What is the Peptide Synthesis Market Size?

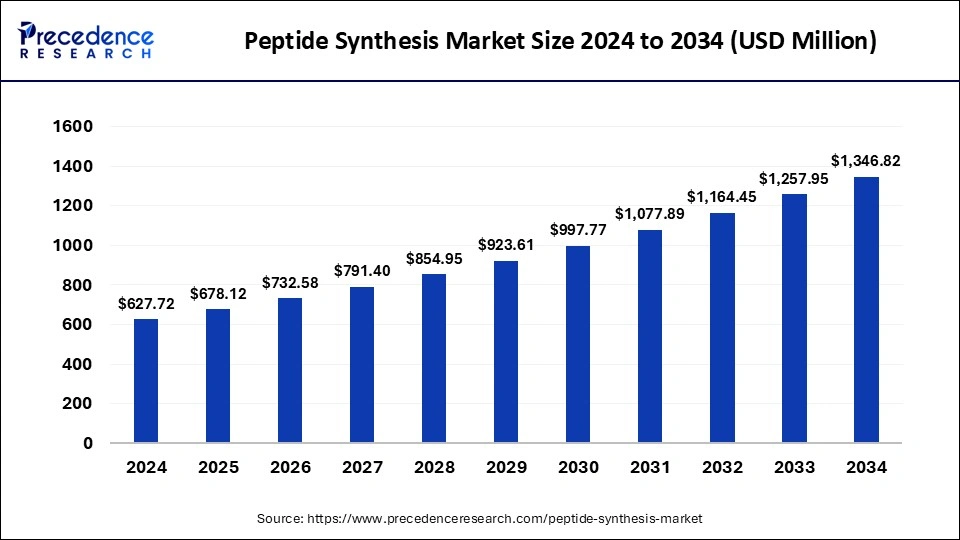

The global peptide synthesis market size was estimated at USD 678.12 million in 2025 and is predicted to increase from USD 732.58 million in 2026 to approximately USD 1,438.78 million by 2035, expanding at a CAGR of 7.81% from 2026 to 2035. The benefits of peptide synthesis include it helps to design newvaccines, drugs, and enzymes and is also used to prepare enzyme binding sites, epitope-scientific antibodies, and map antibody epitopes. These factors help to the growth of the market.

Peptide Synthesis Market Key Takeaways

- The global peptide synthesis market was valued at USD 678.12million in 2025.

- It is projected to reach USD 1,438.78million by 2035.

- The peptide synthesis market is expected to grow at a CAGR of 7.81% from 2026 to 2035.

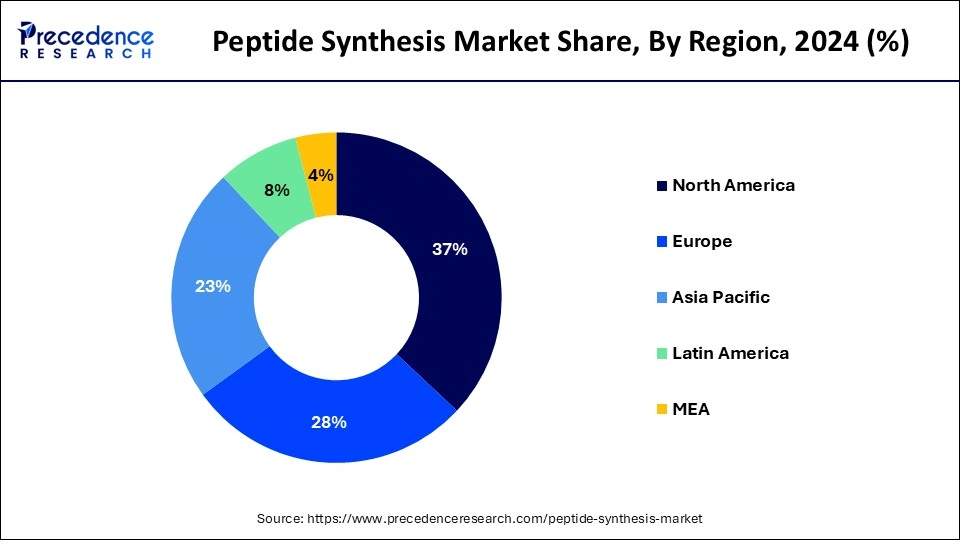

- North America dominated the peptide synthesis market with the largest revenue share of 37% in 2025.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2026 to 2035.

- By product, the reagents & consumables segment dominated the market in 2025.

- By product, the peptide synthesis equipment segment is anticipated to be the fastest-growing during the forecast period.

- By technology, the liquid phase peptide synthesis (LPPS) segment dominated the market in 2025.

- With the help of technology, the solid phase peptide synthesis (SPPS) segment is estimated to be the fastest-growing during the forecast period.

- By application, the therapeutics segment dominated the market in 2024.

- By application, the diagnosis segment is expected to be the fastest-growing during the forecast period.

- By end-use, the pharmaceutical & biotechnology companies segment dominated the peptide synthesis market in 2025.

- By end-use, the contract development & manufacturing organization (CMO)/contract research organization (CRO) segment is anticipated to be the fastest-growing during the forecast period.

Market Overview

The peptide synthesis market deals with pharmaceutical & biotechnology companies, academic research & institutes, and CRO/CMO for the applications of therapeutics, diagnosis, and research. Peptide synthesis is the production of compounds and peptides, where multiple amino acids are linked by amide bonds. The benefits of peptide synthesis include customization and flexibility, scale and efficiency, unnatural amino acids, D-proteins, and industrial production. The applications include helping with the identification and characterization of proteins, making easy protein expression services or protein functions, and creating epitope-specific antibodies against pathogenic proteins. These factors help to the growth of the market.

Artificial Intelligence: The Next Growth Catalyst in Peptide Synthesis

AI is fundamentally transforming the peptide synthesis industry by accelerating drug discovery, moving it from slow, manual trial-and-error to rapid in silico design and optimization. AI-powered algorithms, such as deep generative models, can predict and design novel bioactive peptide sequences with high specificity, enhancing stability and reducing synthesis times.

Furthermore, the integration of AI with automated synthesis platforms and robotics enables high-throughput, "hands-free" production, which significantly reduces labor, minimizes human error, and lowers cost-per-gram for complex, long-chain peptides.

Peptide Synthesis Market Growth Factors

- The peptide synthesis benefits include customization and flexibility, scale and efficiency, unnatural amino acids, D-proteins, and industrial production that helps the growth of the market.

- The applications of peptide synthesis include helping with the identification and characterization of proteins.

- It also helps in the study of protein expression services or protein functions, which helps the growth of the market.

- It also helps to create epitopes-specific antibodies against pathogenic proteins which helps the growth of the peptide synthesis market.

Market Outlook

- Market Growth Overview: The peptide synthesis market is expected to grow significantly between 2025 and 2034, driven by the rising chronic diseases, advancements in synthesis technology, increased research and developments and biotech spending.

- Sustainability Trends: Sustainability trends involve green solvent adoption, sustainable liquid phase peptide synthesis, and chemo-enzymatic peptide synthesis.

- Major Investors: Major investors in the market include Bachem, Merck KGaA, GenScript Biotech Corporation, Thermo Fisher Scientific, and PolyPeptide Group.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1,438.78Million |

| Market Size in 2025 | USD 678.12Million |

| Growth Rate from 2026 to 2035 | CAGR of 7.81% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increased use of peptides in pharmaceutical treatments

The benefits of developing and using pharmaceutical peptides include a lower production amount and lower cell prices. Peptides have good membrane penetration ability, and oral administration helps with easy delivery to patients. The benefits of peptide drugs include having fewer side effects and being safer because their byproducts are amino acids than other drugs. Peptides are highly used in pharmaceutical treatments due to their beneficial properties, which include antithrombic (or anticlotting), antioxidant, and antimicrobial properties. In pharmaceuticals, peptides are referred to as therapeutic peptides and are commonly used for the treatment of diseases. In pharmaceutical treatments, lab-processed peptides are growth hormones and human insulin. Both of these are life-saving for people living with specific conditions. These factors help the growth of the peptide synthesis market.

Restraint

Challenges in peptide synthesis

The main challenge in peptide synthesis includes the development of efficient and sustainable catalytic methods. SPPS (Solid phase peptide synthesis) depends on the effective amide bond formation between amino acids. Limitations of peptide synthesis include it requires the use of a large amount of peptide, a time-consuming process, labor-intensive purification steps for each intermediate compound to make the solution phase, and labor-intensive, which finally yields a limited number of desired products. The solid phase peptide synthesis requires high temperatures and strict reaction conditions. This requires the use of specialized reaction conditions and equipment like high-temperature atmospheres and high-temperature furnaces. These factors can restrict the growth of the peptide synthesis market.

Opportunity

Future scope of the peptide synthesis

In the future, peptide synthesis will find an increased use in treating type-2 diabetes, obesity, and metabolic syndromes. Increasing use of cyclic peptides, synthesizing long peptides, microwave-assisted peptide synthesis, and solid phase synthesis. In medicines, peptides are used because they include cell-penetrating, multifunctional peptide drug conjugates, and technologies focusing on alternative routes of administration. Peptides offer growth opportunities as future therapeutics. These factors help the growth of the peptide synthesis market.

Segment Insights

Product Insights

The reagents & consumables segment dominated the market in 2025. Peptides are highly used for reagents & consumables because of their benefits, including the prevention of the formation of blood clots, killing microbes, acting as antioxidants and antitumors, reducing inflammation, lowering blood pressure, and improving immune functions. It also helps to support bone health and promote muscle growth due to its wound healing and anti-aging effects properties. The most important advantage of peptide reagents & consumables is helping to reduce wrinkles and fine lines, improve skin elasticity, and ability to stimulate collagen production in the skin. These factors help the growth of the reagents & consumables segment and contribute to the growth of the peptide synthesis market.

The peptide synthesis equipment segment is expected to be the fastest-growing during the forecast period. In peptide synthesis, peptide synthesis equipment plays an important role. The manual solid-phase peptide synthesis is carried out with the help of standard laboratory glass wares like sintered glass funnels, round bottom flasks, etc. It also includes overhead mechanical stirrers, wrist action shakers, or orbital shakers. The applications of peptide synthesis equipment include food preservation, medical visualization, peptide therapeutic, the production of proteins, and the production of antibodies. These factors help the growth of the peptide synthesis equipment and contribute to the growth of the peptide synthesis market.

Technology Insights

The liquid phase peptide synthesis (LPPS) segment dominated the market in 2025. The benefits of the liquid phase peptide synthesis (LPPS) segment include flexibility in chemistry for the choice of chemical reagents and reactions, which helps with the high range of coupling chemistries and functional group manipulations. It also includes facilitating modifications and labeling, reduction of side reactions, scale-up capabilities, and high purity and yield. These factors help the growth of the liquid phase peptide synthesis (LPPS) segment and contribute to the growth of the peptide synthesis market.

The solid phase peptide synthesis (SPPS) segment is anticipated to be the fastest-growing during the forecast period. Solid-phase peptide synthesis (SPPS) has benefits that include high efficiency, increased speed, and simplicity. The use of excess reagents in this reaction may be driven to completion and high yields. Building blocks are protected in this method for all reactive functional groups. These factors help the growth of the solid phase peptide synthesis (SPPS) segment and contribute to the growth of the peptide synthesis market.

Application Insights

The therapeutics segment dominated the market in 2025. Peptide synthesis advances and their therapeutics exploration have opened the direction for their use in tissue engineering, gene therapy, molecular and biosensing recognition, nano-delivery systems, drug delivery, and disease diagnosis. Peptide has high tunable and high purity profile properties, which are used in the discovery of non-imaging and imaging-based diagnostics agents like positron emission, peptide-based ELISA, and single-photon emissioncomputed tomography (SPECT).

Peptides are used in drug development to treat many pathologies, including cancer, microbial infections, and obesity, as well as to improve cell-penetrating properties and develop cell-targeting platforms. Chemical peptide synthesis development by SPPS accelerated the therapeutics peptide development. Some recombinant peptide drugs like teriparatide and oxytocin use chemical synthesis for the production of (API) active pharmaceutical ingredients. These factors help the growth of the therapeutics segment and contribute to the growth of the peptide synthesis market.

The diagnosis segment is anticipated to be the fastest-growing during the forecast period. The use of peptide synthesis in diagnosis increased to get accurate and specific information about disease due to their ability to get modified chemically and high purity profile. Peptide synthesis is used for imaging or non-imaging-based diagnostics. In non-imaging-based diagnostics, peptide synthesis is used, and techniques like LC-MS/MS or microarray are used for direct analysis of biofluids, point-of-care testing, and enzyme-linked immunosorbent assay (ELISA). In clinical and scientific research, peptide synthesis is highly used for diagnostics applications; for diagnosis of infectious and non-infectious diseases, peptide-based products are used. These factors help to the growth of the diagnosis segment and contribute to the growth of the peptide synthesis market.

End-use Insights

The pharmaceutical & biotechnology companies segment dominated the peptide synthesis market in 2025. In pharmaceutical & biotechnology companies, the use of peptide synthesis plays an important role. In pharmaceutical manufacturing, chemical, and recombinant peptide synthesis are the two basic processes for amino acids, which offer many benefits for different applications. In pharmaceuticals, peptides are referred to as therapeutic peptides. Peptide synthesis is used to design new vaccines, drugs, and enzymes, and to prepare enzyme binding sites, map antibody epitopes, and epitope-specific antibodies. In pharmaceutical & biotechnology companies, peptide synthesis is used in research, drug development, and diagnostics purposes. These factors helped the growth of the pharmaceutical & biotechnology companies segment and contributed to the growth of the market.

The contract development & manufacturing organization (CMO)/contract research organization (CRO) segment is expected to be the fastest-growing during the forecast period. CMO takes preformulated drugs, which are developed by CRO, and manufactures them on a larger scale. CRO companies provide clinical trial services for the medical device, pharmaceutical, and biotechnology industries. The benefits of CRO & CMO include it helps to understand and segment users to guide them towards purchasing the services and products that best meet their needs. CRO provides a broad spectrum of services, including clinical research, laboratory & lifecycle management, and drug development. These factors help the growth of the contract development & manufacturing organization (CMO)/ contract research organization (CRO) segment and contribute to the growth of the peptide synthesis market.

Regional Insights

What is the U.S. Peptide Synthesis Market Size?

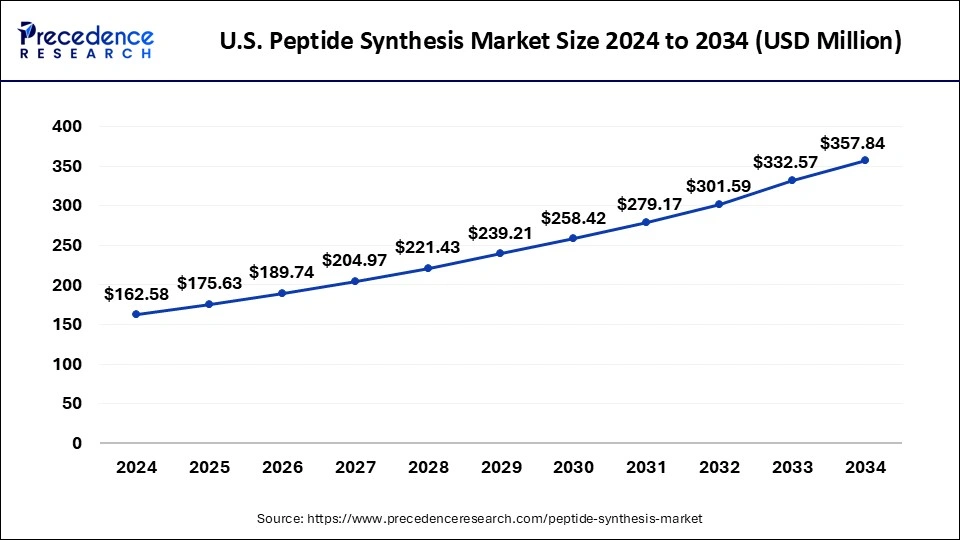

The U.S. peptide synthesis market size was exhibited at USD 175.63 million in 2025 and is projected to be worth around USD 386.92 million by 2035, poised to grow at a CAGR of 8.22% from 2026 to 2035.

North America dominated the peptide synthesis market in 2025. Increased focus on peptide-based drugs and rising awareness about peptide synthesis technologies help the market growth in the North American region. The United States is the leading country for the growth of the market in the North American region. In the United States, Bachem is a leading company specializing in the manufacture and development of oligonucleotides and peptides.

- In September 2023, an increased commercial peptide production capacity with newly upgraded facilities in the US at its Colorado site was inaugurated by a specialist in APIs, drugs, excipients products, and packaging services, CDMO Corden Pharma.

U.S. Peptide Synthesis Market Trends

The U.S.'s the soaring global demand for GLP-1 agonists and next-generation cancer immunotherapies is prompting pharmaceutical firms to pivot toward high-capacity CDMO outsourcing. Simultaneously, the industry is integrating green chemistry protocols to significantly reduce the environmental footprint and high costs associated with traditional manufacturing.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034. Increasing incidences of chronic disease conditions, rising healthcare spending, increased awareness of new peptide-based treatments, and increased investment by market players help the growth of the peptide synthesis market in the Asia Pacific region. China is the leading country for the growth of the market in the Asia Pacific region.

- In January 2024, two new peptide manufacturing plants, one at its Changzhou facility and another in China at the new Taixing site, launched by a global company, WuXi AppTec, that provides a broad portfolio of R&D and manufacturing services that allow companies in medical devices, and pharmaceuticals, and biotech industries to advance the development and deliver treatments to patients. This remarkable expansion increased the company's SPPS (Solid Phase Peptide Synthesis) and addressed the surging global demand for peptide therapeutics.

China Peptide Synthesis Market Trends

China's dominance of local CDMOs offers high-purity, cost-efficient outsourcing solutions, supported by AI-driven optimizations and greener chemical methodologies. While reagents and consumables maintain the highest revenue share, the equipment segment is growing the fastest as labs modernize to meet GMP standards. This shift positions China as a critical global hub for large-scale peptide manufacturing and pharmaceutical innovation.

How did Europe experience notable growth in the Peptide Synthesis market?

Europe's peptide synthesis market is defined by its massive GMP manufacturing capacity and a robust R&D ecosystem that bridges academia and biopharma for high-end innovation. The surge in chronic diseases, particularly metabolic and oncological conditions, is driving the widespread adoption of automated SPPS and microwave-assisted technologies to optimize costs.

Germany Peptide Synthesis Market Trends

Germany's adoption of automated flow-through systems and advanced resins that maximize production speed and cost-effectiveness. A major shift toward enzymatic and microbial fermentation is replacing traditional chemical methods, as highlighted by Research and Markets, to align with national sustainability goals.

Value Chain Analysis of the Peptide Synthesis Market

- Raw Materials & Reagents Supply

This stage involves the production and supply of essential building blocks for synthesis, including Fmoc-protected amino acids, resins (solid support), coupling reagents, solvents (DMF, NMP), and protecting groups.

Key Players: Merck KGaA, Thermo Fisher Scientific, Biosynth, Iris Biotech, and Puresynth Research Chemicals Pvt Ltd. - Equipment & Technology Providers

This segment includes the development and manufacturing of automated peptide synthesizers, purification systems (Prep-HPLC), and lyophilizers (freeze-drying). Innovation in this stage centers on microwave-assisted synthesis and flow chemistry, which reduce synthesis time from hours to minutes.

Key Players: Biotage AB, CEM Corporation, Gyros Protein Technologies (now part of Biotage), Agilent Technologies, and CSBio. - Peptide Synthesis & Manufacturing (CDMOs/CROs)

This stage involves custom synthesis, peptide library creation, and GMP-grade API manufacturing, frequently outsourced by pharmaceutical companies.

Key Players: Bachem Holding AG, PolyPeptide Group, CordenPharma, Lonza Group AG, GenScript Biotech Corporation, AmbioPharm Inc., and Syngene International Limited.

Peptide Synthesis Market Companies

- Novo Nordisk A/S: As a leader in peptide therapeutics, Novo Nordisk drives the market through massive R&D, specializing in the development and production of GLP-1 receptor agonists for metabolic diseases.

- MP Biomedicals: MP Biomedicals contributes to the peptide synthesis market by providing high-quality raw materials, including protected amino acids and resins essential for chemical synthesis.

- Lonza: Lonza operates as a leading Contract Development and Manufacturing Organization (CDMO), offering large-scale, cGMP-compliant solid-phase, liquid-phase, and hybrid peptide synthesis.

- PuroSynth: PuroSynth (Puresynth Research Chemicals) supports the Indian pharmaceutical market by tailoring high-quality reagents and supplying custom peptides to emerging biotech startups.

- Syngene: As a major contract research and manufacturing organization (CRO/CDMO), Syngene supports the market by providing end-to-end services, from custom peptide design to Phase II clinical manufacturing.

Other Major Key Players

- Polypeptide Group

- Creative Diagnostics

- Thermo Fischer Scientific, Inc.

- CEM Corporation

- Biotage

- Bachem Holdings AG

- Merck KGaA

- GenScript Biotech Corporation

- Kaneka Corporation

Recent Developments

- In April 2022, the Liberty 2.0 instrumentation line of automated microwave peptide synthesizers was launched by the CEM Corporation.

- In March 2024, a leading global pharmaceutical company, Aurisco Pharmaceutical, announced an investment in a cGMP peptide manufacturing facility for GLP-1 peptides in Yangzhou, China, at the company's USFDA-inspected site.

- In May 2024, a new Activo-Darwin Semi-Automated Peptide Synthesizer, a cutting edge launched by Activotec Ltd., designed for very high-quality peptide synthesis. The Activo-Darwin tool is very easy, affordable, and flexible for peptide synthesis.

Segments Covered in the Report

By Product

- Equipment

- Peptide Synthesizers

- Lyophilizers

- Chromatography Equipment

- Others

- Reagents & Consumables

- Other

By Technology

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Technology

By Application

- Therapeutics

- Cancer

- Metabolic

- Cardiovascular Disorder

- Respiratory

- GIT (Gastrointestinal Disorders)

- Infectious Diseases

- Pain

- Dermatology

- CNS

- Renal

- Others

- Diagnosis

- Research

By End-use

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organization/Contract Research Organization

- Academic Research & Institutes

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting