What is the Orthopedic Braces and Supports Market Size?

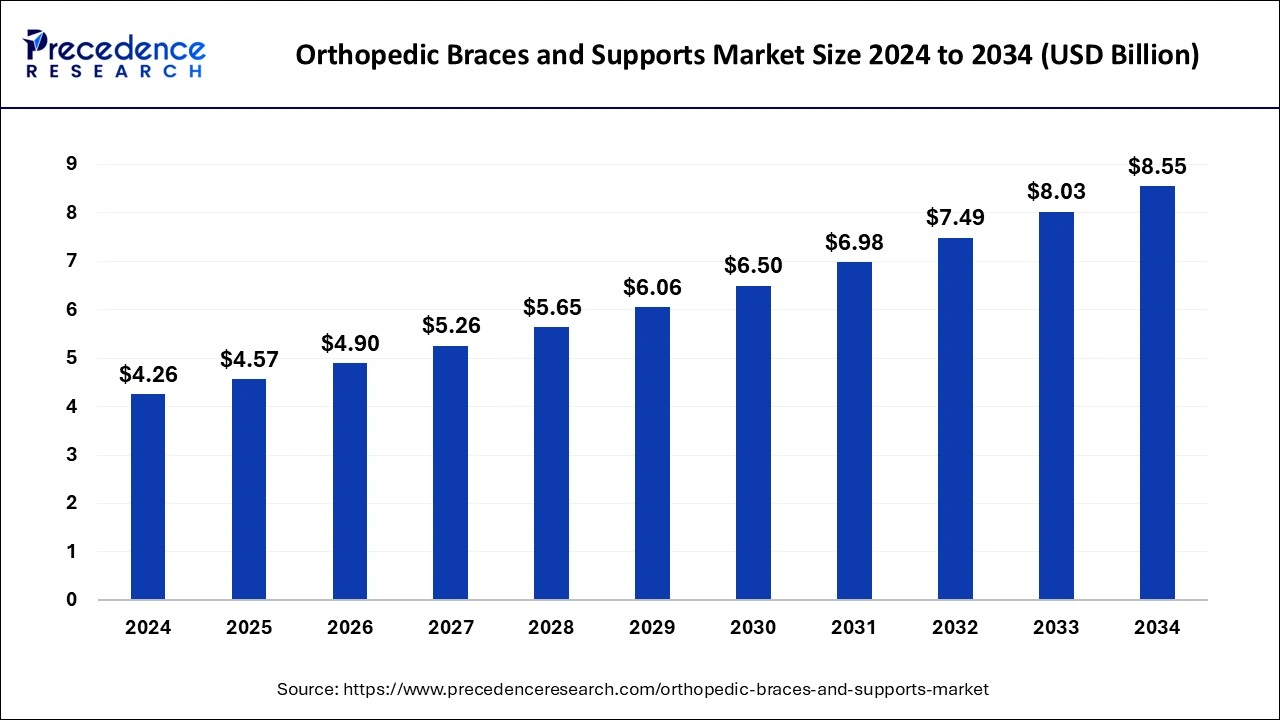

The global orthopedic braces and supports market size is accounted at USD 4.57 billion in 2025 and predicted to increase from USD 4.9 billion in 2026 to approximately USD 9.07 billion by 2035, representing a CAGR of 7.09% from 2026 to 2035.

Orthopedic Braces and Supports Market Key Takeaways

- In terms of revenue, the market is valued at $4.57 billion in 2025.

- It is projected to reach $9.07 billion by 2035.

- The market is expected to grow at a CAGR of 7.22% from 2026 to 2035.

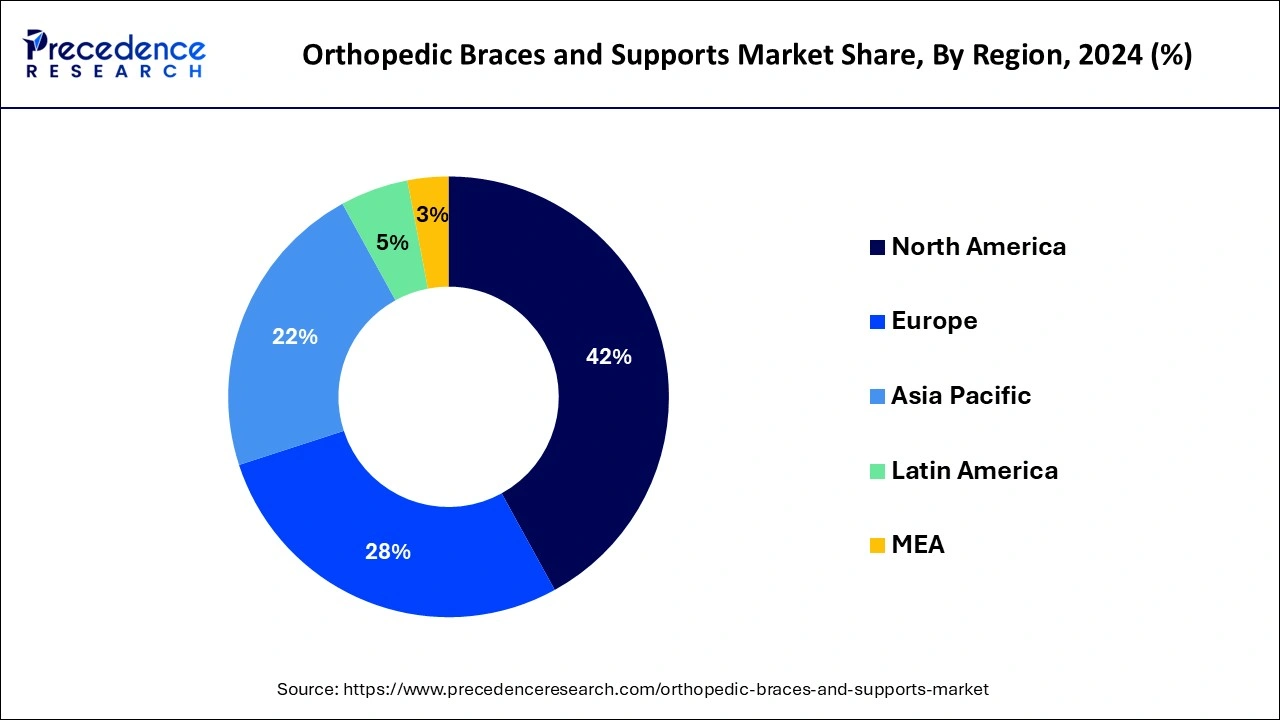

- North America dominated the global market with the largest market share of 42% in 2025.

- By type, the soft & elastic braces and supports segment accounted for 81% of revenue share in 2025.

- By application, the preventive care segment has captured a 39% revenue share in 2025.

- By end-use, the orthopedic clinic's segment has held a 29% revenue share in 2025.

- Asia Pacific is expected to grow at a CAGR of 9.1% during the timeframe 2026 to 2035.

How is AI boosting the growth rate of the Orthopedic Braces and Supports Market?

One such example of the drive for customization may be provided by the ongoing development of AI technologies for the orthopedic brace industry, with automation and real-time monitoring. Design software based on AI improves comfort in treatment and can increase adherence, whereas smart braces equipped with sensors can offer a real-time measurement of movement and feedback on patient performance in rehabilitation. For manufacturers, AI offers a benefit in design, automation, and consistency, so companies can produce customized products at a reasonable cost and on scale. For clinics, AI systems would manage inventory, automate administrative processes, and decrease errors. AI analysis of data will inform improvements in brace design to suit protocols in an evidence-based manner, thereby establishing a new standard of care.

Orthopedic Braces and Supports Market Growth Factors

- Increasing prevalence of orthopedic and musculoskeletal disorders is fueling consistent demand for braces and supports.

- Resurgence in sports participation and sporting injuries has done their bit in a rather larger role in advanced bars.

Other contributing factors include a growing geriatric population battered with age-related weakening of bones and joints. - Development of high-performance products for osteo- and post-operative application, as well as for prevention, is expected to support product adoption.

- Continued availability of these services at affordable rates and also awareness for the preventive aspect through channels like e-commerce will increase the market accessibility for the braces and supports.

Orthopedic Braces and Supports Market Trends

- Innovative technology is enabling the development of smarter braces, improving patient comfort and recovery outcomes. These developments help meet the growing demand for personalized healthcare solutions in orthopedics. This move towards digitalization indicates a larger trend within the healthcare sector, where insights based on data are used to enhance patient outcomes.

- There is a renewed emphasis on using lightweight materials and breathable designs, intended to address comfort concerns and encourage users to adhere to their treatment plans more reliably.

- Artificial intelligence and automation are revolutionizing the market for medical orthopedic braces and supports by enhancing product innovation and operational efficiency. AI technologies are used to develop tailored braces and supports based on individual patient data, leading to improved treatment outcomes and greater patient satisfaction. Automation in manufacturing is enhancing production efficiency, reducing costs, and accelerating the launch of new products.

- Regulatory authorities such as the FDA are activating their inspection of orthopedic devices and demanding faster testing and safety data prior to approving new devices. There is a rising focus on post-market surveillance to ensure that orthopedic devices stay safe and effective over time.

Market Outlook

Start-up Ecosystem

The start-up growth records the introduction of customisation through 3D printing and digitalisation, which has highly influenced the existing operations and systems in the orthopedic braces and supports sector. The start-ups are getting a push due to DTC channels as E-commerce is a leading distribution agent that enables start-ups to meet the needs of the patients directly without any third party.

Industry growth overview

The industry growth for now is running average but convincing as per the geriatric population, technology transformation, and increasing injuries, spotting various reasons, and so on. The customised and intelligent devices might look seamless and harmless, but it's taking a bit of time to convince the crucial areas of the orthopedic sector.

The increasing road and sports injuries and a rising demand for non-invasive care, a painless treatment, have fuelled the orthopedic braces and supports sector and revealed new opportunities for start-ups to clinically prove the tech-based solutions to the relevant areas of the sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.57 Billion |

| Market Size by 2035 | USD 9.07 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.09% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Application, End User, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

- Value Cain Analysis:

Research and Development

The Research and Development (R&D) of orthopedic braces and supports aims to innovate products that enhance comfort, effectiveness, and patient compliance in the management of musculoskeletal problems.

Key Players: Össur, Bauerfeind, Breg, DJO LLC

- Clinical Trials and Regulatory Approvals

Clinical trials for orthopedic braces are studies conducted to investigate the safety and effectiveness of medical devices. Regulatory approvals are the legal process by which medical devices are allowed to be marketed.

Key Players: Enovis, Bauerfeind AG

- Formulation and Final Dosage Preparation

In short, formulation and final dosage preparation are for pharmaceuticals (drugs), whereas orthopedic braces and supports are medical devices.

Key Players: Stryker, Zimmer Biomet

- Packaging and Serialization

A packaging and serialization process exists for orthopedic braces and supports by which a unique identifier is created for the medical device and is enclosed in protective, sterile, and compliant packaging.

Key Players: 3M Company, Enovis Corporation

- Patient Support and Services

Patient Support and Services for Orthopedic Braces and Supports include a wide array of care and support to individuals using orthopedic braces or supports, including the selection of the product, fitting, instructions for use, ongoing management, and follow-up after treatment to ensure

Key Players: DJO LLC, Össur, Breg, Inc., Bauerfeind AG, and 3M

Product Insights

By product, the braces & supports segment accounted largest revenue market share in 2025.

Knee braces and supports segment is expected to grow at the highest growth rate from 2025 to 2034 owing to the various benefits provided by the products which include medial & lateral support, minimized rotation of the knee, injury during motion, and protection against the post-surgical risk of injury.

Type Insights

Based on type, the orthopedic braces & supports market is divided into hard braces and supports, hinged braces and supports, and soft & elastic braces and supports. The soft & elastic braces and supports segment is anticipated to witness the highest growth rate during the forecast year. The increasing availability of improved products, increasing adoption & consumer preference for orthopedic braces in post-operative and preventive care, and supportive reimbursement scenario for the target products in the market are contributing towards the growth of the market in terms of value sales.

Application Insights

Based on application, the market is divided into ligament injury, preventive care, osteoarthritis, compression therapy, post-operative rehabilitation, and others. The ligament injury segment accounted for the highest market share in the year 2024. This is mainly attributable to the rising participation of individuals in sports & athletic activities, the rising number of accidents globally, and the increasing availability of medical reimbursement for ligament injuries which has increased the demand for orthopedic braces & supports in the market.

Regional Insights

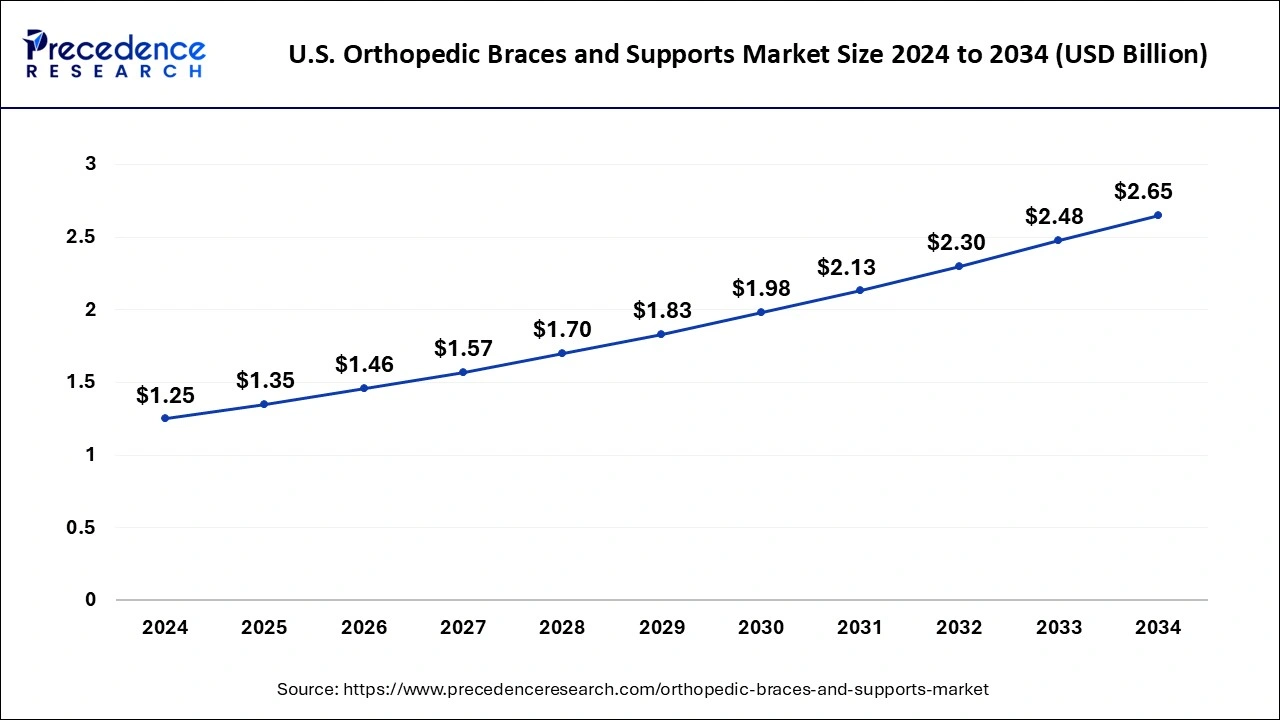

U.S. Orthopedic Braces and Supports Market Size and Growth 2026 to 2035

The U.S. orthopedic braces and supports market size is estimated at USD 1.35 billion in 2025 and is predicted to be worth around USD 2.82 billion by 2035, at a CAGR of 7.64% from 2026 to 2035.

North America accounted revenue share of around 42% in 2025. This is due to the presence of key market players and technologically equipped hospitals in the U.S. and Canada. Europe held the second-highest market share after North America. This is owing to the rising aging population and prevalence of chronic disease in this region which in turn is leading to rising in the number of surgeries. According to the Federal Statistical Office, approximately 17.2 million surgeries were done in Germany in the year 2019, with spinal, intestinal, and hip implant surgeries, endoscopic, and others.

The U.S. orthopedic braces and supports market is experiencing vigorous expansion, fueled by the surged in strategic initiatives undertaken by significant key market players. These industries have recognized the increasing need for orthopedic braces and support, boosted by the increasing incidence of musculoskeletal diseases and the geriatric population prone to orthopedic ailments. Technological advancement allows the customization of braces and supports, serving individual patient demands and enhancing treatment efficiency. The swift speed of invention is likely to result in the decreased prices of older varieties, leading to major opportunities for prominent industries in the emerging economies.

- In February 2025, Icarus Medical, an innovative pioneer in orthopedic bracing technology, announced the launch of the Adonis Knee Brace, a lightweight device utilizing advanced “joint-distraction” technology to provide targeted joint unloading for individuals with medial and lateral osteoarthritis.

Asia-pacific is anticipated to be the fastest growing market during the forecast year. The demand for orthopedic braces and support in this region is rising due to the increasing geriatric and obese population along with the rising prevalence of orthopedic & diabetes-related diseases in this region and increasing healthcare expenditure in countries like India, China, Japan, and others.

What Are the Key Drivers Behind Market Expansion in Europe?

The European orthopedic braces and supports market is expected to witness significant growth over the forecast period. The continuous investment in research and development in the region has resulted in the continual improvement in orthopedic devices, making them more effective, comfortable, and ensuring enhanced outcomes for patients. The use of orthopedic braces in different applications, such as injury prevention, rehabilitation, and post-surgical recovery, is well established by regulatory standards and pro-health policies to support their applications in these procedures.

France will also be a major market in this regional development, orthopedic braces and supports industry is likely to grow fast. A set of favorable government policies, increased demand, and the MedTech ecosystem make France one of the key contributors to the overall development of the European orthopedic braces and supports market.

What Are the Key Trends Driving Growth in the Middle East & Africa Orthopedic Braces and Supports Market?

The Middle East & Africa Orthopedic Braces and Supports Market is fueled by an escalating burden of musculoskeletal disorders, rising occurrence of road traffic accidents, and expanding magnitude of orthopedic surgeries. There has been an increasing use of imported, technologically advanced braces in urban centers in the region and an increasing investment in the healthcare business.

The orthopedic braces and supports industry in South Africa is growing at a steady pace, attributed to the high frequency of sports-related conditions, an ageing population, and the prevalence of arthritis. There is also the rising awareness and demand for physiotherapy and orthopedic treatment in the country.

What Latin American Advancements and Trends are Driving the Growth of the Orthopedic Braces and Supports Market?

Latin America's advancement in this market is measurable and attentive towards the transition in personalised solutions, extensive distribution volume, and digital integration. Technology plays a crucial role in uplifting the regional advancement and growth of this market. The smart braces embedded with the IoT sensors enable remote patient management and real-time monitoring, which is one of the popular tech-based innovations in this market.

The customisation, 3D printing, advanced materials, and AI-powered diagnostics are modernising the market and strengthening its existence in the global market.

The Latin America orthopedic braces and supports market trend is determined by rapid scenarios of musculoskeletal conditions, health awareness (knowledge booster), and demand for modern technologies. The trend is based on the changing preferences of patients for personalised treatment and non-surgical treatment alternatives. The 3D printing technology and smart braces are the major trends in this market.

The advanced materials like memory shaping alloys, moisture-wicking fabrics, and breathable fabrics are enhancing the functionality and bringing comfort to the patients' stressful perception of treatments.

Orthopedic Braces and Supports Market Companies

- Ossur

- BREG, Inc.

- DeRoyal Industries, Inc.

- Bauerfeind

- ALCARE Co., Ltd.

- Ottobock

- Fillauer LLC

- Frank Stubbs Company Inc.

- McDavid

- Hely& Weber

Recent Developments

- In August 2025, Icarus Medical Innovations introduces the Zeus Dynamic Dual Action KAFO, a custom-fabricated orthosis for patients with lower limb weakness, instability, or paralysis, offering patient-adjustable dynamic support.

https://www.news10.com - In June 2025, Dimension Ortho, a global leader in 3D printed orthotics, partnered with Rothman Orthopaedics to implement its personalized bracing and fracture care platform across its U.S. clinical sites.

https://www.prnewswire.com

Segments Covered in the Report

By Product

- Knee Braces and Supports

- Knee Braces for Osteoarthritis and Ligament Injuries

- Post-operational Knee Braces

- Ankle Braces and Supports

- Soft Braces

- Hinged Braces

- Foot Walkers and Orthoses

- Hip, Back, And Spine Braces and Supports

- Neck & Cervical Spine Braces and Supports

- Lower Spine Braces and Supports

- Shoulder Braces and Supports

- Elbow Braces and Supports

- Hand & Wrist Braces and Supports

- Facial Braces and Supports

By Type

- Soft & Elastic Braces and Supports

- Hard Braces and Supports

- Hinged Braces and Supports

By Application

- Subcutaneous

- Intramuscular

- Preventive Care

- Ligament Injury

- Anterior Cruciate Ligament Injury

- Lateral Collateral Ligament Injury

- Other Ligament Injuries

- Post-operative Rehabilitation

- Osteoarthritis

- Compression Therapy

- Other

By End-User

- Orthopedic Clinics

- Over the Counter (OTC)

- Hospitals

- DME Dealers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting