What is Parkinson's Disease Therapeutics Market Size?

The global parkinson's disease therapeutics market size is estimated at USD7.02 billion in 2025 and is predicted to increase from USD 7.49 billion in 2026 to approximately USD 14.28 billion by 2035, expanding at a CAGR of 7.36% from 2026 to 2035. Growing environmental concerns and genetic heredity are increasing the number of cases of Parkinson's disease, which increases the demand for Parkinson's disease therapeutics.

Market Highlights

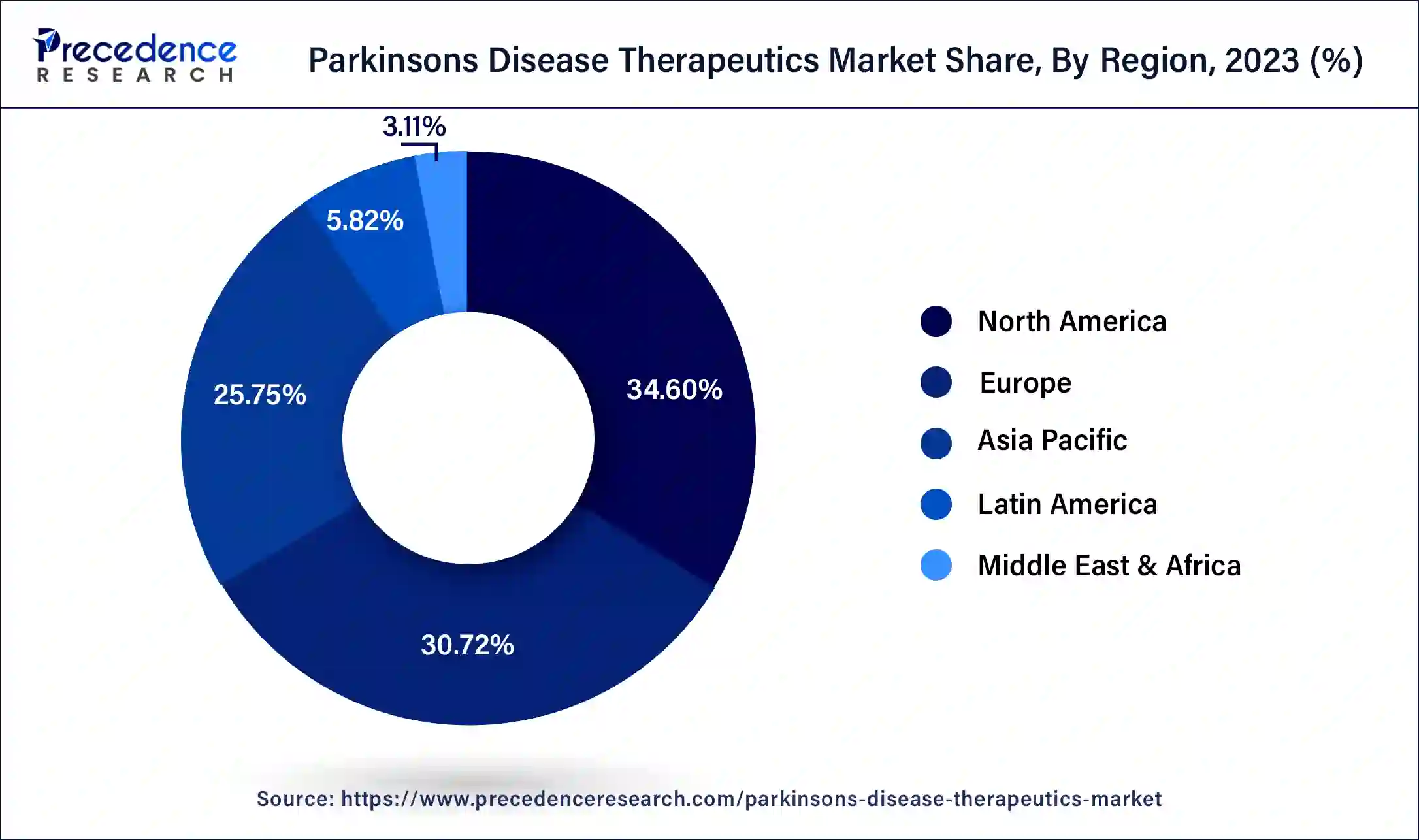

- North America dominated the parkinson's disease therapeutics market with the largest revenue share of 34.60% in 2025.

- Europe is expected to grow to the highest CAGR during the forecast period.

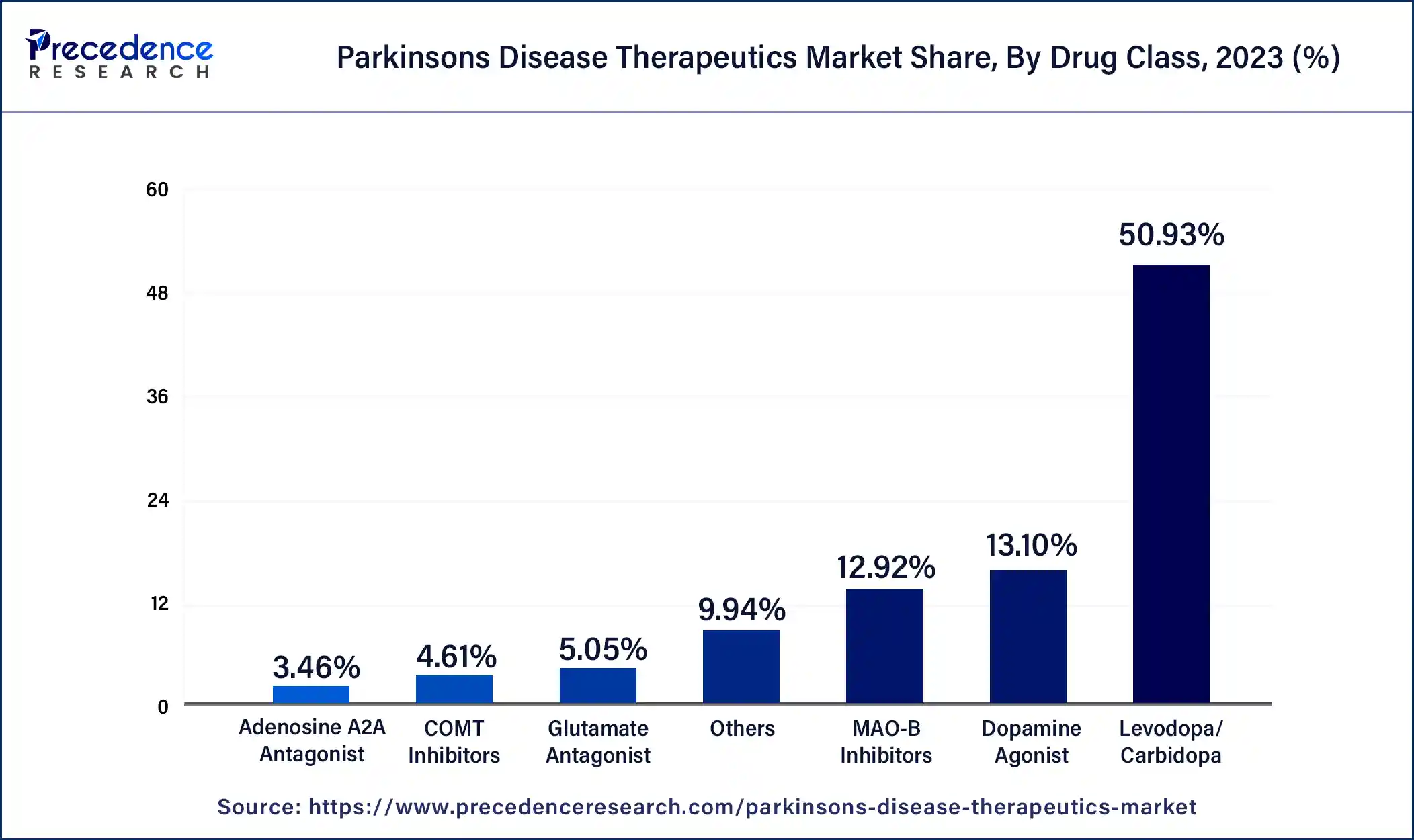

- By drug class, the levodopa/carbidopa segment captured the biggest market share of 50.93% in 2025.

- By drug class, the COMT inhibitors segment is expected to grow at the fastest CAGR during the forecast period.

- By route of administration, the oral segment has contributed the highest market share of 63.18% in 2025.

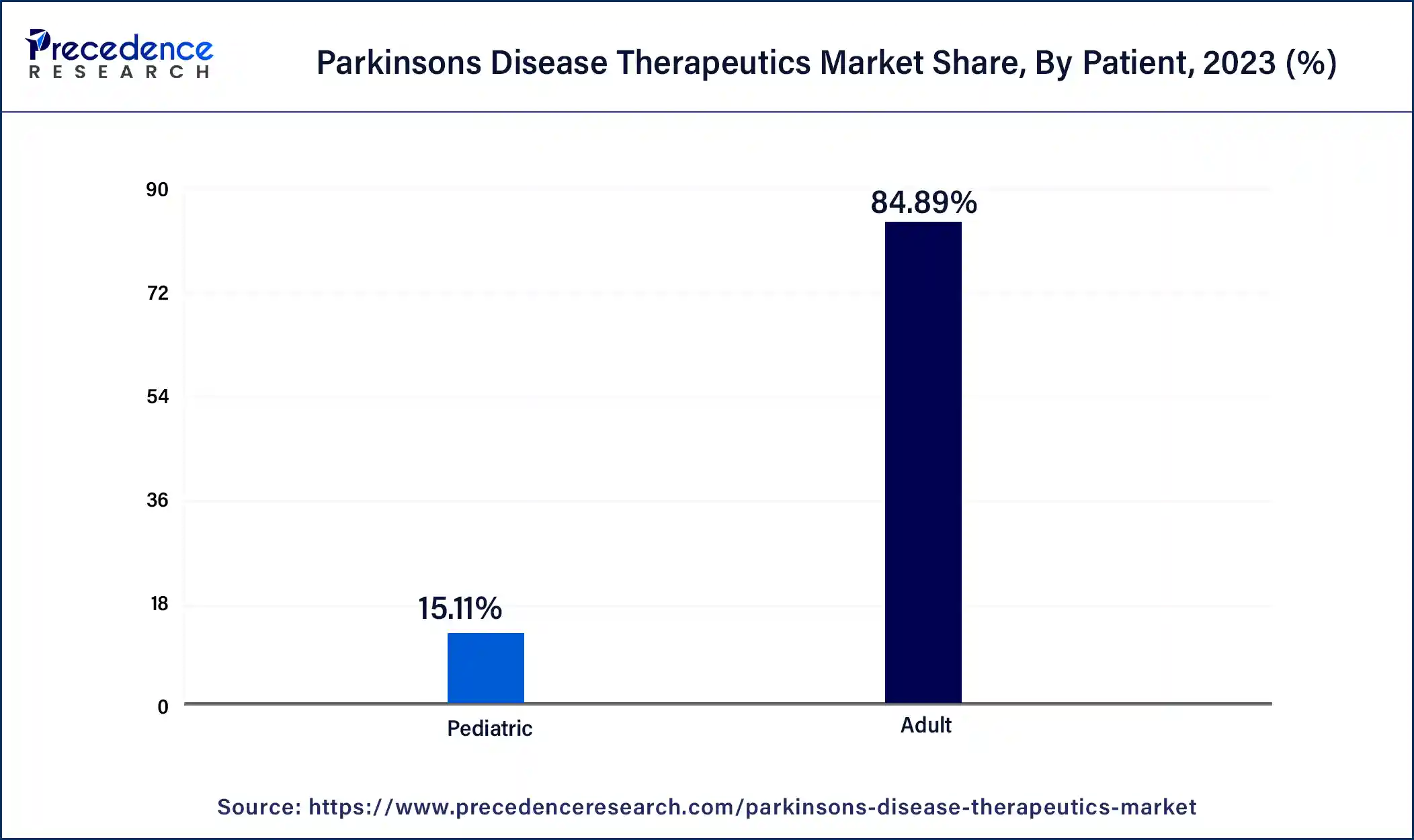

- By patient, the adult segment generated the major market share of 84.89% in 2025.

What are the Diverse Factors Impacting the Global Market Expansion?

The Parkinson's disease therapeutics market provides the resources needed for the treatment of Parkinson's disease, which affects the nervous system and the parts of the body controlled by nerves. In the early stage of Parkinson's disease, the face of the patient shows little or no experience. There is no movement in the arms while walking. The patient's voice becomes soft and slurred. The symptoms of Parkinson's disease include tremors, bradykinesia, rigid muscles, difficulties in thinking, depression and emotional changes, swallowing problems, chewing and eating problems, sleep problems and sleep orders, bladder problems, impaired posture, and balance, loss of automatic movements, changes in speech, changes in writing, and constipation, etc. The causes of Parkinson's disease are unknown, but factors that appear to play a role include genes and environmental triggers.

Artificial Intelligence: The Next Growth Catalyst in Parkinson's Disease Therapeutics

AI is revolutionizing the parkinsons disease therapeutic industry by accelerating drug discovery and biomarker identification, significantly reducing R&D timelines and costs. The integration of adaptive Deep Brain Stimulation (aDBS) and machine learning-driven personalized treatment plans allows for real-time medication and stimulation adjustments tailored to individual patient data.

Furthermore, AI-powered wearable devices enable continuous remote monitoring and objective symptom tracking, shifting the market toward proactive, data-centric clinical management.

Parkinson's Disease Therapeutics Market Growth Factors

- The aging population can boost the Parkinson's disease therapeutics market. With the aging population, there's a heightened focus on improving the quality of life for individuals living with chronic conditions like Parkinson's disease.

- The rising number of research and development activities for advanced Parkinson's disease therapies can be an opportunity for the growth of the market.

- The integration of technology to provide efficient and accurate solutions increases patient satisfaction, which boosts the growth of the Parkinson's disease therapeutics market.

- Evidence-based methods are used, which increase the accuracy, safety, and outcomes of patient treatment. Evidence-based solutions are also used to provide patient-centered care.

- Healthcare professionals also provide services at home, in which the patients' care is taken in the comfort of their homes.

Parkinson's Disease Therapeutics Market Outlook

- Global Expansion: A rise in geriatric populations, a rigorous drug pipeline, and the adoption of digital health technologies for better patient management are propelling further progression.

- Major Investor: The American Parkinson Disease Association raised its research funding by 55% in 2025, committing $4.04 million to new projects.

- Startup Ecosystem: In March 2025, Hologen Neuro AI, a new joint venture formed among MeiraGTx and an AI startup, was established to boost MeiraGTx's AAV-GAD gene therapy program for Parkinson's disease.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 7.02 Billion |

| Market Size in 2026 | USD 7.49 Billion |

| Market Size in 2035 | USD 14.28Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.36% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Class, Route of Administration, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising aging population

The rise in the aging population can be the driver of the Parkinson's disease therapeutics market. Parkinson's disease is more prevalent among Older individuals, and as the population ages, the number of people affected by Parkinson's disease rises. With the aging population, there's a heightened focus on improving the quality of life for individuals living with chronic conditions like Parkinson's disease.

Restraint:

Side effects of Parkinson's disease therapeutics

The side effects of Parkinson's Disease therapeutics include gastrointestinal disturbances such as nausea & vomiting and orthostatic hypotension. Neuropsychiatric features include anxiety and hallucinations that may occur due to “off-target” effects of dopamine acting in extranigral brain regions.

Opportunity:

Rising research and development activities for developing advanced Parkinson's disease therapeutics

The rising research and development activities for developing advanced Parkinson's disease therapies can be an opportunity for the growth of the Parkinson's disease therapeutics market for these therapies. Research and development activities include technological innovations, drug discoveries, pipeline clinical trial expansion, collaborative effects efforts, patient sanitary approaches, and regulatory support. For instance, Pharmaceutical companies invest in R&D in anticipation of future profits. For each drug that a company considers pursuing, anticipated returns depend on three main factors: the expected lifetime global revenue from the drug, the new drug's likely R&D costs, and policies that affect the supply of and demand for prescription drugs.

Segment Insights

Drug Class Insights

The levodopa/carbidopa segment dominated the Parkinson's disease therapeutics market in 2025. The most common therapy for Parkinson's disease for many years has been levodopa, frequently in conjunction with carbidopa. Because it restores dopamine levels in the brain, it is quite effective at reducing motor symptoms. Parkinson's disease symptoms, such as bradykinesia (slow movement), stiffness, and tremors, are especially well-managed with levodopa. For many patients as well as healthcare professionals, this makes it the right option. The levodopa has a lengthy history of safety and efficacy, which accounts for its widespread usage in therapeutic settings. That maintains its dominance in the Parkinson's disease therapeutics market because it is frequently the first-line treatment for Parkinson's disease.

The COMT inhibitors segment is expected to grow at the highest CAGR during the forecast period. COMT stands for Catechol-O-methyltransferase. COMT is a protein that degrades levodopa before the crossing of the blood-brain barrier. Levodopa/carbidopa treatment is combined with COMT inhibitors, such as entacapone and opicapone. They extend the activity and increase the effectiveness of levodopa by inhibiting the COMT enzyme, which breaks it down. Better symptom management is the outcome of this combination, which is quite advantageous for the patients. COMT inhibitors can lessen the "off" periods when the medication's benefits wear off and symptoms reappear by prolonging the half-life of levodopa. Because of this, patients may have a higher quality of life, which makes COMT inhibitors an appealing choice. The advantages of COMT inhibitors and other supplemental therapies are becoming increasingly apparent as our understanding of Parkinson's disease develops. In addition to the usual levodopa/carbidopa therapy, this has resulted in a rise in adoption and more regular prescriptions. The COMT is used in the management of the later center but used in conjunction with levodopa.

Global Parkinson's Disease Therapeutics Market Revenue, By Drug Class, 2021-2023(USD Million)

| Drug Class | 2021 | 2022 | 2023 |

| Levodopa/Carbidopa | 2,800.4 | 2,969.3 | 3,152.8 |

| Dopamine Agonist | 730.0 | 768.8 | 810.7 |

| Adenosine A2A Antagonist | 187.5 | 200.2 | 214.0 |

| COMT Inhibitors | 242.0 | 262.8 | 285.6 |

| MAO-B Inhibitors | 732.1 | 764.6 | 799.5 |

| Glutamate Antagonist | 267.4 | 289.1 | 312.9 |

| Others | 531.4 | 571.4 | 615.1 |

Route of Administration Insights

The oral segment dominated the Parkinson's disease therapeutics market in 2025. The oral route of administration is an administration in which drugs or active ingredients are delivered from the mouth, which proceeds via the digestive system for systemic distribution. The drug is ingested by the patient; it is usually taken as a pill, capsule, or liquid. The medication dissolves in the gastrointestinal tract's fluids, mostly in the intestines and stomach. The gastrointestinal tract's lining, especially the small intestine, is where the dissolved medication is absorbed. The gut walls' large surface area and abundant blood flow aid in this absorption. The absorbed medication travels via the portal vein through the liver before entering the bloodstream. A percentage of the medication is metabolized by the liver, which may limit the quantity of active medication that enters the bloodstream. First-pass metabolism or the first-pass effect are terms used to describe this. The residual active medication enters the circulation and spreads throughout the body to carry out its medicinal effects.

The transdermal segment is growing significantly in the Parkinson's disease therapeutics market. Drug distribution via transdermal patches is a practical and non-invasive approach. In particular, they are simpler to administer than oral drugs for older patients or those who experience dysphagia, which is a prevalent symptom of Parkinson's disease. Over a lengthy period of time, transdermal patches offer a continuous and regulated release of medicine. This lessens the swings brought on by oral dosage that might cause "on-off" phenomena by helping to maintain steady medication levels in the circulation. The transdermal patches help reduce adverse gastrointestinal effects, including nausea and vomiting, which are frequently connected to oral drugs, by avoiding the gastrointestinal tract. The transdermal devices that administer drugs continuously can result in better treatment results. For example, studies have demonstrated the efficacy of the rotigotine transdermal patch (Neupro) in the management of both motor and non-motor symptoms of Parkinson's disease.

Global Parkinson's Disease Therapeutics Market Revenue, By Route of Administration, 2021-2023(USD Million)

| Route of Administration | 2021 | 2022 | 2023 |

| Oral | 3,569.1 | 3,733.9 | 3,911.0 |

| Subcutaneous | 362.9 | 390.9 | 421.6 |

| Transdermal | 541.2 | 575.9 | 613.7 |

| Others | 1,017.9 | 1,125.5 | 1,244.3 |

Patient Insights

The adult segment dominated the Parkinson's disease therapeutics market in 2025. The older persons are most affected by Parkinson's disease. Parkinson's disease is more common, and its incidence rises sharply with age, especially in people over 60. This demographic trend guarantees that the majority of patients in need of therapeutic interventions are adults. The number of people entering age groups where Parkinson's disease is more common is rising as the world's population ages. As a result of this change in demographics, the illness is detected and treated in a greater percentage of people. Historically, the adult population has been the primary target of Parkinson's disease drug development and approval. A market that is mostly focused on adult therapies results from the fact that the majority of clinical studies and treatment recommendations are created with adult patients' requirements in mind.

The pediatric segment is growing in the Parkinson's disease therapeutics market. Parkinson's disease in children and those with early onset is becoming more well-recognized and may be diagnosed more accurately. The need for pediatric-specific therapies is driven by earlier and more frequent diagnoses in younger kids as a result of increased awareness among parents and healthcare providers. Recent developments in genetic research have revealed certain mutations linked to juvenile and early-onset Parkinson's disease. As a result, the pediatric population now has improved knowledge, diagnosis, and tailored therapy. Parkinson's disease treatment has typically neglected the juvenile population. As pharmaceutical companies concentrate on creating medicines, especially for younger patients, closing this gap offers enormous revenue prospects.

Global Parkinson's Disease Therapeutics Market Revenue, By Patient, 2021-2023(USD Million)

| Patient | 2021 | 2022 | 2023 |

| Adult | 4,628.1 | 4,928.1 | 5,254.9 |

| Pediatric | 862.9 | 898.1 | 935.7 |

Regional Insights

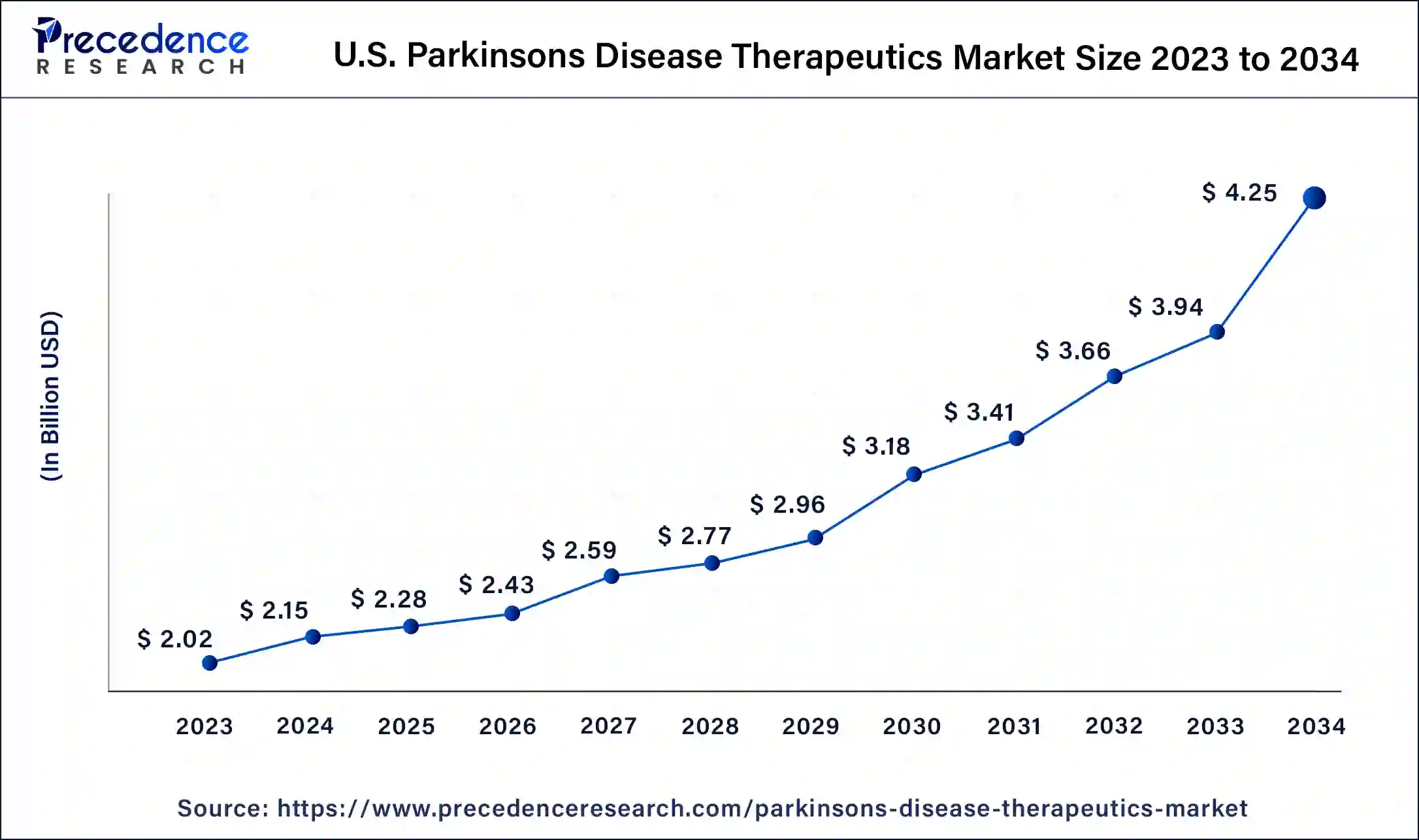

What is the U.S. Parkinson's Disease Therapeutics Market Size?

The U.S. parkinson's disease therapeutics market size is evaluated at USD 2.28 billion in 2025 and is predicted to be worth around USD 4.54 billion by 2035, at a CAGR of7.13% from 2026 to 2035.

Promising Advancements In R&D Therapies: U.S. Market Trend

The U.S. market is increasingly embracing the advances in R&D, resulting in novel drugs, varied treatment options, and improved disease recognition. Moreover, the leading players are extensively leveraging new therapies, such as Bemdaneprocel, which is an embryonic stem cell-derived therapy used in the replacement of lost dopamine-producing neurons.

How did North America Dominate the Market in 2025?

North America dominated the Parkinson's disease therapeutics market in 2025. A significant number of people in North America, especially in the US, have Parkinson's disease. The number of people diagnosed with the ailment is rising in this area due to aging populations, which creates a greater market for therapies. North America is home to cutting-edge medical facilities and technology, as well as a sophisticated healthcare infrastructure. This increases the need for medications by enabling early diagnosis, thorough therapy, and improved management of Parkinson's disease. Many prestigious pharmaceutical firms and research facilities that make significant investments in Parkinson's disease research and development are located in the region. As a result, there is a constant flow of novel and cutting-edge treatments into the Parkinson's disease therapeutics market.

- In February 2024, the San Diego-based Biotech announced the launch of Parkinson's cell therapy with $82 million.

- In January 2024, Olatec Therapeutics received a grant to commence a Phase II clinical trial of dapansutrile to slow down or stop Parkinson's disease progression. Cure Parkinson's granted the award for the trial under its International Linked Clinical Trials (iLCT) program. Dapansutrile is an oral inhibitor of the nucleotide-binding domain, leucine-rich–containing family, pyrin domain–containing.

Robust Focus on New Formulations & Delivery Systems is Driving Europe

Europe is anticipated to witness rapid expansion in the parkinson's disease therapeutics market in the coming era. This progression is mainly influenced by ongoing innovations in novel formulations and delivery approaches, including Produodopa (foslevodopa/foscarbidopa), a continuous subcutaneous 24-hour infusion of levodopa-based therapy, which received approval from the European Commission in January 2024 & Kynmobi (apomorphine hydrochloride), a new sublingual film formulation for the intermittent treatment unveiled in Germany in May 2024.

Updated Clinical Regulations: German Market Trend

Persistent progression in Germany will be impacted by the updated clinical guidelines, by the German Neurological Society (DGN) for the diagnosis and treatment of Parkinson's disease. These regulations further provide clear guidance on the use of invasive therapies, such as DBS and pump therapies, and focus on comprehensive multidisciplinary care.

Exploration of Nano-formulations & DMTs is Fueling the Asia Pacific

Asia Pacific is predicted to expand at a lucrative CAGR in the parkinson's disease therapeutics market. Day by day, various companies in ASAP are advancing nano-formulations of drugs, such as melatonin and 17β-oestradiol (E2), which are targeted drug delivery systems focusing on escalating safety and efficiency. Alongside, ASAP scientists have made a shift toward disease-modifying therapies (DMTs) to slow down the disease expansion through gene therapy, cell-based therapies, & immunomodulatory drugs.

India's Parkinson's Therapy Surge

The Parkinson's Disease Therapeutics Market in India is growing significantly, driven by an aging population, rising disease incidence, and enhanced awareness. Increased R&D, new product launches, and improved healthcare access are key factors fueling this rapid expansion. The market sees a notable rise in demand for advanced treatment options and innovative therapies across the country.

Latin America Innovations in the Parkinson's Disease Therapeutics Market

The Latin American market is expanding as a direct response to a growing geriatric population and the subsequent rise in age-related neurological conditions. Enhanced public awareness and more accurate diagnostic techniques are facilitating earlier clinical intervention, ensuring more patients receive specialized care.

Brazil Parkinson's Disease Therapeutics Market Trends

Brazil's market is growing steadily, driven by an increasing prevalence of Parkinson's due to an aging population and greater awareness of neurological health. Carbidopa-levodopa combinations dominate the treatment landscape as the most widely used drug class, supported by the convenience of oral administration and inclusion in public health programs, while other segments like dopamine agonists, MAO-B inhibitors, and novel formulations contribute to diversified therapeutic options.

Parkinson's Disease Therapeutics Market: Value Chain Analysis

- R&D This mainly encompasses from underlying causes and pathologies of PD, like alpha-synuclein accumulation, mitochondrial dysfunction, inflammation, and genetic factors, to clinical trial phases & regulatory approvals.

Key Players: Roche, Denali Therapeutics, BlueRock Therapeutics, etc. - Clinical Trials & Regulatory ApprovalsThe FDA approval process includes different phases of testing to demonstrate safety and efficacy.

Key Players: Zhujiang Hospital, Mahidol University, Giovanni Mirabella, etc. - Patient Support & ServicesFor patients, there are numerous multidisciplinary care teams, patient support programs (PSPs) empowered by pharmaceutical companies and non-profit organizations, and financial assistance programs.

Key Players: AbbVie, Amneal Pharmaceuticals, Novartis, etc.

Key Players in Parkinson's Disease Therapeutics Market and Their Offerings

- Cerevel Therapeutics- It has explored tavapadon, a selective D1/D5 receptor partial agonist.

- Hallamshire Physiotherapy Ltd_A company that mainly offers specialized, evidence-based services for Parkinson's disease, emphasizing slowing symptom growth and enhancing movement, balance, and confidence.

- Novartis AG- A key player that facilitates Symmetrel (amantadine), with a strong pipeline of potential new therapies in development through alliances.

- Olatec Therapeutics- It has introduced dapansutrile (OLT1177), a proprietary, oral NLRP3 inhibitor.

- Teva Pharmaceuticals Ltd.- A vital company provides various generic medications used in Parkinson's treatment, like generic forms of Levodopa/Carbidopa/Entacapone, Ropinirole, and Pramipexole.

Recent Developments

- In September 2025, BlueRock Therapeutics (a subsidiary of Bayer AG) announced a historic milestone in neurodegenerative research: the treatment of the first patient in its Phase III exPDite-2 clinical trial for bemdaneprocel (BRT-DA01). This study is the first-ever pivotal Phase III trial for an allogeneic pluripotent stem cell-derived therapy designed to treat Parkinson's disease.(Source: https://www.bayer.com )

- In June 2025, Alzheimer's Research UK (ARUK) and Cure Parkinson's announced a strategic partnership to accelerate the delivery of new treatments for people with Parkinson's and dementia. The collaboration will leverage shared expertise and resources, building on Cure Parkinson's international linked clinical trials initiative, to prioritize promising drug candidates for clinical trials.(Source: https://www.alzheimersresearchuk.org )

- In February 2024, Hallamshire Physiotherapy Ltd, Sheffield, launched a revolutionary new therapy to help people with Parkinson's manage some of their symptoms. Stroll Augmented Reality Therapy involves patients wearing a special headset linked to specialist digital therapeutic software to help improve mobility, confidence, and independence.

- In January 2024, AbbVie announced the launch of Produodopa in Europe. Produodopa is useful for the treatment of advanced Parkinson's disease with severe motor fluctuations and hyperkinesia or dyskinesia.

- In August 2023, Acorda Therapeutics, Inc. announced the launch of a new INBRIJA (levodopa inhalation powder) website and brand campaign. The campaign, "For the Fighters," is based on direct feedback from people with Parkinson's (PwPs).

Segments Covered in the Report

By Drug Class

- Levodopa/Carbidopa

- Dopamine Agonists

- Adenosine A2A Antagonist

- COMT Inhibitors

- MAO-B Inhibitors

- Glutamate Antagonist

- Others

By Route of Administration

- Oral

- Subcutaneous

- Transdermal

- Others

By Patient

- Adult

- Pediatric

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting