Handheld Point of Sale Market Size and Forecast 2025 to 2034

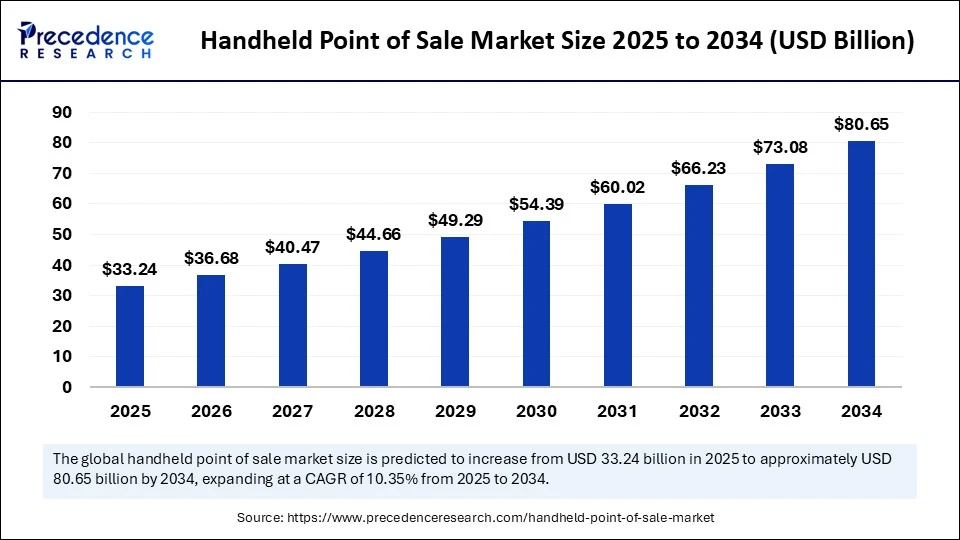

The global handheld point of sale market size was estimated at USD 30.12 billion in 2024 and is predicted to increase from USD 33.24 billion in 2025 to approximately USD 80.65 billion by 2034, expanding at a CAGR of 10.35% from 2025 to 2034. The market is growing due to rising demand for mobile, efficient, and contactless payment solutions in retail, hospitality, and field service sectors.

Handheld Point of Sale Market Key Takeaways

- In terms of revenue, the global handheld point of sale market was valued at USD 30.12 billion in 2024.

- It is projected to reach USD 80.65 billion by 2034.

- The market is expected to grow at a CAGR of 10.35% from 2025 to 2034.

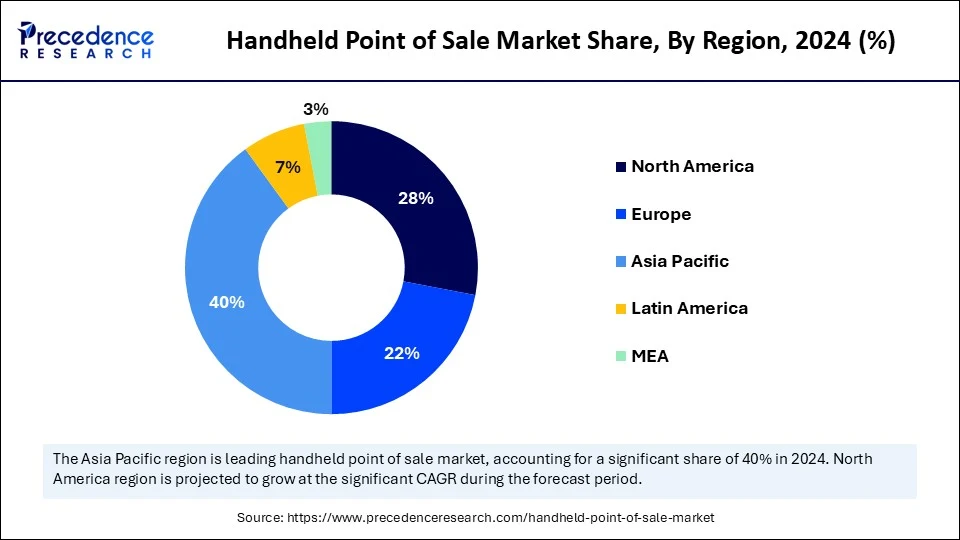

- Asia Pacific dominated the market with the largest market share of 40% in 2024 and is expected to be the fastest growing.

- By product type, the smartphone-based mPOS readers segment held the biggest share of 45% in 2024.

- By product type, the mobile POS terminals segment is expected to grow at the fastest CAGR during the forecast period.

- By form factor, the dongle/reader segment captured the highest market share of 50% in 2024.

- By form factor, the tablet-style handheld POS systems segment is projected to grow at the fastest CAGR during the forecast period.

- By component, the hardware segment led market in 2024.

- By component, the software & services segment is emerging as the fastest-growing during the forecast period.

- By payment technology, the contactless/NFC segment contributed the highest market share at 40% in 2024.

- By payment technology, the QR code/barcode payments and mobile wallets segments are expected to grow at the fastest CAGR during the forecast period.

- By end-user industry, the retail segment generated the major market share of 35% in 2024.

- By end user industry, the hospitality segment is expected to grow at the fastest CAGR during the forecast period.

- By application/use case, the payment acceptance segment accounted for the significant market share of 50% in 2024.

- By application/use case, the inventory & price check segment is the fastest-growing segment during the forecast period.

What Is the Impact of AI Integration on Transaction Speed and Customer Experience in the Handheld Point of Sale Market?

The customer experience and transaction speed are being greatly improved by the incorporation of artificial intelligence (AI) into products coming from the handheld point of sale market. POS devices can process payments more quickly by utilizing AI-driven algorithms, which offer automated error detection, predictive data entry, and optimized transaction routing. Checkout times are shortened as a result, particularly in busy settings like quick-service restaurants and retail stores.

On the customer experience side, AI enables personalized interactions by analyzing past purchase data to suggest relevant products, promotions, or loyalty rewards in real time. It also supports voice-assisted ordering, automated inventory updates, and predictive stock alerts, ensuring customers find the products they need. Additionally AI AI-powered fraud detection helps create a secure payment environment, building trust between merchants and customers.

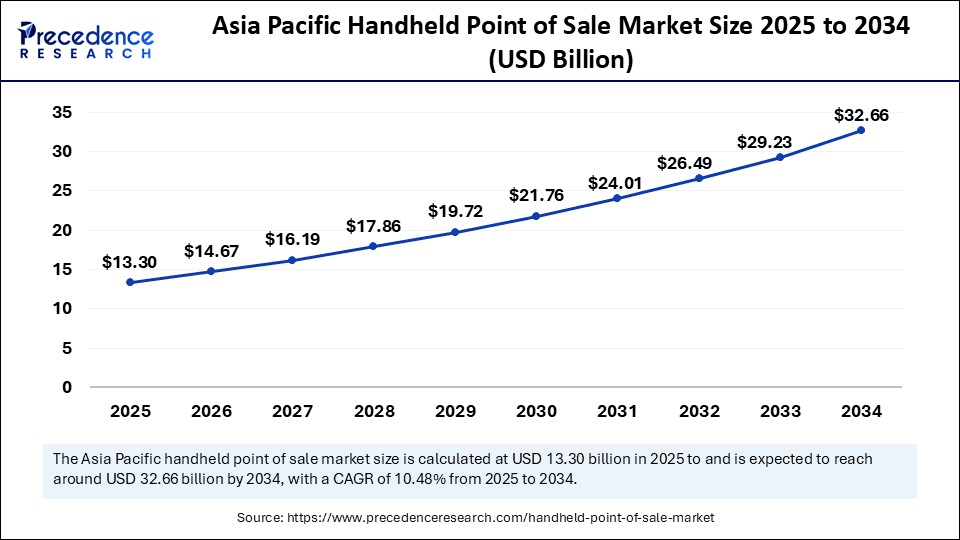

Asia Pacific Handheld Point of Sale Market Size and Growth 2025 to 2034

The Asia Pacific handheld point of sale market size is evaluated at USD 13.30 billion in 2025 and is projected to be worth around USD 32.66 billion by 2034, growing at a CAGR of 10.48% from 2025 to 2034.

Why Did Asia Pacific Dominate the Market in 2024?

Asia Pacific dominated the handheld point of sale market in 2024 and is expected to sustain its position in the coming years, backed by the widespread use of mobile technology and the quick adoption of digital payments. Competitive hardware availability and robust government initiatives supporting cashless transactions are propelling market penetration. The regions' lead will continue to be strengthened by advancements in handheld point of sale systems and growing merchant adoption. Its dominance is being reinforced by the existence of a robust fintech ecosystem and rising investments in payment infrastructure. It is anticipated that rising customer preference for contactless and mobile wallet transactions will maintain strong growth momentum.

North America is experiencing notable growth, fueled by the need for integrated retail and hospitality solutions as well as the growing use of contactless payments. The region's market is growing more quickly thanks to improvements in cloud-based point of sale technology and growing customer expectations for quicker, more convenient checkouts. Strong cooperation between payment processors and point of sale providers is improving the capabilities of the solutions. The adoption of AI-powered analytics, omnichannel commerce, and customer engagement features is also accelerating across industries.

Market Overview

The Handheld point of sale (POS) market devices, software, and services enable payment acceptance and point-of-sale operations using portable, hand-held form-factor terminals (including dongles/readers paired with smartphones, PDA-style terminals, rugged mobile POS, and wearable payment devices).

How Is the Shift Toward Cashless Payments Influencing the Handheld Point of Sale Market?

The shift toward cashless payments is boosting the handheld point of sale (POS) market by driving demand for portable, contactless, and quick payment solutions that enhance customer convenience and operational efficiency. In order to keep up with the growing number of customers who use contactless cards, mobile wallets, and QR code payments, businesses are increasingly using handheld point of sale devices. This trend is further reinforced by government programs that encourage digital payments, particularly in developing nations, and the post-pandemic demand for touchless hygienic transactions. Handheld point of sale systems are becoming an essential part of the contemporary payment ecosystem by facilitating quicker checkouts, mobility, and integration with business management tools.

Handheld Point of Sale Market Growth Factors

- Cashless payments:Surge in mobile wallets, QR, and contactless use.

- Retail & Hospitality Growth: Faster checkouts, improved service.

- Tech Upgrades: Cloud, AI, and IoT are boosting efficiency.

- Omnichannel Needs: Supports online and offline payment integration.

- Emerging Markets: Digital payment adoption is increasing in demand.

- Post-pandemic hygiene: Preference for touch-free payment methods.

- Mobility & Flexibility: Enables transactions anywhere, anytime.

- Lower Device Costs: Affordable solutions for SMEs and startups.

- Government Initiatives:Policies promoting digital transactions.

- Data Insights: POS analytics improving business decision making.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 80.65 Billion |

| Market Size in 2025 | USD 33.24 Billion |

| Market Size in 2024 | USD 30.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Form Factor, Components, Payment Technology, End-user industry, Application/Use Case, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How has the Growth of the Retail & Hospitality Sectors affected the Handheld Point of Sale Market?

The retail and hospitality sectors are driving higher demand in the handheld point of sale market since mobile point of sale systems are becoming integrated into retail chains, shopping centers, hotels, cafes, and delivery-based services. These gadgets enable employees to take orders, handle payments, and provide receipts right at the customer's table checkout line or even outside the store during special occasions. Higher customer satisfaction ratings, shorter wait times, and more efficient services are all a result of this mobility. Because of their portability, food trucks and seasonal businesses have also embraced handheld point of sale systems in significant numbers.

- On 26 February 2025, HowToPay launched POS mini in Thailand, a compact device with bill printing and app integration for small restaurants and mobile vendors.(Source: https://news.howtopay.com)

How Are Government Digital Payment Initiatives Driving the Handheld Point of Sale Market?

Governments in numerous nations are aggressively encouraging cashless transactions through national campaigns, tax breaks, and subsidies for point-of-sale purchases. Programs such as the Digital India initiative in India and the PSD2 regulations in Europe have expedited the shift to electronic payments. Small town and rural markets where companies are increasingly implementing handheld point of sale devices to adhere to regulations and obtain financial benefits are particularly affected by these policies.

- On 30 May 2025, Rongta Technology Unveiled P3 smart desktop POS and PDA products at COMPUTEX 2025.(Source: https://www.imachine-tech.com)

Restraints

How Do High Initial Setup & Integration Costs Hinder the Handheld Point of Sale Market?

The handheld point of sale market is getting held back by the overall costs frequently incurred for staff training initiatives, software subscriptions, hardware purchases, and integration with accounting and CRM systems. This initial outlay of funds can be a major turnoff for startups or smaller companies with limited funding. Additionally, some companies are reluctant to upgrade because they are worried about how installation and onboarding will affect their current workflows.

Data Security & Privacy Concerns

Even with encryption and compliance certification, cybercriminals may still target contemporary handheld point-of-sale devices. Under international data protection laws, data breaches may result in monetary loss, harm to one's reputation, and legal repercussions. Many small and medium-sized businesses are vulnerable because they lack the specialized IT teams needed to keep up robust security measures. This causes hesitance to embrace mobile point of sale technology, particularly in industries that deal with delicate financial transactions.

Opportunities

How Is the Expansion in the Hospitality and Event Industries Expected to Affect the Handheld Point of Sale Market?

Handheld point of sale systems are being used more and more in the hospitality industry, which includes food trucks, pop-up cafes, and outdoor events, in order to serve patrons while they are on the go. Queues are shortened and customer satisfaction is increased when orders and payments can be made anywhere. The market for portable payment devices is expanding rapidly in the areas of sporting events, trade shows, and seasonal gatherings. Additionally, event planners are finding it more appealing due to integration with ticketing and booking systems.

Growth of Contactless and QR-based Payments

Innovation is being driven in the handheld point of sale space by consumer preference for tap-to-pay and QR-based transactions. Companies are seeking solutions that facilitate a variety of payment methods, such as UPI-based payments, digital wallets, and NFC cards. Particularly in busy retail settings, this trend gives businesses a chance to stand out by providing universal compatibility and quick transactional speeds.

Product Type Insights

Why Did the Smartphone-Based mPOS Readers Segment Dominate the Market?

The smartphone-based mPOS readers segment held the largest share of the handheld point of sale market because of their rapid deployment, portability, and affordability. Without requiring significant infrastructure investment, they enable field service providers, delivery agents, and small and medium-sized retailers to process payments. They're an affordable option for both developed and emerging markets because they can pair with existing smartphones. These devices are also simple to scale for companies with varying or seasonal transaction volumes. Their market dominance is further reinforced by their battery efficiency and compatibility with multiple payment methods. Adoption is increased because many financial institutions offer these readers in conjunction with merchant accounts.

The mobile POS terminals segment is expected to grow at the fastest rate during the forecast period as they combine tools for customer interaction, inventory management, billing, and payment acceptance into a single small device. In order to increase customer satisfaction and streamline operations, quick service restaurants, retail chains, and eateries and quickly implement these solutions, making they perfect for high-volume settings because of their sturdy construction, extended battery life, and offline functionality. Additionally, they support sophisticated integrations like e-receipt generation, AI-powered sales recommendations, and loyalty programs to enhance operational efficiency. Mid to large businesses are showing a great deal of interest in these multifunctional capabilities.

Form Factor Insights

Why Did the Dongle/Reader Segment Dominate the Handheld Point of Sale Market?

The dongle/reader segment dominated the market due to its portability, affordability, and simplicity of integration with mobile devices. They are preferred by delivery services, small retailers, and pop-up shops because they are portable and support multiple platforms. In high-turnover businesses, their use is increased by their ease of setup. For seasonal employees, they are perfect because they require little training. Fintech companies' competitive pricing guarantees ongoing adoption.

The tablet-style handheld POS systems segment is projected to grow at the fastest rate in the handheld point of sale market, offering large touchscreens and intuitive interfaces. Used for in-store sales, order tracking, and payments, they improve customer service efficiency. Cloud integration and real-time data sync enhance their appeal. Many models also support barcode scanning and receipt printing, expanding functionality. Retailers favor them for enabling “assisted selling” on the shop floor.

Component Insights

Why Did the Hardware Segment Dominate the Handheld Point of Sale Market in 2024?

The hardware segment dominated the market because core devices are necessary for secure payment processing. EMV and NFC hardware predominates. Durable certified devices for a range of environments are preferred by merchants. The robust demand for hardware is maintained by features like multi-payment capability and ergonomic designs. For vendors, recurring sales are also fueled by hardware upgrades. Growth is aided by the emergence of ruggedized point-of-sale systems for delivery and outdoor operations.

The software segment is growing rapidly due to the increasing adoption of POS apps for cloud-based analytics, CRM, and e-commerce integration. They are accessible through subscription pricing, comprehensive reports, and remote updates. Enterprise interest is increased by managing multiple stores. Fraud detection and sales insights powered by AI are enhancing value. Adoption is strengthened through integration with accounting and ERP systems.

Payment Technology Insights

Why Did the Contactless/NFC Segment Dominate the Handheld Point of Sale Market in 2024?

The contactless/NFC segment held the largest share at 40% in 2024 for its speed, hygiene benefits, and universal card network support. Tap to pay shortens checkout times, improving customer experience. Wearable and smartphone NFC use adds momentum. Regulatory encouragement for contactless limits also boosts usage. Retailers prefer NFC for its proven security and convenience.

The QR code/barcode payments and mobile wallets segments are set to grow fastest, especially in Asia. Adoption is fueled by instant settlement, low setup costs, and app-based or UPI integration. They are used by retailers for loyalty plans and promotions. Their appeal is growing due to cross-border QR payment interoperability. Emerging market governments are also encouraging the use of QR codes.

End-User Industry Insights

Why Did the Retail Segment Dominate the Handheld Point of Sale Market in 2024?

The retail segment dominates the handheld point of sale market, driven by the high transaction volumes in the industry and the demand for quick, adaptable checkout options. By enabling store employees to accept payments from anywhere in the store, handheld point of sale devices shorten lines and enhance the customer experience. They also facilitate the integration of loyalty programs, product recommendations, and inventory checks. In order to facilitate assisted selling, which enables staff members to close deals immediately, retailers are increasingly utilizing these gadgets. The need to connect online and in-store sales through omnichannel capabilities is driving the use of handheld point of sale systems in retail.

Hospitality- QSR & mobile order segment is growing rapidly as staff can take orders and process payments at the counter, at the table, or even outside in dining areas, thanks to handheld point of sale devices, which speed up service and increase turnover rates. Order fulfillment is made easier in QSR settings by integrating online ordering platforms and kitchen display systems. Additionally, mobile order capabilities reduce wait times by enabling customers to place and pay for orders ahead of time. This market is expanding quickly due to growing consumer preferences for contactless dining and convenience.

Application/ Use Case Insights

Why Did the Payment Acceptance Segment Dominate the Market in 2024?

The payment acceptance segment saw significant demand in the handheld point of sale market, driven by applications driving handheld POS adoption, as companies in the retail, hospitality, transportation, and field services sectors depend on these gadgets to conduct safe and speedy transactions. Because handheld point of sale devices are portable, employees can process payments from any location, which shortens checkout lines and improves customer satisfaction. They are adaptable to different customer preferences because they accept a variety of payment methods, such as EMV, NFC QR codes, and mobile wallets. Higher sales volumes are directly correlated with faster transaction speeds in high-traffic settings such as stadiums, quick service restaurants, and events. In places with inadequate connectivity, offline payment options also guarantee business continuity. For payments made while on the go in delivery services and pop-up stores, many companies are also utilizing handheld point-of-sale devices.

Inventory management & analytics is the fastest-growing application, driven by the need for real-time stock updates and sales insights. Handheld POS devices now integrate with inventory systems, helping prevent stockouts and overstocking, built-in analytics track product performance and forecast demand, aiding better decision making and profitability.

Handheld Point Of Sale Market Companies

- Verifone

- Ingenico (Worldline)

- PAX Technology

- Castles Technology

- BBPOS

- SumUp

- Square (Block)

- Clover (Fiserv)

- Miura Systems

- Sunmi

- Newland (Shenzhen Newland)

- ID TECH

- Spire Payments

- Zebra Technologies

- Honeywell

- Datalogic

- Motorola Solutions

- Poynt (GoDaddy / Poynt)

- SZZT (Shenzhen SZZT Electronics)

- Nayax

Recent Developments

- On 13 May 2025, Square unveiled its sleek, smartphone-sized Square Handheld, weighing just 11 oz and featuring a Gorilla Glass touchscreen, barcode scanner, 16 MP camera, and long-lasting battery, powered by the new unified Square Point of Sale app.(Source: https://www.digitaltransactions.net)

- On 31 July 2025, Toast Inc. introduced the Toast Go 3, its latest portable POS offering built for restaurants, complete with built-in cellular capability, IP65 dust/liquid protection, 24-hour battery life, and AI-powered features like instant upsells and real-time operational insights.

(Source: https://www.fastcasual.com) - On 1 July 2025, Flipdish introduced a new all-in-one Handheld POS combining order taking, payment processing, loyalty integration, and swivel-mounted charging, designed for casual dining, food trucks, and high turnover venues.(Source: https://www.flipdish.com)

Segments Covered in the Report

By Product Type

- Smartphone-based mPOS readers (plug-in dongles/card readers)

- Mobile POS terminals (all-in-one touchscreen handhelds)

- Rugged handheld POS terminals (field/industrial grade)

- Handheld POS with integrated thermal printer

- PDA-style handheld POS (data capture + POS)

- Wearable POS devices (wristband/ring/badge)

- Handheld barcode-scanner POS units

By Form Factor

- Dongle/reader (plug-in to smartphone/tablet)

- Pocket card reader (standalone compact)

- Tablet-style handheld terminal

- PDA / gun-style device

- All-in-one terminal with printer

- Wearable form factors

By Components

- Hardware

- Card reader (EMV chip reader)

- NFC / contactless module

- Magnetic stripe reader

- Thermal receipt printer (integrated or docked)

- Barcode / 2D scanner

- Display (capacitive touch / non-touch)

- Battery & power systems

- Communication modules (cellular/Wi-Fi/Bluetooth)

- Security hardware (secure element / TPM)

- Software & services

- Payments & transaction processing software

- POS application/sales software

- Inventory management & stock control

- Order management/kitchen & table service software

- Loyalty, CRM & promotions modules

- Reporting, analytics & BI

- SDKs, APIs & developer tools

- Security & compliance services (PCI, tokenization)

- Installation, integration & managed services

By Payment Technology

- EMV chip & PIN

- Contactless / NFC

- Magnetic stripe (swipe)

- QR code/barcode payments

- Mobile wallets (tokenized wallets)

- Offline transaction/batch mode

By End-user industry

- Retail

- Grocery & supermarket

- Convenience stores

- Specialty retail (electronics, cosmetics, etc.)

- Apparel & fashion

- Hospitality

- Full-service restaurants

- Quick service restaurants (QSR)

- Bars & nightclubs

- Hotels & resorts

- Transportation & Logistics

- Field sales & delivery

- Last-mile delivery

- Warehousing & distribution

- Healthcare

- Clinics & hospitals (billing/bedside)

- Pharmacies

- BFSI & Mobile banking agents

- Government & public sector

- Education (campus retail & cafeterias)

- Events & ticketing

- Vending & unattended retail

- Field services (invoicing/payments on site)

- Others (salons, parking, fuel stations)

By Application/Use Case

- Payment acceptance (card / contactless / mobile)

- Billing & invoicing/receipts

- Inventory & price check

- Order taking & table management

- Returns/exchanges/refunds

- Loyalty enrollment & redemption

- Mobile ticketing & access control

- Field collection & remittance

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting