What is the Peptide Therapeutics Market Size?

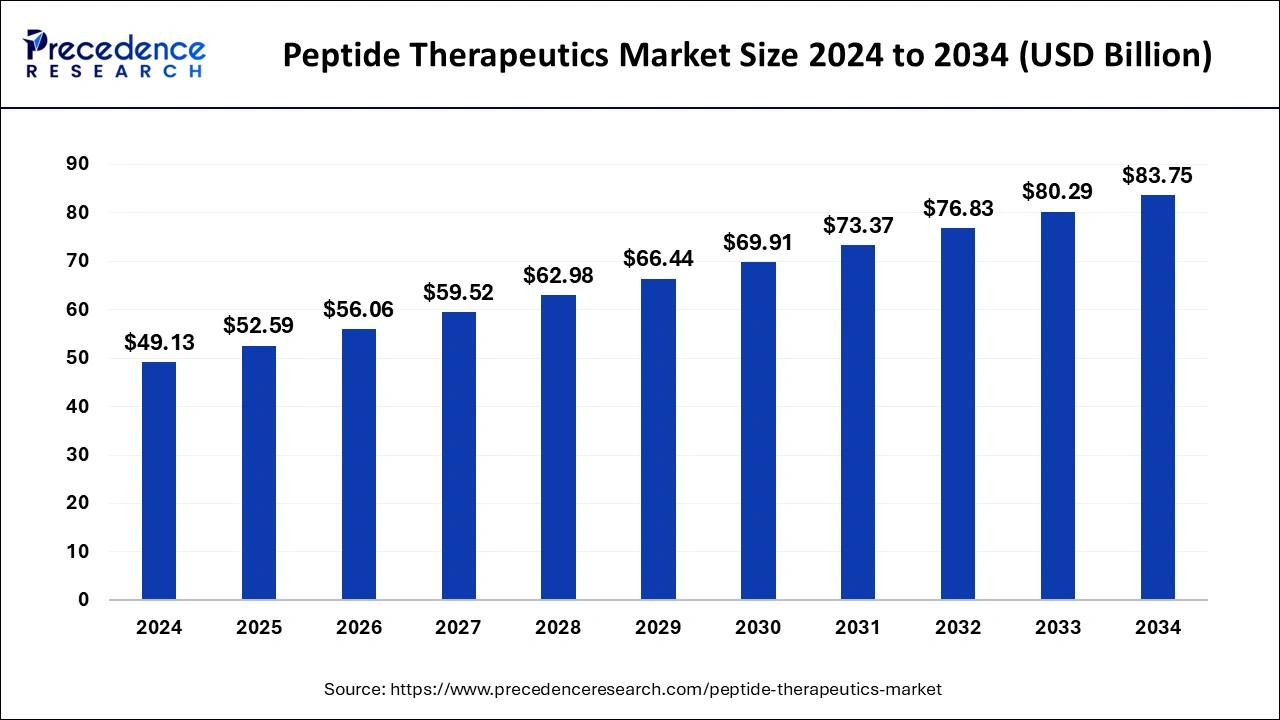

The global peptide therapeutics market size is calculated at USD 52.59 billion in 2025 and is predicted to increase from USD 56.06 billion in 2026 to approximately USD 87.21 billion by 2035, expanding at a CAGR of 5.19% from 2026 to 2035. The peptide therapeutics market growth is driven by an increasing prevalence of cancer and other metabolic diseases.

Peptide Therapeutics MarketKey Takeaways

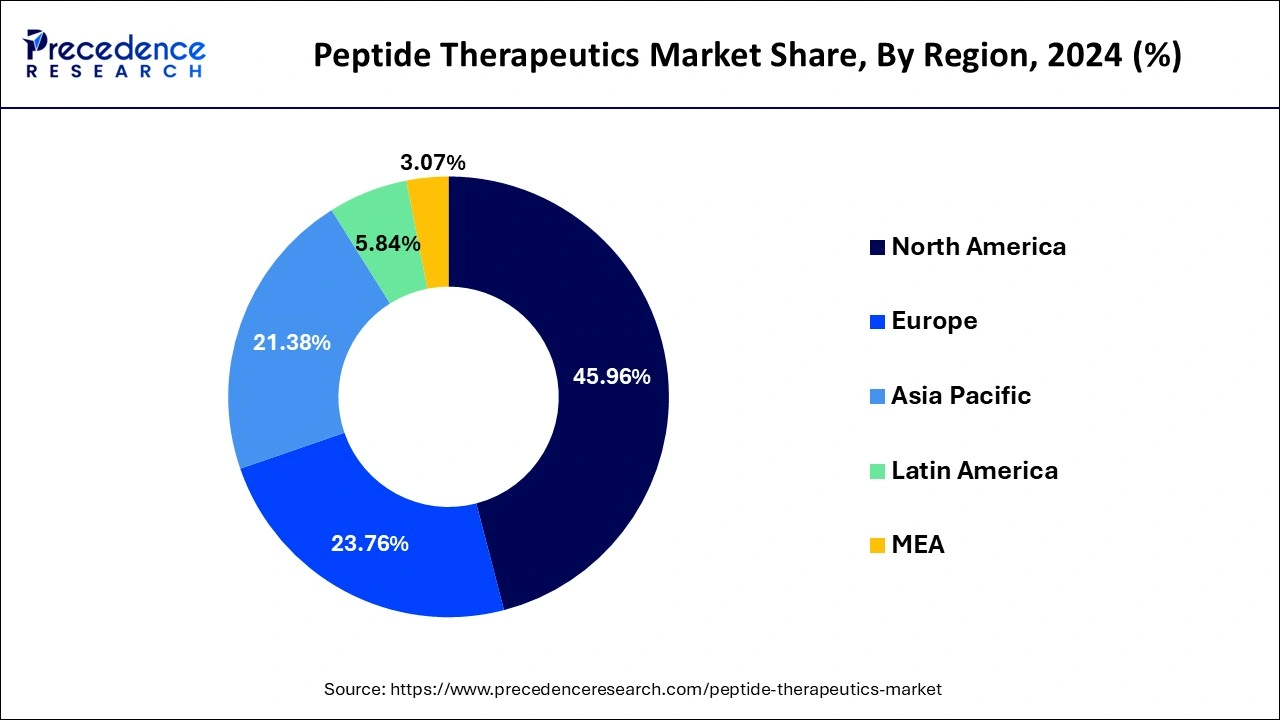

- North America dominated the market with the highest market share of 45.96% in 2025.

- Asia Pacific is projected to expand at the fastest CAGR of 6.20% between 2026 and 2035.

- By application, the metabolic disorder segment has captured around 22.80% of the market share in 2025.

- By application, the gastrointestinal disorder segment is poised to grow at a CAGR of 6.31% between 2026 and 2035.

- By type, the innovative segment has accounted for more than 60.40% of revenue share in 2025.

- By type, the generic segment is expected to expand at a notable CAGR of 4.76% between 2026 and 2035.

- By route of administration, the parenteral segment has generated more than 76.03% of revenue share in 2025.

- By route of administration, the oral segment is expanding at a CAGR of 6.02% between 2026 and 2035.

- By distribution channel, the hospital pharmacies segment has contributed around 39.90% of the market share in 2025.

- By distribution channel, the online drug stores segment is projected to grow at a CAGR of 5.51% between 2026 and 2035.

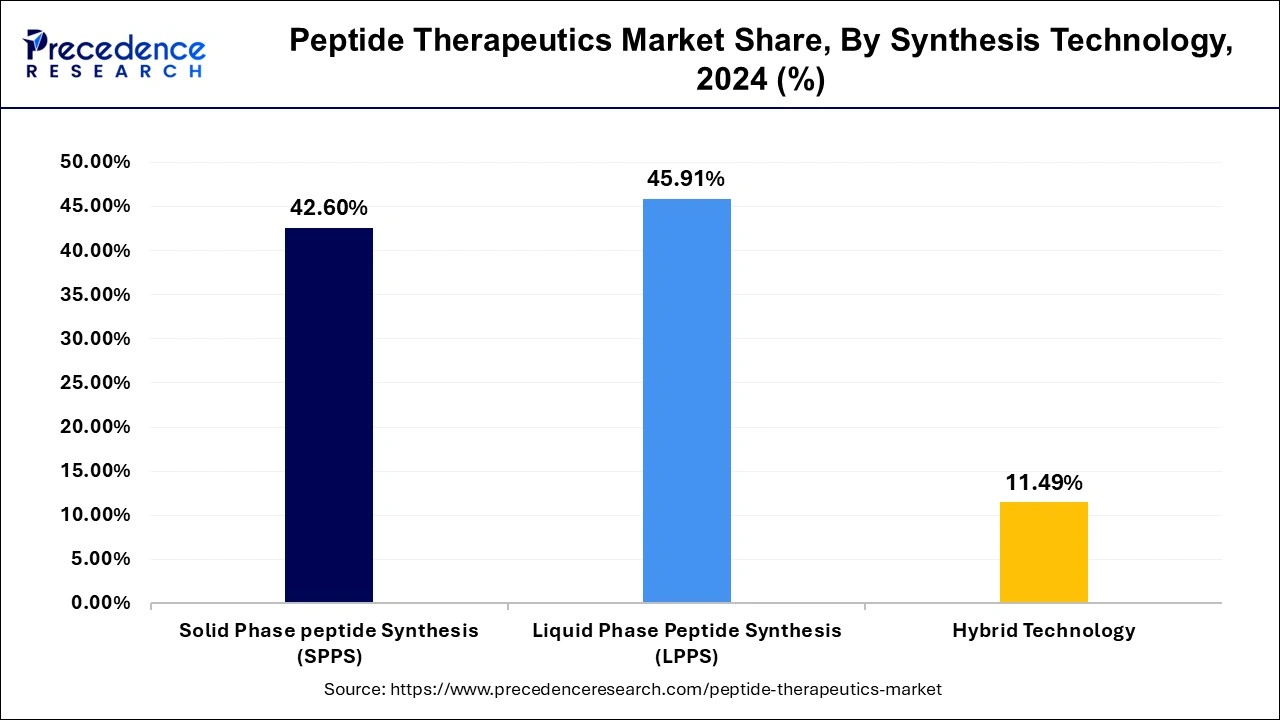

- By synthesis technology, the liquid phase peptide synthesis (LPPS) segment has recorded the largest market share of 45.87% in 2025.

Market Overview

Naturally occurring peptides are strings of amino acids present in all living organisms. Peptide therapeutics are used for the treatment of various diseases. Peptides act as anti-infective growth hormones and even serve as ion channel ligands. Peptide therapeutics are capable of performing the same functions.

The development in biotech and pharmaceutical industries worldwide has proven that peptide therapeutics can stimulate essential hormones. With growing age, peptide production in the human body is disrupted. Peptide therapeutics safely and effectively reintroduce vital peptides into the body.

Peptide therapeutics treat neurological issues, diabetes, cancer, heart issues, and numerous other diseases. Moreover, peptide therapeutics offer muscle endurance, pain relief, injury recovery, and help in weight loss. Peptides are directly delivered into the bloodstream during the therapy. Peptide therapeutics have advanced rapidly in the pharmaceutical and biotech industries. Peptide therapeutics have gained popularity in the global nutrition industry in recent years.

Furthermore, the healthcare sector across the globe has adopted the peptide drug delivery option rapidly. Peptide therapeutics have positively impacted human health by improving stamina and immunity and reducing undesired side effects caused by prolonged chronic diseases.

What is the Role of AI in the Peptide Therapeutic Market?

The key benefit of artificial intelligence (AI) algorithms can also improve the synthesis process by predicting the most efficient and cost-effective routes for peptide synthesis. The main benefit of using peptides in therapies is their ability to minimize the impact on healthy cells, allowing for targeted action directly on tumor cells. AI is used in addiction treatment to personalize care plans, predict relapse risks, analyze patient data, and automate administrative tasks. AI systems can identify patterns in behavior and treatment responses, helping clinicians provide tailored interventions that increase the likelihood of successful recovery.

AI in peptide therapeutics includes that we can access an AI therapist chatbot 24/7 with no wait times. AI therapy may be an easier entry point for those who are hesitant to see a therapist, and it is offered at a lower cost compared to human therapy. AI has the potential to transform drug discovery by improving data analysis and prediction, leading to faster and more effective treatments.

Market Trends

- Technological innovation in peptide therapeutics

- Rising investment in R&D of new drugs

- Increasing incidences of metabolic diseases

- Rising prevalence of cancer

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.59 Billion |

| Market Size in 2026 | USD 56.06 Billion |

| Market Size by 2035 | USD 87.21 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.19% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application, By Type, By Route of Administration, By Distribution Channel and By Synthesis Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing incidences of metabolic disorders:

Peptide drug application in metabolic disorders and discovery strategies. All life activities are dependent on metabolic homeostasis, which is maintained by many biological pathways in the body. In recent years, many peptide drugs for metabolic disorders treatment have become blockbusters in the pharmaceutical market. Metabolic peptides can influence metabolic processes and contribute to both inflammatory and anti-inflammatory responses.

Restraint

High cost of drug development:

The high cost of a drug is an expensive prescribed item and represents an inappropriate cost relative to the total cost of the relevant episode in terms of volume and cost. The high cost of drug development is challenging for an industry being pressured to cut costs. It makes it harder to advance new ideas and create new cures. The cost of the medical product to the market has been increasing, and clinical trials constitute a large portion of these costs.

Opportunity

Expansion of minimally invasive therapies:

The minimally invasive therapies' benefits include visible scars that are smaller and fewer, reduced costs, quicker return to work, less need for narcotics, fewer respiratory complications, lower bleeding, improved surgical accuracy, decreased risk of muscle damage, accurate procedures, minimal scarring, improved cosmetic outcomes, smaller incisions, lower complication rates, less tissue trauma, faster recovery, reduced blood loss, less scarring, shorter hospital stays, lower risk of infection, and less pain.

Segment Insights

Application Insights

The metabolic disorder segment held a dominant presence in the market in 2025.

- In March 2025, for obesity and other metabolic diseases, Novo Nordisk bets $200M on a triple-targeting drug. Novo Nordisk is licensing rights to a United Biotechnology drug that sparks metabolic effects by binding to and activating receptors for GLP-1, GIP, and glucagon. (Source: medcitynews.com)

The cancer segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- In October 2024, the launch with a focus on developing innovative peptide-based immunotherapies for difficult-to-reach targets, especially protein-protein interactions, was announced by Spima Therapeutics SAS. (Source: bioworld.com)

Peptide Therapeutics Market Revenue (USD Million), By Application, 2022-2024

| Application | 2022 | 2023 | 2024 |

| Gastrointestinal Disorder | 4.31 | 4.61 | 5.01 |

| Metabolic Disorder | 9.92 | 10.46 | 11.20 |

| Neurological Disorder | 3.02 | 3.20 | 3.45 |

| Cancer | 11.64 | 12.38 | 13.36 |

| Others | 14.23 | 15.02 | 16.10 |

Type Insights

The innovative segment accounted for a considerable share of the market in 2025.

- In June 2025, with an oversubscribed $50 million initial financing and a strategic partnership with UTSW focused on nucleic acid-based protein therapeutics was launched by Signify Bio. Signify's mission is to create personalized medicines for all by combining the promise of signal peptide-engineered control with the speed and power of mRNA-encodable design. (Source: businesswire.com)

The generic segment is projected to experience the highest growth in the market between 2026 and 2035.

- In January 2025, the Food and Drug Administration's permission received by Hikma for a new generic, and the company also launched two new generic products. The FDA approved Hikma's first generic referencing Victoza (liraglutide injection) 18 milligram/3 milliliter, a glucagon-like peptide-1 (GLP-1) receptor agonist indicated to improve glycemic control in adults and pediatric patients aged 10 years and older with Type 2 diabetes as an adjunct to diet and exercise. (Source: drugstorenews.com)

Route of Administration Insights

The parenteral segment led the market.

- In November 2022, the operation of a new parenteral formulation manufacturing line at the drug product site in Wuxi city, China, was launched by WuXi STA, a subsidiary of WuXi AppTec. (Source: contractpharma.com)

The oral segment is set to experience the fastest rate of market growth from 2026 to 2035.

Peptide Therapeutics Market Revenue (USD Million), By Route of Administration, 2022-2024

| Route of Administration | 2022 | 2023 | 2024 |

| Oral | 4.43 | 4.72 | 5.12 |

| Parenteral | 32.77 | 34.72 | 37.35 |

| Pulmonary | 2.59 | 2.74 | 2.94 |

| Mucosal | 1.72 | 1.82 | 1.95 |

| Others | 1.60 | 1.67 | 1.76 |

Distribution Channel Insights

The hospital pharmacies segment registered its dominance over the market in 2025.

- In May 2025, the Co-Pay Cap for Weight Loss Drugs Amid New Federal Drug Pricing Effort was launched by Evernorth. 9Source: ajmc.com)

The online drug stores segment is anticipated to grow with the highest CAGR in the market during the studied years.

Synthesis Technology Insights

The liquid phase peptide synthesis (LPPS) segment maintained a leading position in the market in 2025.

- In September 2024, a new liquid phase peptide synthesis (LPPS) technology that uses traditional active pharmaceutical ingredients (API) batch reactors and continuous flow, obviating the dependency on specialized, solid-phase reactors, was successfully developed by Cambrex, a leading global contract development and manufacturing organization (CDMO), and announced that Snapdragon Chemistry, a Cambrex Company. (Source: prnewswire.com)

The solid phase peptide synthesis (SPPS) segment is projected to expand rapidly in the market

Regional Insights

U.S. Peptide Therapeutics Market Size and Forecast 2026 to 2035

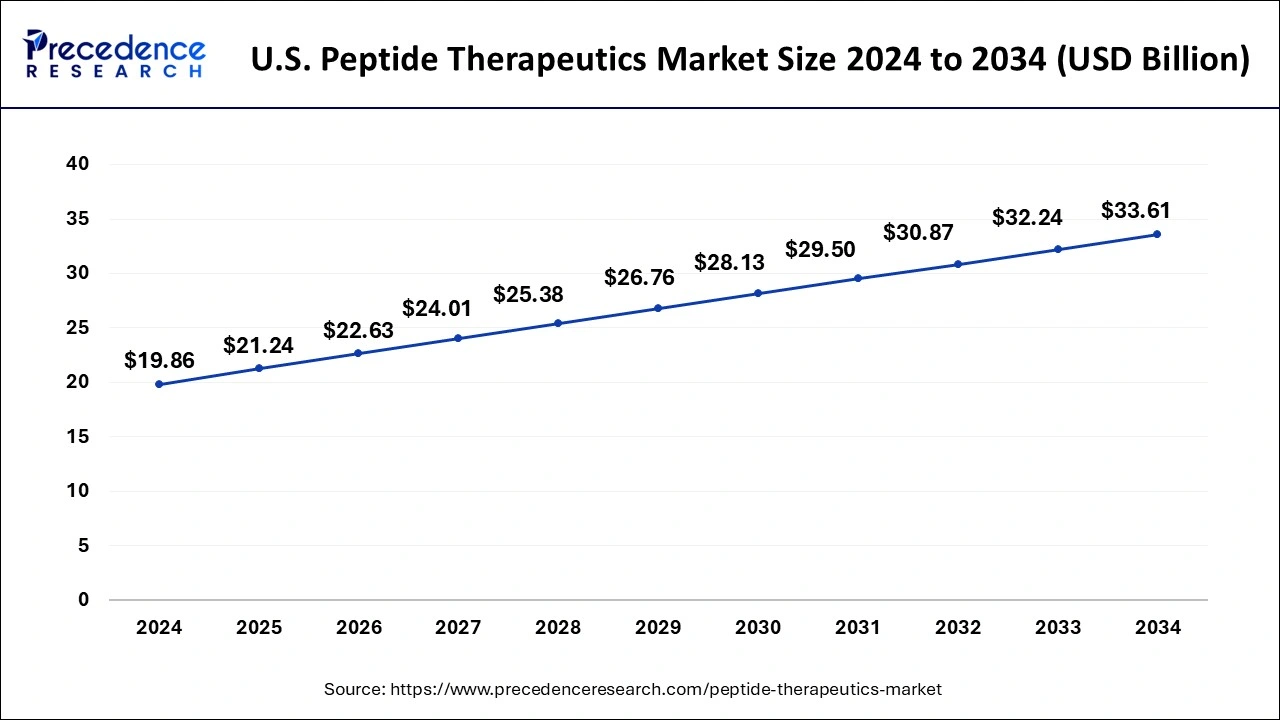

The U.S. peptide therapeutics market size is estimated at USD 21.24 billion in 2025 and is anticipated to reach around USD 34.98 billion by 2035, with a CAGR of 5.12% from 2026 to 2035.

North America led the global peptide therapeutics market and captured more than 45.96% of the revenue share in 2025. The market's growth in North America is attributed to the rising demand for peptide drug products to treat cancer in the region.

The development of thebiotechnologyand pharmaceutical industries has fueled market growth in North America. Europe shows potential market growth for peptides in the region. The well-established healthcare industry in Europe is considered a significant factor in the development of the market. However, high-priced peptide drugs in Europe hamper the growth of the market.

Asia Pacific is anticipated to witness significant growth during 2026-2035. The rising prevalence of diabetes and infectious diseases is a driving factor for developing the market in the Asia Pacific. Developing the healthcare and biotech sectors in India and China is considered to fuel the demand for peptide drugs in the upcoming years. The growth of the peptide therapeutics market in the Asia Pacific is driven because of the availability of low-cost raw materials in the region.

The rising development of novel peptide drugs for treating respiratory disorders and increasing investments in R&D activities propel the growth of the peptide therapeutics market in Latin America. Brazil is expected to dominate the peptide therapeutics market owing to the country's increased number of peptide therapies. Moreover, rapid adoption and increased awareness of peptide therapies in the Middle East and Africa will boost the demand for peptide therapeutics in these regions during the forecast period.

- In February 2025, to expand peptide therapeutics and CDMO capabilities, Granules India signed an acquisition agreement with a Switzerland-based Senn Chemicals AG, a contract development and manufacturing organization (CDMO) specializing in peptides. The acquisition, expected to close in the first half of 2025, is subject to specific conditions. (Source: expresspharma.in)

Peptide Therapeutics Market Companies

- Eli Lilly & Company

- Amgen Inc.

- Pfizer, Inc.

- Ever Neuro Pharma GmbH

- Bausch Health

- Abbvie

Recent Developments

- In August 2025, to launch an AI-powered platform for accelerated peptide drug discovery, Atombeat, Inc., a leading force in AI for drug discovery, and BioDuro, a globally trusted Contract, Research, Development, and Manufacturing Organization (CRDMO). (Source: laotiantimes.com)

- In November 2024, to develop mirror peptides, Aizen Therapeutics was launched. Mirror peptide-based biologics can be stable than the traditional peptide-based drugs. (Source: cen.acs.org)

Segments Covered in the Report

By Application

- Gastrointestinal Disorder

- Metabolic Disorder

- Neurological Disorder

- Cancer

- Others

By Type

- Generic

- Innovative

By Route of Administration

- Oral

- Parenteral

- Pulmonary

- Mucosal

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Drug Stores

By Synthesis Technology

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Technology

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting