What is the Sulphur Filtration Market Size?

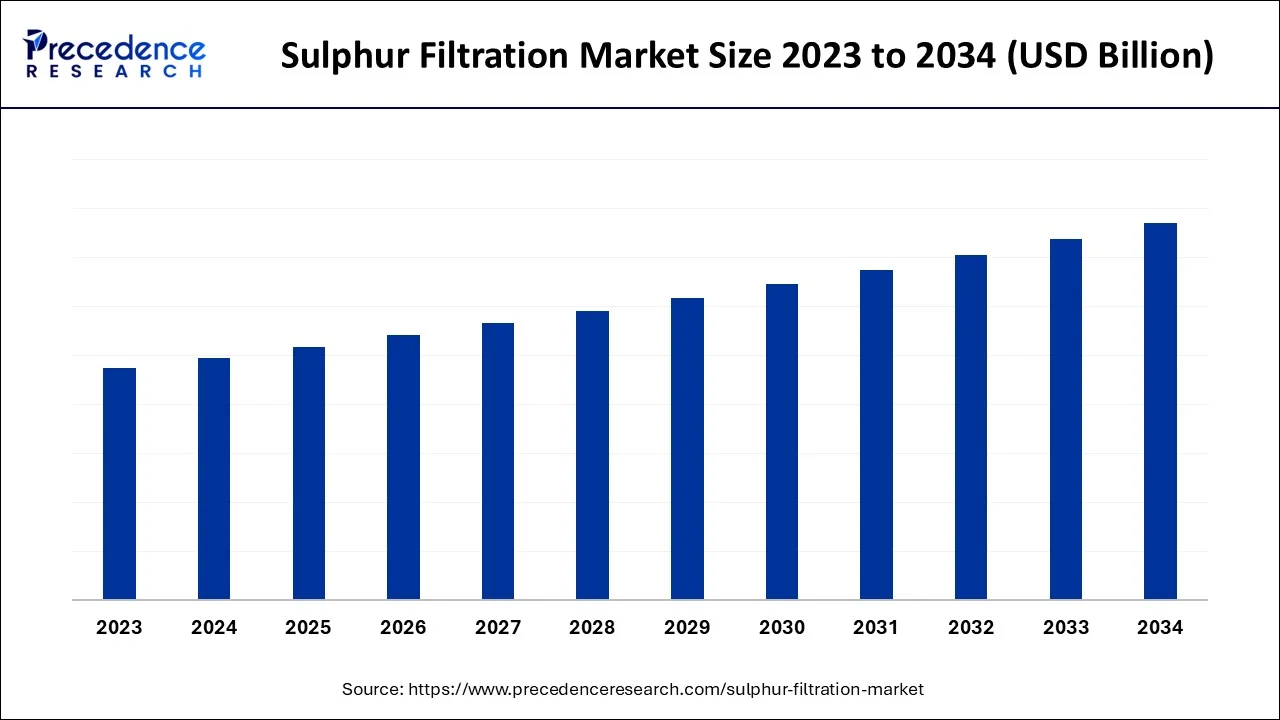

The global sulphur filtration market is surging, with an overall revenue growth expectation of hundreds of millions of dollars from 2026 to 2035.

Sulphur filtration is the process of removing sulphuric substances from gases or liquids in order to reduce their sulphur content, for example, SO2 and hydrogen sulphide H2S. In the case of sulphur compounds that are produced byproducts and need to be managed in order to comply with environmental regulations, it is an essential step for a number of industries including oil and gas, petrochemicals, power generation and waste management. Sulphur filters are intended to mitigate the harmful effects of sulphur emissions on human health and the environment. Air pollution, acid rain formation and ecosystem degradation are known to be the effects of sulphur compounds. For this reason, filtration systems are used to capture and eliminate sulphur compounds from manufacturing processes prior to their release into the atmosphere or being disposed of in water.

Depending on the specific application and nature of the sulphur compounds concerned, a number of technologies or techniques are in use for the removal of sulphur. The use of wet cleaning, dry cleaning, adsorption and catalytic conversion is also common filtration techniques. The wet cleaning process involves passing gas or liquids through the scrubber unit that is intended to capture sulphur compounds in a liquid solution. Dry cleansing uses solid sorbents for the chemical reaction and removal of sulphur compounds. Adsorption is the process of transferring gases and liquids to a medium that adsorbs sulfur compounds onto their surface, e.g. activated carbon. Catalytic converters use catalysts that facilitate chemical reactions to convert sulphur compounds into less harmful substances.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Second Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa |

Market Dynamics

Key Market Drivers

Industrial expansion- The production of sulphuric acid as by-products is also increasing due to an increase in the activities of industry sectors such as oil and gas, petrochemicals, power generation and waste management. These substances, including sulphur dioxide SO2, hydrogen sulphide H2S, should pose an adverse effect on the environment and health conditions unless they are properly controlled. In order to manage and reduce the emission of sulphur compounds, thus ensuring compliance with stringent emissions regulations, an increasing demand for efficient filtration systems is emerging.

The oil and gas sector, in particular, plays an essential role in driving industrial expansion as well as demand for sulphur filter solutions. Products such as sour gas, sour crude oil, and refinery off-gases with high concentrations of sulphur compounds are often produced by oil refining processes. An efficient sulphur separation system is required by refineries so that those compounds can be removed before they reach the atmosphere in order to meet environmental regulations and reduce their impact on the environment.

Furthermore, industrial expansion and the demand for sulphur filters will be stimulated by power generation facilities, in particular those using fossil fuels. During the combustion of sulphur-containing fuels, coal-fired power stations and thermal installations using natural gas can release significant quantities of sulphur compounds. To help power plants meet emission rules and reduce sulphur emissions, as well as to ensure cleaner and more sustainable energy production, it is necessary to install sulphur filtration technologies such as flue gas desulfurization systems.

Therefore, the key factor driving the growth of the sulphur filtration market is industrial expansion. Effective sulphur filtration solutions are required to cope with the growth of production and releases of sulphuric compounds as byproducts in industries like oil and gas, petrochemicals or power generation. In order to mitigate the adverse environmental and health impact of sulphur compounds, industrial sectors can make use of advanced filtration technology that allows them to reduce emissions while complying with environmental regulations. The demand for sulphur dioxide filtration systems is anticipated to increase, which will provide opportunities for market growth and advanced technology in this field as industrial activity continues to expand worldwide.

Adoption of cleaner energy sources: The growth of the sulphur filter market is largely driven by adoption of clean energy sources. The global shift to a greener and less carbon-intensive future has led to increased emphasis on the reduction of environmental pollution, as well as mitigation of impacts from industry activities. In power generation and industrial processes, cleaner sources of energy, such as renewable energy and natural gas, are increasingly replacing fossil fuels. Nevertheless, byproducts with a sulphurous content that require an effective filtration in order to minimize their impact on the environment may also be produced from these clean energy sources.

Biomass power generation, biogas plants, and natural gas processing, for example, generate sulphur compounds as by-products. This results in a need to apply effective sulphur filter systems with the objective of removing sulphur compounds and ensuring compliance with emission standards. In order to meet the objectives of sustainable and more environmentally friendly energy production, industries can effectively manage and reduce sulphur emissions by applying advanced filtration technologies. The demand for Sulphur Filters is expected to rise as more and more countries make use of Clean Energy sources, resulting in the development of market opportunities for filters technology developments and expansion.

Key Market Challenges

Complex Operating Conditions: The development of the sulphur filtration market is hindered by a high degree of complexity in operating conditions. The sulphur filter systems need to be used in difficult and challenging environments such as temperatures exceeding 350 C, acid gases or liquids. Depending on their composition of sulfur compounds they are often subjected to different treatment conditions. As a consequence of these conditions, filtration equipment may be subject to high strain and require higher maintenance requirements, less effective functioning and shorter service life.

Furthermore, filtration processes may become more complex and could result in decreased performance if impurities, particulate matter or other contaminants are present in gas or liquid streams. To cope with such difficult operating conditions, special filtration technologies and materials that are resistant to harsh environments while still maintaining high performance shall be developed. It may be technically challenging and costly for both equipment producers and end users to design and implement such systems. Therefore, to ensure long term reliability and effectiveness of sulphur filters systems as well as facilitate market growth in the sector, efforts must be made to address complex operating conditions.

Key Market Opportunities

Expansion of industrial sectors: The growth of the sulphur dioxide filtration market can be significantly stimulated by industrial expansion. The production of sulphur compounds as byproducts is increasing due to the expansion of industry in different sectors, for instance, oil and gas, petrochemicals, power generation and waste management. In order to control and mitigate the release of sulphur compounds, ensuring that stringent emission rules are complied with, this rise in industrial activity is creating a greater demand for effective sulfur filtration solutions.

The oil and gas industry is particularly important for stimulating the growth of industries, as well as demand for sulphur filtration systems. Products such as sour gas, sour crude oil, and refinery off-gases with high concentrations of sulphur compounds are often produced by oil refining processes. The use of effective sulphur filtration equipment is required by refineries for the removal of these compounds before their release to the atmosphere, in order to comply with environmental legislation and minimize its impact on the environment.

At the same time, major growth is observed in the petrochemical sector and significant sulphur emissions are generated. In the manufacturing process, sulphur compounds may be released at petrochemical plants producing a wide range of chemical products, plastics and composite materials. These industries have the ability to control emissions, minimize their effect on the environment and comply with emission standards if they adopt robust sulphur filtration systems.

Moreover, industrial expansion and the demand for sulphur filter systems is supported by power production facilities, particularly those using fossil fuels. When combustion of sulphur content fuels is performed, coal power stations and gas plants used for thermal applications may be capable of releasing substantial quantities of sulphur compounds. The installation of sulphur filtration systems such as flue gas desulfurization (FGD), which helps power plants comply with emission regulations and reduces sulphur emissions ensures a cleaner and more sustainable energy production in the future.

Furthermore, waste management sector, including landfill gas processing and waste treatment facilities, creates sulphuric substances that should be properly filtered to minimize their impact on the environment. Demand for sulphur dioxide filtration systems in the sector is projected to increase with increasing waste volumes due to population growth and urbanization.

Therefore, the sulphur filter market offers promising growth opportunities due to the development of industrial sectors. The market is capable of supporting industries to reduce sulphur emissions, comply with the environmental legislation and achieve sustainability and responsible operation in providing efficient and reliable filtration solutions. An increasing demand for sulphur filters, which will drive the market forward and support other innovation in this area, is driven by continuing industrial growth, especially in developing economies.

Type Insights

On the basis of type, the market is segmented into pressure filters, gravity filters, and centrifugal filters. Pressure filters are the most common type of sulphur filter. They are relatively inexpensive and easy to replace. Gravity filters are more durable than pressure filters, but they are also more expensive. Centrifugal filters are the most expensive type of sulphur filter, but they are also the most effective at filtering impurities.

Application Insights

By application, the market is segmented into fertilizer, rubber, plastics, and others. The fertilizer segment is the largest segment of the sulphur filtration market. This is due to the increasing use of sulphur in the production of fertilizers. The rubber segment is also growing rapidly due to the increasing use of sulphur in the production of rubber products. The plastics segment is expected to grow at a steady pace in the coming years.

Regional Insights

How did North America Dominate the Market in 2025?

North America dominated the sulphur filtration market with the largest share in 2025. This is due to the early adoption of sulphur filtration in the region. With the rising expansion of oil & gas, power generation, and petrochemical industries in countries like the U.S. and Canada, there is a high demand for sulfur filtration, as these industries are major sources of sulfur emissions. In addition, strict environmental regulations encouraged various industries to use sulphur filtration to comply with emission standards.

U.S. Sulphur Filtration Market Trends

With a dominant share in the sulphur filtration market, the U.S. is putting efforts into sulphur-packed bioreactors, which primarily treat high-organic-carbon wastewater and for deep denitrification of drinking water sources. While Andritz partnered with Paques to facilitate a sulfur recovery solution for pulp mills, by using bacteria to convert sulfides from green liquor into valuable elemental sulfur.

Spurring Industrialization & Sustainability is Bolstering the Asia Pacific

Asia Pacific is expected to be the fastest-growing market for sulphur filtration in the coming years. This is mainly due to the rising industrialization in countries like India and China. Various governments are imposing stringent regulations on industries to reduce their carbon footprints. Moreover, the increasing focus on sustainability and the rising concerns about air pollution contribute to regional market growth.

China Sulphur Filtration Market Trends

In the future, China will expand rapidly by continuing the use and improvements in well-developed methods, such as Flue Gas Desulfurization (FGD), and also evolving novel, highly effective "tail gas desulfurization" projects in industries, including petrochemicals. Regulatory pressure to reduce sulfur emissions from petrochemical, natural gas, and refining operations is encouraging the shift toward hybrid adsorbent materials, and advanced desulfurization solutions that offer superior sulfur removal, regeneration capability and lower operational costs.

Focusing on the Integration of AI & Smart Monitoring is Fueling Europe

Europe is predicted to expand significantly, as many companies are widely integrating AI-enabled tracking and real-time gas analytics into sulphur recovery processes to optimize process control, safety, and predictive maintenance. This encourages smart, automated systems to support facilities that adapt to diverse feedstock quality and regulatory pressures.

Germany Sulphur Filtration Market Trends

Specifically, Mitsui subsidiary Aglobis is planning an innovative commercial sulphur burner in Germany's Duisburg area, with operations anticipated to initiate in 2027. This shows a long-term investment in local processing capabilities to handle the sulphur shortage. The shift toward cleaner energy sources such as natural gas, biofuels, and hydrogen is further boosting adoption. Overall, the market reflects regulatory compliance, technology upgrades, and sustainability priorities.

Sulphur Filtration Market- Value Chain Analysis

- Feedstock Procurement

This mainly comprises a hydrocarbon stream, which contains sulphur impurities that must be removed through filtration, adsorption, or hydrotreating to meet product specifications and protect downstream catalysts and equipment.

Key Players: Marathon Petroleum Company LLC, Sulphurnet, Shell PLC, etc. - Waste Management and Recycling

Primarily, sulphur waste is recovered through thermal processing/vaporization, molten sulfur filtration, and acid recycling, while waste management is done via neutralization and sequestration or incorporation into building construction materials.

Key Players: MANN+HUMMEL, Desotec, Clean Harbors, etc. - Regulatory Compliance and Safety Monitoring

It is powered by the International Maritime Organization (IMO) MARPOL Annex VI regulations for shipping, which mandate a global fuel sulphur content limit of 0.50%.

Key Players: SulfurWorx, SafeRack, Sulzer, etc.

Top Companies in the Sulphur Filtration Market & Their Offerings:

- Donaldson Company, Inc.- They widely facilitate chemical filtration solutions for targeting and removing sulphur compounds.

- Graver Technologies, Inc.- A company that emphasises particulate and organic contaminant removal across diverse industries.

- Pall Corporation- It has explored numerous filtration & separation solutions, like SepraSol Plus Liquid/Gas Coalescers.

- Alfa Laval AB- This company leverages highlighting sulphur management through exhaust gas cleaning systems (scrubbers) in the marine industry.

- Filter Specialists, Inc.- This specialises in comprehensive liquid sulphur filtration solutions, mainly using Ceramic Filter Tubes in their Sulphurnet systems for polishing molten sulphur.

Sulphur Filtration Market Companies

- Donaldson Company, Inc.

- Graver Technologies, Inc.

- Pall Corporation

- Alfa Laval AB

- Filter Specialists, Inc.

- Westfalia Separator Group GmbH

- Durco Filters Company

- BHS Process Technology

- Filtration Group, Inc.

Segments Covered in the Report

By Type

- Pressure Filters

- Gravity Filters

- Centrifugal Filters

By Application

- Fertilizer

- Rubber

- Plastics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting