PFAS Filtration Market Size and Forecast 2025 to 2034

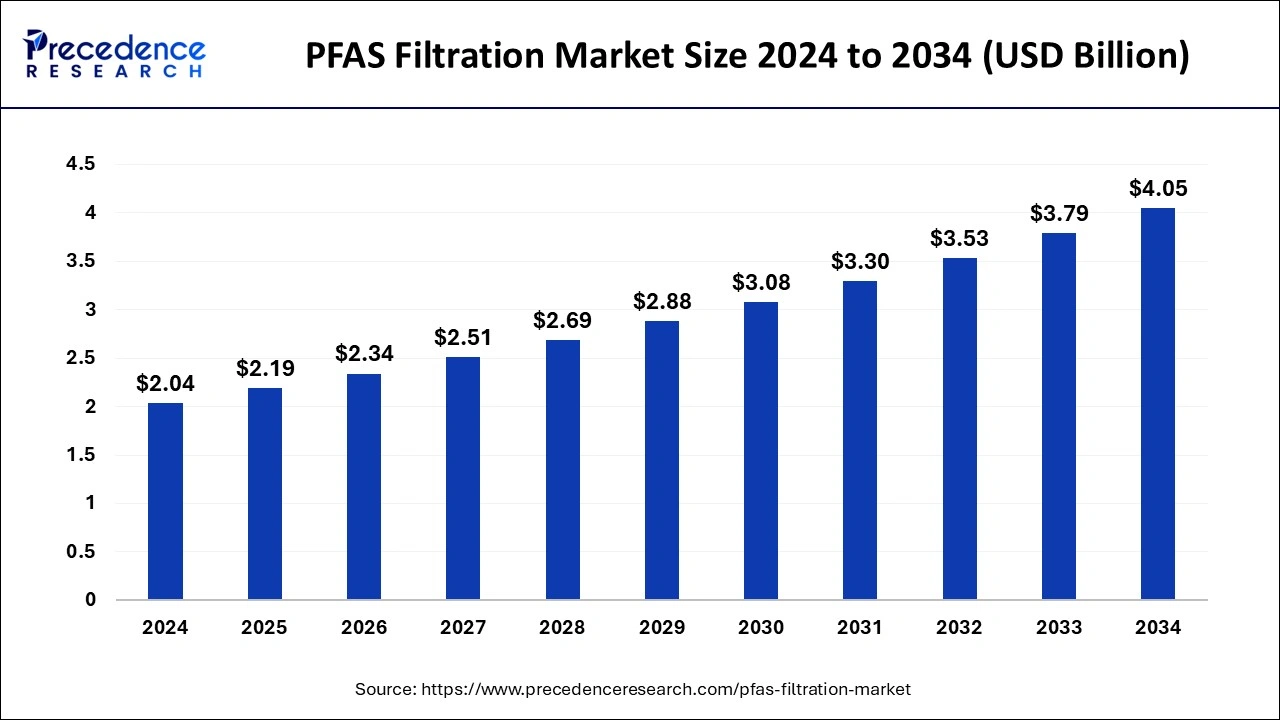

The global PFAS filtration market size was calculated at around USD 2.04 billion in 2024 and is expected to hit around USD 4.05 billion by 2034, growing at a CAGR of % from 2025 to 2034. The rising need to prevent exposure to sole PFAS in the environment, which is associated with causing harmful health effects to humans and animals, is increasing the adoption of the PFAS filtration market.

PFAS Filtration Market Key Takeaways

- Asia Pacific dominated the global PFAS filtration market in 2024.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By technology, the granular activated carbon (GAC) segment held a significant market share of 32.40% in 2024.

- By technology, the membrane filtration segment is expected to grow at a significant CAGR of 9.70% from 2025 to 2034.

- By media type, the activated carbon segment led the market with a major market share of 38.10% in 2024.

- By media type, the bio-adsorbents and nanomaterials segment is expected to grow at a significant CAGR of 10.50% over the projected period.

- By application, the water treatment segment dominated the market with the largest share of 41.60% in 2024.

- By application, the site remediation segment is expected to grow at a significant CAGR of 9.90% from 2025 to 2034.

- By end-use industry, the municipal water utilities segment captured the largest market share of 36.80% in 2024.

- By end-use industry, the residential segment is anticipated to grow at a significant CAGR of 9.50% from 2025 to 2034.

- By distribution channel, the direct sales segment led the market share of 34.20% in 2024.

- By distribution channel, the online retail segment is expected to grow at a significant CAGR of 9.50% over the projected period.

How is Artificial Intelligence (AI) changing the PFAS Treatment Market?

Artificial intelligence plays a crucial part in the PFAS filtration market by developing and optimizing a new way of wastewater and drinking water treatment technology for zero-pollution initiatives. The researchers are developing a new technology that collects and breaks down perpetual chemicals (PFAS) in one step in the purification process, which later gets collected directly to the drinking water and treatment plants. Machine Learning technology is used to enhance PFAS degradation in flow reactors. It is designed and developed to optimize and create a permanent solution for drinking water. The machine learning technique effectively detects ion concentration in the water more accurately than the existing sensors, which rely on electrical conductivity measurements. Artificial intelligence holds potential applications within national water quality management systems.

Market Overview

PFAS stands for Perfluoroalkyl and Polyfluoroalkyl Substances. It is a man-made chemical group used in several consumer products and industrial processes. PFAS is present in water, fish, air, and soil worldwide. It is estimated to be found in up to 49 states within the U.S. PFAS is a forever chemical, as it is extremely persistent in the environment and bodies. According to the Agency for Toxic Substance and Disease Registry (ASTDR), PFAS leads to several health problems, such as thyroid disease, liver damage, obesity, fertility issues, pregnancy-induced hypertension, an increase in cholesterol, and cancer. PFAS is treated using the Filtration technique, which contains activated carbon or reverse osmosis membranes.

- The U.S. Environmental Protection Agency (EPA) has finalized a rule to improve per- and polyfluoroalkyl substance (PFAS) to the Toxics Release Inventory (TRI) to report when companies release even small concentrations of PFAS into the environment.

PFAS Filtration Market Growth Factors

- Regulatory and customer pressure: Implementation of PFAS treatment has come into light for immediate action. Therefore, it is important for water utilities to address regulatory agency demands and customer concerns.

- Eliminate service disruptions: Building a robust infrastructure for PFAS-contaminated sources optimizes the service. When contaminants are detected, the water utilities' key concern is to quickly fix the problem and resume normal operation.

- Health Benefits: Reducing the exposure of PFAS through regulatory agencies that look after chemical isolation is mitigating the health threats that drive the PFAS filtration market.

- Environmental Benefits: PFAS causes pollution at every stage of production, contaminating the air, water, and soil of the surroundings. The Removal Act helps to protect the environment.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 2.04 Billion |

| Market Size in 2025 | USD 2.19 Billion |

| Market Size in 2034 | USD 4.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.11% |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Place of Treatment, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

PFAS contaminating water and food

The highest exposure to PFAS is through consuming PFAS-contaminated water and food. The PFAS and other chemicals present in the environment enter the food supply through crops and animals grown, raised, or processed in the contaminated areas. PFAS enters drinking water when industries release PFAS-contaminated water, air, or soil, discharge from sewage treatment plants, land application of contaminated sludge, leach from landfills, and use certain fire-fighting foams. PFAS is a chemical that is difficult to break down, and humans and animals are under constant exposure to it. Foods such as teas, pork, candy, sports drinks, processed meat, butter, chips, and bottled water have high PFAS levels.

- The survey claims that 77% of public water systems have yet to implement PFAS treatment method fully. Where installed, there are several technologies to remove PFAS from drinking water, which remove about 99% of PFAS regulated by the EPA.

Restraint

High-cost

PFAS filtration market treatment is an expensive process in the environment and public water systems; it costs billions or trillions of dollars every year, resulting in the restraining of the PFAS treatment market. The current expense of removing and destroying PFAS released annually into the environment is expected to exceed the global GDP of 106 trillion dollars. There are some levels of the treatment which are not technically or economically achievable. Without a significant reduction in the production of PFAS, the present global environmental harm will continue to increase.

Opportunity

Biological methods

There are several chemical, physical, and biological ways of removing PFAS. In the coming future, the biological method in the PFAS filtration market is anticipated to be witnessed greatly as it is the most cost-effective method, eco-friendly, and simple in the operational process. The biological technique comprises biodegradation, bioremediation, bioabsorption, term remediation, and phytoremediation. The combination of these techniques in PFAS removal is way more effective than using a single method. Additionally, the biological approach is better and less dangerous than the chemical approach.

Technology Insights

In the PFAS filtration market, granular activated carbon (GAC) dominated in 2024 due to its widespread availability, cost-effectiveness, and proven efficacy in removing long-chain PFAS compounds like PFOA and PFOS. GAC effectively removes these compounds through adsorption, where PFAS molecules bind to the activated carbon's porous surface. These systems can easily integrate into existing filtration setups, minimizing the need for significant infrastructure changes, making them reliable for both point-of-use and point-of-entry treatment.

The membrane filtration segment is experiencing the fastest growth, driven by its effectiveness in removing both long and short-chain PFAS compounds, increasing regulatory demands for clean water, and advancements in membrane technology such as reverse osmosis and nanofiltration. These membranes can remove over 90% of PFAS, including challenging short-chain compounds that other methods, like activated carbon or ion exchange, may not effectively eliminate. Their scalability allows implementation in various settings, including municipal water treatment plants and industrial wastewater treatment, making them a versatile solution for addressing PFAS contamination.

Media Type Insights

The activated carbon segment also led the PFAS filtration market in 2024 due to its effectiveness, affordability, and widespread availability. Granular activated carbon is particularly preferred for municipal and industrial water treatment because of its high surface area and capacity to adsorb long-chain PFAS such as PFOS and PFOA. Its ease of integration into existing infrastructure and a proven track record contribute to its dominance in the market. Regulatory bodies, including the EPA, have established guidelines and standards that often favor or include activated carbon filtration methods for PFAS removal.

The bio-adsorbents and nanomaterials segment is witnessing the fastest growth in the market, attributed to their superior adsorption capacity, high surface area, and potential for cost-effectiveness and sustainability compared to traditional filtration methods. These materials can be tailored to target specific PFAS compounds, thereby improving removal efficiency. Although initial costs may be higher, the potential for regeneration and reuse of nanomaterials can lead to long-term savings compared to other methods, such as activated carbon. The development of carbon-based nanomaterials, metal oxides, and bio-based adsorbents with enhanced properties for PFAS removal is also driving this segment's growth.

Application Insights

The water treatment segment of the market is expected to experience significant growth in 2024. This increase is primarily driven by rising regulatory pressure, the demand for safe drinking water, and widespread contamination of water sources by PFAS (per- and polyfluoroalkyl substances). Municipalities are heavily investing in PFAS filtration technologies to comply with stricter regulations and protect public health, making water treatment a primary focus. Furthermore, these are pervasive in various water sources like stormwater and wastewater, making municipal water treatment facilities a primary target for remediation.

The site remediation segment is projected to experience the fastest growth during this forecast period. This is due to heightened regulations, increased public awareness, and the necessity for effective solutions to combat widespread PFAS contamination. Public awareness about the health risks associated with PFAS is prompting more aggressive remediation efforts. Innovations such as In Situ Chemical Oxidation (ISCO) and integrated detection-remediation systems are offering more effective and scalable solutions for PFAS removal and destruction. Governments worldwide are enacting stricter regulations on PFAS levels in drinking water and other environmental media, which is creating a greater demand for remediation technologies.

End-use Industry Insights

The municipal water utilities segment dominated the market in 2024. This is largely due to stringent regulations, the need to provide safe drinking water to large populations, and the pervasive presence of PFAS in municipal water sources. PFAS contamination in drinking water is a significant public health concern, leading to an increased demand for effective filtration solutions in municipal water treatment plants. Municipal water systems process vast amounts of water, necessitating large-scale filtration solutions such as granular activated carbon, ion exchange resins, and membrane-based systems. Municipalities often have access to funding and resources, including federal and state grants, to support the implementation of new PFAS filtration technologies.

The residential segment is currently experiencing the fastest growth in the market. This is primarily due to increasing awareness of PFAS contamination in drinking water, stringent regulations, and the rising adoption of point-of-entry and point-of-use filtration systems in homes. These systems are becoming increasingly popular as homeowners seek reliable and convenient solutions for PFAS removal. Governments worldwide are implementing stricter regulations on PFAS levels in drinking water, prompting homeowners to search for effective filtration methods. Additionally, collaborations between water technology companies and residential filtration providers are offering comprehensive solutions.

Distribution Channel Insights

The direct sales segment, including OEMs (Original Equipment Manufacturers) and engineering firms, led the market in 2024. This success is attributed to the specialized demands of these customers and the technical expertise needed to implement effective PFAS filtration solutions. These customers often require customized systems and ongoing support, which a direct sales model effectively facilitates. Direct sales allow for close collaboration between filtration providers and customers to design, implement, and optimize these systems. This model enables filtration providers to offer comprehensive support throughout the integration process, ensuring smooth implementation and optimal performance.

The online retail segment is anticipated to experience rapid growth in the market. This is primarily due to increased consumer awareness, accessibility, and the convenience of direct-to-consumer sales. This growth is further fueled by heightened public concern over PFAS contamination in drinking water and the desire for accessible, affordable filtration solutions. Online retailers provide a convenient platform for consumers to purchase filters directly, bypassing traditional distribution channels. This model can offer a wider range of filter options, including those designed for home use, at competitive prices, making it easier for consumers to find effective solutions.

Regional Insights

Asia Pacific dominated the global PFAS filtration market in 2024. The dominance of this region is experienced with the help of rapid growth of industrialization, urbanization, and environmental awareness. In Asia Pacific, Singapore is one of the countries with the world's highest quality of drinking water, according to the Singapore National Water Agency. Asia's largest water treatment plant in Mumbai is incorporated with telemetry and SCADA systems, which offer advanced capabilities to monitor, control, and data acquisition.

Asia Pacific has an expanding initiative on wastewater management and wastewater reuse including hygiene sanitation as the region has 80% discharge of untreated wastewater. The PFAS filtration market growth is expected to be witnessed in the future with technological advancement, financing, incentives, awareness, and partnerships for PFAS treatment.

- Under the Stockholm Convention, PFAS regulation is currently limited in Asia, with some adherence to restrictions on PFOS and PFOA.

North America is expected to grow at the fastest CAGR in the PFAS filtration market during the forecast period. The North American government is investing in the American agenda, and EPA is making unprecedented funding available to help ensure all people receive clean and safe water. There is a growing demand to implement EPA regulations in these major metropolitan areas.

Another factor in the growth of the PFAS treatment market in North America is the high rate of PFAS concentration. In 2023, Monroe, New Jersey, has the highest concentration of 82 parts per trillion whereas, according to EPA, 3-4 ppt is the maximum level. Other 18 states in the United States, such as Los Angeles, Austin, and Denver, are exposed to unsafe drinking water.

- Recently, Bipartisan Infrastructure Law invested USD 1 billion in funding to help states and territories implement PFAS testing and treatment at public water systems to fight against PFAS contamination.

PFAS Filtration Market Companies

- Veolia

- Black & Veatch

- Revive Environmental

- WSP

- ALTRA SANEXEN

- Evoqua

- De Nora

- AECOM

- Cyclopure, Inc.

- Clean Earth

- Battelle memorial Institute

- TRC Companies, Inc.

- Calgon Carbon Corporation

- Clean Harbors

- Gradiant

Latest Announcements by Industry Leader

- In October 2024, Veolia North America CEO Frédéric Van Heems said, “Veolia is a global leader in PFAS treatment with a full array of solutions across the spectrum of PFAS, and our BeyondPFAS effort marks an evolution in our ability to provide our customers with the end-to-end solutions they need. BeyondPFAS' tailored approach helps you streamline implementation, optimize costs, minimize risks, and secure long-term operational efficiency. America's PFAS challenges are still emerging, and Veolia is here to help America face them.”

Recent Developments

- In October 2024, Veolia, the leading provider of environmental solutions in the U.S. and Canada expanded its PFAS treatment and compliance capabilities with the launch of BeyondPFAS offering a proven technical capability in PFAS treatment and disposal with its skill in helping customers navigate regulatory requirements and identify funding resources.

- In September 2024, De Nora, the world's leading supplier of electrodes for all major industrial electrochemical processes, launched a new propreietay line of SORB™ FX vessels to deliver enhanced PFAS removal which ic capable of treating flow rates ranging from 25 gallons per minute to 2,800 galllons per minute. The improved feature is based on the proven technology of water decontamination mainstay.

Segments Covered in the Report

By Technology

- Granular Activated Carbon (GAC) Filtration

- Point-of-Entry (Whole House) Systems

- Point-of-Use Systems (Under-sink, Countertop)

- Ion Exchange Resins

- Single-use Resins

- Regenerable Resins

- Reverse Osmosis (RO)

- Residential RO Systems

- Industrial/Commercial RO Systems

- Membrane Filtration

- Nanofiltration

- Ultrafiltration

- Advanced Oxidation Processes (AOPs)

- UV/Hydrogen Peroxide

- Ozone-based AOPs

- Electrochemical Treatment

- Hybrid Technologies

- GAC + RO

- RO + AOPs

By Media Type

- Activated Carbon

- Coconut Shell Carbon

- Bituminous Coal-based Carbon

- Synthetic Adsorbents

- Ion Exchange Resins

- Anion Exchange

- Specialty PFAS-targeted Resins

- Membranes

- Polymeric Membranes

- Ceramic Membranes

- Bio-adsorbents and Nanomaterials

- Graphene Oxide

- Biochar

- Zeolites

By Application

- Water Treatment

- Drinking Water

- Groundwater Remediation

- Wastewater Treatment

- Site Remediation

- Excavation & On-site Treatment

- In-situ Chemical Oxidation (ISCO)

- Food & Beverage Processing

- Healthcare & Pharmaceuticals

- Chemical Manufacturing Effluent Management

By End-use Industry

- Municipal Water Utilities

- Industrial Manufacturing

- Electronics & Semiconductors

- Textiles and Leather

- Automotive

- Aerospace & Defense

- Oil and Gas

- Chemical and Petrochemical

- Healthcare Facilities

- Residential Sector

- Commercial Buildings (Offices, Hotels, Restaurants)

By Distribution Channel

- Direct Sales (OEMs & Engineering Firms)

- Online Retail

- Offline Retail

- Plumbing Supply Stores

- Home Improvement Stores

- Distributors & Dealers

- EPC Contractors & System Integrators

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting