Peptide Therapeutics Contract API Manufacturing Market Size and Forecast 2025 to 2034

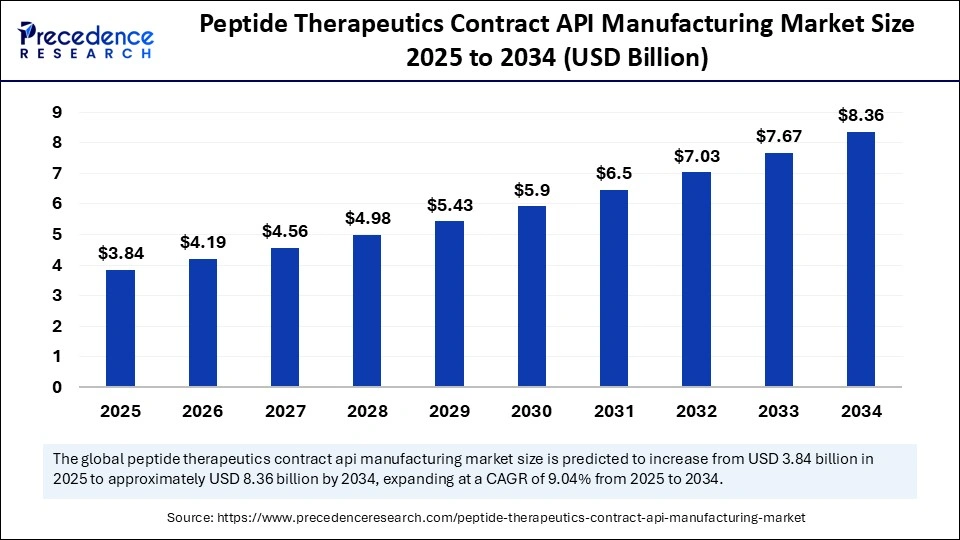

The global peptide therapeutics contract API manufacturing market size accounted for USD 3.52 billion in 2024 and is predicted to increase from USD 3.84 billion in 2025 to approximately USD 8.36 billion by 2034, expanding at a CAGR of 9.04% from 2025 to 2034. The growth of the peptide therapeutics contract API manufacturing market is driven by the rising incidence of chronic diseases, increasing demand for personalized medicine, and improvements in peptide synthesis technologies.

Peptide Therapeutics Contract API Manufacturing MarketKey Takeaways

- The global peptide therapeutics contract API manufacturing market was valued at USD 3.52 billion in 2024.

- It is projected to reach USD 8.36 billion by 2034.

- The market is expected to grow at a CAGR of 9.04% from 2025 to 2034.

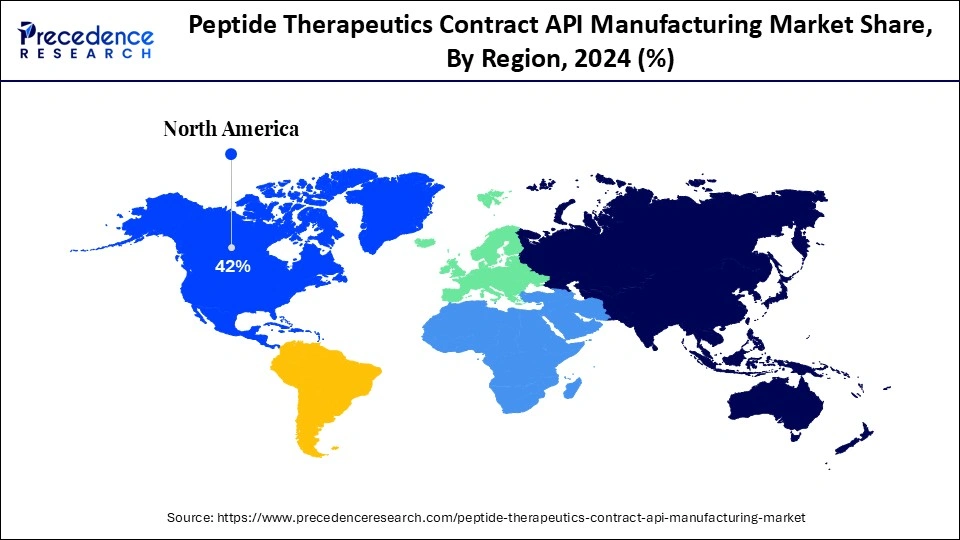

- North America dominated the global market with the largest market share of 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By scale of operation, the pre-clinical segment held a significant market share in 2024.

- By scale of operation, the clinical segment is expected to grow at the fastest CAGR over the forecast period.

- By the synthesis method, the chemical synthesis segment held the largest share of the market in 2024.

- By synthesis method, the non-chemical synthesis segment is expected to grow at the fastest CAGR in the upcoming period.

- By enterprise size, the large enterprise segment captured the highest market share in 2024.

- By enterprise type, the small and medium enterprise segment is expected to grow at a significant CAGR in the coming years.

How is AI Transforming the Peptide Therapeutics Contract API Manufacturing Market?

Artificial Intelligence significantly impacts the market. AI-based platforms can accelerate peptide drug discovery by predicting peptide structures, optimizing sequences, and precisely modeling biological interactions. AI enables real-time process monitoring, predictive equipment maintenance, and automated quality control, leading to improved batch uniformity and minimized downtime in manufacturing. Furthermore, AI enhances supply chain management by predicting demand, allocating resources effectively, and ensuring timely delivery of peptide APIs.

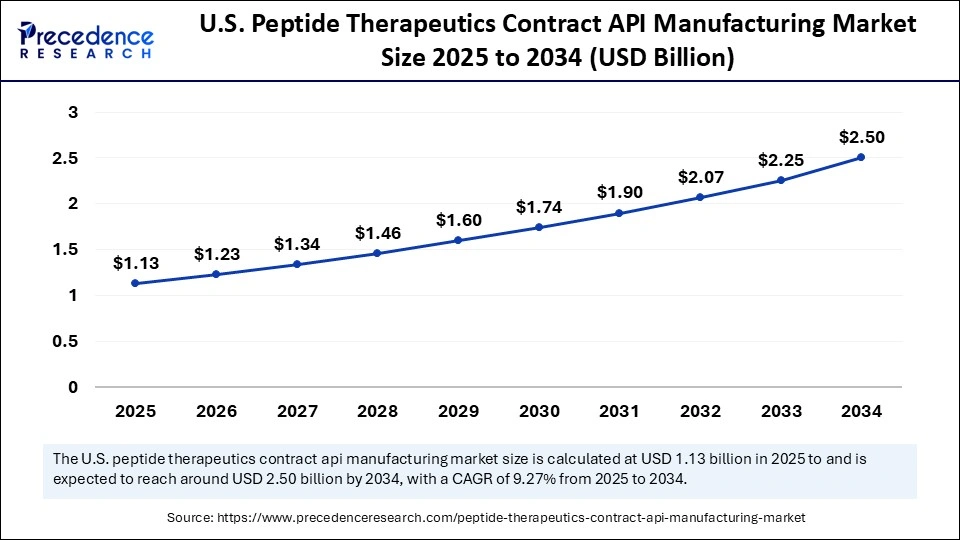

U.S. Peptide Therapeutics Contract API Manufacturing Market Size and Growth 2025 to 2034

The U.S. peptide therapeutics contract API manufacturing market size was exhibited at USD 1.03 billion in 2024 and is projected to be worth around USD 2.50 billion by 2034, growing at a CAGR of 9.27% from 2025 to 2034.

Why Did North America Lead the Peptide Therapeutics Contract API Manufacturing Market in 2024?

North America dominated the market with the largest share in 2024. This is mainly due to its well-established pharmaceutical industry, developed healthcare infrastructure, and strong investment in the biotechnology and life sciences. North America has a large number of major pharmaceutical and specialized contract manufacturing organizations capable of producing high-quality peptide active pharmaceutical ingredients. Additionally, North America benefits from an established regulatory system ensuring high-quality standards, which also expedites the approval of new therapeutics. The regional market is strengthened by key players in contract manufacturing, cutting-edge research facilities, and the presence of leading biotech companies. Advancements in modern manufacturing technologies, such as continuous manufacturing and automation, are improving the scalability and affordability of peptide API production throughout the region.

Why is Asia Pacific Witnessing the Fastest Growth in the Peptide Therapeutics Contract API Manufacturing Market?

Asia Pacific is witnessing the fastest growth due to the expansion of healthcare infrastructure, growing demand for innovative therapies, and government policies supporting drug discovery and development. Emerging markets like China, India, and South Korea play a significant role due to their growing pharmaceutical manufacturing capacities and low-cost production processes. Furthermore, the increasing prevalence of chronic diseases like diabetes, cancer, and cardiovascular diseases is driving demand for novel peptide-based therapeutic procedures.

China is emerging as a major player in the market, with its large patient population boosting the demand for new therapeutics and supporting clinical trials and drug development. The Chinese government's interest in becoming a strategic innovator in biotechnology has also attracted significant investments, strengthening the region's manufacturing sector.

What are the Major Factors Fueling the Growth of the Peptide Therapeutics Contract API Manufacturing Market Within Europe?

The European peptide therapeutics contract API manufacturing market is expected to grow at a significant rate in the coming years. This is mainly due to the rising investment in research and innovation, with many global academic institutions, biotech centers, and pharmaceutical firms dedicated to developing peptide-based therapeutic drugs. The increasing use of contract manufacturing organizations by pharmaceutical companies is a significant trend, enabling expedited and more efficient production while meeting regulatory requirements. Favorable government policies and funding initiatives supporting biotechnology and pharmaceutical industries are also attracting investments and creativity. Moreover, Europe's well-developed healthcare system and the growing number of patients with chronic conditions like diabetes and cancer sustain market growth.

Market Overview

The process of outsourcing the manufacturing of peptide-based active pharmaceutical ingredients to specialized manufacturers is referred to as peptide therapeutics contract API manufacturing. Peptide therapeutics contract API manufacturing is the process of outsourcing peptide-based active pharmaceutical ingredient production to specialized manufacturers. Pharmaceutical companies are forming alliances with contract manufacturing organizations, leveraging their competitive advantages in technical expertise, regulatory understanding, and superior facilities. As peptide-based therapeutics gain traction, which offer high specificity, non-toxicity, and significant pharmacological potential, the peptide therapeutics contract API manufacturing market is anticipated to demonstrate modest growth.

The rising incidence of chronic and life-threatening diseases, such as cancer and metabolic disorders, is driving the use of peptide-based drugs, which show great promise and effectiveness in their management. These drugs are favored in modern therapy due to their high target specificity, improved efficacy, and fewer side effects. Pharmaceutical companies are increasingly outsourcing API production, driven by the growing complexity of regulatory compliance and cost pressures, particularly for specialized and customized peptide drugs.

What Factors Are Fueling the Rapid Expansion of the Peptide Therapeutics Contract API Manufacturing Market?

- Increasing Incidence of Chronic and Multi-Morbidities: The global increase in chronic diseases, including cancer, diabetes, and cardiovascular diseases, is boosting the demand for advanced treatments. This rise in the therapeutic needs compels pharmaceutical companies to seek outsourcing API manufacturers skilled in producing high-quality peptides through efficient, large-scale production methods.

- Improvements in technologies of Peptide Synthesis: Innovations in drug development, like solid-phase peptide synthesis, microwave-aided synthesis, and automated equipment, have transformed peptide production. These technologies enable the purification of peptide APIs, resulting in higher purity, reduced production times, and lower costs, thereby enhancing commercial viability.

- Regulatory Complexity: Peptide drug development is highly regulated, demanding stringent quality and safety standards. Manufacturers must comply with international standards like cGMP and FDA regulations to mitigate risks in development timelines and boost confidence in product quality, thus increasing the likelihood of market approval.

- Increased Demand for Individualized and Selective Medicines: Modern medicine increasingly focuses on personalized drugs tailored to individual patient profiles. Peptides are ideal for individualized therapies due to their specificity and biocompatibility. As the use of targeted therapies expands, the need for flexible and innovative API production solutions will also rise.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.36 Billion |

| Market Size in 2025 | USD 3.84 Billion |

| Market Size in 2024 | USD 3.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Scale of Operation, The Synthesis Method, Enterprise Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Personalized Medicine Trend Drives the Demand for Specialized Peptide Manufacturing

The increasing focus on personalized medicine and targeted therapies is driving the demand for custom peptide synthesis and manufacturing services. Peptides' high specificity, biocompatibility, and customizability make them ideal for personalized and targeted therapy. Consequently, pharmaceutical companies increasingly use peptides for targeted therapies in treating diseases such as cancer, metabolic disorders, and autoimmune conditions.

These companies are increasingly interested in CMOs offering integrated services, from early-stage development to commercial-scale production, to streamline the transition from lab research to market. As personalized peptide therapeutics gain regulatory and commercial traction, manufacturers' success in providing flexible, precise, and high-quality solutions will remain a key market factor.

Restraint

High Manufacturing Costs and Process Complexity Limit Market Accessibility

The high cost of production and the complexity of peptide production are major factors restraining the growth of the peptide therapeutics contract API manufacturing market. Peptide APIs have complex structures and require unique techniques in synthesis, purification, and quality assurance. The chemistry involved, such as solid-phase and liquid-phase synthesis, utilizes expensive reagents and complex hardware and is heavily environmentally regulated.

Ensuring high purity and structural correctness involves costly and time-consuming high-performance liquid chromatography (HPLC), mass spectrometry, and other advanced analytical methods, which increase both time and expense per batch. Large pharmaceutical companies and contract manufacturing entities will face significant financial and technical barriers, creating challenges in the market.

Opportunity

Advancements in Peptide API Manufacturing

Technological advancements create immense opportunities in the peptide therapeutics API manufacturing market. Peptide synthesis methods, including solid-phase peptide synthesis (SPPS), liquid-phase peptide synthesis (LPPS), and microwave-assisted synthesis, are transforming peptide synthesis. These specialized methods enhance productivity, purity, and the ability to manage complex peptide structures, enabling larger volumes and more affordable costs.

The alliances enable firms to concentrate on fundamental R&D and take advantage of the technical capabilities and the regulatory authority of an external manufacturing partner. Besides, globalization of healthcare markets and rising acceptance of peptide drugs in emerging economies are creating new opportunities for contract manufacturers.

The rising trend of outsourcing also opens up new growth avenues. Pharmaceutical companies are partnering with CMOs. These alliances allow pharmaceutical companies to focus on core R&D and leverage the technical expertise and regulatory knowledge of an external manufacturing partner. Additionally, the globalization of healthcare markets and the growing acceptance of peptide drugs in emerging economies are generating new opportunities for contract manufacturers.

Scale of Operation Insights

Why did the Pre-Clinical Segment Dominate the Market in 2024?

The pre-clinical segment dominated the peptide therapeutics contract API manufacturing market with the largest revenue share in 2024. This is primarily driven by the increasing use of contract manufacturing organizations (CMOs) in early-stage drug development. CMOs provide specialized services, including complex peptide synthesis, analytical method development, and regulatory consultancy, which are crucial for screening and identifying new drug candidates.

Pre-clinical studies demand rigorous testing and iterative compound optimization, where contract manufacturers excel due to their advanced R&D capabilities. The collaboration between drug manufacturers and CMOs also help streamline timelines, enabling drug companies to accelerate promising candidates. The CMOs' ability to offer comprehensive development services, including synthesis, characterization, and stability studies, has further solidified the pre-clinical segment's leadership in the peptide therapeutics contract manufacturing landscape.

The clinical segment is expected to grow at a significant CAGR over the forecast period. The complexity and sensitivity of peptides necessitate experienced manufacturers who can ensure consistency, stability, and compliance across various trial phases. Furthermore, the clinical phase requires scale-up, robust documentation, validation, and quality control to meet regulatory standards like the FDA and EMA. These organizations offer technical expertise and the flexibility to adapt to changing timelines and dosage requirements. By outsourcing clinical API manufacturing, drug developers can focus on trial design and regulatory strategy and minimize operational risks.

Synthesis Method Insights

What Made Chemical Synthesis the Dominant Segment in the Peptide Therapeutics API Manufacturing Market

The chemical synthesis segment dominated the market with a major revenue share in 2024, fuelled by the general application of solid-phase peptide synthesis (SPPS), which has gained a reputation because of its ability to scale, high level of automation, and efficiency. The SPPS process offers the benefit of step-by-step peptide synthesis with high purity, ideal for both small and large-scale production of therapeutic peptides. The ability to automate the synthesis process enhances production speed and consistency, meeting the growing demands of the pharmaceutical industry. Pharmaceutical companies are increasingly partnering with contract manufacturing organizations specializing in chemical synthesis to produce peptide APIs cost-effectively with high production capacity. The rising demand for peptide-based therapies for chronic disease further supports segmental growth.

The non-chemical synthesis segment is expected to grow at the fastest rate in the upcoming period. Non-chemical synthesis methods, such as enzymatic or recombinant techniques, are gaining traction and will continue to grow. Non-chemical production is typically more environmentally friendly, generating fewer toxic byproducts and requiring less harsh reaction conditions, making it ideal for eco-friendly manufacturing. As investments in biopharmaceutical innovation and sustainable production processes increase, contract manufacturing organizations with experience in non-chemical synthesis are becoming more attractive to drug developers.

Enterprise Type Insights

Why Does the Large Enterprise Segment Dominate the Peptide Therapeutics Contract API Manufacturing Market in 2024?

The large enterprise segment dominated the peptide therapeutics contract API manufacturing market with the biggest revenue share in 2024. This is due to the availability of abundant resources, highly developed technologies, and well-established infrastructures in large enterprises. Outsourcing API manufacturing to a specialized contract manufacturing organization allows businesses to focus on their internal assets, such as drug discovery and clinical development, while CMOs provide high-quality, cost-effective manufacturing services. Furthermore, they can manage mass-scale production and supply chain logistics, solidifying their position at the forefront of the peptide therapeutics market.

The small and medium enterprise segment is expected to grow at a significant CAGR over the forecast period. SMEs in the pharmaceutical and biotechnology sectors are realizing the benefits of outsourcing. Thus, they are outsourcing peptide API production to experienced CMOs due to inadequate infrastructure, funds, and skills. Partnering with CMOs grants SMEs access to innovative synthesis technology, quality, and regulatory compliance services at lower initial costs. This outsourcing allows them to focus on innovation and drug development, with production needs handled efficiently. Moreover, data security and operational flexibility are enhanced, increasing the focus of businesses toward affordable and scalable manufacturing methods by SMEs.

Recent Developments

- In January 2025, Bachem Holding AG, a giant peptide producer, declared that it would need to increase its Swiss-manufacturing section to fulfill the rising international demand for peptide API. The new facility will feature state-of-the-art solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS) opportunities and will allow Isopeptide to produce very complex peptides that are more scalable and efficient.

- In October 2024, the Lonza Group announced the expansion of its peptide manufacturing facility in Visp, Switzerland. The move is a strategic initiative that enhances the role of Lonza as a dominant player in the global peptide API segment, capable of meeting the increasing need for personalized medicine and also biologics.

- In August 2024, WuXi applied for the expansion of peptide production capacity within the office in Changzhou, China. This expansion comprises the incorporation of large-scale reactors, advanced analytical test systems, and a complete integrated quality control system, all of which improves its capability of providing high-quality peptide APIs to pharmaceutical customers worldwide.

(Source: https://www.outsourcedpharma.com)

(Source: https://www.lonza.com)

(Source: https://tides.wuxiapptec.com)

Peptide therapeutics contract API manufacturing market Companies

- Bachem Group (Switzerland)

- CordenPharma (Germany)

- Lonza (Switzerland)

- PolyPeptide Group (Sweden)

- AmbioPharm Inc. (U.S.)

- WuXi AppTec (China)

- CEM Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- JITSUBO CO, LTD. (Japan)

- ChemPartner (China)

- ApexBio Technology (U.S.)

- Biotage (Sweden)

- AnaSpec (U.S.)

- Syngene International Limited (India)

- BCNPeptides (Spain)

- CPC Scientific Inc. (U.S.)

- Creative Peptides (U.S.)

- CSBio (U.S.)

- Hybio Pharmaceutical Co., Ltd. (U.S.)

- Senn Chemicals (Switzerland)

Segments Covered in the Report

By Scale of Operation

- Pre-clinical

- Clinical

By the Synthesis Method

- Non-chemical synthesis

- Chemical synthesis

By Enterprise Type

- Large enterprise

- Small and medium enterprises

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting