What is the Pharmacy Automation Market Size?

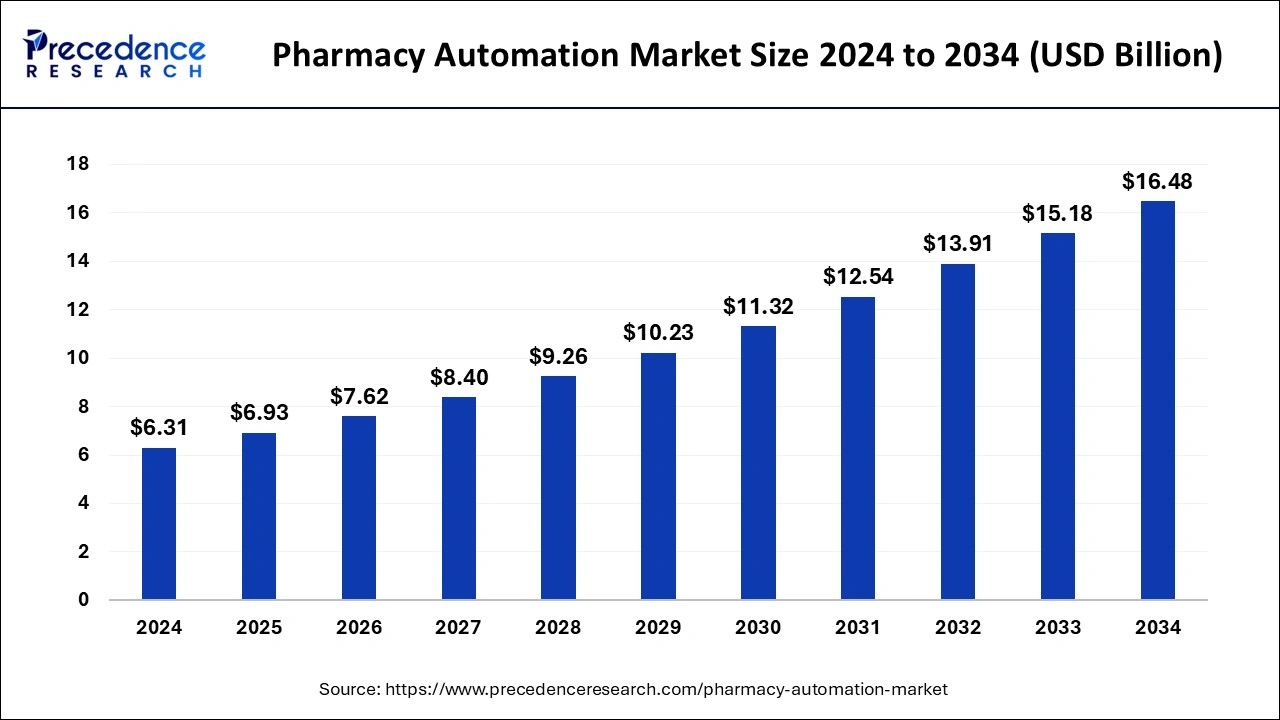

The global pharmacy automation market size is calculated at USD 6.93 billion in 2025 and is predicted to increase from USD 7.62 billion in 2026 to approximately USD 17.75 billion by 2035, expanding at a CAGR of 9.86% from 2026 to 2035.

Market Highlights

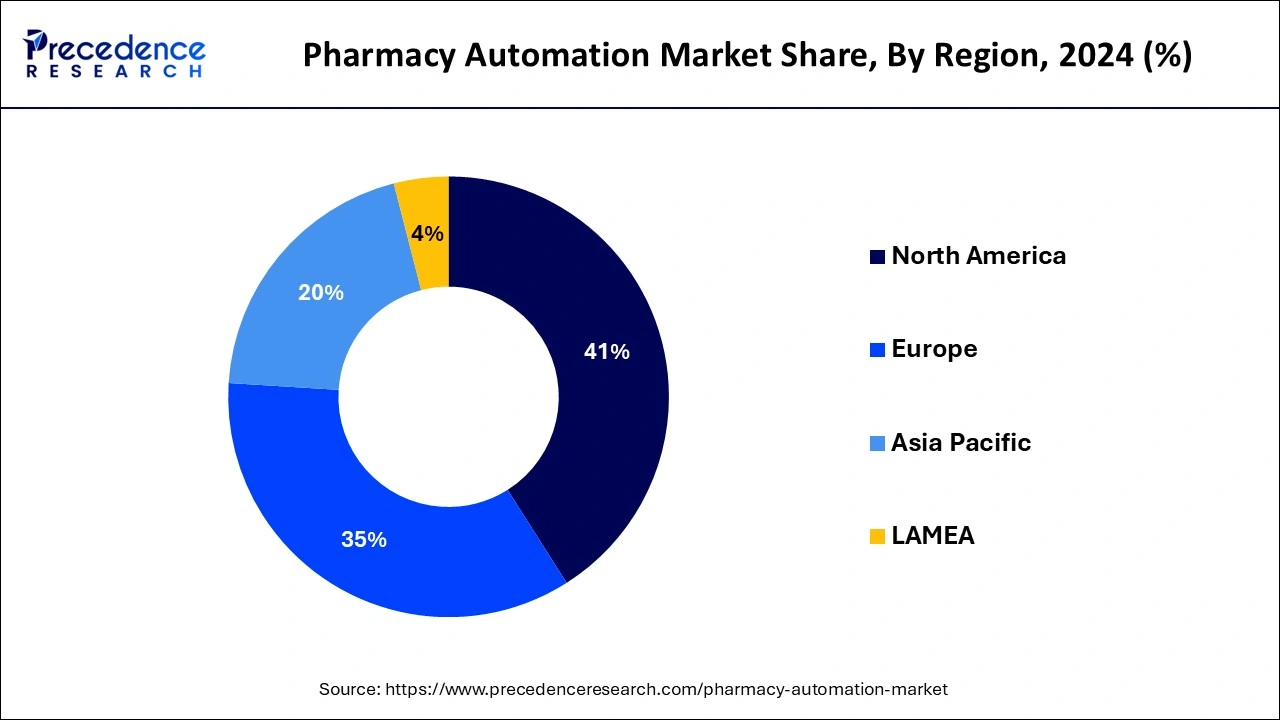

- North America has captured highest revenue share of around 41% in 2025.

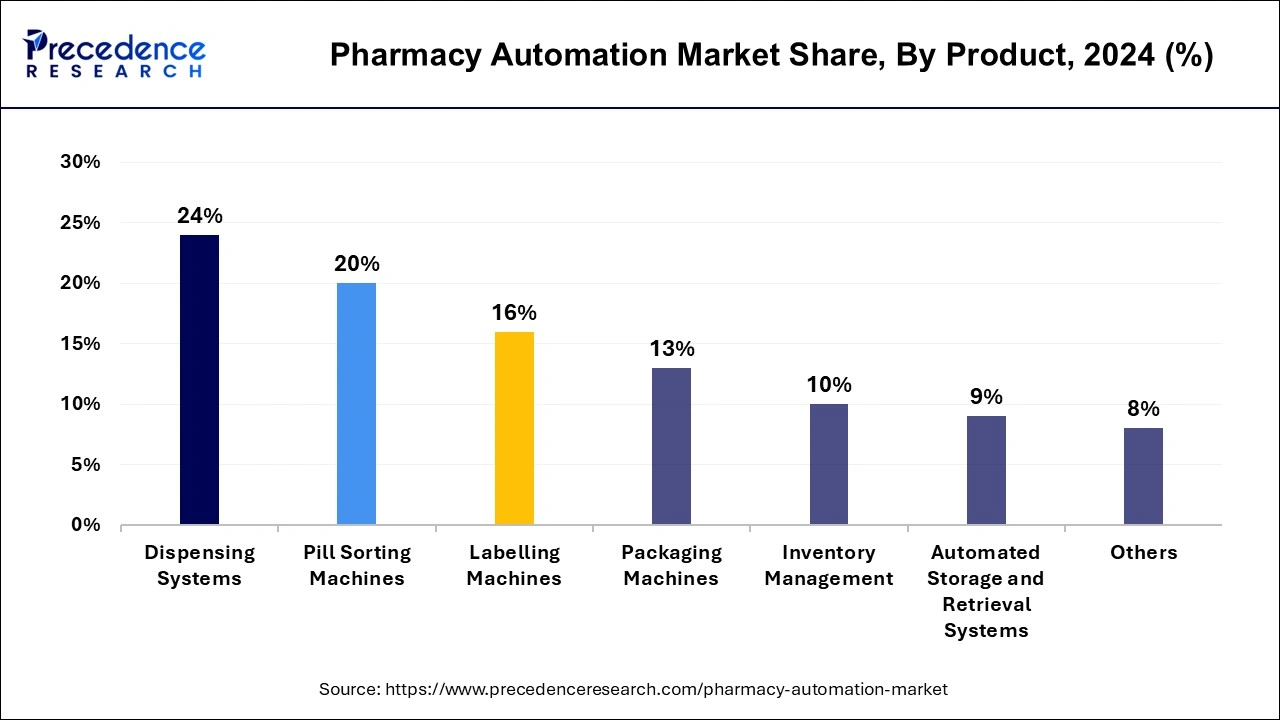

- By Product, the dispensing systems segment has accounted revenue share of around 23.17% in 2025.

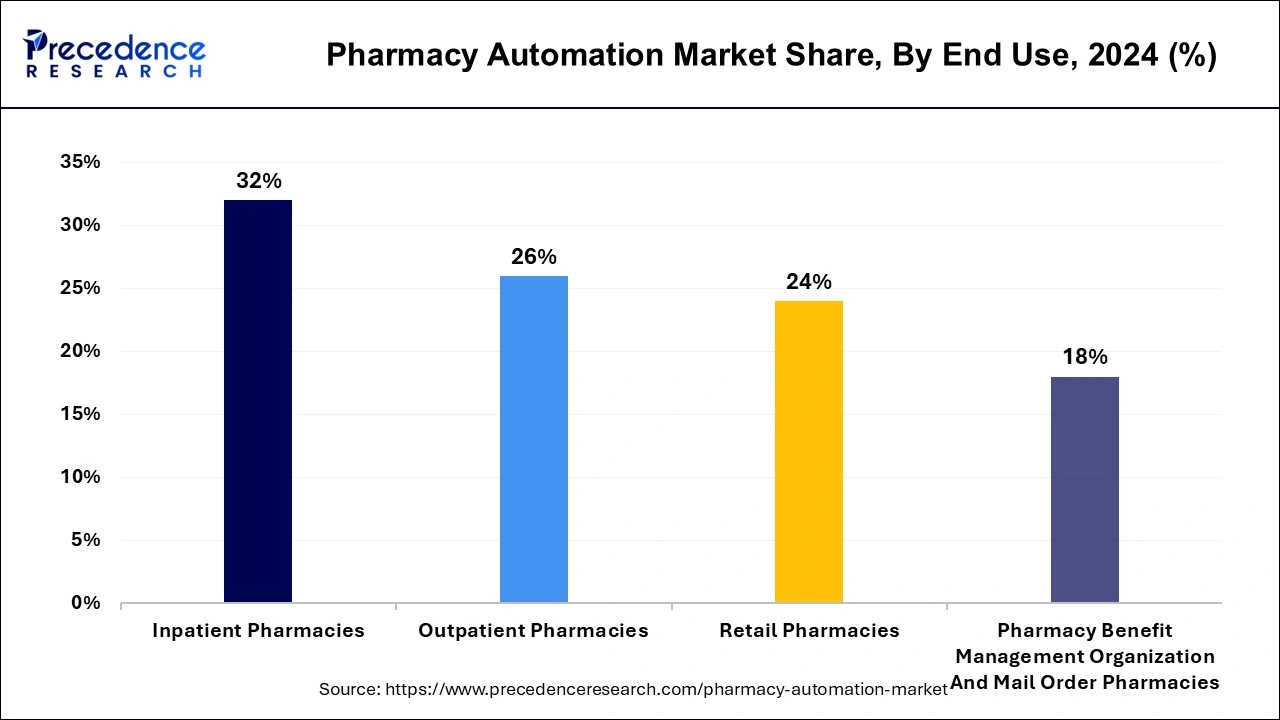

- By End Use, the inpatient pharmacies segment has generated highest revenue share of 31.51% in 2025.

- The retail pharmacies segment has held 24.70% revenue share in 2025.

Market Size and Forecast

- Market Size in 2025: USD 6.93 Billion

- Market Size in 2026: USD 7.62 Billion

- Forecasted Market Size by 2035: USD 17.75 Billion

- CAGR (2026 to 2035): 9.86%

- Largest Market in 2025: North America

Artificial Intelligence: The Next Growth Catalyst in Pharmacy Automation

AI transforms the pharmacy automation market through precision, efficiency, and enhanced care. It monitors inventory in real-time and reduces medication waste by analyzing drug interactions and making dosage recommendations. AI further provides the means to streamline administrative tasks and speed up drug discovery processes, enabling a precision formulation attempt, while furthering and enhancing quality control in manufacturing. Along the logistical lines, it renders the supply chain resilient, acts as a common ground for integrating electronic health records with AI-generated insights for personalization of treatments, thereby reducing operational costs, and redirecting the pharmacist's focus toward clinical care.

Pharmacy Automation Market Growth Factors

The growth of global pharmacy automation market is being driven by the growing need for device that helps in reducing medication errors. Furthermore, the growing geriatric population as well as growing adoption of automated devices and innovative technologies is also contributing towards the growth of global pharmacy automation market. The rising healthcare expenditure is also driving the growth and development of worldwide pharmacy automation market over the forecast period.

Another factor driving the growth of global pharmacy automation market is the expansion of pharmaceutical sector all around the globe. As per the Indian Brand Equity Foundation, Indian companies exported pharmaceuticals worth $17.27 billion from 2017 to 2018, and this figure is predicted to rise by 30% by 2020 to $20 billion. The thriving pharmaceutical business is expected to boost the growth of worldwide pharmacy automation market.

The geriatric population has risen globally. As a result, the number of life threatening and chronic disorders is on the rise, as is the number of prescriptions prescribed. As per the study of Economic analysis of the prevalence and clinical and economic impact of medication error in England, released in June 2021, the National Health Service in England makes an estimated 237 million prescription errors per year, resulting in hundreds of fatalities. As a result, pharmacies and hospitals are implementing new pharmacy automation technology to cut costs while increasing patient safety.

The increased mergers and acquisitions as well as an increase in the number of partnerships between companies to extend their product capabilities, are predicted to drive the growth of global pharmacy automation market. The key market players, particularly in emerging nations, are focusing on ongoing product development while supplying products at competitive rates.

- Rising demand for reducing medication errors is prompting system automation to improve the measure of accuracy and patient safety.

- Rising incidences of geriatric population and chronic diseases thus impress the rise in prescription volumes; this impresses an increased need for automated pharmacy solutions.

- Growing globalization of pharmaceutical trade engenders automation for overseeing production, handling, and dispensing necessities.

- Continuous updates in robotic, AI, and data analytics technologies are being harnessed for enhanced automation of pharmacy operations with assured safety and reliability.

- Strategic collaborations have further cemented their portfolios and have thus stretched the reach of their market presence among the giants in the trade.

Market Outlook

- Market Growth Overview: The Pharmacy Automation market is expected to grow significantly between 2025 and 2034, driven by the increasing need to reduce medication errors, the integration of artificial intelligence and machine learning is a transformative trend, the shift towards decentralized pharmacy models and the expansion of telepharmacy and remote dispensing services.

- Sustainability Trends: Sustainability trends focus on the need for efficiency and cost reduction alongside environmental responsibility. The use of energy-efficient systems and sustainable packaging materials to minimize environmental impact and reduce waste.

- Major Investors: Major investors in the market include Danaher Corporation (via subsidiaries), BD (Becton, Dickinson and Company), Omnicell, Inc., and McKesson Corporation.

- Startup Economy: The startup economy in the market is focused on niche innovators developing specialized solutions to address specific industry gaps. These nimble companies often integrate emerging technologies like AI, cloud computing, and IoT to improve efficiency and enable new services like e-pharmacy and telepharmacy.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD6.93 Billion |

| Market Size in 2026 | USD 7.62Billion |

| Market Size by 2035 | USD 17.75 Billion |

| Growth Rate from 2026 to 2035 |

CAGR of 9.86% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising requirement for prescription data management solutions

Pharmacy automation systems with robust prescription data management capabilities help enhance patient safety. By automating the prescription filling process, these solutions minimize the risk of medication errors, such as incorrect dosages or drug interactions. Prescription data management solutions can also provide real-time access to patient medication history and alerts for potential issues, promoting better decision-making and patient care. With increasing regulations and the need for stringent data management, pharmacies are turning to automation to simplify compliance processes and reduce the risk of errors or non-compliance. Thus, the rising requirements for prescription data management solutions are observed to drive the growth of the market.

- In June 2024, an international cloud-based provider, BoomerangFX announced its partnership with Dr.First in order to launch e-prescribing systems for aesthetic medicines for North America.

Emphasis on medication error reduction

As healthcare providers focus on improved patient care, the market for pharmacy automation is observed to grow significantly in the upcoming years. Medication errors can have financial implications for healthcare organizations, leading to increased healthcare costs due to additional treatments, extended hospital stays, and legal consequences. By reducing medication errors, pharmacy automation systems contribute to cost savings by minimizing the need for corrective actions and avoiding potential legal disputes. Furthermore, automated systems optimize inventory management, reduce waste, and help control medication costs.

Restraint

Concerns with accurate outcomes

Pharmacy automation relies on the trust and acceptance of healthcare professionals and patients. If accuracy concerns persist, pharmacists may be hesitant to rely on automation for critical tasks, such as medication dispensing or drug interaction checks. Accuracy issues in pharmacy automation can have financial implications for healthcare providers. Errors caused by automation systems can lead to costly legal claims, damage to reputation, or additional expenses related to reprocessing medications or compensating affected patients. Healthcare providers may be hesitant to invest in automation technology if they perceive accuracy concerns as potential financial risks. Thus, the concerns with accuracy or accurate outcomes offered by automation systems create a restraint for the market by hindering its expansion.

High initial investment cost for transformation

Implementing pharmacy automation systems may require modifications to the physical layout and infrastructure of the pharmacy. For example, installing robotic dispensing systems or automated storage systems might require space and structural adjustments. Renovations and infrastructure upgrades can significantly add to the overall cost of automation. Implementing pharmacy automation systems often requires integration with existing pharmacy workflows and systems. This integration process can be complex and time-consuming, involving additional costs for customization, software development, and IT support. Furthermore, training pharmacy staff to effectively use and manage the automation systems also adds to the overall cost. Thus, such high upfront costs are observed to create a major restraint for the market.

Opportunity

Penetration of artificial intelligence (AI) technologies

Artificial intelligence (AI) algorithms can assist pharmacists in verifying prescriptions by automatically checking for potential errors or inconsistencies. By comparing the prescription against patient records and relevant medical databases, AI can flag potential issues such as incorrect dosages, drug interactions, or contraindications, enabling pharmacists to make informed decisions. On the other hand, generative AI solutions can offer inventory management for healthcare providers.

AI can optimize inventory management by predicting medication demand based on historical data, seasonal variations, and other factors. It can help pharmacies maintain optimal stock levels, reducing the risk of stockouts or overstocking. AI-powered systems can also monitor expiration dates and facilitate proper rotation of stock to minimize waste. Thus, the penetration of artificial intelligence is observed to open a plethora of opportunities for the market.

Rising online sales of medicines

The Covid-19 pandemic with movement restrictions and prolonged lockdown has brought a significant growth opportunity for the online sales of medicines across the globe. This element is observed to open a plethora of opportunities for the global pharmacy automation market too. The convenience of purchasing medications online has led to a surge in the number of orders. This increased demand has created a need for automated systems to handle order processing, prescription verification, and dispensing. Pharmacy automation solutions can help streamline these processes, ensuring accurate and efficient order fulfillment. Online sales often require medications to be shipped and delivered to patients. Pharmacy automation technologies can help ensure medication safety during the packaging and dispensing process, reducing the risk of errors. Additionally, automation systems can incorporate features such as patient counseling and medication reminders, promoting adherence to prescribed treatments.

Challenge

Lack of standardization

Standardization is essential for seamless upgrades, maintenance, and replacement of components within pharmacy automation systems. In the absence of standardized interfaces and protocols, integration with newer technologies or replacement of outdated components can become complex, costly, and time-consuming. Lack of standardization in user interfaces and workflows across different pharmacy automation systems can pose challenges in training and support. Pharmacists and pharmacy technicians need to learn and adapt to different systems, leading to increased training costs, longer implementation times, and potential errors due to unfamiliarity with multiple interfaces. To address this challenge in the market, many standardization organizations are collaborating with healthcare providers and pharmaceutical companies.

Segments Insights

Product Insights

The medication dispensing systems segment dominated the pharmacy automation market in 2023. The growth of the segment is attributed to the growing number of deaths due to medication errors. In addition, strict government regulations are also boosting the medication dispensing systems segment. Moreover, adoption of advanced technologies is paving way for the expansion of segment.

The automated medication compounding systems segment is projected to hit strong growth over the forecast period. As per the survey on pharmacy automation equipment done by Pharmacy Purchasing and Products in 2019, 84% of hospital pharmacies have or plan to employ automated dispensing cabinets. One of the primary factors driving the growth of the segment is the growing use of sterile compounding.

End Use Insights

The retail pharmacy segment dominated the pharmacy automation market in 2023. The supermarket pharmacies, chain pharmacies, mass merchandiser pharmacies, and independent pharmacies are all examples of retail pharmacies. The growth of the segment is attributed to the rising need to reduce dispensing errors, the surge in the number of retail pharmacies, and increased burden on pharmacists.

The hospital pharmacy segment is expected to witness significant growth over the forecast period. This is due to the growing use of automated dispensing cabinets, automated medication storage, and barcoded unit dose packaging systems to improve production and efficiency. In December 2020, for example, Owensboro Health implemented Omnicell Central Pharmacy Dispensing Service to decrease pharmaceutical dispensing problems and enhance inventory management.

Regional Insights

What is the U.S. Pharmacy Automation MarketSize?

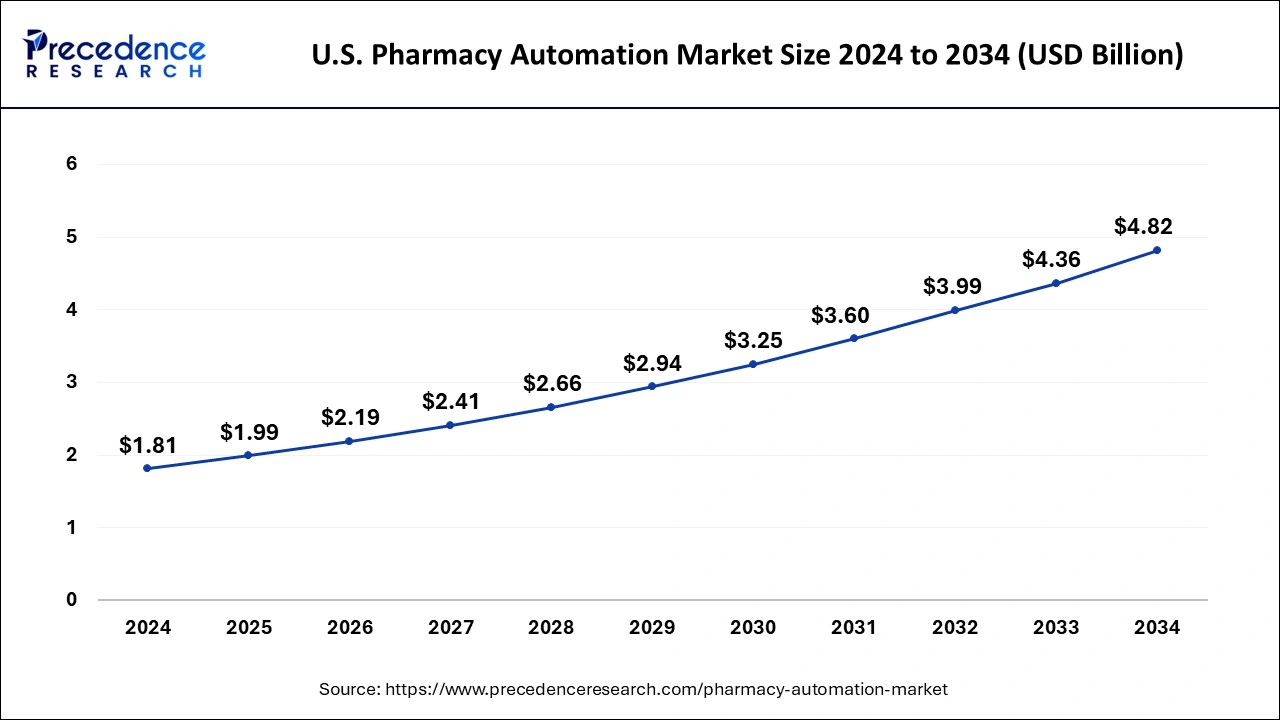

The U.S. pharmacy automation market size is exhibited at USD 1.99 billion in 2025 and is projected to be worth around USD 5.22 billion by 2035, growing at a CAGR of 10.12% from 2026 to 2035.

What Made North America Dominant in the Market in 2025?

North America dominated the pharmacy automation market in 2024. The U.S. dominated the pharmacy automation market in North America region. More than 100,000 suspected drug errors are reported each year in the U.S., as per the U.S. Food and Drug Administration. Furthermore, according to a study conducted by Johns Hopkins University, drug errors cause over 250,000 deaths in the U.S. each year. As a result, it's one of the nation's major causes of death, which is driving the growth of pharmacy automation market in North America region. In addition, technological developments are also driving the expansion of North America pharmacy automation market. For example, Omnicell's XT series automated dispensing system has been installed in five of Duke University Hospital's hospitals in the U.S. These updated cabinets have a 30% higher capacity and can hold 30% more pharmaceuticals in the same footprint as the previous design.

U.S. Pharmacy Automation Devices Market Trends

In the US, companies are consistently upgrading their software platforms, including the AI-driven capabilities within the DoctorsApp platform, which connects inpatient prescriptions directly with the hospital pharmacy for a paperless and streamlined workflow. Alongside, South Korea-based Hanmi unveiled Countmate, a fully automated vial dispensing machine customized for the Canadian and US markets.

Accelerating Demand for Healthcare Services is Fostering the Asia Pacific

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. China dominates the pharmacy automation market in Asia-Pacific region. The pharmacy automation market in Asia-Pacific is being driven by growing geriatric population and rising healthcare funding and investments. In addition, the rising requirement for minimizing medication errors is driving the growth of Asia-Pacific pharmacy automation market. Medication errors, account for 2.0% to 3.0% of healthcare centers or hospitals admissions in Australia, as per the Australian Commission on Safety and Quality in Healthcare.

Indian Pharmacy Automation Devices Market Trends

The pharmacy automation devices market in India is increasingly booming, with the adoption of cloud-based POS (Point of Sale) systems for centralized inventory and billing management, which allows real-time data sharing and remote access. Along with this, India is combining e-prescriptions directly with hospital pharmacies, which shows minimal manual entry errors, indicating potential interactions in real-time, and evolving paperless patient records.v

U.S. Pharmacy Automation Market Trends

The U.S. is in urgent need of enhanced patient safety, error reduction, and greater operational efficiency amidst rising prescription volumes and labour shortages. Key trends include the integration of AI and robotics for optimized workflows and inventory management, alongside a shift towards cloud-based systems and decentralized automation.

China Pharmacy Automation Trends

China has extensive government investment in healthcare modernization, the need to reduce medication errors, and a burgeoning ageing population. Key trends involve the significant adoption of AI and robotics in hospitals and the rise of "Internet+" pharmacy models to streamline dispensing and improve efficiency.

How is Europe Rising in the Pharmacy Automation Market?

Europe's market has a strong regional emphasis on patient safety, strict regulatory compliance, and managing the healthcare demands of an ageing population. Automation, including robotics and AI integration, is being widely adopted to enhance operational efficiency, reduce medication errors, and allow pharmacists more time for patient care.

Extensive Robotic Dispensing Systems are Supporting Europe

Specifically, Pharmathek's SINTESI robot is established for central pharmacies to simplify warehouse management, improve space, and ensure accurate and secure medication handling. Alongside, EU firms are leveraging automated packaging & labeling systems by using more sophisticated image processing, like the Euclid3D gripper by Pharmathek.

Germany Pharmacy Automation Devices Market Trends

The pharmacy automation devices market in Germany is anticipated to expand at a lucrative CAGR. The region is bolstering electronic pill and capsule counters, which enhance effectiveness and minimise errors in manual counting processes. Besides this, tech companies are exploring unified software solutions for managing inventory, monitoring prescriptions, handling patient data, and interfacing with hardware.

United Kingdom Pharmacy Automation Trends

The U.K. regions' critical need to reduce medication errors and boost operational efficiency within the NHS, supported by proactive digital initiatives. The increasing prescription volumes from an ageing population and a shift towards AI, robotics, and online pharmacy models. Significant capital investment is needed, but the long-term benefits in patient safety and efficiency outweigh the costs.

Pharmacy Automation Market Value Chain Analysis

- R&D: This stage is essentially about scouting for promising substances through search and selecting them, followed by preliminary checking safety and stability, as well as therapeutic potential and some commercial considerations.

Key Players: AstraZeneca, Pfizer, Eli Lilly, Bristol Myers Squibb - Clinical Trials and Regulatory Approvals: This phase requires human testing of the means and methods of evaluation of data by the bodies concerned to enforce compliance with strict regulatory requirements, before commercialization.

Key Players: Food and Drug Administration (FDA), European Medicines Agency (EMA), Central Drugs Standard Control Organization (CDSCO), World Health Organization (WHO). - Final Manufacturing and Dosage Preparation: The preparation of final dosage forms from active ingredients, to ensure that an appropriate and stable dosage form acceptable to the patient in terms of desired drug release characteristics, is crucial.

Key Players: Cipla, Zydus Lifesciences, Mankind Pharma, Torrent Pharmaceuticals - Packaging and Serialization: This ensures that the product is properly packaged by being issued with tamper-evident labeling or coding having a unique serial number for identification traceability.

Key Players: IMA, Uhlmann Pac-Systeme, Syntegon Technology, Marchesini Group. - Distribution to Hospitals and Pharmacies: Distribution ensures that hospitals and retail outlets are supplied with pharmaceutical products efficiently, both in transportation and logistics.

Key Players:Sun Pharma, Cipla, ABC Pharma Distributors - Patient Support and Services: Patient care is enhanced through automation in prescription management, dispensing, and adherence monitoring.

Key Players:Omnicell, Becton, Dickinson and Company (BD), KUKA AG

Pharmacy Automation Market Companies

- AmerisourceBergen Corporation:

A global healthcare company that provides pharmaceutical sourcing and distribution services, with their automation contributions primarily integrating through their vast distribution network and ensuring seamless supply chain management for automated systems. They help connect pharmacies with automated solutions that streamline inventory and order fulfillment. - Accu Chart Plus Healthcare Systems, Inc:

Specializes in solutions for automated medication dispensing and charting, focusing on products that enhance accuracy and accountability in hospital and institutional settings. Their systems aim to reduce errors in medication administration by providing clear, real-time data integration between charting and dispensing. - McKesson Corporation:

A major healthcare supply chain management company that offers a range of automation solutions designed to optimize pharmacy operations, from inventory management to dispensing. They help pharmacies improve efficiency and patient safety through their broad portfolio of technology solutions and distribution services. - Pearson Medical Technologies, LLC:

Focuses on automated medication packaging and dispensing systems that improve efficiency in high-volume settings like mail-order pharmacies and central fill facilities. Their contributions help streamline the process of counting, packaging, and verifying large numbers of prescriptions with high accuracy. - CareFusion (Becton Dickinson And Company):

A leading provider of medication management solutions, including automated dispensing cabinets (ADCs) like the Pyxis system, which are widely used in hospitals for secure and accurate medication access at the point of care. They focus heavily on enhancing patient safety and clinical workflow efficiency in acute care settings. - Medacist Solutions Group, LLC:

Specializes in drug diversion monitoring and analytics software, providing an automation layer for data analysis to detect potential misuse of controlled substances. Their software contributes to regulatory compliance and patient safety by proactively identifying discrepancies in medication dispensing patterns. - TouchPoint Medical:

Focuses on developing intelligent medication management solutions and medical carts that integrate seamlessly into clinical workflows at the bedside. They provide technology that enhances medication access control, documentation, and overall workflow efficiency in clinical environments. - Deenova S.R.L:

A European leader in pharmacy automation, offering solutions for automated unit-dose dispensing, bedside administration, and inventory management. Their technology aims to create a "closed-loop" medication management system, improving safety and reducing operational costs in hospitals. - Parata Systems, LLC:

Provides a wide array of pharmacy automation technology for retail, hospital, and long-term care settings, including robotic dispensing and medication adherence packaging systems. They focus on improving pharmacy efficiency, reducing labor costs, and helping pharmacies shift towards more patient-centric services. - Swisslog Healthcare:

Offers comprehensive automation solutions for hospitals and healthcare facilities, including pneumatic tube systems, transport robotics, and fully automated medication management systems. Their contributions focus on optimizing internal logistics and ensuring the timely and accurate delivery of medications throughout hospital complexes. - Health Robotics S.R.L.:

Its offerings are integrated into Omnicell's portfolio of end-to-end automated medication management solutions. - Medacist Solutions Group, LLC:

A company that offers diverse software and data analytics, such as RxAuditor OnDemand, RxAuditor 360, etc. - Amerisource Bergen Corporation:

This emphasises inventory management, medication tray management, and logistics. - Accu-Chart Plus Healthcare Systems, Inc:

It usually facilitates medication packaging, barcode labeling, and software for hospital and institutional pharmacies. - Omnicell, Inc.:

This provides solutions through Robotics, Smart Devices, Intelligent Software, and Expert Services.

Recent Developments

- Omnicell purchased Ateb Inc. in 2016, a company that provides independent and chain pharmacies with pharmacy-based patient care solutions and medication synchronization.

- Parata Systems, a provider of pharmacy automation, declared the introduction of Max 2, their next generation vial filling robot, in October 2019. The pharmacy automation robots automate the filling, labeling, and capping of vials to boost productivity and meet the needs of busy pharmacies.

- Rowa, a German business specializing in robotic medication storage and retrieval systems, was bought by CareFusion Corporation in 2011 to expand its brand share in hospitals and retail pharmacies in areas outside the U.S.

- In August 2021, iA, a software enabled pharmacy provider, declared the launch of new Pharmacy Fulfillment, Therapy Management Solutions, and SmartPod to modernize pharmacy services.

- CareFusion Corporation, a worldwide medical technology firm with a comprehensive portfolio of solutions in the areas of infection prevention, medication management, procedural effectiveness, respiratory care, and operating room was bought by BD in 2015.

- Walgreens Boots Alliance and Amerisource Bergen formed a strategic partnership in January 2021. Amerisource Bergen purchased Walgreens Boots Alliance Healthcare Business, allowing it to focus on expanding its retail pharmacy business. Both firms are extending and expanding their commercial partnerships as a result of this strategic partnership.

- Swisslog Healthcare launched the Open Pharmacy in June 2020 to convert pharmacies into health hubs. As a result, community pharmacies have been able to overcome challenges and adapt to shifting dynamics and trends.

- TCGRx and ScriptPro LLC entered into a distribution and co-marketing arrangement in 2014, allowing the firm to provide TCGRxadherence packaging solutions to retail pharmacies across the U.S. At the National Community Pharmacists Association Annual Convention in October 2016, Kirby Lester unveiled an improved version of their flagship tablet counting devices, the KL1 and KL1 Plus.

Segments Covered in the Report

By Product

- Dispensing Systems

- Pill Sorting Machines

- Labelling Machines

- Packaging Machines

- Inventory Management

- Automated Storage and Retrieval Systems

- Others

By End Use

- Inpatient Pharmacies

- Acute Care Settings

- Long Term Care Facilities

- Outpatient Pharmacies

- Outpatient/Fast Track Clinics

- Hospital Retail Settings

- Pharmacy Benefit Management Organization And Mail Order Pharmacies

- Retail Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting