What is the Point of Sale Terminals Market Size?

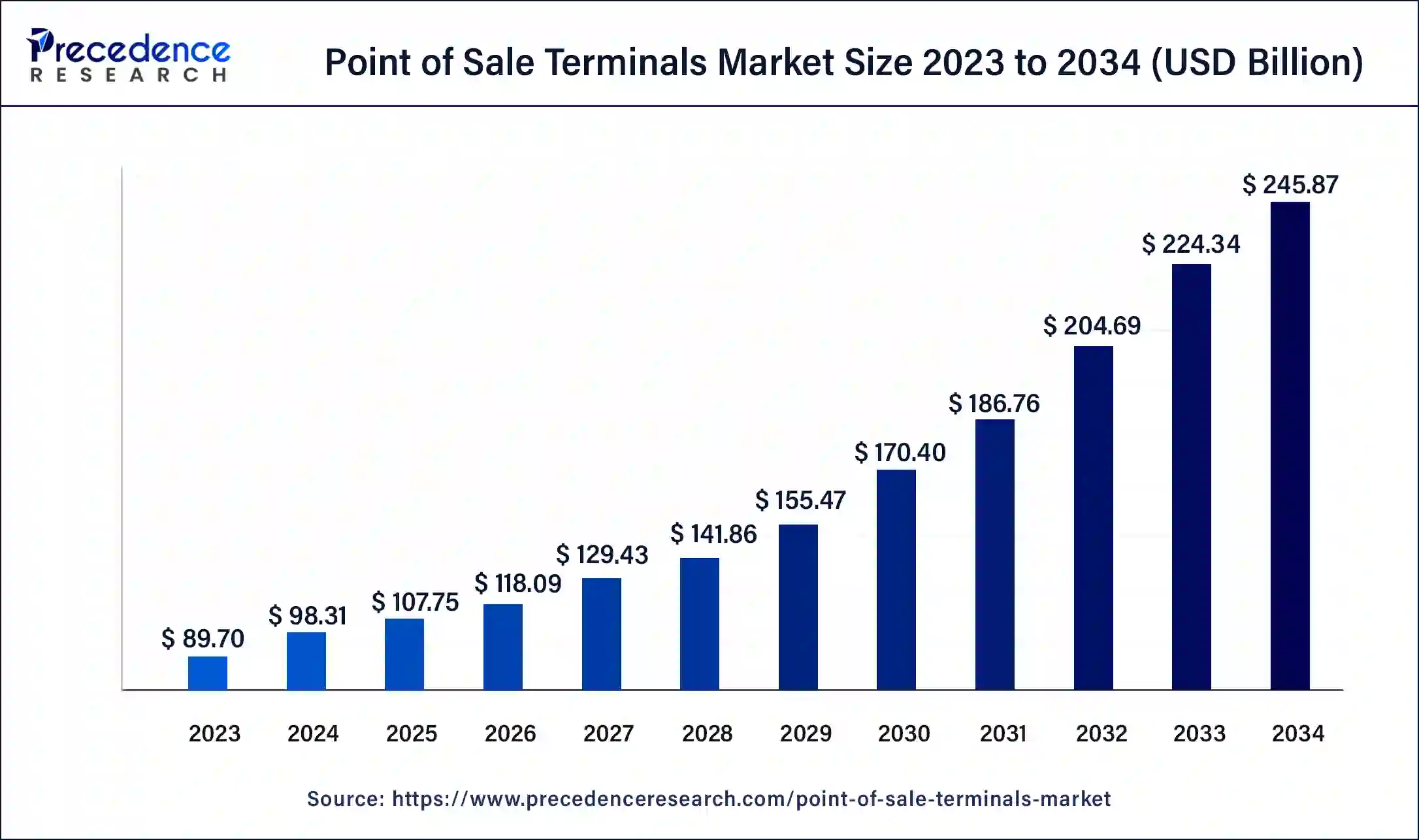

The global point-of-sale terminals market size is accounted at USD 107.75 billion in 2025 and is predicted to increase from USD 118.09 billion in 2026 to approximately USD 266.15 billion by 2035, expanding at a CAGR of 9.46% from 2026 to 2035.

Point of Sale Terminals Market Key Takeaways

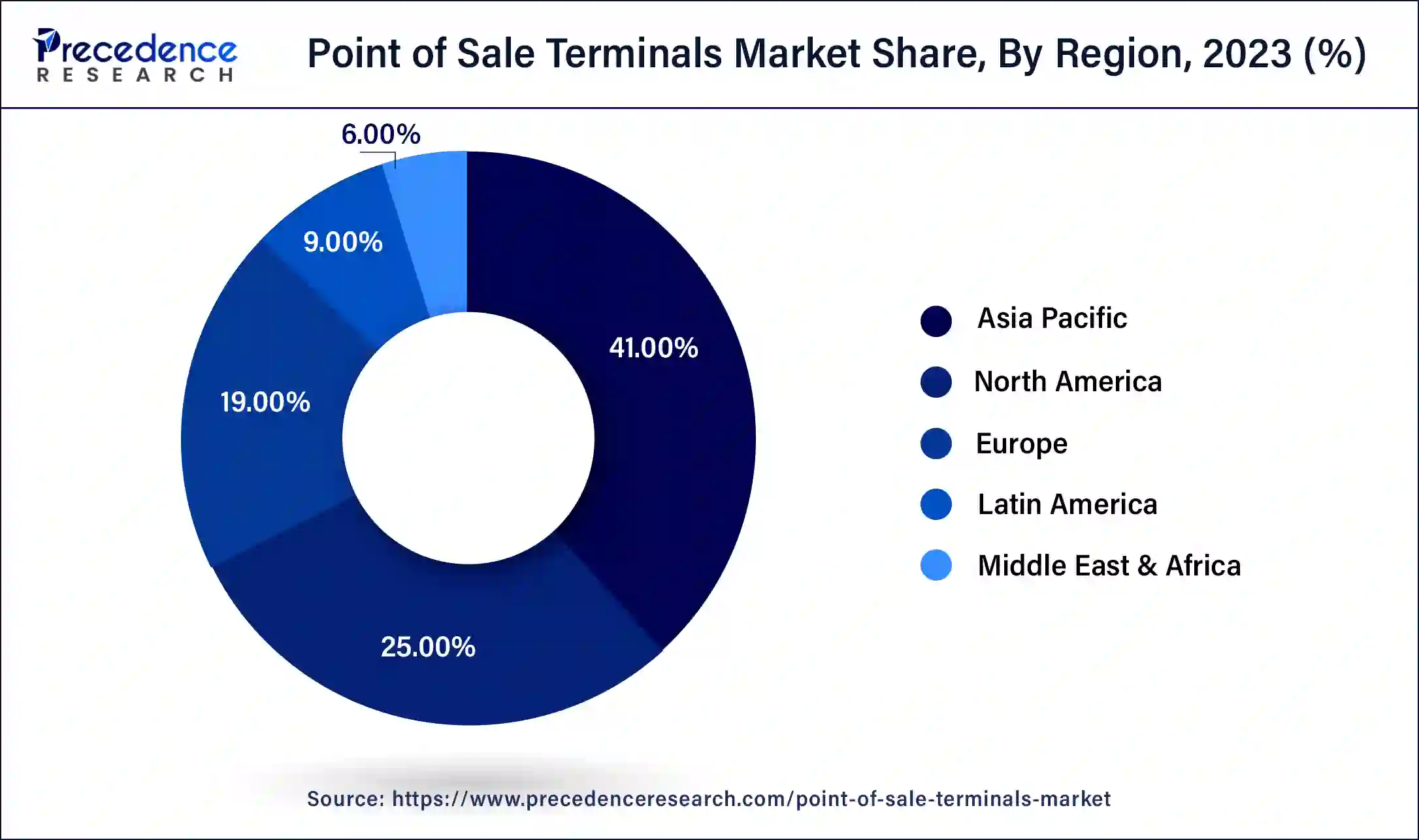

- Asia Pacific region held a market share of over 41% in 2025.

- By product, the fixed product segment has held the largest market share of 54% in 2025.

- By component, the hardware segment captured the biggest revenue share of 61% in 2025.

- By deployment, the cloud segment registered the maximum market share in 2025.

- By end user, the retail segment is estimated to hold the highest market share of 39% in 2025.

Why POS Terminals Are Becoming the Backbone of Modern Retail and Hospitality

The point-of-sale terminals market has grown in the recent years due to a greater demand for contactless payments. The outbreak of the COVID-19 pandemic has been extremely beneficial in encouraging these types of payments. It is helpful in providing contactless payments for the different types of products and services. This market is expected to grow well during the forecast period due to an increased use and availability of the smartphones with the customers in the developed as well as the developing nations. Increased use of the point-of-sale terminals through the mobile phone will drive the market growth during the forecast period.

As the return on investment provided by the use of these dominance is expected to grow the market shall be favorable in the coming years. Also, there is an increased use of point-of-sales terminals which has been extremely beneficial in managing the employee and in managing the customer. Increased use of the point-of-sale terminals also helps in keeping a check on the inventory. It also helps in the integration of the in-store sales as well as the online sales. Wireless devices are used in the point-of-sales terminal system in order to make experience for various dreams as well as food. That has been increased use of the point-of-sale terminals technology for payment in hospitals and many other places. They are also used for making the payments of the rental cabs as well as the restaurants. Companies are adopting the point-of-sale terminals in order to boost the sales by accepting the payments online.

The retail sector as well as the hospitality sector is promoting the use of the point-of-sale terminals. Due to an incorporation of this technology the need for a large number of people being hired in different types of operations in a manufacturing company. As the critical information is stored and used on these terminals one of the major challenges that this industry faces are that of the security. Constant use of Internet and the network makes this product prone to cyber-attacks. The breach of security in this case could lead to the usage of the cards that are previously used for making the payments.

The COVID-19 pandemic had a negative effect on the point-of-sale terminals market in the developing as well as the developed economies. Due to a disruption in the supply chain and logistics many losses were incurred by the major companies. after the pandemic most of the industries we will again move towards accepting the payments in the cashless or contactless modes. The social distancing norms and the restrictions that were laid down during the lockdown the market had seen slow growth. The demand for the point-of-sales terminals had also dropped. After the pandemic there has been a major shift in the habits of the consumers. Most of the consumers are seeking menu boards in a digital format in the restaurants. There is a growing demand for artificial intelligence in various services. The point-of-sales terminals are expected to grow during the forecast. In the sectors like the restaurants, hospitals as well as the entertainment places.

Point of Sale Terminals Market Growth Factors

The availability of the point-of-sales terminals through the use of the mobile phones on the smartphones will drive the market growth in the coming years. After the pandemic the demand for contactless and cashless payments has grown to a large extent which is expected to drive the market growth in the coming years. These systems have offered or favorable return on investment due to which the market is expected to grow during the forecast period. The adoption of this product is expected to grow as DM ploy ease as well as the consumers can see the benefits offered by the use of this product. It helps in tracking the inventory and it provides a platform to understand the in-store sales as well as the online sales. The availability of wireless communication modes that are offered at affordable rates will drive the market growth during the forecast period.

Payments are made through the use of different wireless devices for the products and the services that are utilized by the consumers. There is a growth in the usage of this technology in restaurants hospitals and even renting the cabs. It is extremely helpful in accounting as well as managing the inventory. It helps in tracking the sales through the online mode or the offline mode. There is a growth in the usage of this technology due to the efficiency and the reliability provided by the product. Major service outlets are relying on this product. there is a growing demand for this product as there have been major advancements in the use of the technology which was initially only transaction based it has now become a financial solution to the companies due to the integration of the CRM.

The advancements in this product has helped in cleverly managing the business. This product is available at less cost of maintenance and it keeps tracks of all the transactions mail. The availability of the real time data is one of the advantages of this system and the market is expected to grow during the forecast period. Many major companies are making use of this system instead of the billing software's that they previously used. The availability of the peso terminals through a touch screen mode will be more user friendly. This will also help in ensuring less energy consumption during the usage of this terminal. there are a large number of services provided by various manufacturers in the form of or lease contract. Across the developing nations as well as the developed nations the COVID-19 pandemic has created a change in the outlook of the consumers.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising adoption of contactless and digital payments, increased smartphone penetration, and demand for efficient transaction management. Integration with inventory, analytics, and cloud-based systems further drives market expansion across retail, hospitality, and healthcare sectors.

- Global Expansion- The global market is expanding as businesses across Asia-Pacific, North America, Europe, and other regions adopt digital payment solutions. Growing e-commerce, mobile payments, and international retail expansion are driving widespread POS deployment worldwide.

- Startup ecosystem-The POS terminals startup ecosystem is thriving with new companies developing mobile, cloud-based, and AI-enabled payment solutions. Support from venture capital, fintech accelerators, and technology partnerships is driving innovation, particularly in retail, hospitality, and small-to-medium enterprise segments.

- Major investors: Major investors and key players in the market include established tech giants like NCR Corp, Diebold Nixdorf, Oracle, Toshiba, and Ingenico, alongside innovative payment solutions providers such as Square (Block, Inc.), Shopify, and Clover (Fiserv).

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9.46% |

| Market Size in 2025 | USD 107.75 Billion |

| Market Size in 2026 | USD 118.09 Billion |

| Market Size by 2035 | USD 266.15 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Component, Deployment, End User, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segmental Insights

Product Insights

The fixed product segment held a market share of about 54% in 2025. It shall maintain its position in the coming years. the bigger vendors have created a larger demand for the fixed POS terminals and one of the reasons for doing so is the amount of the installation required and it supports the growth of the market. as there are many risks associated with the usage of the cloud data there is a greater demand for the service is on premises. Major vendors are seeking the installation of these terminals at their own sites. As this helps in providing better security. There are many other functions provided by this system like printing bills managing the inventory, customer relationship management and supporting the device is used for making the payments.

The mobile product segment is also expected to grow at a compound annual growth rate of 11% over the forecast period. Increased use of smartphones under easy access has led to the adoption of the mobile point-of-sales terminal. This mode of payment is on easy mode and extremely convenient. It also helps in enhancing the customer satisfaction as this online payment method helps in reducing the amount of time spent in the queues. the output and the efficiency of the restaurants has increased to a great extent and the restaurants are able to provide quality experience to its customers all of these factors will drive the market growth during the forecast period.

Component Insights

The hardware segment will dominate the market and it is expected to account for 61% of the market share. The hardware segment involves a lot of hardware devices. Day to day activities are managed with the use of these hardware devices. These hardware devices are an integral part of the fixed terminal system.

The software segment is anticipated to reach at a CAGR of 10.5% during the forecast period. The software segment is expected to grow as it is helpful in providing analysis of the sales, it provides the function of data support and many other multifunctional features. In order to perform various functions different software are provided by the companies.

Deployment Insights

The cloud segment will dominate the market in the coming year. It is expected to grow at a higher compound annual growth rate of 11.2% from 2026 to 2035. Instead of owning the entire system many consumers prefer the services on the basis of the subscription.

The expense is used in setting up a fixed product is reduced to a great extent and it is extremely helpful for many restaurants and other areas. The installation process is extremely lengthy and involves a heavy cost. Most of the companies have adopted the cloud-based product as it offers a large range of benefits. The cloud-based product is extremely efficient in providing updates and improving the process by enhancing the experience of the user.

End User Insights

The retail segment dominated the market with a revenue share of 39% in 2025. The retail segment is expected to grow well during the forecast. Due to the integration of the point-of-sales system. There is a growing demand for this product as it is extremely helpful in saving time. Major delays already used to a great extent due to the use of this system.

The retail segment includes older brick and mortar stores. The introduction of the new technology, which is of mobile wallet the market will grow well. It shall be helpful in providing and increasing the penetration in the market.

Regional Insights

Asia Pacific Point of Sale Terminals Market Size and Growth 2026 to 2035

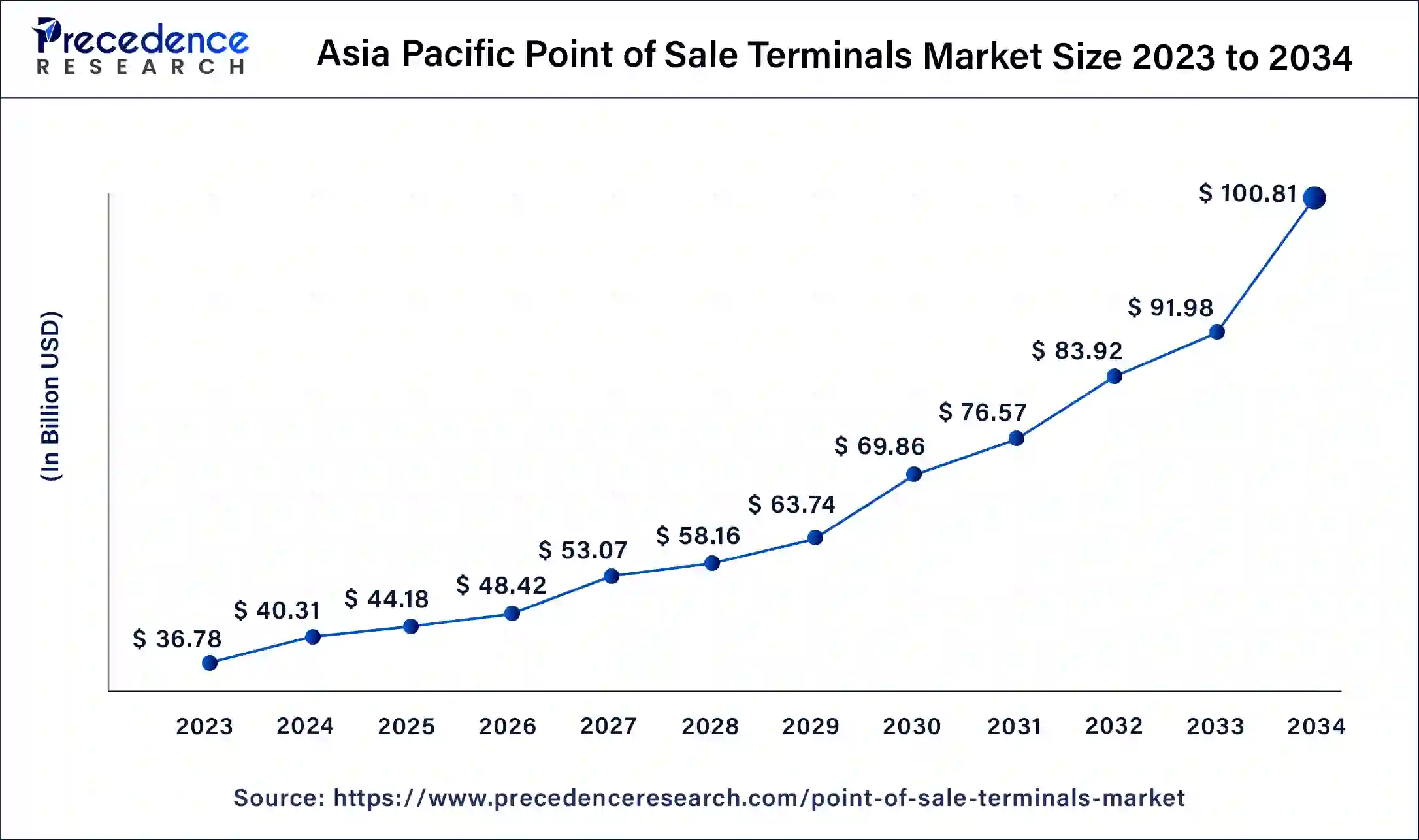

The Asia Pacific point-of-sale terminals market size is estimated at USD 44.18 billion in 2025 and is predicted to be worth around USD 109.13 billion by 2035, at a CAGR of 9.50% from 2026 to 2035.

Why Are POS Solutions Gaining Rapid Adoption Across Asia Pacific?

The Asia Pacific region will grow well during the forecast period. The supportive initiatives taken by the governments in this region will drive the market growth. There is a great demand for the digital payment methods in this region and it is expected to provide better opportunities for them point-of-sales terminal products. There's a great demand for digital payments through the countries like India, China as well as Japan.

China is leading the growth of Digital Payments

China's market is growing due to rapid digital payment adoption, expansion of mobile wallets like Alipay and WeChat Pay, and strong government support for cashless transactions. The retail, hospitality, and transportation sectors are integrating POS systems to streamline operations and improve customer experience. Additionally, rising smartphone penetration, widespread QR-based payments, and investments in smart retail technologies are accelerating POS deployment across both urban and rural regions, driving steady market growth.

North America is adopting Market Smarter Point of Sale Solutions

North American region is also expected to witness a good amount of growth 5.2% in the coming year. Demand for contactless payments and cashless services.

North America's market is expanding due to widespread adoption of contactless payments, strong digital infrastructure, and rising demand for secure, fast, and integrated transaction systems. Retail, healthcare, and hospitality sectors are increasingly replacing traditional payment setups with advanced POS solutions. Growth in mobile POS, e-commerce integration, and cloud-based platforms further boosts adoption. Additionally, strict data security regulations and rising consumer preference for cashless transactions contribute to sustained market growth across the region.

The U.S. is Transforming Retail with Advanced POS System

The U.S. market is expanding due to strong consumer preference for digital and contactless payments, accelerated by e-commerce growth and mobile wallet usage. Businesses across retail, restaurants, healthcare, and entertainment are adopting advanced POS systems to streamline operations, enhance customer experience, and improve transaction security. The rise of cloud-based POS, integration with inventory and CRM tools, and strict data protection standards further support widespread adoption, driving consistent market growth nationwide.

Europe is Embracing Contactless and Mobile Payment Technology

Europe's market is expanding due to rising demand for contactless and cashless payments, supported by strong regulatory frameworks promoting secure digital transactions. Retailers, restaurants, and service providers are rapidly upgrading to smart, cloud-enabled POS systems to enhance efficiency and customer experience. Growing adoption of mobile POS, increased e-commerce activity, and investments in omnichannel retail strategies are further fueling the market. Additionally, consumer preference for convenience and digital banking is accelerating POS deployment across the region.

The UK is Upgrading Businesses with Intelligent POS Terminals

The UK market is rising as businesses accelerate digital transformation to modernize payment infrastructure and replace outdated cash registers with intelligent POS platforms. Growth is supported by the country's booming fintech ecosystem, increasing demand for unified commerce solutions, and strong merchant adoption of loyalty-integrated POS systems. The rise of self-checkout, digital menus, and automation in retail and restaurants further fuels deployment. Additionally, SMEs are rapidly shifting to affordable cloud-based POS tools to improve efficiency.

Value Chain Analysis

Raw Material Sourcing

- Raw material sourcing includes obtaining essential components such as ABS plastic, metal alloys, and electronic parts.

- The procurement process involves supplier evaluation, price negotiation, quality inspection, and logistics management.

- Efficient sourcing ensures reliable supply, cost-effectiveness, and high-quality POS terminal production.

Key Players: Ingenico Group, Verifone Systems, PAX Technology, Square Inc., Toshiba Global Commerce Solutions.

Testing and Certification

- POS terminals in India require mandatory certifications: TEC (technical compliance), BIS (safety and quality), and WPC (for wireless-enabled devices).

- The certification process includes laboratory testing, application submission, and final approval with marking.

- Obtaining certifications is essential for regulatory compliance and market access.

Key Players: Ingenico Group, Verifone Systems, PAX Technology, Square Inc., Mswipe Technologies.

Installation and Commissioning

- Installation includes connecting hardware and software, uploading inventory and user data, configuring payment options, and integrating with business management systems.

- Commissioning involves testing the complete setup, training staff, and performing final checks before going live.

- Ongoing optimization ensures smooth operation and efficient transaction management.

Key Players: Verifone Systems, PAX Technology, Square Inc., Toshiba Global Commerce Solutions.

Top Vendors and their Offerings

- Presto - Provides cloud-based POS systems for restaurants and hospitality, offering order management, digital menus, and contactless payment solutions to enhance customer experience and operational efficiency.

- Acrelac -Delivers integrated POS hardware and software solutions for retail and service sectors, focusing on inventory management, payment processing, and analytics to optimize business operations.

- Toshiba Corporation - Offers advanced POS terminals and retail solutions, including touchscreen systems, payment processing, and inventory integration, targeting large-scale retail, hospitality, and service industries.

- Quail Digital - Specializes in mobile and self-service POS solutions, enabling quick payments, digital receipts, and seamless integration with online ordering and loyalty programs.

- Oracle Corporation - Provides enterprise-grade POS software and hardware solutions, supporting omnichannel retail, payment processing, analytics, and inventory management for restaurants, retail stores, and service providers.

Recent Developments

- In May 2025, 46,000 smart PoS terminals across Nigeria were launched by the United Bank for Africa (UBA). This launch is a major play to reclaim market share from dominant fintechs, including Moniepoint, OPay, and PalmPay. (Source: thecondia.com)

- By enhancing the capabilities of the iPhone provided by apple there shall be improvements by offering the contactless payment options. This new development shall be beneficial to the merchants. It also limits the use of any additional hardware.

Segments covered in the report

By Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

By Component

- Hardware

- Software

- Services

By Deployment

- On premise

- Cloud

By End User

- Restaurants

- Fine Dine

- Casual Dine

- Drive-Thru

- Others

- Drive-Thru

- Others

- FSR

- QSR

- Institutional

- Fast Casual

- Others

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content