What is the U.S. Pharmacy Benefit Management Market Size?

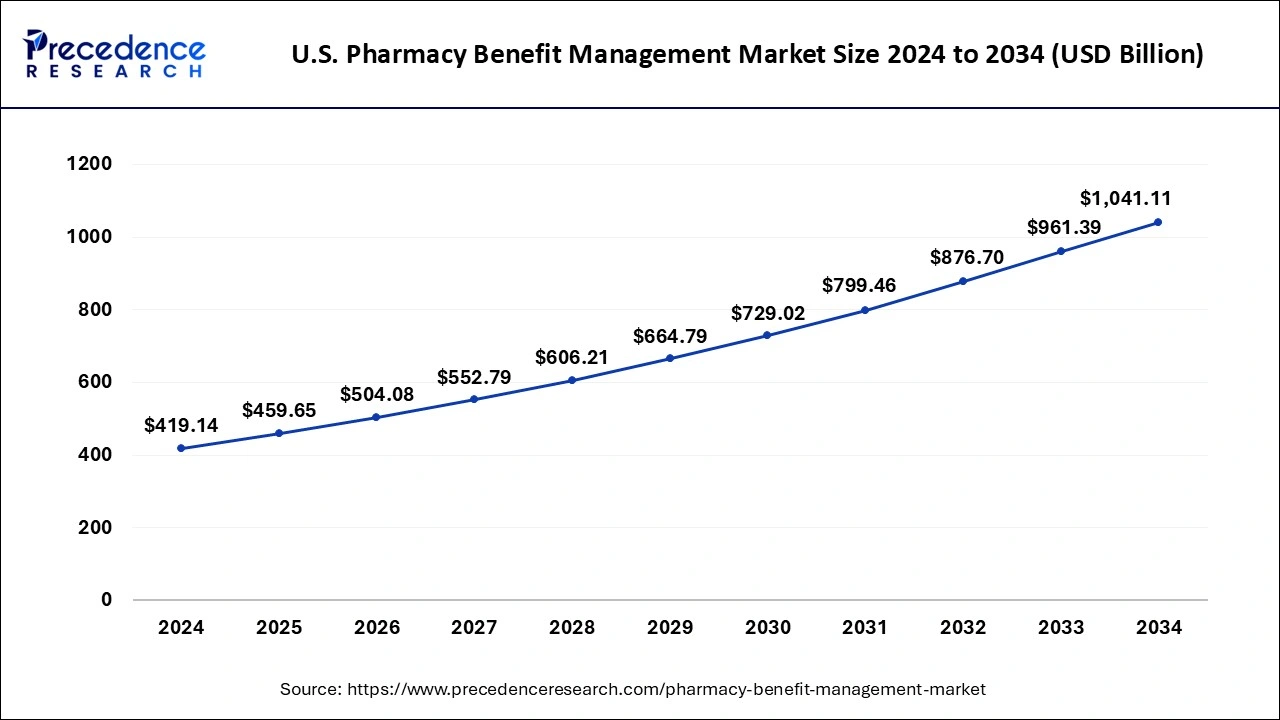

The U.S. pharmacy benefit management market size is calculated at USD 459.65 billion in 2025, is predicted to increase from USD 504.08 billion in 2026, and is expected to reach around USD 1,041.11 billion by 2034, expanding at a CAGR of 9.7% from 2025 to 2034.

Market Highlights

- By Business Model, the standalone PBM segment dominated the market with the largest market share of 60% in 2025.

- By Business Model, the healthcare insurance provider segment is expected to generate significant revenue throughout the forecast period.

- By Services, the specialty pharmacies segment dominated the market in 2025.

- By Services, the retail services segment is expected to witness significant growth during the predicted timeframe.

- By End-user, the commercial segment projected the highest market growth in 2025.

- By End-user, the federal segment is expected to dominate the market during the anticipated time period.

Market Size and Forecast

- Market Size in 2025: USD 459.65 Billion

- Market Size in 2026: USD 504.08 Billion

- Forecasted Market Size by 2034: USD 1,041.11 Billion

- CAGR (2025-2034): 9.7%

Market Overview

Pharmacy benefits management is generally defined as it is a group of companies that provide middlemen in pharmacies and insurance companies and drug manufacturing. Pharmacy benefits management plays a major role in securing and deciding the cost of the drug for insurance and insurance companies. These services decide the cost of drugs by negotiating with pharmaceutical companies and pharmacies. These discounts are then passed to the insurance companies.

The pharmacy benefits management market in the United States offer multiple services, plans as well as business models. The market services in the nation include health plans, health services and specialty services such as claim processing, retail pharmacy networks, formulary management, disease management, adherence initiatives and drug utilization reviews.

U.S. Pharmacy Benefit Management Market Outlook

- Market Growth Overview: The U.S. pharmacy benefit management market is expected to experience steady growth from 2024 to 2034, driven by a shift toward cost-optimization strategies in healthcare, the expansion of digital prescription networks, and advancements in formulary management solutions. The market is likely to maintain strong momentum due to increased drug utilization, the growing use of complex specialty drugs, and higher enrollments in Medicare and Medicaid. Additionally, ongoing regulatory pressure for greater transparency and more equitable pricing models is expected to drive operational modernization within the U.S. PBM industry.

- Major Trends: There is a rapid shift toward value-based care models in the U.S., which is expected to improve PBM alignment with clinical outcomes. Ensuring access to essential medications while maintaining financial stability has become a core principle guiding the evolution of the PBM industry in the U.S.

- Digital Transformation: Digital health integration is expected to reshape the competitive landscape in the PBM sector, with technologies like AI, blockchain, and predictive analytics playing a central role in claims validation and cost modeling. Leading health plans, such as OptumRx and Prime Therapeutics, are adopting unified digital solutions that enable real-time benefit claims processing, telepharmacy services, and patient data monitoring. These innovations are anticipated to enhance medication adherence and reduce healthcare spending by personalizing treatments for patients.

- Major Investors: The major investors in the market include private equity firms, venture capitalists, and institutional investors, such as pension funds and hedge funds. These investors contribute by providing capital for PBM innovation and expansion, supporting technological advancements such as AI and blockchain integration, and backing consolidation efforts, including mergers between PBMs and health insurers, to create more efficient, data-driven value chains in healthcare. Their investment helps drive market growth, improve operational efficiency, and enhance the overall quality of pharmacy benefit management services.

U.S. Pharmacy Benefit Management Market Growth Factors

The healthcare industry is the widest and most ever-expanding industry. Healthcare infrastructure is rising enormously in the United States. Drugs and treatment cost is the major hurdle that arises for the patients. Pharmacy benefits management works on the management of the cost of the drugs. While the economically well-established countries including the United States have allocated a big budget for healthcare infrastructure facilities, the adoption rate of such services to manage the overall budget of the industry is high. Due to the rising drug cost, there is not a surprise that pharmacy benefits management services are expanding in the United States. Moreover, the development of novel drugs in the market of United States will continue to highlight the acceleration of the market in the upcoming years.

The Pharmacy benefits management companies work on negotiating the cost of the drug by ensuring the bulk purchases and payments. The benefits can be helpful for consumers. By lowering the cost of the drugs and treatment, the PBM organizers aim to help to ensure the appropriate drug usage and maintain drug safety. Thus, this benefit offered by the services will continue to act as a growth factor for the market.

U.S. Pharmacy Benefit Management Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 459.65 Billion |

| Market Size in 2026 | USD 504.08 Billion |

| Market Size by 2034 | USD 1,041.11 Billion |

| Growth Rate from 2025 to 2033 | CAGR of 9.7% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Business Model, Service, and End-user |

Market Dynamics

Drivers

Increasing medication accessibility

Access to medical services in the United States is facilitated by making sure that the medications are both affordable and safe. Patients who receive individualized care may also feel secure enough to take their prescribed drugs without being concerned about the expense or course of their care. In keeping with a tailored strategy, PBMs can work with companies to offer insightful counsel on efficient health plans. The objective of this activity is to deliver the greatest care at the most affordable cost. These groups can also seek approaches to increase the availability of specialist medications for individuals who require them.

The increasing accessibility to medication can drive the growth of the market by expanding the customer base and increasing the volume of prescriptions processes. This could lead to greater demand for PBM services as more individuals gain access to healthcare and pharmaceuticals. Additionally, a larger patient population could lead to increased negotiations with drug manufacturers for better pricing, which PBMs facilitate, further contributing to the market's growth.

Restraint

Lack of transparency

Due to the difficulties with pharmaceutical benefit managers, there is a discussion on the transparency of PBM activities. PBMs assert that they are in a good position to save plans and customers money, but because their business practices are opaque, they are frequently able to utilize their clout to increase their profits at the expense of the customer. This has prompted policymakers to consider changing the rebate system by requiring PBMs to pass along more rebate savings or increasing transparency. The lack of transparency in the market acts as a restraint by making it difficult for stakeholders, such as patients, employers and even for healthcare providers. This lack of visibility into pricing mechanisms and negotiations between PBMs and pharmaceutical manufacturers can hinder competition and potentially lead to higher healthcare costs for consumers.

Opportunity

Integration of digital treatment program

The expanded use of evidence-based digital treatment programs to treat chronic illnesses is one area of digital health that, driven by customer demand. It is essential to change behavior in order to enhance employee health outcomes and to offer tried-and-true software, applications, and other digital technologies to assist people in managing and treating a wide range of illnesses. Offering digital treatment programs that are supported by clinical research and recognized by regulatory agencies can result in fewer complications or hospitalizations as well as lower healthcare expenditures for both the employee and the plan sponsor.

The integration of digital treatment programs in the United States pharmacy benefit management market is observed to present multiple opportunities as it offers several benefits such as personalized patient care, better medication adherence and better management of chronic conditions. These programs can enhance patient engagement, monitor medication usage and offer real-time data to healthcare providers, leading to more effective and efficient treatment outcomes. As a result, PBMs can leverage these digital solutions to optimize medication management, control costs and enhance patient well-being, thereby influencing the growth of the market.

Segment Insights

Business Model Insights

The standalone PBM segment dominated the market with the highest market share in 2024. The dominance of the segment is attributed to the presence of the major free-standing pharmaceutical companies. The business model segment's growth is also driven by the specialized focus and adaptability of standalone PMBs. These PBMs operate independently, allowing them to tailor their services to meet the unique needs of clients, such as insurance companies and government programs.

Moreover, their independence fosters transparency in pricing and contracting, fostering trust among stakeholders. Clients appreciate transparency, as it aligns with their goals of reducing costs and enhancing patient outcomes. The focused expertise of standalone PBMs allows for efficient drug formulary management, claims processing and medication counseling.

The health insurance provider segment is expected to grow at a significant rate during the forecast period. The growth of the segment is attributed to the increasing number of populations insured under commercial insurance and rising access to public health insurance. With the rising number of assigned insurances, several payers are assigned to the PBM which is also one of the driving factors for the segment.

Service Insights

The specialty pharmacies segment dominated the market with the highest market share in 2024. Specialty pharmacies are special kinds of medication which is helpful for patients with chronic diseases and more severe illnesses, the rising cases of chronic diseases in the nations supplement to the segment's growth. Specialty pharmacies deal with patients and pharmacies for providing medication for chronic illnesses. Specialty pharmacies provide treatment for patients with more detailed education. Specialty medication requires patient monitoring and management. There is an additional staff that works in the specialty pharmacies which will ensure education adherence and increase the effectiveness of the treatment plan. Specialty pharmacy staff communicate with patients up to date about adjustment and changes which are required for the treatment plan.

The retail pharmacies segment is expected to grow in the market during the forecast period. Retail pharmacy is the most common type of practice for Americans to visit for medication. Retail pharmacies are generally used for the common type of treatment and work on several prescriptions. Retail pharmacies offer medication for treatment like allergies, high blood pressure, cold and flu remedies, antibiotics, etc. The chances of adoption of pharmacy benefit management services by retail pharmacies are high owing to the availability of large number of consumers.

End-User Insights

The commercial segment dominated the market in 2024. With employers-sponsored health insurance being the prevalent mode of coverage, a large portion of the population falls under the commercial category. This translates to a substantial number of individuals seeking prescription medications through commercial health plans. The commercial segment's dominance is expected to extend due to its influence in shaping PBM contracts and service offerings. These entities often demand tailored solutions to meet the needs of their diverse employee populations.

U.S. Pharmacy Benefit Management Market – Value Chain Analysis

1. Prescription Data and Plan Design

The PBM value chain begins with health plan sponsors, employers, and government programs defining drug benefit structures, formularies, and reimbursement models based on population health needs and cost-containment goals.

- Key Players: CVS Health, Cigna (Express Scripts), OptumRx, Prime Therapeutics, Anthem (CarelonRx)

2. Drug Manufacturer Contracting and Rebates

PBMs negotiate with pharmaceutical manufacturers to secure rebates, discounts, and formulary placements, leveraging scale to influence drug pricing and patient access.

- Key Players: Cigna (Express Scripts), OptumRx, CVS Caremark, MedImpact, Elixir Rx Solutions

3. Pharmacy Network Management

PBMs establish and manage vast retail, mail-order, and specialty pharmacy networks, setting reimbursement rates, ensuring compliance, and integrating claims processing systems for participating pharmacies.

- Key Players: CVS Health, OptumRx, Prime Therapeutics, MedImpact, HUB International Limited

4. Claims Processing and Benefit Administration

This stage involves adjudicating pharmacy claims in real time, verifying member eligibility, and applying copay, deductible, and formulary rules to ensure accurate and efficient reimbursement.

- Key Players: Change Healthcare, Optum Insight, CVS Health, Cigna (Express Scripts)

5. Clinical and Utilization Management

PBMs apply evidence-based programs such as prior authorization, step therapy, and medication therapy management to optimize drug use, reduce waste, and improve outcomes.

- Key Players: OptumRx, CVS Health, Prime Therapeutics, Cigna (Express Scripts), Anthem (CarelonRx)

6. Specialty Pharmacy and Distributio

High-cost, complex specialty drugs are dispensed and managed through integrated specialty pharmacy channels offering patient education, adherence support, and cold-chain logistics.

- Key Players: CVS Specialty, Accredo (Cigna), Optum Specialty Pharmacy, Prime Therapeutics Specialty Pharmacy, Elixir Specialty

7. Data Analytics, Reporting, and Compliance

Advanced data analytics and regulatory compliance systems ensure transparency in rebate flow, fraud detection, and adherence to federal and state laws (FTC, CMS, HHS-OIG).

- Key Players: Change Healthcare, Optum Insight, CVS Health, MedImpact, HUB International Limited

8. Member Support and Outcomes Optimization

The final stage focuses on member engagement through digital tools, pharmacist consultations, and personalized medication programs that enhance adherence and overall health outcomes.

- Key Players: CVS Health, Cigna (Express Scripts), OptumRx, Prime Therapeutics, Anthem (CarelonRx)

U.S. Pharmacy Benefit Management Market Companies

- CVS Health: A leading healthcare services company and parent of CVS Caremark, CVS Health manages one of the largest PBM networks in the U.S., offering integrated pharmacy benefit, specialty pharmacy, and retail health solutions.

- Cigna: Through its Express Scripts subsidiary, Cigna delivers advanced PBM services focused on cost management, formulary optimization, specialty drug solutions, and value-based care for employers and health plans.

- Optum, Inc.: A subsidiary of UnitedHealth Group, OptumRx provides comprehensive PBM services, including clinical management, specialty pharmacy programs, and data-driven analytics to improve medication outcomes.

- MedImpact: An independent, privately held PBM known for its transparent pricing model, MedImpact offers pharmacy network management, formulary design, and clinical solutions for health plans and employers.

- Anthem: Operating its PBM division under CarelonRx (formerly IngenioRx), Anthem delivers integrated pharmacy benefit and specialty drug management solutions aimed at reducing costs and improving patient adherence.

- Change Healthcare: Specializing in healthcare technology and analytics, Change Healthcare supports PBMs and payers with claims processing, network optimization, and real-time data solutions for better medication management.

- Prime Therapeutics LLC: Owned by several Blue Cross and Blue Shield plans, Prime Therapeutics provides PBM and specialty pharmacy services emphasizing collaborative models that align payers, providers, and patients.

- HUB International Limited: It offers comprehensive PBM solutions, including drug benefit management and consulting services, to help organizations optimize their pharmacy programs and control costs.

- Elixir Rx Solutions LLC: It provides innovative, technology-driven pharmacy benefit services focused on improving medication adherence, cost savings, and personalized care for employers and health plans.

Recent Developments

- In Aug 2023, Maria Cantwell and BUTLER COUNTY, Chuck Grassley (R-Iowa) announced the major nonprofit advocacy group “AARP” which is advertised by Pharmacy Benefit Manager (PBM) Transparency Act.

- In Aug 2023, the pharmacy-benefit manager of CVS Caremark dropped by Blue Shield of California in approval of a company's group that will provide the services at the same cost. The drug-pricing contracts of pharmacy-benefit manager Prime Therapeutics used by the Blue Shield.

- In September 2025, President Donald J. Trump unveiled a landmark agreement with Pfizer, marking the first deal under his administration aimed at aligning American drug prices with those paid by other developed nations. The initiative, based on the “most-favored-nation” (MFN) pricing model, is expected to significantly reduce prescription costs for U.S. consumers by tying domestic prices to the lowest international benchmarks.

- In September 2025, the Pharmaceutical Research and Manufacturers of America (PhRMA) announced plans to launch AmericasMedicines.com, a first-of-its-kind digital platform that will go live in January 2026. The website is designed to enable patients to purchase prescription drugs directly from pharmaceutical manufacturers, effectively bypassing pharmacy benefit managers (PBMs) and other intermediaries. Through this initiative, PhRMA aims to increase affordability and transparency by connecting patients directly to lower-cost medicines and manufacturer assistance programs.

- In October 2025, Evernorth, the health services division of The Cigna Group, introduced a rebate-free pharmacy benefit model in October 2025. This innovative framework focuses on transparent pricing, cost reduction, and enhanced access to local pharmacies—ensuring that essential medications remain within easy reach for American patients. The model reflects a growing industry trend toward simplifying drug pricing structures and prioritizing direct value for consumers.

Segment Covered in the Report

By Business Model

- Standalone PBM

- Health Insurance Providers

By Service

- Specialty Pharmacy

- Retail Pharmacy

By End-user

- Commercial

- Federal

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting