What is the Pedicle Screw Systems Market Size?

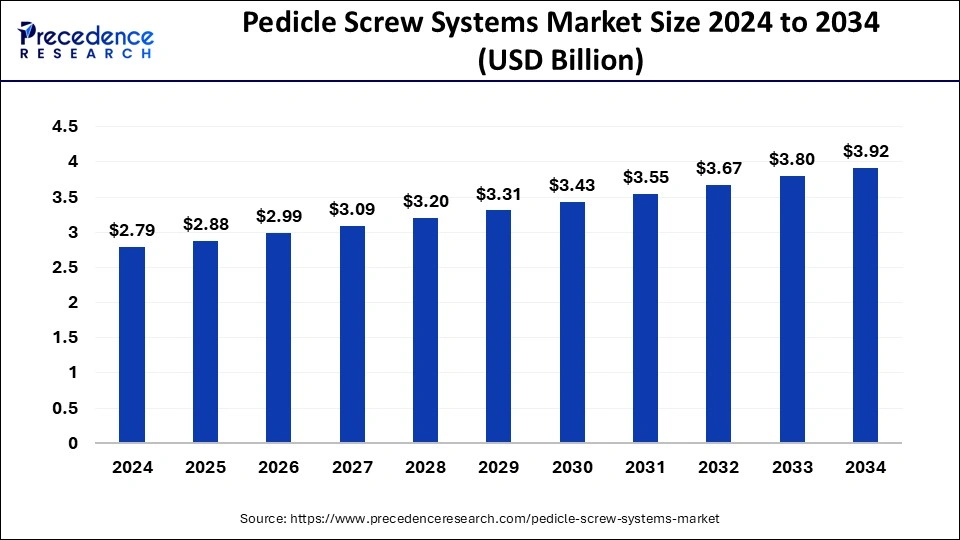

The global pedicle screw systems market size is calculated at USD 2.88 billion in 2025 and is predicted to increase from USD 2.99 billion in 2026 to approximately USD 4.04 billion by 2035, expanding at a CAGR of 3.44% from 2026 to 2035.

Pedicle Screw Systems Market Key Takeaways

- In terms of revenue, the global pedicle screw systems market is valued at USD 2.88 billion in 2025.

- It is projected to reach USD 4.04 billion by 2035.

- The market is expected to grow at a CAGR of 3.44% from 2026 to 2035.

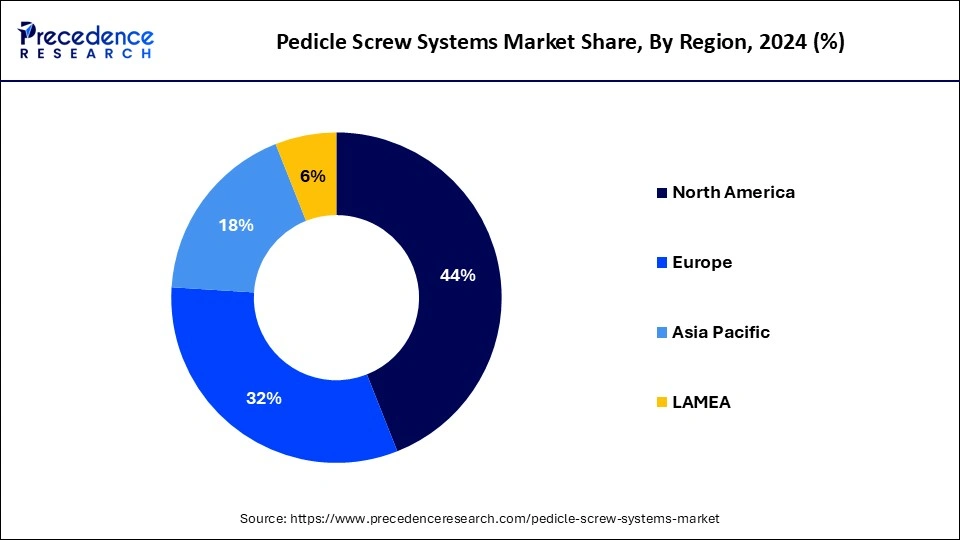

- North America led the market with the largest revenue share of 44% in 2025.

- Europe is expected to grow at a significant CAGR in the market during the forecast period.

- By product type, the polyaxial pedicle screw segment has held a major revenue share of 61% in 2025.

- By product type, the monoaxial pedicle screw segment is expected to grow rapidly in the market by product type during the forecast period.

- By surgery, the open surgery segment has contributed more than 76% in 2025.

- By surgery, the minimally invasive surgery segment is expected to expand at the highest CAGR in the market during the forecast period.

- By indication, the spinal deformities segment led the market in 2025.

- By indication, the spinal trauma segment is expected to gain a notable share of the market during the forecast period.

- By application, the thoracolumbar segment dominated the market in 2025.

- By application, the lumbar segment is expected to grow rapidly in the market during the forecast period.

Market Overview

The pedicle screw systems market refers to businesses involved in one kind of spinal instrumentation utilized in spinal fusion procedures to give the spine rigidity and support. In order to assist in rectifying deformities, fixing fractures, or alleviating pressure on the spinal cord and nerves caused by disorders like scoliosis, spondylolisthesis, or spinal stenosis, these devices are made to immobilize and straighten the vertebral column.

The pedicle screw systems market is fragmented with multiple small-scale and large-scale players, such as ATEC Inc, DePuy Synthesis Spine Inc, B Braun Melsungen AG, CoreLink Holding LLC, Globus Medical Inc, Medtronic PLC, Orthofix Medical Inc, Zimmer Biomet, Stryker Corporation, XTANT Medical.

Pedicle Screw Systems Market Growth Factors

- The pedicle screw systems are used in open surgery and minimally invasive surgery of spinal deformities and spinal trauma.

- The pedicle screw systems market is driven by the increasing number of surgeries performed each year and the demand for advanced trends in spine fixation.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.04 Billion |

| Market Size in 2025 | USD 2.88 Billion |

| Market Size in 2026 | USD 2.99 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.44% |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Surgery, Indication, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Rising number of accidents

The rising number of accidents can grow the pedicle screw systems market. Spinal injuries are a common impact of accidents, especially those involving vehicles and high-impact sports. The surgery using pedicle screws or other spinal fixation devices is typically required for such kinds of injuries.

Restraint

Technical limitation of pedicle screw system

The technical limitation of the pedicle screw system slowdown the pedicle screw systems market. In order to avoid causing damage to surrounding tissues and spinal nerves, pedicle screw systems need to be positioned extremely, in fact. The patient's and surgeon's acceptance of the procedure can get discouraged by poor outcomes resulting from technical limitations in navigation and placement effectiveness.

Opportunity: Demand for advanced trends in spine fixation

The demand for advanced trends in spine fixation can be the opportunity to grow the pedicle screw systems market. The level of accuracy and results of spinal procedures are enhanced by advancements in pedicle screw systems, including better materials, minimally invasive surgical methods, and improved imaging and navigation technology. The operations are safer, more efficient, and more appealing to patients and doctors because of the advanced trend in spine fixation.

Product Type Insights

The polyaxial pedicle screw segment dominated the pedicle screw systems market in 2025. In contrast to monoaxial screws, polyaxial pedicle screws offer more placement and angulation freedom. Their extensive usage stems from their remarkable adaptability to a wide range of complicated spinal abnormalities and spinal anatomy. The versatility of the screw head allows surgeons to achieve the best possible alignment and fixation of the spinal construct. By guaranteeing more accurate placement and stability and lowering the possibility of problems, this flexibility enhances surgical results. In difficult spine procedures, including those requiring severe scoliosis, trauma, or multi-level spinal fusion, polyaxial screws are very helpful. Their shape makes it simpler to put and contour rods, which is essential in such difficult processes.

The monoaxial pedicle screw segment is expected to grow rapidly in the pedicle screw systems market by product type during the forecast period. Because they provide stiff fixation, monoaxial screws are especially well-suited for several surgical operations that call for a high level of stability. In situations of trauma and certain spinal deformity treatments, accurate and strong alignment is essential. Monoaxial screws are becoming more versatile and performing better because to design and material innovations. More advanced biomechanical features of upcoming monoaxial screws will boost their usefulness in intricate spinal operations.

Surgery Insights

The open surgery segment dominated the pedicle screw systems market in 2025. For many years, the usual treatment for spinal problems has been open surgery. The open spinal procedures are performed by highly trained and experienced surgeons, which helps to explain their continuous dominance. In the case of severe scoliosis, major injuries, and multi-level spinal fusion, open surgery is frequently necessary. To obtain the desired surgical results in these patients, a direct and complete approach is required. The open surgery is a major consideration in the design of many sophisticated pedicle screw systems. Because of this compatibility, the newest and most efficient screw systems are always in stock and ready for use throughout open operations. When compared to minimally invasive methods, open surgery offers superior visibility and access to the spine. This enables surgeons to operate with more control and precision.

The minimally invasive surgery segment is expected to expand at the highest CAGR in the pedicle screw systems market during the forecast period. Due to the many advantages minimally invasive operations provide, such as less discomfort after surgery, shorter hospital stays, faster recovery periods, and fewer scars, patients are choosing them more and more. The use of minimally invasive surgery procedures is being driven by this increasing patient choice. The effectiveness and safety of minimally invasive surgery have been greatly enhanced by ongoing advancements in navigation systems, imaging technology, and surgical tools. Both surgeons and patients find minimally invasive surgery to be more appealing and realistic as a result of these technical developments. The minimally invasive surgery methods are being taught to more surgeons, which improves their capacity to carry out these surgeries efficiently.

Indication Insights

The spinal deformities segment led the pedicle screw systems market in 2025. When treating spinal abnormalities, pedicle screws have made it possible to straighten curvature more effectively than hybrid, hook, or sublaminar wire structures. The advantage is thought to be attributed to the robust anchoring that pedicle screws give, which appears to be more significant than the reduction approach that was employed. The coronal and axial planes are where spinal deformity correction mostly takes place, yet there have also been reports of hypokyphosis correction and thoracic kyphosis reduction. Compared to alternative anchoring implants, pedicle screws provide a higher potential for three-dimensional correction of spinal abnormalities, particularly in the transverse plane.

In the coronal plane, monoaxial screws outperformed polyaxial screws in terms of corrections and derotation method effectiveness. In comparison with alternative anchoring implants, pedicle screws provide a higher potential for three-dimensional correction of spinal abnormalities, particularly in the transverse plane. In the coronal plane, monoaxial screws outperformed polyaxial screws in terms of corrections and derotation method effectiveness. Nonetheless, greater sagittal profile restoration is linked to the use of polyaxial screws. Additionally, monoplane screws were created to increase rod engagement simplicity without compromising sagittal plane strength.

The spinal trauma segment is expected to gain a notable share of the pedicle screw systems market during the forecast period. The world over, the number of cases of spinal trauma is increasing, frequently as a result of violence, falls, sports injuries, and auto accidents. An increase in pedicle screw-based surgical operations is required due to the rise in spinal injuries.

The results of spinal trauma procedures have improved due to advancements in spinal surgical methods and the creation of more advanced and efficient pedicle screw systems. These developments increase the viability and success of these procedures, which promotes their uptake. As the world's population ages, so does its vulnerability to spine-related problems, including trauma. The need for sophisticated pedicle screw systems is growing since older patients frequently need more involved spine procedures. The capacity to identify spinal trauma has been enhanced by developments in diagnostic imaging technology, including MRI and CT scans.

Application Insights

The thoracolumbar segment dominated the pedicle screw systems market in 2025. Because it bears the weight of the body and allows for mobility, the thoracolumbar area of the spine, which includes the lumbar and thoracic vertebrae, is especially vulnerable to degenerative disorders and injuries. As a result, this spinal section is used in more procedures. In thoracolumbar procedures, pedicle screw systems are frequently used to treat a variety of disorders, such as degenerative disc disease, scoliosis, spinal tumors, and other abnormalities. One reason for these systems' prominence is their ability to handle a variety of diseases with ease. The crucial region for the stability and movement of the spine is the thoracolumbar spine. To guarantee effective outcomes and patient recovery, surgical operations in this area frequently need strong and dependable fixation options, such as pedicle screw systems.

The lumbar segment is expected to grow rapidly in the pedicle screw systems market during the forecast period. A variety of issues, including degenerative disc disease, lumbar spondylosis, herniated discs, and spinal stenosis, frequently affect the lumbar spine. The need for pedicle screw systems-based surgical procedures is driven by the rising incidence of these disorders. As the world's population ages, wear and strain on the lumbar spine increases in elderly persons. The need for lumbar spine procedures has increased dramatically by this demographic trend. An increase in lumbar spine issues is being caused by sedentary lifestyles, bad posture, and obesity. The frequency of lumbar spine illnesses needing surgical treatment rises with the prevalence of various lifestyle variables.

Regional Insights

U.S. Pedicle Screw Systems Market Size and Growth 2026 to 2035

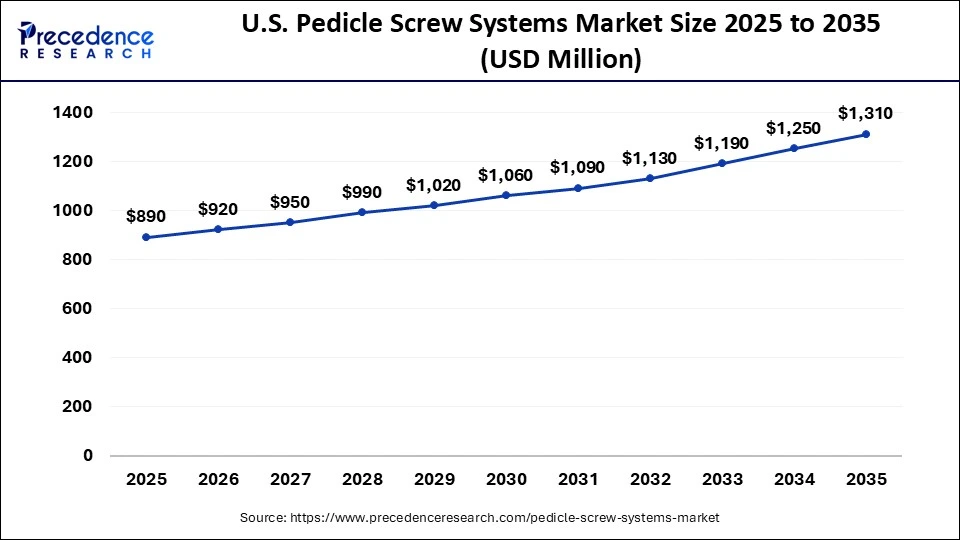

The U.S. pedicle screw systems market size is estimated at USD 890 million in 2025 and is predicted to be worth around USD 1,310 million by 2035 with a CAGR of 3.94% from 2026 to 2035.

North America held the largest share of the pedicle screw systems market in 2025. With a large number of well-equipped hospitals and specialist spine care facilities, North America has one of the most sophisticated healthcare systems in the world. This cutting-edge infrastructure facilitates the broad use of complex medical equipment, such as pedicle screw systems. Due to their increased susceptibility to spine-related problems, older persons are becoming more and more in need of pedicle screw systems and spinal procedures.

In North America, the prevalence of spine problems such as scoliosis, spinal stenosis, and degenerative disc disease is significant. This high frequency is fueled by the region's aging population and sedentary lifestyles, which in turn drive demand for spinal procedures and related technologies. The population of North America is aging significantly, especially in the US and Canada.

Europe is expected to grow at a significant CAGR in the pedicle screw systems market during the forecast period. In Europe, the frequency of spinal abnormalities such as scoliosis, degenerative spine illnesses, and spinal traumas is increasing. This trend is fueled by an aging population and lifestyle issues, including obesity and sedentary behavior, which raise the need for surgical procedures utilizing pedicle screw systems.

Europe has one of the largest percentages of old people in the world. Age-related spine problems such as osteoporotic fractures and degenerative disc diseases are more common as the population ages, which raises the demand for pedicle screw systems and spinal procedures. Europe is renowned for emphasizing innovation and medical research. These therapies are becoming more attractive and accessible advanced to ongoing improvements in spinal surgical procedures, and the creation of less invasive and more effective pedicle screw systems.

What are the Advancements in the Pedicle Screw Systems Market in Asia-Pacific?

Asia Pacific is witnessing significant growth in the market. This growth is due to various factors like a growing healthcare infrastructure, rising disposable incomes, and an increasing awareness of spinal health. The region is supported by large patient populations, especially in countries like China and India. Government initiatives to modernize healthcare are also gaining traction in the region, creating opportunities for advanced surgical procedures and technologies.

China Pedicle Screw Systems Market Trends: The region's market landscape is evolving significantly, with companies focusing on affordability and accessibility of pedicle screw systems. The region is also seeing increased collaboration between healthcare providers and manufacturers. Domestic and international manufacturers are intensifying competition through R&D collaboration, product innovation (like 3D-printed and robotics-compatible systems), and localized production to meet cost and performance needs.

What are the Key Trends in the Pedicle Screw Systems Market in Latin America?

Latin America is experiencing substantial growth in the market. This growth is due to the region's expanding hospital networks and gradual improvement in healthcare access. The region is further supported by growing medical tourism, especially in Brazil and Mexico, which offer advanced and cost-effective spinal procedures. Moreover, rising accident and trauma cases further fuel demand for spinal fixation systems. Continuous investments in specialized orthopedic and neurosurgical care improve growth prospects.

Brazil Pedicle Screw Systems Market Trends: Investment opportunities in Brazil are substantial, driven by the rising demand for advanced spinal fixation devices. There is also a rise in local manufacturing and distribution partnerships, which helps in reducing costs and improving accessibility.

How is the Middle East and Africa Region Growing in the Pedicle Screw Systems Market?

The Middle East and Africa are set to witness steady growth over the forecast years. This growth is driven by rising trauma cases and the growing awareness of advanced spinal treatment processes. The region is also supported by various government investments, particularly across Gulf countries like Saudi Arabia and the UAE. Increasing collaborations with global medical device companies are also gaining traction. Expanding private healthcare systems also creates future opportunities.

Saudi Arabia Pedicle Screw Systems Market: The country's market landscape has a strong focus on affordability and the introduction of innovative products tailored to local needs. As healthcare systems evolve, the demand for advanced pedicle screw systems is expected to rise even more. Overall, the trend points towards sustained growth in pedicle screw adoption, supported by demographic shifts, procedural demand, and investments in spine care services in Saudi Arabia.

Pedicle Screw Systems Market Companies

- ATEC Inc

- DePuy Synthesis Spine Inc

- B Braun Melsungen AG

- CoreLink Holding LLC

- Globus Medical Inc

- Medtronic PLC

- Orthofix Medical Inc

- Zimmer Biomet

- Stryker Corporation

- XTANT Medical

Recent Developments

- In April 2024, Johnson & Johnson's DePuy Synthes orthopedic unit announced plans to showcase new advancements across its spine portfolio. The company plans to show the offerings at the 31st International Meeting on Advance Spine Techniques (IMAST) 2024 this week.

- In August 2023, Huntsville, Alabama-based technology company Curiteva announces FDA 510(k) clearance to market a Navigation Instrument System to complement its Prodigy Pedicle Screw System and SI-LUTION Sacroiliac Joint Fusion Systems.

- In January 2023, Orthopaedics company Orthofix Medical announced the full commercial introduction of the new Mariner Deformity Pedicle Screw System. The first patient cases with the new Mariner system were reported at the same time.

- In August 2022, Nexus Spine, a developer of biomechanically advanced solutions for spinal pathologies, announced the full commercial launch of its PressON™ posterior lumbar fixation system. PressON™ features rods that press onto pedicle screws rather than attach using set screws.

Segment Covered in the Report

By Product Type

- Monoaxial Pedicle Screw

- Polyaxial Pedicle Screw

- Others

By Surgery

- Open Surgery

- Minimally Invasive Surgery

By Indication

- Spinal Deformities

- Spinal Trauma

By Application

- Cervical Fusion

- Thoracolumbar

- Lumbar

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting