What is the Portable Gas Detectors Market Size?

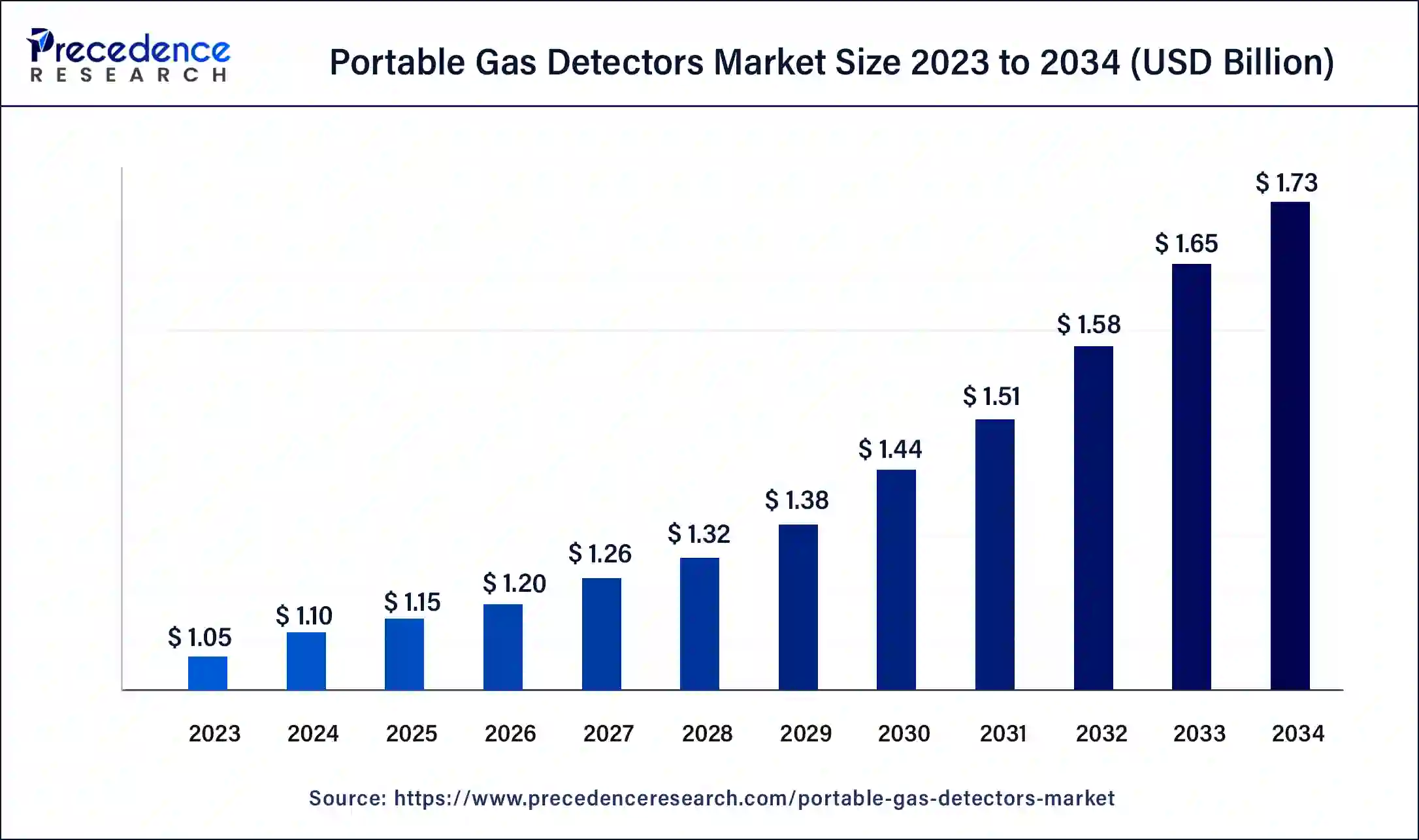

The global portable gas detectors market size is estimated at USD 1.15 billion in 2025 and is predicted to increase from USD 1.20 billion in 2026 to approximately USD 1.73 billion by 2034, growing at a CAGR of 4.63% over the forecast period 2025 to 2034. increase in the e-commerce industry are key factors driving the growth of the portable gas detectors market.

Portable Gas Detectors Market Key Takeaways

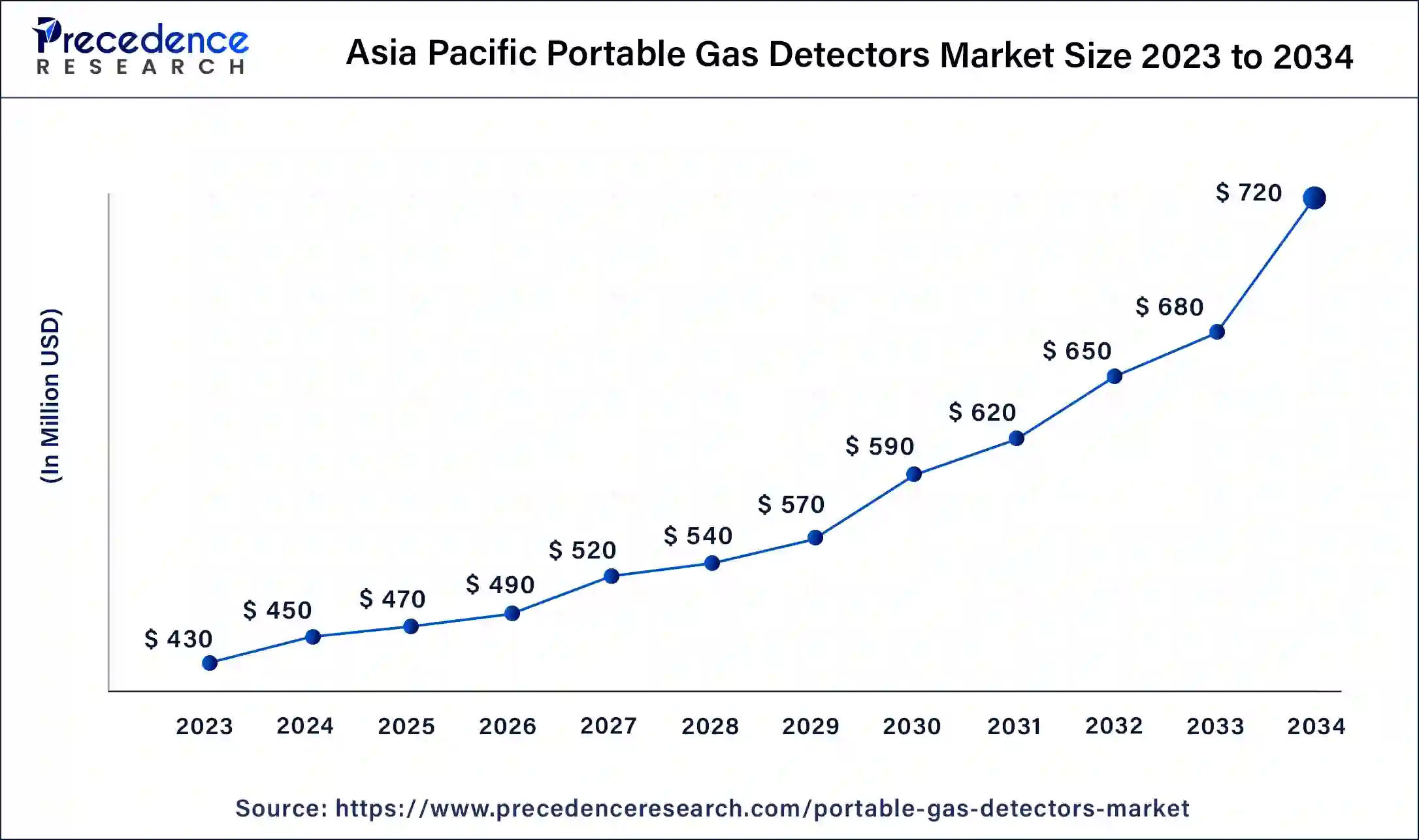

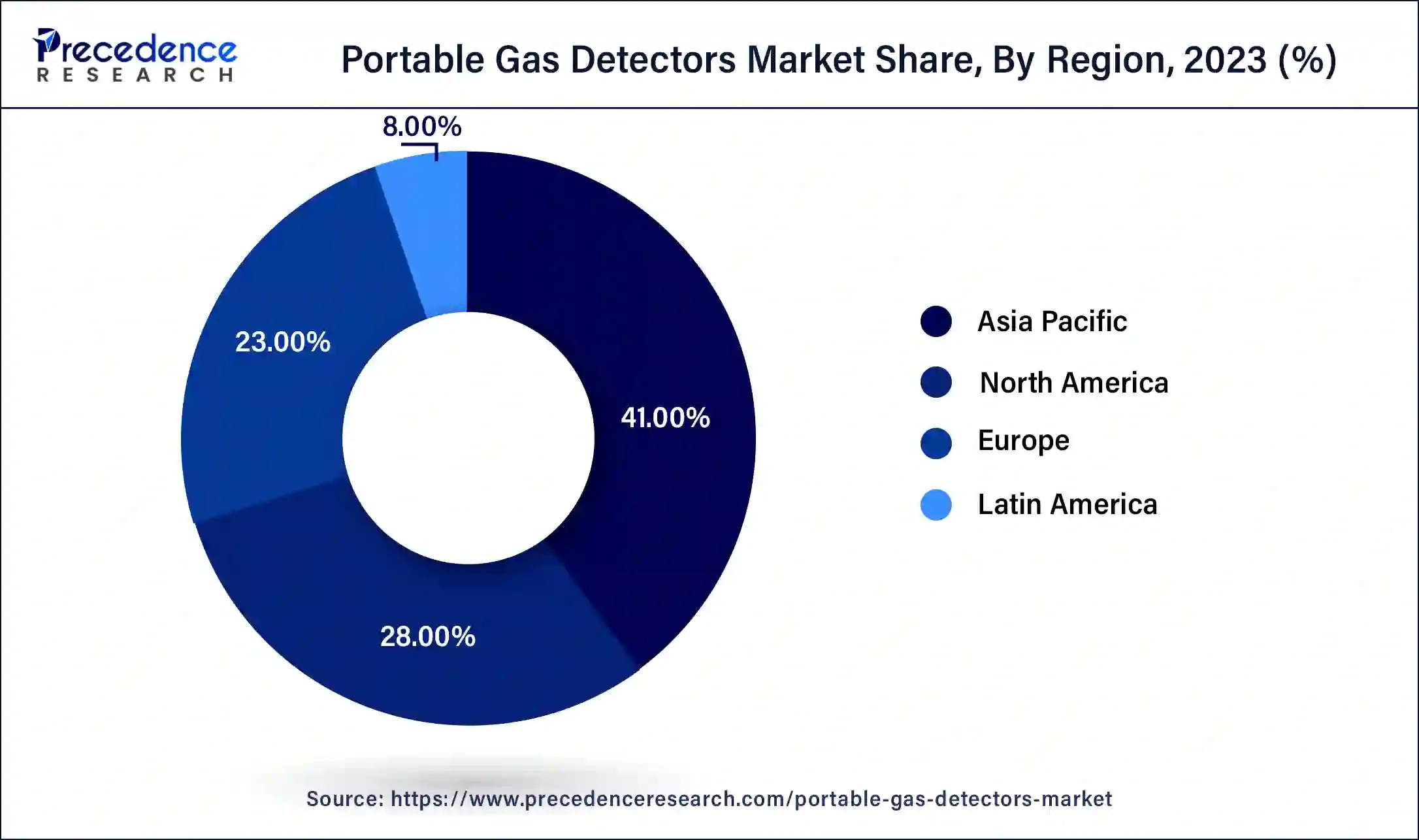

- Asia Pacific dominated the portable gas detectors market with the largest market share of 41% in 2024.

- North America is expected to witness the fastest growth in the market over the forecast period.

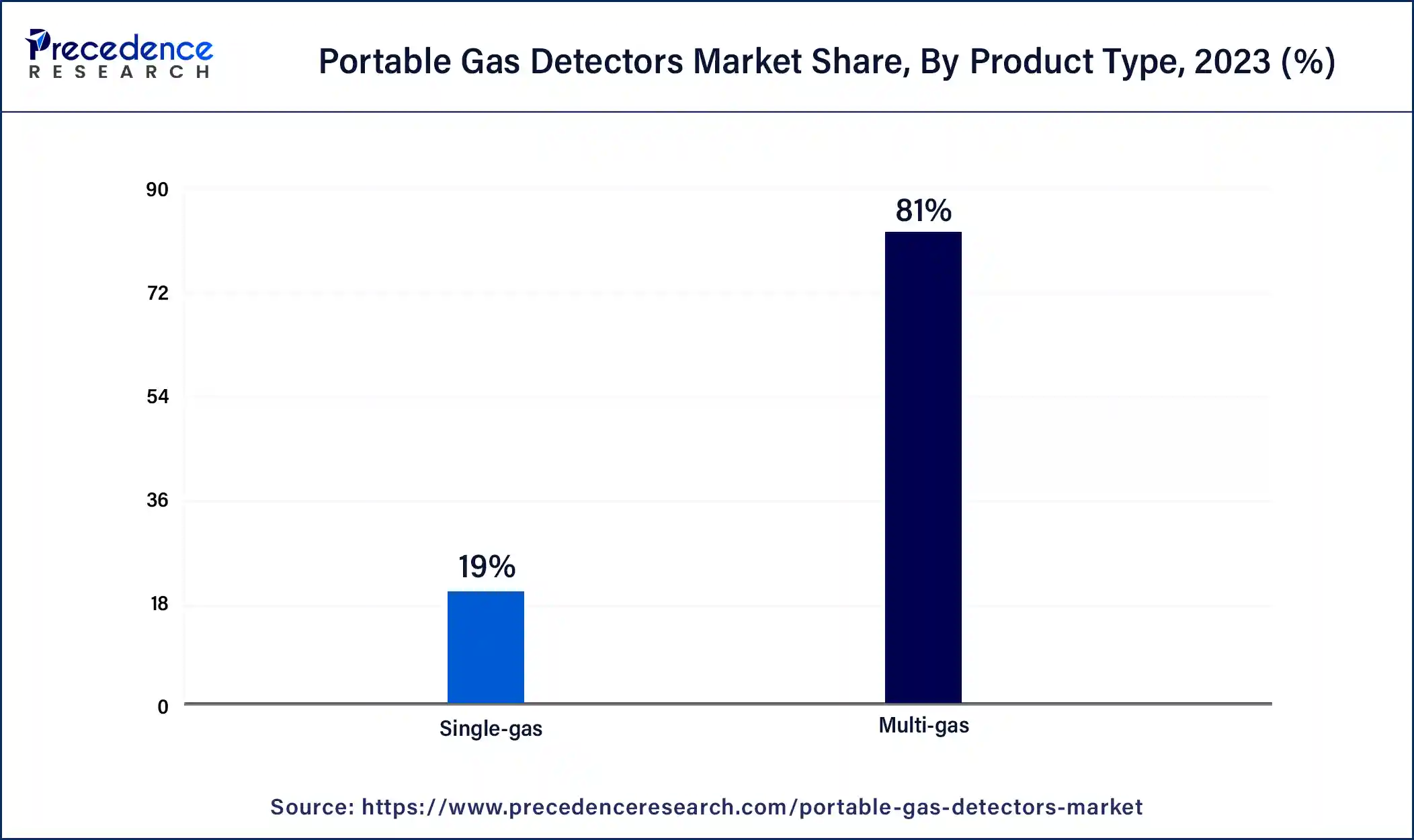

- By product type, the multi gas detector segment generated the biggest market share of 81% in 2024.

- By product type, the single gas detectors segment is expected to grow at the fastest rate in the market over the forecast period.

- By gas type, the flammable gas segment led the global market in 2024.

- By gas type, the toxic gases segment is anticipated to grow at the fastest rate in the market during the forecast period.

- By distribution channel, in 2024, the direct sale segment dominated the market globally.

- By distribution channel, the indirect sales segment is estimated to show the fastest growth in the market over the projected period.

- By end-user, the oil & gas segment led the market in 2024.

- By end-user, the chemical & petrochemicals segment is projected to grow at the fastest rate in the market during the forecast period.

Market Overview

Portable gas detection devices are essential for identifying hazards from gases that cannot be sensed by human detection, such as toxic gases, oxygen deficiency, and combustible gases or vapors. These portable detectors feature specialized sensors, including catalytic bead, electrochemical, photoionization, infrared, holographic, and ultrasonic types, each designed to monitor environmental changes. The advantages of the portable gas detectors market include the ability to cover a broad area, provide quick responses to environmental changes, and indicate the level of hazard present.

Impact of AI on the Portable Devices Industry

The portable gas detectors market is experiencing growth due to the rising demand for portable gas detectors that incorporate Internet of Things (IoT) and artificial intelligence (AI) technologies. These advancements are essential for making predictive maintenance, providing real-time data analysis, and delivering alerts to miners dispersed across various locations. The innovation focuses on developing innovative AI methods to address the critical social and industrial challenge of detecting and controlling gas leaks promptly by mitigating property damage and preventing loss of life in severe situations.

Market Outlook

- Market Overview: The rise of awareness of hazardous gases, and also an increase in safety regulations for industries, has greatly increased the use of portable gas detectors across the mining, oil and gas, chemical plant, etc. sectors.

- Global Expansion:Global demand for portable gas detectors is increasing due to industrialization, infrastructure development, growth in the mining and construction sectors of emerging economies, with Asia-Pacific experiencing the highest growth in demand. Many regulatory frameworks require that direct reading portable gas monitors be used before allowing workers to enter a confined space or potentially hazardous location (for example, rule requiring monitoring atmospheric conditions prior to entering a confined space).

- Increasing Demand: Demand for portable gas detectors is not limited to industries such as oil, gas, mining and chemicals; demand is also significant within the construction, waste water treatment, and emergency response industries, which involve many types of confined space entries and toxic/flammable gas exposures.

- Technological Advancements:Recent advancements in technology, including sensor technology, compact and wearable designs, and real-time (including multi-gas) detection, make it easier for users to use the devices in various field environments and to detect gas quickly.

Portable Gas Detectors Market Growth Factors

- The rising number of gas sensors in smartphones and other devices is expected to drive the growth of the portable gas detectors market.

- Advancement by adoption of Industrial Internet of Things technology can fuel the portable gas detectors market growth shortly.

- Innovation in the mining industry and construction sector can boost the portable gas detectors market growth over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.73 Billion |

| Market Size in 2026 | USD 1.20 Billion |

| Market Size in 2025 | USD 1.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.63% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Gas Type, End-user, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Improved safety standards

The global enforcement of stricter industrial safety regulations is creating a substantial time for the portable gas detectors market. Enhanced safety standards and guidelines introduced by governments and international regulatory agencies aim to protect workers and environments from the risks associated with gas leaks. Hence, this regulatory shift is anticipated to drive a significant increase in demand for gas detection equipment and provide manufacturers and suppliers with considerable growth prospects to broaden their footprint.

- In March 2024, Honeywell announced that it would be the first gas detector manufacturer to join the ‘Made in Saudi' initiative*, demonstrating the company's commitment to supporting localization and economic diversification in Saudi Arabia.

Restraint

Regional differences in regulations

Variations in regulations across regions can pose challenges for manufacturersof the portable gas detectors market, striving to develop a universal solution that meets all safety standards and criteria. Diverse regional safety regulations may limit the marketability of certain products. Additionally, integrating gas detection systems with existing industrial processes or safety infrastructure can present difficulties. Issues of compatibility might arise, which can potentially lead to increased costs or delays for organizations.

Opportunity

Implantation communication protocol for wireless integration of gas detectors

The advancement of standardized digital communication protocols, such as the highway addressable remote transducer (HART) protocol, offers enhanced reliability and safety in gas leakage detection. The HART protocol facilitates two-way communication and enables data exchange between gas detectors and control systems, which fixes accurate and real-time information for industries. Wireless integration allows for real-time monitoring of gas levels and environmental conditions and also provides immediate alerts and notifications to operators or personnel in case of gas leaks, anomalies, or hazardous events. This approach shortens installation time, reduces labor costs, lowers maintenance needs, and improves system reliability. These benefits collectively contribute to cost savings and productivity improvements throughout the system's lifecycle by creating significant opportunities for the portable gas detectors market.

- In December 2023, CO2Meter, a leading manufacturer in gas detection solutions, announced the release of an industrial gas detector designed to monitor gases in industrial environments. The highly anticipated CM-900 industrial gas safety series will measure either oxygen or carbon dioxide, protecting employees working near and around hazardous gases in the field.

Segment Insights

Product Type Insights

The multi-gas detector segment dominated the portable gas detectors market in 2024. Multi-gas meters are important for ensuring worker safety, adhering to regulations, detecting gas leaks early, and improving situational awareness. These devices provide a comprehensive overview of the work environment, which allows the identification of potential leaks before they escalate into hazardous or catastrophic situations. This capability is anticipated to drive growth in the segment.

- In October 2023, ENVEA launched its NDIR-GFC multi-gas analyzer MIR 9000e. Eco-designed, ultra-compact, smart & connected instrument, the MIR 9000e is a must-have for measuring combustion exhaust gases from boilers, industrial furnaces, and process applications, as well as for CEMS applications.

The single gas detectors segment is expected to grow at the fastest rate in the portable gas detectors market over the forecast period. This is because single gas detectors specialize in monitoring one specific gas, such as Carbon Monoxide, Ammonia, Hydrogen Cyanide, or Sulfur Dioxide, among others. These detectors are typically more compact and lighter compared to multi-gas detectors, which makes them convenient to wear as part of a uniform or clip onto a belt. The benefits of single gas detectors, including their portability and ease of use, are driving growth in this segment throughout the projected period.

Gas Type Insights

The flammable gas segment led the global portable gas detectors market in 2024. A flammable gas detector is designed to identify the presence of explosive or flammable gases based on their Lower Explosive Limit (LEL). It serves to detect leaks of combustible gases, including natural gas, butane, propane, hydrocarbons, solvents, and alcohol. The convenient use of flammable gas detectors is boosting the segment's growth.

The toxic gases segment is anticipated to grow at the fastest rate in the portable gas detectors market during the forecast period. Toxic gases are harmful when inhaled, causing adverse physiological effects. Carbon monoxide and hydrogen cyanide, two of the most frequently implicated toxic gases in inhalation injuries, are major contributors to smoke inhalation harm. While such inhalation is often accidental, these gases are also linked to deliberate harm, such as in cases of suicide attempts or capital punishment.

Distribution Channel Insights

In 2024, the direct sale segment dominated the portable gas detectors market globally. Direct sales include transactions where a brand sells its products or services directly to the end-user, bypassing intermediaries or distributors. This approach provides a straightforward path to entrepreneurship and allows individuals to launch a business with minimal startup costs and without the need for prior experience.

The indirect sales segment is estimated to show the fastest growth in the portable gas detectors market over the projected period. Indirect sales involve a company leveraging third-party entities, such as affiliates, resellers, or distributors, to promote and sell its products. This method enables businesses to extend their market reach and increase sales without having to oversee each transaction directly.

End-User Insights

The oil & gas segment led the portable gas detectors market in 2024. Gas leak detectors play a crucial role in the oil and gas sector, providing essential protection against hazardous gases like toxic, combustible, and deadly substances. Driven by numerous government initiatives that promote the use of these devices, the Oil & Gas industry is anticipated to become one of the leading adopters of gas detectors. As energy demand rises, the world is encountering challenges to ensure the secure supply of energy resources to fulfill the domestic needs of various economies.

The chemical & petrochemicals segment is projected to grow at the fastest rate in the portable gas detectors market during the forecast period. The petrochemical sector, which includes products derived from petroleum and natural gas such as synthetic rubber, yarn, polymers, plastics, and detergents, is a key component of the chemical industry. This wide industry encompasses various product manufacturing sectors that rely heavily on chemicals in their production processes.

- In July 2024, KBR launched KCOTKlean? , a suite of low and zero-carbon technologies to Decarbonize Petrochemicals.KCOTKleanSM achieves significant carbon reduction by leveraging circular feeds, cleaner fuels, electrification, or carbon capture.

Regional Insights

Asia Pacific Portable Gas Detectors Market Size and Growth 2025 to 2034

The Asia Pacific portable gas detectors market size is valued at USD 470 million in 2025 and is expected to worth around USD 720 million by 2034, at a CAGR of 4.81% from 2025 to 2034.

Asia Pacific dominated the portable gas detectors market in 2024. In the region, substantial investments in infrastructure and technology are driving the increased adoption of advanced gas detection solutions. Growing awareness of occupational health risks and the heightened demand for safer, more sustainable industrial operations are fueling the market for gas detection equipment.

China stands out as a major market for these devices within the Asia Pacific, with rising demand aimed at maintaining air quality, detecting hazardous gases, particularly in commercial buildings, and preventing critical incidents. This trend is expected to boost the region's gas detector market. Furthermore, Singapore has become a key hub for the petrochemical industry due to significant investments from leading global players and efforts to reduce carbon emissions.

The trend for China continues to be an increase in demand due to the rapid Industrialization, large number of Manufacturing Clusters, and an increase in Safety Compliance from the Petrochemical, Mining, and Construction industries. The implementation of monitoring systems for hazardous gases by Government agencies in Industrial Zones and the recent growth in investments in Smart IoT-enabled safety systems are driving increased demand for Smart Detectors. Additionally, many Local Manufacturers have jumped into the Marketplace with affordable pricing and increased Market Penetration.

North America is expected to witness the fastest growth in the portable gas detectors market over the forecast period. The region features a well-established industrial landscape spanning sectors such as oil & gas, chemicals, manufacturing, and mining, among others. These industries adhere to rigorous safety regulations and standards, which require the implementation of gas detection systems to ensure both worker safety and regulatory compliance. Hence, there is a steady and considerable demand for gas detectors within these fields. Additionally, North America hosts several prominent manufacturers and suppliers of gas detection equipment that utilize advanced technology and innovation to provide high-quality, reliable, and state-of-the-art solutions.

The trend of the U.S. Market is quite mature because of established workplace safety regulations, high rates of technology adoption in the Oil and Gas, Chemical, and Mining sectors, and constant improvements in technology (Examples: Wireless and Multi-Gas Detection). A combination of high levels of Industrial Automation along with a number of large Global Manufacturers also enables steady demand for detector products throughout large-scale industrial facilities.

- In November 2023, New Cosmos launched the DeNova Detect natural gas alarm for home use. This is the first battery-powered gas alarm for the consumer market that can run up to 10 years before replacement. America's natural gas pipelines are aging, resulting in thousands of home gas fires and hundreds of explosions yearly.

How Europe is gaining Growth Potential in Portable gas detectors market?

Europe has exhibited steady growth in the portable gas detector market because there are more stringent regulations related to workplace safety, increasing volumes of inspections by industries, and increasing numbers of gas detectors utilized throughout manufacturing, chemical, as well as the energy sectors of the European economy. Additionally, the integration of connected gas detection equipment is becoming more popular, leading to faster notifications and better worker protection. The ongoing improvement of industrial safety protocols has resulted in stable and ongoing increased demand for these products throughout the European economy.

The trend for Germany is driven by strict Occupational Safety Standards and high levels of demand from the Automotive, Chemical, and Energy Industries. The desire for Accuracy, Reliability, and Advanced Sensing Technologies drives customers to purchase higher-end and more costly Technologically Advanced Portable Detectors. Demand for Portable Gas Detectors will continue to grow due to the increased number of Renewable Energy Projects that are continuing to expand in Germany, where Gas Monitoring will remain critical to Ensuring Safe Operations.

What are the Present an Opportunity in The Middle East and Africa?

With increasing oil and gas developments, diversification of various industries, and increased awareness of hazardous gases in confined spaces, the Middle East and Africa continue to grow. The Gulf Region is investing heavily in the use of new and innovative safety detection products, and in Africa, new portable gas detection products are being deployed throughout the mining and construction sectors as well as in utilities. Continued growth in industry development along with growing regulatory requirements focused on safety will expand the growth of the market in the Middle East and Africa.

The UAE Market is driven by the high levels of Oil & Gas activity, Major Industrial Infrastructures, and Established Safety Standards in Refineries and Industrial Plants. The increase of Advanced Portable Detectors with Wireless Connectivity (Real-Time Monitoring) will continue.

Region-wise global gas production statistics (2023)

| Region | 2023 Gas Production Change | Key Details |

| Global | +0.7% | Slight increase after stagnation in 2022 |

| The U.S. | +4.7% | Nearly matches 2010-2019 average growth |

| Middle East | +2.7% | Below historical average; Iran +1.3%, Saudi Arabia stable |

| Asia | +3.5% | China +6%, India +6%, Indonesia +2.1% |

| Africa | Stable | Algeria +8.3%, Egypt -11 |

| Latin America | Stable | Brazil +8.6% |

| Australia | +0.8% | Minimal increase |

Portable Gas Detectors Market Companies

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Industrial Scientific Corporation

- RAE Systems by Honeywell

- BW Technologies by Honeywell

- Teledyne Technologies Incorporated

- Sierra Monitor Corporation

- Sensidyne, LP

- GfG Gesellschaft für Gerätebau mbH

- RKI Instruments Inc.

Recent Developments

- In February 2023, Industrial Scientific Corporation Launched the MX2 Multi-Gas Monitor, offering exceptional versatility and portability for various gas detection applications.

- In December 2023, Honeywell Partnered with Siemens to offer integrated gas detection solutions with enhanced data integration and real-time insights for process optimization.

- In May 2022, CO2Meter, a worldwide designer and manufacturer of high-quality gas detection, monitoring, and analytical solutions, announced the acquisition of GasLab.com, a provider of oxygen gas sensing and monitor technology, to further expand its capabilities in gas detection.

Segments Covered in the Report

By Product Type

- Single-gas

- Multi-gas

By Gas Type

- Oxygen

- Flammable Gases

- Toxic Gases

By End-user

- Oil & Gas

- Chemical & Petrochemical

- Mining

- Manufacturing

- Utilities

- Commercial & Residential

By Distribution Channel

- Direct Sales

- Indirect Sales

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting