launched technologies in the packaging industry. Such advancements in packaging technology are intended to act as a driver for the growth of the industrial packaging market in the upcoming period. The rising advancements in the packaging industry are also helping the production and supply chain cycle for large-scale industries.

In July 2022, PACORR unveiled their advanced and massively upgraded testing machine for the global packaging industry. The new Box Compressor Tester is stated to help manufacturers to test and check the quality of corrugated boxes and other packaging materials.

Restraint

Fluctuations in the prices of raw material

The manufacturing process of industrial packaging involves multiple raw materials, including plastic, paper, metal, and others. The fluctuations caused in the prices of such materials due to production and supply chain issues apparently restrain the growth of the industrial packaging market. The continuously rising or fluctuating prices of raw materials limit market players from adopting a rigid and fixed packaging system for long-term practices.

In addition, fluctuating prices can cause ineffective management of companies' budgets. Fluctuating raw material prices can create uncertainty in the pricing of industrial packaging products. Packaging manufacturers may find it challenging to accurately estimate their production costs and set product prices, which can lead to pricing volatility. This uncertainty in pricing can impact buyers' decision-making process and make it difficult for manufacturers to negotiate contracts or secure long-term commitments from customers, ultimately affecting the stability of the industrial packaging market.

Opportunity

Rising demand for customized solutions from various industries

The rising demand for customized solutions from various industries presents significant opportunities for the industrial packaging market, different sectors have different packaging needs, and manufacturers can capitalize on this by developing customized packaging solutions for specific industries. This can include packaging solutions designed to meet specific regulatory requirements or optimized for a particular industry's unique needs.

The demand for customized solutions can drive innovation in the industrial packaging market. As industries seek packaging solutions that meet their specific requirements, there is a growing need for innovative and differentiated packaging solutions. This can include advancements in packaging materials, designs, functionality, sustainability features, and technology integration, such as IoT-enabled packaging or smart packaging solutions. Industrial packaging manufacturers offering innovative and differentiated customized solutions can gain a competitive edge and capitalize on the growing demand for unique and value-added packaging solutions.

Product Insights

By product, the global industrial packaging market is segmented into Drums, IBCs, Sacks, Crates, Corrugated boxes, Pails, and Others. The corrugated boxes segment is expected to achieve a noticeable growth during the forecast period. The emerging e-commerce business line is anticipated to promote the demand for corrugated boxes throughout the analyzed period. In addition, the end-user expansion is intended to propel the segment's growth.

According to the report published by Statista in March 2023, the worldwide production of corrugated cardboard was estimated to be over 190 million tones in 2022. Corrugated cardboard is used in multiple packaging industries, from electronics to food and beverages.

On the other hand, the intermediate bulk containers segment is observed to remain the most lucrative segment of the market during the forecast period, and the cost-effectiveness and availability of versatile material in IBCs are monitored to maintain the segment's growth. The demand for IBCs is intended to rise from the chemical, paint, coatings, and pharmaceutical industries owing to the beneficial factor of carrying materials in unreactive matters.

Material Insights

The plastic segment is observed to remain the most attractive segment of the market during the forecast period; the extended shelf life provided by plastic packaging material is regarded as a driver for the segment's growth; food and beverages, pet care, and pharmaceuticals industries are more likely to choose advanced plastic packaging.

Metal material is another leading segment of the market; metal is another prominent choice of packaging for non-edible products. The segment's growth is attributed to quality, durability, rapidly changing consumer preferences, and metal material strength. In addition, metal is considered a fire-resistant material that minimizes the risk of fire and other potential hazards in multiple industries, including chemical, oil and gas, and other manufacturing plants. The resistance and durability properties of metal material, along with the easy availability in many regions, are supplementing the segment's growth.

End-User Insights

The food and beverages segment dominated the market in 2024; the segment is expected to maintain its dominance due to the projected timeframe. The focus on preserving food items and regulatory compliance for food packaging has driven the segment's growth in recent years. Additionally, the convenience of food transportation offered by industrial packaging has supported the development of the food and beverages segment. Industrial packaging is often designed to be easy to handle, transport, and store. It may include handles, resealable closures, and stackability, making it more convenient for food manufacturers, distributors, and retailers to handle and transport large quantities of food products efficiently.

The oil and lubricant is expected to be the most lucrative segment during the forecast period. Industrial packaging in the oil and lubricant industry is designed to be compatible with standard handling and transportation equipment, such as forklifts, pallet jacks, and shipping containers. This allows for efficient loading, unloading, and transportation of oil and lubricant products, saving time and effort in logistics operations.

Moreover, the cost-effectiveness and leakage prevention offered by industrial packaging for products in the oil and lubricant industry are observed to maximize the utilization of packaging solutions during the forecast period. Oil and lubricant products are often shipped and stored in bulk, which can pose a risk of leakage or spillage. Industrial packagings, such as drums and IBCs, are designed with features such as seals, closures, and bungs that help prevent leakage and spills, ensuring that the products are contained safely and minimizing the risk of environmental damage or accidents.

Regional Insights

North America holds the largest share of the global industrial packaging market, and the region is expected to sustain its dominance during the forecast period. Already established industries, the presence of advanced packaging technologies in the region, and the availability of potential market players are significant factors for the growth of the industrial packaging market.

The United States industrial packaging market is a substantial segment of the global industrial packaging market, with the United States being one of the largest economies in the world. The US industrial packaging market is characterized by a wide range of packaging solutions used across various industries, including automotive, food and beverages, pharmaceuticals, chemicals, construction, electronics, and more.

Asia Pacific is the fastest-growing region for the industrial packaging market; the region is also witnessing rapid urbanization and population growth, leading to increased consumption of goods and higher demand for industrial packaging. Urbanization is accompanied by the development of industries such as food and beverages, consumer goods, automotive, electronics, and more, which require robust and effective packaging solutions.

The Asia Pacific region has experienced significant growth in e-commerce and logistics activities, increasing online shopping trends, and changing consumer behaviors. E-commerce relies heavily on efficient packaging for safe transportation and delivery of goods, creating a demand for industrial packaging solutions suitable for e-commerce and logistics operations. In addition, food and beverage and retail industries are expected to increase the consumption of packaging solutions in countries such as India and China.

India is one of the significant marketplaces for industrial packaging in Asia Pacific; rising government support towards the packaging industry and emerging industrialization are significant drivers for the nation's growth in the industrial packaging market. The Indian government has started supporting small-scale businesses with substantial incentives, low taxes, and subsidies in order to encourage business.

Industrial Packaging Market Companies

- Orora Limited

- Sigma Plastics Group

- Amcor

- Mondi

- Sononco

- International Paper

- Greif Inc

Recent Developments

- In April 2023,a global leader in eco-friendly packaging options, Ranpak Holdings Corporation, announced the launch of sustainable andbiodegradable packagingsolutions in the form of ‘Gaemi MS Mini,' a plastic-free wrapping solution as an alternative to bubble-wrapped packaging. The new wrapping solution is observed as an ideal solution for the warehouse.

- In April 2023,Tesco announced the launch of the firstrecyclable packagingfor its pre-prepared food tray packaging. The change from the company is done under strategic collaboration with leading packaging manufacturer, Faerch. With this collaboration, approximately 30% recycled tray content will be included in Tesco's meal tray.

- In February 2023,Cruz Foam announced the launch of new sustainable packaging material in the form of foam packaging material. The new packaging solution aims to ship fragile and temperature-sensitive goods. The Cruz Foam aims to replace bubble wrap, bubble mailers, and other plastic packaging solutions.

- In August 2022,BASF and Nippon Paint China announced the launch of industrial packaging solution with an eco-friendly option; the new eco-friendly packaging solution has been adopted for Nippon Paint's mixed mortar series products. The newly launched product aims to reduce the use of plastic packaging by promoting sustainability.

Segments Covered in the Report

By Product Type

- Drums

- IBC's

- Sacks

- Crates

- Corrugated boxes

- Pails

- Others

By Material

- Plastic

- Metal

- Wood

- Others

By End-Users

- Automotive

- Food & Beverage

- Pharmaceuticals

- Oil and lubricant

- Construction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content