Packaging Coatings Market Size and Forecast 2025 to 2034

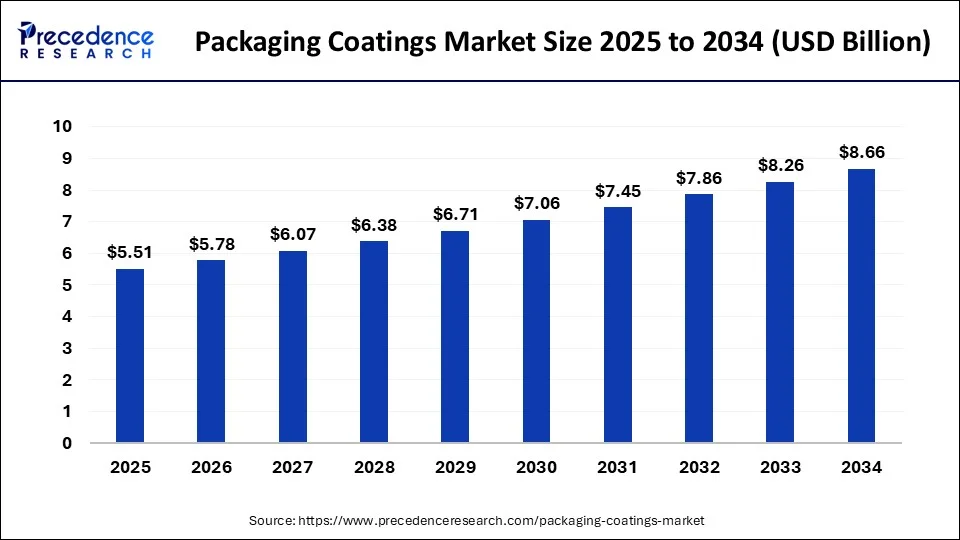

The global packaging coatings market size accounted at USD 5.26 billion in 2024 and is expected to reach around USD 8.66 billion by 2034, expanding at a CAGR of 5.11% from 2025 to 2034.

Packaging Coatings Market Key Takeaways

- In terms of revenue, the packaging coatings market is valued at $5.51 billion in 2025.

- It is projected to reach $8.66 billion by 2034.

- The packaging coatings market is expected to grow at a CAGR of 5.11% from 2025 to 2034.

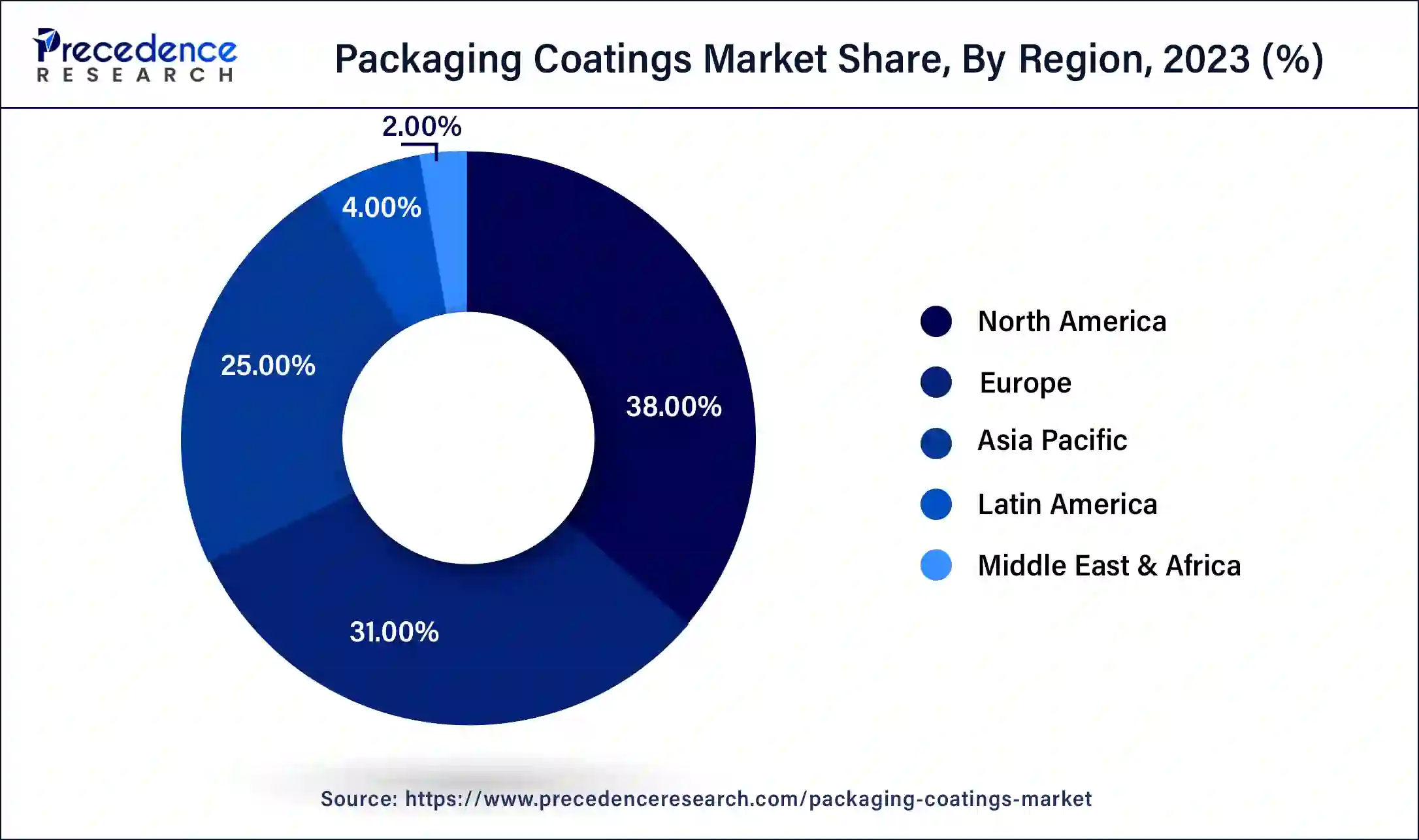

- North America led the market with the biggest market share of 38% in 2024.

- Asia-Pacific is projected to expand at the fastest CAGR during the forecast period.

- By application, the beverage cans segment recorded more than 43% of revenue share in 2024.

- By Application, the promotional packaging is anticipated to grow at a noteworthy CAGR of 7.8% during the forecast period.

- By Type, the epoxy thermoset segment registered a maximum market share of 29% in 2024.

- By Type, the urethane segment is predicted to grow at a remarkable CAGR over the projected period.

- By End User, the food & beverages segment held the largest revenue share of 46.8% in 2024.

- By End User, the consumer electronics segment is expected to grow at a notable CAGR over the projected period.

U.S. Packaging Coatings Market Size and Growth 2025 to 2034

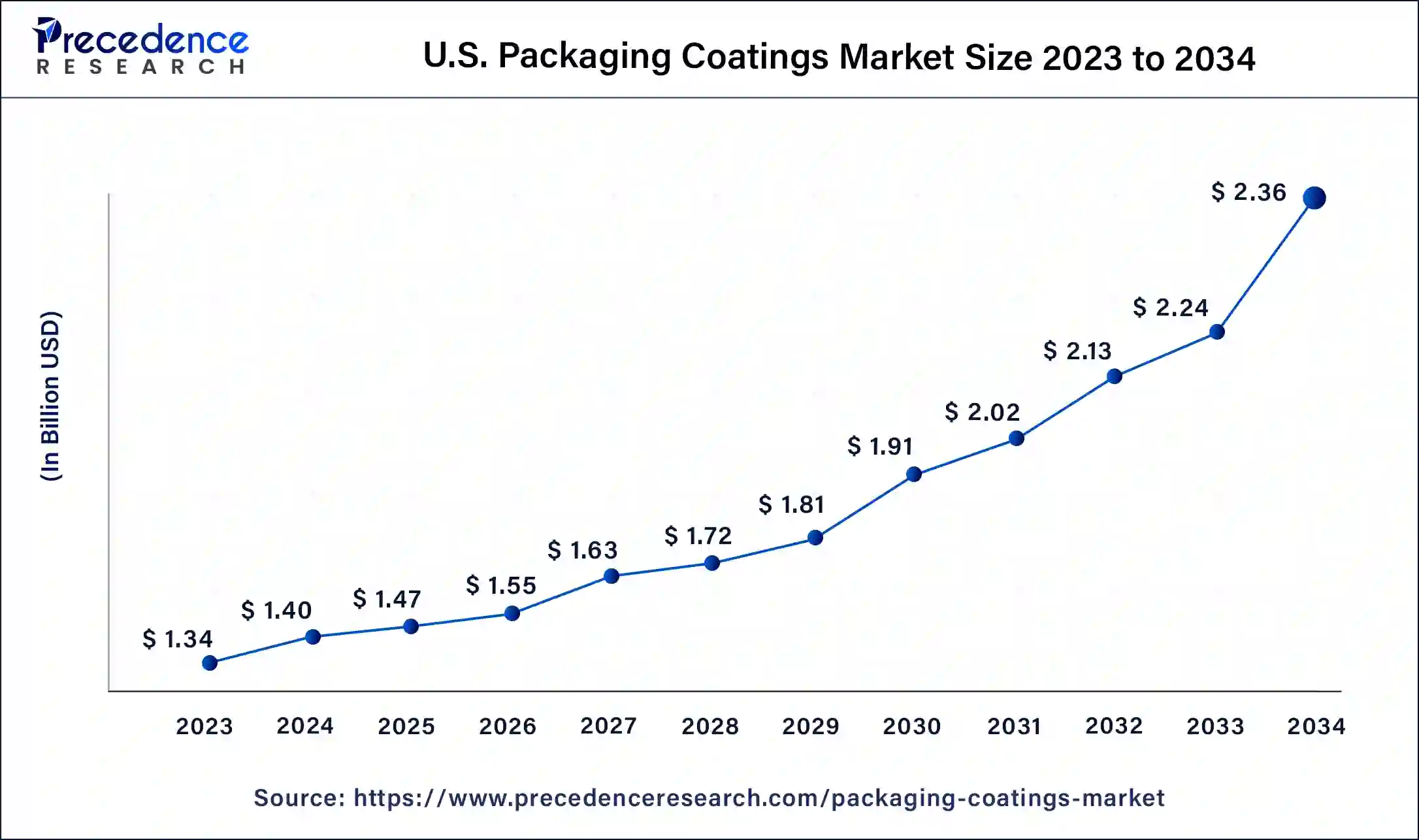

The U.S. packaging coatings market size was estimated at USD 1.40 billion in 2024 and is predicted to be worth around USD 2.36 billion by 2034, at a CAGR of 5.36% from 2025 to 2034.

North America has held the largest revenue share 38% in 2024.In North America, the packaging coatings market is witnessing a strong focus on sustainability and eco-friendliness. Stringent regulations and heightened consumer awareness have led to increased adoption of water-based and solvent-free coatings that align with environmental standards. Moreover, the surge in e-commerce has propelled the demand for coatings that enhance the durability and protective capabilities ofpackaging materials. This region also emphasizes innovative functional coatings that cater to health and safety concerns.

The US has seen a significant growth in the market, the growth is driven by the expanding food and beverages industry in the country, with growth in E-commerce, focus on sustainability, and use of eco-friendly packaging solutions driving the growth of the market in the country. The regulatory compliance regarding low VOC emissions and the promotion of eco-friendly alternatives by the companies also drive the growth. Leading companies in the US packaging coatings market include PPG Industries, Inc., AkzoNobel N.V., and The Sherwin-Williams Company. These key players play a major role in the growth of the market in the country.

Asia-Pacific is estimated to observe the fastest expansion The Asia-Pacific packaging coatings market is characterized by rapid growth, primarily driven by the expanding packaging industry in countries like China and India. The region exhibits a notable trend toward customization, with brands seeking unique packaging solutions. Additionally, there is a growing emphasis on functional coatings, such as antimicrobial and tamper-evident coatings, to address health and safety concerns. Sustainable coatings are also gaining traction in response to evolving consumer preferences and environmental regulations, making Asia-Pacific a dynamic and diverse market for packaging coatings. The rapid growth in industrialization and urbanization is fueling the market of the region. Within the region, Southeast Asian countries and China are attracting opportunities in the food and beverage industries. The large food and beverage industries instantly leverage the demand for the packaging coating companies.

Inia has seen a steady growth in the market, driven by consumer preferences for sustainable and eco-friendly alternatives. The growth is driven by the rising urbanization and increasing disposable incomes, and the rapidly growing e-commerce sector in the country, which drives the growth. The growing applications, like in food and beverage packaging, metal cans, acrylic coatings, and water-based coatings, fuel the demand for the market in the country. Major companies operating in the Indian packaging coatings market include Akzo Nobel NV, BASF SE, Arkema Group, Berger Paints India Limited, and Clariant, which play a key role in the growth of the market.

Market Overview

Packaging coatings are specialized materials applied to diverse packaging substrates, including paper, cardboard, plastic, metal, and glass. They serve dual purposes: enhancing performance and appearance. These coatings bolster barrier properties, shielding contents from moisture, oxygen, and light, ensuring product integrity.

Moreover, they enhance packaging durability, making it resilient during handling and transportation. By improving aesthetics, offering options like gloss or matte finishes, and enabling printing for labeling and branding, packaging coatings play a pivotal role in elevating both the functionality and visual appeal of packaging across various industries. They also enhance the packaging's durability, enabling it to withstand transportation and handling.

Additionally, packaging coatings can provide aesthetic enhancements, such as gloss or matte finishes, and enable the printing of labels or branding. These coatings play a vital role in ensuring product protection, quality, and market appeal, making them a crucial component of modern packaging solutions across various industries.

Market Trends

- Growing demand for eco-friendly coatings due to a strong shift towards biodegradable, renewable, and recyclable packaging solutions for coatings, with a focus on the development of plant-based coatings, drives the growth.

- Technological advancements like innovation in coating technology, energy-curable coating, and customized packaging solutions fuel the growth of the market.

- Stringent regulatory standards in packaging materials and the influence of the development and adoption of sustainable solutions drive the growth of the market.

- Focusing on low VOC emissions and consumer preferences for the rising adoption of water-based and low VOC coatings, which helps minimize environmental impact, drives the growth.

Packaging Coatings Market Growth Factors

Packaging coatings are specialized materials applied to various packaging substrates to enhance their performance and visual appeal. These coatings play a crucial role in protecting products from external factors, improving aesthetics, and ensuring packaging durability. The global packaging coatings market is dynamic, influenced by diverse growth drivers, industry trends, and presenting both challenges and opportunities. The market's growth is primarily driven by the expanding packaging industry, rising consumer demand for packaged goods, and increased focus on product aesthetics.

Additionally, stringent regulations regarding food safety and sustainability are fueling the adoption of compliant and eco-friendly coatings. The growth of e-commerce and the need for robust packaging solutions are also significant drivers.

Notable trends include the shift toward sustainable and eco-friendly coatings to align with environmental concerns. Water-based coatings are gaining prominence due to their eco-friendliness and regulatory compliance. Moreover, innovations in functional coatings, such as antimicrobial and tamper-evident coatings, are on the rise. Challenges include the need for cost-effective coatings that meet specific performance requirements. Striking a balance between sustainability and functionality remains a complex task.

Moreover, competitive pressures and the demand for customized coatings pose challenges to manufacturers. Opportunities exist for companies that can develop innovative, sustainable, and cost-effective coatings. Expansion into emerging markets and catering to specialized packaging needs can drive growth. Meeting the evolving demands of e-commerce packaging and offering solutions for health and safety concerns presents promising business avenues.

Technological Advancement

Technological advancements in the packaging coatings market feature digital printing, bio-based formulations, and smart and active packaging. Digital printing is a low-cost, quick, and innovative technology. It allows customization and personalization of the application packaging. The bio-based materials are in increasing demand due to their sustainable and environmentally friendly alternative options. The smart and active packaging, like intelligent coating, helps in monitoring the packaging process with its tamper-evident feature is a valuable contribution to the environment. The sustainable coating encourages an approach to recyclable and biodegradable coatings that protect the environment.

The enhancement to the barrier properties, such as metal oxide, polymers, and ceramics-based coatings, prevents products from human damage. The nano-engineered protective layers, basically a nanotechnology, help to survive under extreme conditions and temperatures. This enhancement and advancement are bolstering the packaging coatings market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.11% |

| Market Size in 2024 | USD 5.26 Billion |

| Market Size in 2025 | USD 5.51 Billion |

| Market Size by 2034 | USD 8.66 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application, By Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding packaging industry and functional coatings

With the continuous growth of the packaging sector, driven by heightened consumer reliance on packaged goods and the flourishing e-commerce landscape, there is an escalating need for coatings that enhance the performance and aesthetics of packaging materials. These coatings protect products during storage and transportation while providing visual appeal.

As the packaging industry expands to meet increasing consumer demand, the demand for coatings that can elevate packaging performance and aesthetics is on the rise, making them a pivotal component of modern packaging solutions. Moreover, functional coatings, such as antimicrobial coatings for enhanced hygiene and tamper-evident coatings for product integrity, have become crucial.

In response to health and safety concerns, brands are turning to these specialized coatings to meet consumer expectations. This shift in demand is driving manufacturers to innovate and develop coatings that enhance packaging and serve essential functions, further surging the market's growth. The packaging coatings market is witnessing a surge in demand as it aligns with the expanding packaging industry's needs and caters to the growing demand for functional coatings that address health, safety, and product protection concerns.

Restraints

Environmental concerns and sustainability compliance

Environmental concerns and sustainability compliance are imposing constraints on the packaging coatings market. Developing and adopting eco-friendly coatings often come with higher production costs, which can discourage manufacturers looking to minimize expenses. Additionally, there can be performance trade-offs when transitioning to sustainable coatings, as they may not always match the functional capabilities of traditional options. Balancing sustainability with essential packaging requirements like barrier properties and durability can be a challenge.

Furthermore, stringent environmental regulations and evolving sustainability standards necessitate compliance, and non-compliance can lead to fines and legal complications. While consumer demand for sustainable packaging is on the rise, a disconnect between consumer expectations and available sustainable coating solutions can also hinder market adoption. Despite these constraints, the industry is actively innovating to develop cost-effective, high-performance, and compliant sustainable coatings, acknowledging the growing global shift towards environmentally responsible packaging solutions.

Opportunities

Sustainable solutions and e-commerce packaging

The global shift towards sustainability and environmental consciousness has reshaped the packaging industry. Consumers now seek products with minimal environmental impact, driving the need for eco-friendly packaging materials. In response, packaging coatings manufacturers are developing sustainable options that reduce waste, emissions, and reliance on non-renewable resources. These coatings, often biodegradable or recyclable, align with consumers' eco-conscious preferences and regulatory requirements.

As sustainability continues to dominate consumer choices, the demand for eco-friendly coatings grows, making it a driving force in the market. Moreover, the explosive growth of e-commerce, further accelerated by the COVID-19 pandemic, has transformed packaging requirements. Products shipped through online platforms need robust packaging coatings that can withstand the rigors of transit and protect contents from potential damage during delivery. Packaging coatings play a pivotal role in ensuring that products reach consumers in pristine condition.

As e-commerce becomes a dominant retail channel, the demand for coatings that offer durability, protection, and a positive unboxing experience is propelling significant growth in the packaging coatings market.

Application Insights

According to the application, the beverages can segment held 43% revenue share in 2024. The packaging coatings in beverage cans serve to protect the contents from contamination and maintain the integrity of the product. Trends in this segment include the development of coatings that enhance can aesthetics, providing vibrant and eye-catching designs. Additionally, there is a focus on coatings that offer better resistance to acidic beverages, ensuring the taste remains unaffected. Furthermore, coatings that support sustainability, such as those enabling easier can recycling, are gaining traction in line with environmental concerns.

The promotional packaging is anticipated to expand at a significant CAGR of 7.8% during the projected period. In promotional packaging, coatings play a vital role in creating visually appealing designs and enhancing branding. Trends involve the use of special coatings like UV or holographic finishes to create attention-grabbing effects. Moreover, there is a growing demand for coatings that are compatible with digital printing techniques, allowing for personalized and variable data printing in promotional materials. Additionally, coatings with tactile and sensory enhancements are becoming popular, providing consumers with a unique and engaging unboxing experience.

Type Insights

Based on the type, the Epoxy Thermoset segment held the largest market share of 29% in 2024. Epoxy thermoset coatings in the packaging coatings market are a type of protective coating known for their durability and resistance to moisture, chemicals, and corrosion. They are widely used in the packaging industry to provide a robust barrier that safeguards packaged products from external factors. Epoxy thermoset coatings are witnessing increased adoption due to their exceptional protective qualities, making them suitable for food and beverage packaging.

Moreover, there's a trend toward developing epoxy coatings that are both high-performance and eco-friendly, aligning with sustainability goals. These coatings are increasingly used for metal packaging, providing a reliable solution for preserving the contents' quality and extending shelf life.

On the other hand, the Urethane segment is projected to grow at the fastest rate over the projected period. Urethane Coatings are another important type in the packaging coatings market. They are valued for their flexibility, abrasion resistance, and impact resistance, making them suitable for applications where packaging may undergo stress during transportation and handling. In recent years, urethane coatings have gained traction for their versatility and protective attributes, particularly for flexible packaging materials.

The market trend is toward developing urethane coatings that offer enhanced adhesion and barrier properties, making them ideal for a wide range of packaging substrates. Additionally, there's a growing demand for low-VOC (volatile organic compound) urethane coatings to meet environmental regulations and consumer preferences for eco-friendly packaging solutions.

End-user Insights

In 2024, the Food & Beverages sector had the highest market share of 46.8% on the basis of the installation. In the packaging coatings market, coatings used in the Food & Beverages sector are specifically designed to enhance product safety, extend shelf life, and maintain the visual appeal of packaged goods. These coatings often include barrier properties to protect against moisture, oxygen, and contaminants, ensuring the freshness and integrity of food and beverage products.

A prominent trend in this segment is the increasing demand for eco-friendly and sustainable coatings that align with consumers' growing environmental concerns, driving innovation towards greener packaging solutions.

The Consumer Electronics sector is expected to expand at the fastest rate over the projected period. Coatings employed in the Consumer Electronics sector aim to protect electronic devices during transit and storage. It offers durability, scratch resistance, and, in some cases, heat dissipation properties. A notable trend in this segment is the development of coatings with advanced functionalities, such as anti-fingerprint and antimicrobial properties, to enhance user experience and product longevity. Additionally, as consumers seek more aesthetically pleasing electronic devices, coatings that provide premium finishes and unique textures are gaining popularity.

Packaging Coatings Market Companies

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Sherwin-Williams Company

- Axalta Coating Systems

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Jotun Group

- Tikkurila Oyj

- Nippon Paint Holdings Co., Ltd.

- Altana AG

- Fujikura Kasei Co., Ltd.

- Toyo Ink SC Holdings Co., Ltd.

- Dymax Corporation

- Michelman, Inc.

- Follmann GmbH & Co. KG

Recent Developments

- In January 2025, PPG, the American Fortune 500 company and a global supplier of paints, coatings, and specialty materials, expanded its non-bisphenol A (BPA) HOBA internal coatings line with the introduction of PPG HobaPro 2848.(Source - https://www.alcircle.com )

- In February 2025, Actega launched barrier coatings that are delivering global solutions for sustainable packaging. Actega produces innovative barrier coatings tailored to the food, cosmetics, and pet care industries.(Source - https://www.printweek.in )

- In August 2024, Stahl strengthened its packaging coatings business through the acquisition of Weilburger Graphics. The acquisition is an opportunity for the company to extend innovation in the field of the packaging coatings market. ( Source: https://www.european-coatings.com )

- In 2023,PPG partnered with Satys, a French industrial group specializing in aircraft sealing, painting, and surface treatment, to offer electrocoating (e-coat) services for original equipment manufacturer (OEM) aircraft parts.

- In 2021, PPG successfully completed its acquisition of Tikkurila, a prominent Finnish paint and coatings company. This acquisition strengthened PPG's foothold in the Nordic region and broadened its product range to encompass architectural coatings, decorative paints, and industrial coatings. It further solidified PPG's global presence in the coatings industry and positioned the company to offer a more comprehensive portfolio of coatings solutions to customers in the Nordic market and beyond.

- In 2020, Axalta announced a partnership with Brabham Automotive in Australia. Axalta's advanced waterborne coating technology, from its paint brand Standox, will be used on over 70 limited edition luxury vehicles from the Celebration and Signature Series produced by Brabham Automotive and distributed worldwide.

- In 2019,DIC (Dainippon Ink & Chemicals) acquired a mid-tier coating resins manufacturer in India. This strategic acquisition marked DIC's full-scale entry into India's burgeoning coating resins market, capitalizing on the country's fast-growing economy and increasing demand for coating materials.

Segments Covered in the Report

By Application

- Food Cans

- Beverage Cans

- Caps & Closures

- Aerosols & Tubes

- Industrial Packaging

- Promotional Packaging

- Specialty Packaging

By Type

- Epoxy Thermoset

- Urethane

- UV-Curable

- BPA Free

- Soft Touch UV-Curable & Urethane

By End User

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Consumer Electronics

- Automotive Components

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting