What is the Celiac Disease Treatment Market Size?

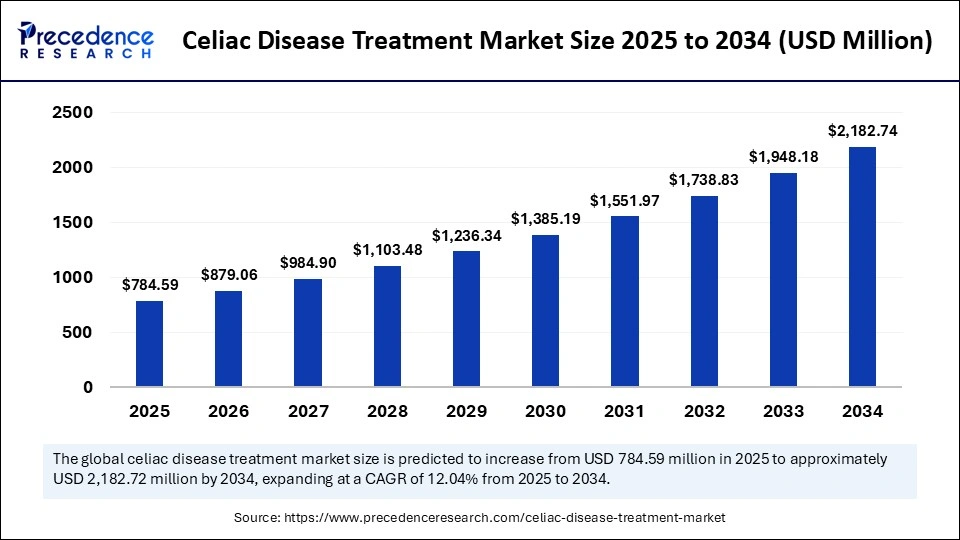

The global celiac disease treatment market size is calculated at USD 784.59 million in 2025 and is predicted to increase from USD 879.06 million in 2026 to approximately USD 2,182.74 million by 2034, expanding at a CAGR of 12.04% from 2025 to 2034. The market is experiencing significant growth due to increased diagnosis, disease awareness, and ongoing research into new therapies.

Market Highlights

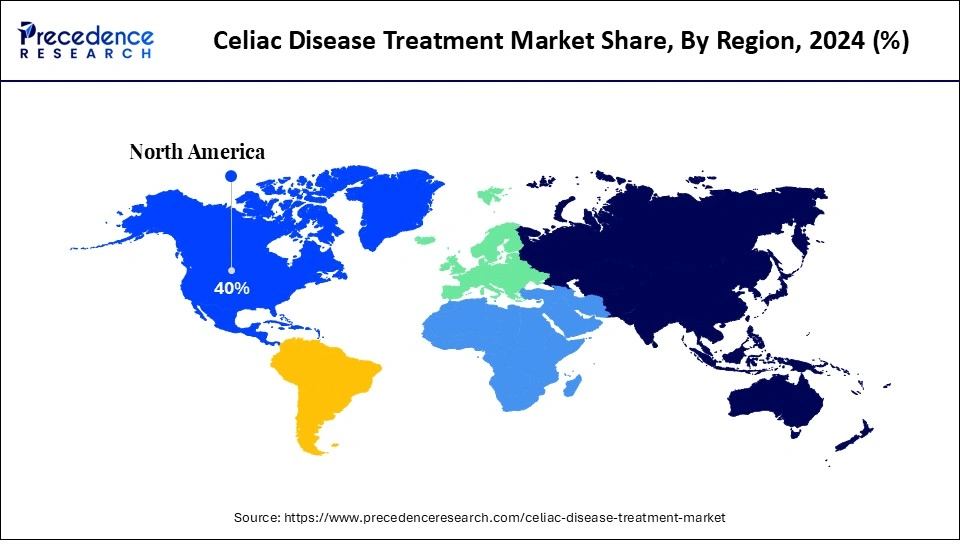

- North America held the largest market share of 40% in 2024.

- The Asia Pacific is expected to experience the fastest CAGR from 2025-2034.

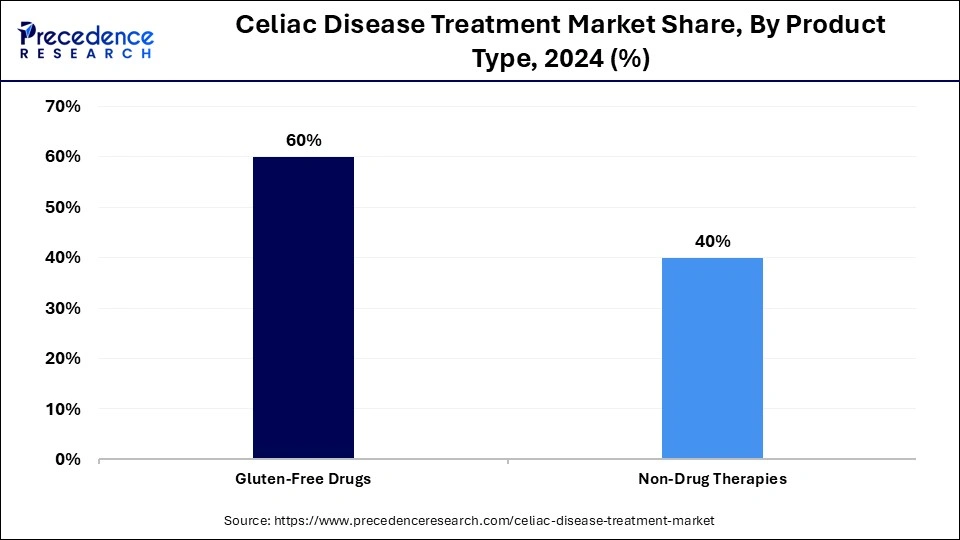

- By product type, the gluten-free drugs segment held the largest market share of 60% in 2024.

- By product type, the non-drug therapies segment is expected to witness the fastest growth from 2025-2034.

- By mechanism of action, the immune modulators segment contributed the highest market share of 40% in 2024.

- By mechanism of action, the enzyme therapy segment is expected to grow at the fastest CAGR from 2025-2034.

- By route of administration, the oral segment generated the biggest market share of 70% in 2024.

- By route of administration, the injectable segment is expected to grow at the fastest CAGR from 2025-2034.

- By end users, the hospitals & clinics segment accounted for the largest market share of 50% in 2024.

- By end users, the pharmacies & retail stores segment is expected to grow at the fastest CAGR from 2025-2034.

- By distribution channel, the hospital pharmacies segment held the largest market share of 45% in 2024.

- By distribution channel, the online/e-commerce segment is expected to grow at the fastest CAGR from 2025-2034.

What is the Celiac Disease Treatment Market?

The celiac disease treatment market refers to the industry involved in providing therapies, medications, and management strategies for individuals diagnosed with celiac disease, an autoimmune disorder triggered by gluten ingestion. The market includes pharmaceutical products, dietary supplements, diagnostic tools, and other therapeutic interventions aimed at reducing symptoms, preventing complications, and improving patients' quality of life. It is driven by the increasing prevalence of diagnosed cases worldwide, advancements in diagnostic techniques, and ongoing research into innovative treatment options.

Key Technological Shifts in the Celiac Disease Treatment Market

Technologies like AI are significantly impacting the celiac disease treatment market by dramatically improving diagnostics, driving drug discovery, and enabling personalized patient management. AI models, such as deep learning, are trained on thousands of biopsy data and images to accurately identify the features of celiac disease.

According to a new study, AI demonstrates higher diagnostic accuracy in detecting celiac disease than human pathologists do with video capsule endoscopy analysis, a less invasive procedure, highlighting AI's significant role in disease detection and drug discovery as well.

Celiac Disease TreatmentMarket Outlook

The celiac disease treatment market is experiencing steady growth, driven by the rising global prevalence of celiac disease and improvements in diagnostic rates. Increased public awareness of gluten-related disorders, coupled with the broader adoption of gluten-free diets, is significantly boosting demand. Additionally, advancements in therapeutic interventions, including enzyme therapies, biologics, and immune-modulating drugs, along with the growing availability of treatment options through specialty pharmacies and online distribution channels, are supporting market expansion.

The market is witnessing global traction, with North America and Asia Pacific emerging as key growth regions. North America's growth is supported by high disease awareness, diagnostic infrastructure, and research funding, while Asia Pacific is seeing rising diagnoses due to improving healthcare access and changing dietary patterns. In Europe, market growth is strongly underpinned by government-backed healthcare initiatives, robust diagnostic networks, and awareness campaigns aimed at early identification and management of celiac disease.

The celiac disease treatment space is supported by a robust and innovation-driven startup ecosystem. Notably, Beyond Celiac Investments (BCI), a strategic advocacy initiative, is channeling capital into therapeutic development. Biotech startups such as ImmunogenX, Glutenon, and Calypso Biotech are actively pursuing peptide-based drugs and biologics, and many are advancing through various stages of clinical trials. These early-stage innovators are pushing the boundaries of treatment beyond traditional dietary management, aiming to offer disease-modifying therapies that could significantly reshape the market landscape.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 784.59 Million |

| Market Size in 2026 | USD 879.06 Million |

| Market Size by 2034 | USD 2,182.74 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Mechanism of Action, Route of Administration, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Celiac Disease Treatment MarketSegment Insights

Product Type Insights

The gluten-free drugs segment dominated the market while holding the largest share of 60% in 2024. This dominance is primarily attributed to the lifelong adherence to a strict gluten-free diet, which remains the most widely prescribed and effective approach to managing the condition. Increased awareness of celiac disease, including its symptoms and long-term complications, has fueled demand for gluten-free therapeutic products. Moreover, the wide availability and accessibility of gluten-free products across retail and specialty channels continues to support this segment's expansion.

The non-drug therapies segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the fact that, currently, non-pharmacological interventions, particularly dietary modifications, are the only universally accepted and medically endorsed treatment for celiac disease. The segment is further bolstered by the rapid expansion of the gluten-free food and beverage industry and the emergence of advanced nutritional technologies, creating new opportunities for innovation in supportive therapies and lifestyle management solutions.

Mechanism of Action Insights

The immune modulators segment led the market with a 40% share in 2024. This dominance stems from the fact that celiac disease is an autoimmune disorder, triggered by the ingestion of gluten-containing foods. Immune modulator therapies are specifically designed to regulate or suppress the body's abnormal immune response to gluten, thereby addressing the root cause of the disease rather than just managing its symptoms. These drugs offer the potential for more definitive, long-term therapeutic outcomes and are gaining traction as research shifts toward disease-modifying treatments beyond dietary control.

The enzyme therapy segment is expected to witness the fastest growth during the forecast period. This growth is primarily driven by its potential to mitigate the effects of gluten ingestion, offering an alternative to the strict, lifelong gluten-free diet currently required for managing celiac disease. Enzyme-based treatments are gaining traction within the medical community for their ability to break down immunogenic gluten peptides, thereby reducing intestinal damage and improving patient quality of life, especially in cases of accidental gluten exposure.

Route of Administration Insights

The oral segment dominated the market, holding the largest share of 70% in 2024. This dominance is primarily attributed to the convenience, non-invasiveness, and broad availability of orally administered therapies. Oral treatments align with patient preferences for easy-to-use, self-managed options, particularly as awareness of gluten-related disorders grows. The increasing shift toward non-invasive therapeutic approaches for managing chronic conditions has significantly reinforced the demand for oral formulations, making this the most widely adopted route of administration across diverse demographics.

The injectable segment is expected to register the fastest CAGR over the forecast period. Growth in this segment is being driven by the emergence of novel biologics and immune-modulatory therapies, particularly for refractory or severe cases of celiac disease that do not respond adequately to dietary management alone. As these advanced therapies often require precise systemic delivery, injectable formulations are considered the most effective and clinically appropriate route, especially in controlled or hospital-based settings, contributing to their accelerating uptake.

End User Insights

The hospitals & clinics segment held the largest market share of 50% in 2024. This is largely due to the fact that hospitals and specialized clinics serve as primary points of diagnosis and treatment initiation. These facilities offer access to advanced therapeutic interventions such as enzyme therapies and biologics, particularly for moderate to severe or refractory cases. Additionally, the growing prevalence of celiac disease, coupled with the expansion of well-structured healthcare infrastructure globally, continues to support this segment's growth.

The pharmacies & retail stores segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the rising global demand for gluten-free products and the increased accessibility of over-the-counter supplements, enzyme therapies, and dietary aids through pharmacies and retail outlets. Pharmacies play a crucial role in supporting ongoing disease management, offering both prescription and non-prescription products essential for daily care. As awareness increases and product availability improves, this segment is expected to expand significantly, especially in urban and semi-urban areas.

Distribution Channel Insights

The hospital pharmacies segment led the market, holding the largest share of 45% in 2024. The segment's dominance is due to the services provided by hospital pharmacies to diagnose and treat complex autoimmune diseases like celiac disease, helping manage them effectively with the support of healthcare professionals and ongoing research. Hospital pharmacies offer a comprehensive care approach, monitoring symptoms and changes in patients' responses throughout the treatment.

The online/e-commerce segment is expected to expand at the fastest CAGR during the foreseeable period of 2025-2034. The segment is expanding significantly due to the increasing preference among consumers and healthcare professionals for a wider product selection and competitive pricing on medications for celiac disease treatment. E-commerce platforms offer exactly the same benefits, fueling the segment's growth.

Celiac Disease Treatment MarketRegional Insights

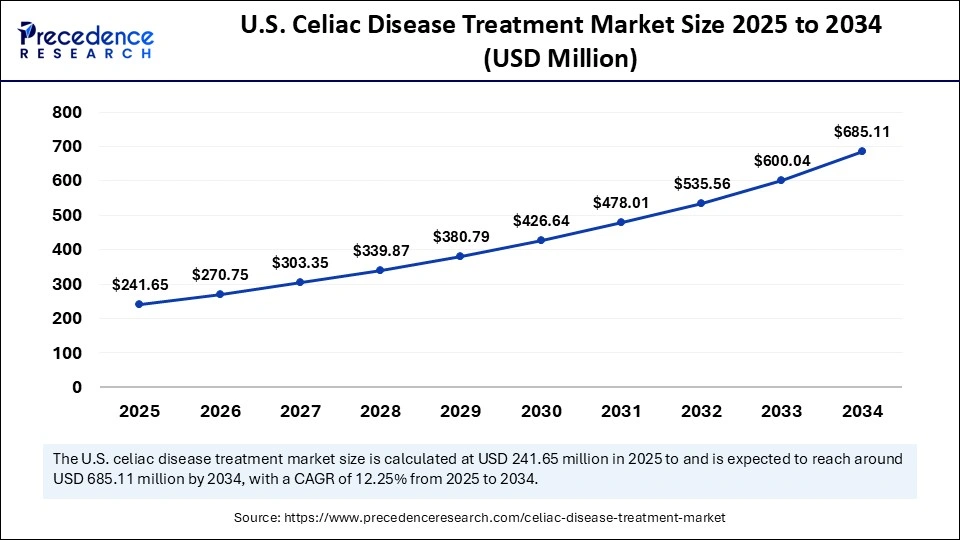

The U.S. celiac disease treatment market size is evaluated at USD 241.65 million in 2025 and is projected to be worth around USD 685.11 million by 2034, growing at a CAGR of 12.25% from 2025 to 2034.

What Made North America a Dominant Force in the Celiac Disease Treatment Market?

North America registered dominance in the market by holding the largest share of 40% in 2024. The region's dominance is attributed to a combination of factors, including strong government-backed healthcare initiatives, significant investments in drug discovery and treatment innovation, and an expanding market for gluten-free products. The region also benefits from a well-established research infrastructure and widespread awareness of autoimmune and gluten-related disorders. Additionally, the presence of major biotech and pharmaceutical companies, as well as a thriving startup ecosystem focused on immune and gastrointestinal health, continues to accelerate advancements in treatment and accessibility across the region.

U.S. Celiac Disease Treatment Trends

The U.S. FDA plays a vital role in market growth by providing regulatory guidelines for drug development and safety instructions, along with approaches like fast-track designation to accelerate the review of potential therapies for unmet needs. Additionally, leading academic centers like Mayo Clinic invest heavily in celiac disease research.

Asia Pacific is expected to experience the fastest growth in the upcoming period. The regional market growth is driven by a convergence of factors, including rising awareness of gluten-related disorders, increased healthcare expenditure, and government-backed health policies aimed at strengthening diagnostic and treatment capabilities. The region is witnessing significant advancements in diagnostic technologies, such as genetic testing and antibody-based detection, which are enabling earlier and more accurate identification of celiac disease.

Additionally, sustained investment in healthcare infrastructure is expanding access to medical services, particularly in emerging economies. This expansion is facilitating wider screening, improved patient reach, and enhanced disease management strategies. The ongoing commercialization of advanced diagnostics and therapies further positions Asia Pacific as a high-growth market for celiac disease treatment over the next decade.

India Celiac Disease Treatment Market Trends

There is a significant surge in the consumption of gluten-free foods in India, driven by the rising incidence of celiac disease and growing awareness of the need for lifelong dietary management. In response, domestic manufacturers are actively launching new gluten-free products, particularly targeting health-conscious consumers and diagnosed patients in urban centers.

Additionally, there has been a noticeable improvement in diagnostic capabilities and public health awareness, with both the general population and healthcare professionals increasingly recognizing the symptoms and long-term risks associated with celiac disease. This evolving landscape is creating a favorable environment for market growth, especially in terms of product innovation, retail expansion, and early diagnosis initiatives.

Europe is expected to grow significantly due to increased awareness, the high prevalence of this health condition, and supportive government healthcare policies. Patient advocacy groups and public health campaigns, along with improved diagnostic technologies, forecast higher rates of celiac disease diagnosis across Europe.

Germany Celiac Disease Treatment Market Trends

Germany has a robust healthcare system that incorporates advanced diagnostic technologies and research. It includes celiac-specific antibodies and genetic markers. Additionally, the rapid growth of gluten-free products in German supermarkets, health stores, and restaurants highlights its well-developed efforts to combat celiac disease.

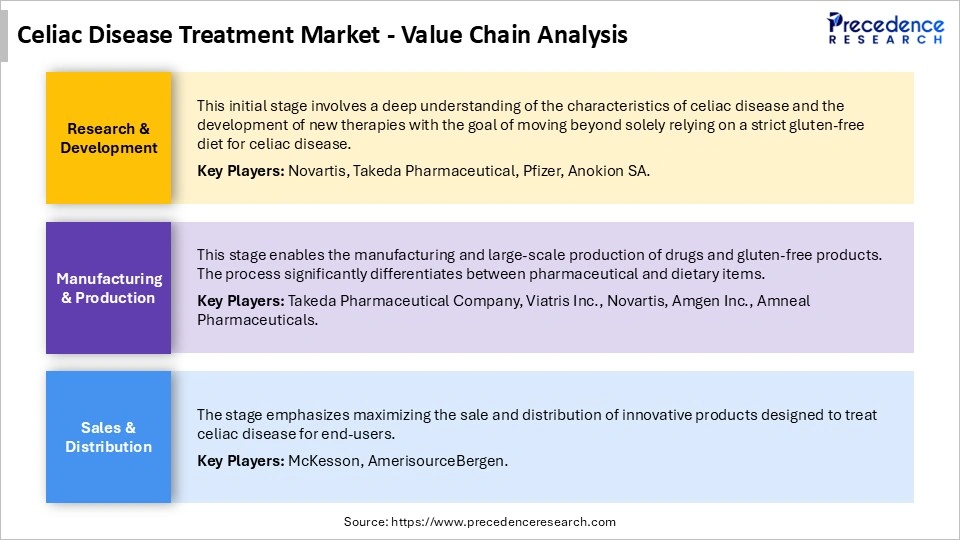

Celiac Disease Treatment Market Value Chain

Top Companies in the Celiac Disease Treatment Market

| Tier | Representative Companies | Rationale/Role | Estimated Cumulative Share |

| Tier I Major Players | Takeda Pharmaceutical Company Limited; Amgen Inc.; Pfizer Inc.; Novartis AG; Johnson & Johnson | These firms have global scale, major R&D programs, broad therapeutic portfolios (including adjunctive therapies for celiac or autoimmune indications), and strong commercialization reach. Their size, resources and breadth of operations put them at the forefront of the market. | 45% |

| Tier II Established Players | BioLineRx Ltd; Innovate Biopharmaceuticals Inc.; Calypso Biotech SA; Amneal Pharmaceuticals LLC; Zydus Pharmaceuticals Ltd | These companies play significant roles in developing targeted therapies (enzyme therapies, immune modulators) for celiac disease or offer strong regional prominence, but their global impact is less than the largest global pharmas. They fill important niches and support growth. | 25% |

| Tier III Emering/Niche Players | 9 Meters Biopharma Inc; ImmunogenX Inc.; Anokion SA; ActoBio Therapeutics; Cour Pharmaceuticals Ltd | These are early stage or highly specialized firms focused on novel mechanisms (eg. glutenase enzymes, zonulin antagonists, peptide therapies) or specific geographic/diagnostic niches. They contribute meaningfully but are not yet dominant. | 20% |

Recent Developments

- In February 2025, AliveDx submitted a 510(k) premarket notification and is looking to gain approval from the U.S. FDA for its MosaiQ AiPlex Connective tissue diseases microarray, intended to enhance diagnostic precision and efficiency for the detection of celiac diseases. (Source: https://www.medicaldevice-network.com)

- In September 2024, Barinthus Biotherapeutics initiated its first-in-human Phase 1 trial of VTP-1000 in adults having celiac disease. It's a randomized, placebo-based clinical trial that consists of a controlled gluten challenge. It holds potential to evaluate the safety and tolerability of VTP-1000.(Source: https://investors.barinthusbio.com)

Exclusive Analysis on the Celiac Disease Treatment Market

The celiac disease treatment market is entering a major inflection phase, underpinned by structural shifts in diagnostics, therapeutic innovation, and patient self-management behaviors. With ever-widening screening programs and a gradual shift from purely dietary management toward adjunctive pharmacologic and enzyme-based therapies, the market is moving from a support product model into a bona fide therapeutic growth engine. Key catalysts include rising global diagnosis rates, driven by improved serology, genetic profiling, and point of care testing, and a deeply underserved patient pool, which opens a sizeable white space for new entrants and incumbents alike.

Moreover, the convergence of innovative enzyme therapies, biologics targeting immune mediators, and advanced supplements is creating a layered value opportunity. While vitamins and minerals dominate today, emerging modalities, such as gluten-degrading proteases and immune modulators, are poised to unlock premium treatment segments and drive differentiated outcomes. The incremental value lies not just in new molecules but in holistic management platforms combining diet, diagnostics, therapy, and digital adherence solutions.

Regional dynamics further amplify upside potential. North America continues to anchor market revenue, thanks to high diagnosis rates and R&D infrastructure, but the true growth frontier lies in regions such as Asia Pacific and Latin America, where screening penetration remains low, healthcare expenditure is rising, and awareness remains nascent. These emerging geographies offer accelerated CAGRs and attractive strategic entry points for global players and local innovators alike.

In summary, the market stands out as a fertile ground for investment and competitive differentiation: growing prevalence, diagnostic expansion, therapeutic innovation, and geographies awakening to the disease combine to create a multi-vector growth story. Stakeholders who can navigate the regulatory, commercial, and patient engagement complexities will find themselves well-positioned in this under penetrated therapeutic niche.

Celiac Disease Treatment MarketSegments Covered in the Report

By Product Type

- Gluten-Free Drugs

- Enzyme Therapy

- Immunotherapy

- Nutraceuticals / Supplements

- Non-Drug Therapies

- Dietary Interventions

- Probiotics / Prebiotics

- Medical Foods

By Mechanism of Action

- Enzyme Therapy

- Gluten-Degrading Enzymes

- Protease-Based Therapies

- Immune Modulators

- Monoclonal Antibodies

- Vaccine-Based Therapies

- Other Therapies

- Probiotics

- Symptomatic Treatments

By Route of Administration

- Oral

- Tablets

- Capsules

- Liquids / Powders

- Injectable

- Subcutaneous

- Intravenous

- Topical / Others

- Skin Patches

- Nasal Sprays

By End User

- Hospitals & Clinics

- Specialty Clinics

- Gastroenterology Units

- Pharmacies & Retail Stores

- Community Pharmacies

- Online Pharmacies

- Home Care & Others

- Direct-to-Patient Programs

- Home-Based Therapy

By Distribution Channel

- Hospital Pharmacies

- Direct Procurement

- Hospital Networks

- Retail Pharmacies

- Brick & Mortar

- Online Retail

- Online / E-Commerce

- Specialty Websites

- Marketplace Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting