What is the Materials for PEM Fuel Cells Market Size?

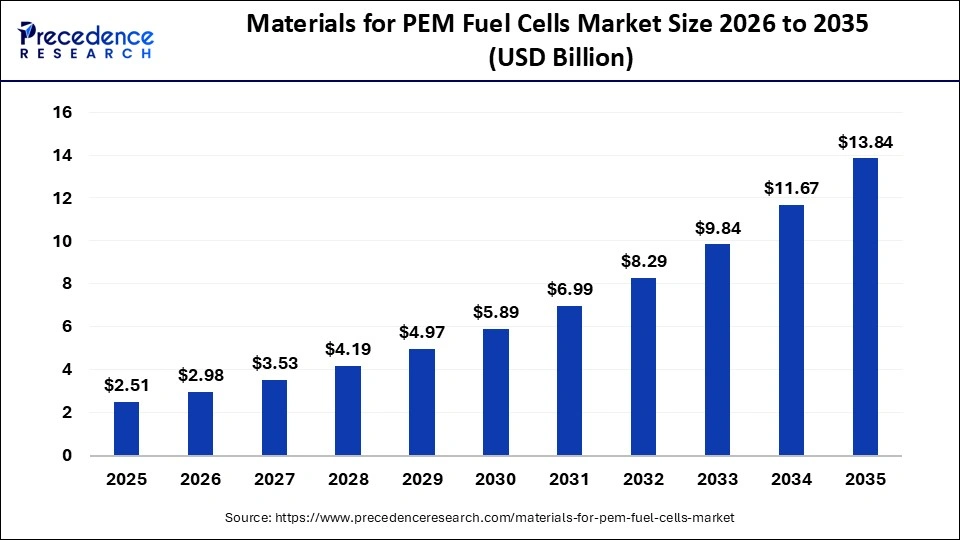

The global materials for PEM fuel cells market size accounted for USD 2.51 billion in 2025 and is predicted to increase from USD 2.98 billion in 2026 to approximately USD 13.84 billion by 2035, expanding at a CAGR of 18.62% from 2026 to 2035. This market is growing due to the rising adoption of clean hydrogen technologies and increasing demand for efficient, zero-emission energy solutions across transportation and industrial sectors.

Market Highlights

- Asia Pacific dominated the materials for PEM fuel cells market, having the biggest share in 2025.

- The Europe is expected to rise at a notable CAGR between 2026 and 2035.

- By material type, the catalyst materials segment contributed the biggest market share in 2025.

- By material type, the membrane materials segment is growing at a notable CAGR between 2026 and 2035.

- By catalyst type, the platinum-based segment held the major market share in 2025.

- By catalyst type, the non-PGD catalysts segment is expected to grow at a strong CAGR between 2026 and 2035.

- By application, the automotive segment captured the largest market share in 2025.

- By application, the heavy-duty vehicles & industrial forklifts segment is expanding at a notable CAGR between 2026 and 2035.

Market Overview

What's Driving the Momentum in the PEM Fuel Cell Materials Market?

The PEM fuel cell materials market is gaining momentum as industries accelerate the shift toward clean hydrogen-based energy systems. Demand for high-performance membranes, catalysts, and gas diffusion layers is increasing as key sectors, such as automotive, industrial power systems, and stationary energy applications, scale up deployments of proton exchange membrane fuel cells. These materials must support high proton conductivity, durability, and efficient water management to ensure reliable long-term operation, which drives continuous innovation in material science.

Global decarbonization targets are also playing a central role in strengthening the market, as countries introduce national hydrogen strategies, tax credits, and deployment incentives that directly support PEM technologies. Automakers are expanding fuel cell electric vehicle (FCEV) programs, and industrial users are adopting PEM systems for backup power and grid balancing, which boosts demand for advanced materials. Rising investment in green hydrogen production, coupled with pilot projects for fuel cell trucks, buses, and distributed energy systems, further accelerates material consumption across the value chain.

Key Technological Shifts in the Materials for PEM Fuel Cells Market

| Technological Shifts | Description |

| Ultra-Low / Platinum-Free Catalysts | Movement toward catalysts that use minimal or zero platinum to reduce cost and dependency on precious metals. |

| Next-Generation Membranes (PFSA Alternatives) | Development of non-fluorinated, high-durability membranes with improved thermal and chemical stability. |

| Advanced Gas Diffusion Layers (GDLs) | Use of carbon-based, lightweight GDLs with better porosity, water management, and resistance to degradation. |

| High-Durability MEAs | Integration of stronger catalyst layers and reinforced membranes to extend MEA lifespan in harsh operating conditions. |

| Recyclable & Eco-Friendly Materials | Shift toward materials that can be recovered, reused, and manufactured with a lower environmental footprint. |

| Improved Bipolar Plate Materials |

Introduction of corrosion-resistant metal and composite plates that offer higher conductivity and faster production rates. |

Materials for PEM Fuel Cells Market Outlook

As businesses and governments seek greener hydrogen-powered ways to cut carbon emissions, the PEM fuel cell materials market is growing. The demand for high-efficiency membrane catalysts and supporting components is driven by their growing use in industrial applications, electric vehicles, and backup power systems. The markets overall growth is further accelerated by growing investments in hydrogen infrastructure.

Sustainability is at the core of PEM fuel cell material innovations, with companies focusing on reducing platinum usage, improving recyclability, and developing eco-friendly membranes. The global push for net-zero emissions is amplifying interest in hydrogen-based technologies, leading manufacturers to prioritize longer-lasting, low-impact materials. These trends are helping PEM fuel cells become more cost-efficient, greener, and commercially viable.

The startup ecosystem is expanding quickly as new businesses develop affordable hydrogen solutions, membrane engineering, and catalyst design. VC firms, energy giants, and government initiatives aimed at accelerating clean tech breakthroughs are providing strong support to startups. Their adaptability and emphasis on innovative materials are driving PEM fuel cells toward greater efficiency, lower costs, and broader practical use.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.51 Billion |

| Market Size in 2026 | USD 2.98 Billion |

| Market Size by 2035 | USD 13.84 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.62% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type, Catalyst Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Materials for PEM Fuel Cells Market Segmental Insights

Material Type Insights

Catalyst Materials (Pt-Based & Non-Pt): Catalyst materials, particularly platinum-based catalysts, dominate the PEM fuel cell materials market because they deliver the highest stability and efficiency in hydrogen oxidation and oxygen reduction reactions, which directly determines overall power output. Their unrivaled electrochemical performance, tolerance to operating stresses, and proven long-term durability make them the preferred choice across automotive stacks, heavy-duty mobility platforms, and stationary backup systems. Despite their high cost and exposure to global platinum supply fluctuations, Pt-based catalysts remain essential due to their consistent performance under varying humidity, load cycling, and temperature conditions, which competing non-Pt technologies still struggle to match at a commercial scale.

Membrane Materials (Pfsa, Hydrocarbon Membranes): Membrane materials, including advanced PFSA and new hydrocarbon-based membranes, represent the fastest-growing segment as manufacturers work to reduce system costs while achieving higher fuel cell efficiency. These next-generation membranes offer improved proton conductivity, better mechanical strength, and enhanced resistance to chemical degradation, enabling longer stack life under demanding automotive and heavy-duty operating cycles. Their higher heat tolerance supports elevated operating temperatures, improving water management and lowering cooling requirements. As commercial vehicle OEMs and industrial power developers transition to high-output, long-duration PEM systems, demand for these membranes is rising sharply, supported by ongoing R&D into reinforced structures and cost-reduced chemistries.

Catalyst Type Insights

Platinum-based Catalysts (Pt/C): The Platinum-based catalysts segment dominates the market because they remain the best at accelerating key fuel cell reactions, ensuring high power output and outstanding durability. For commercial vehicles their compatibility with PEm systems makes them essential. These catalysts have been shown to work in the field for decades. Because platinum behaves consistently and predictable, OEM continue to rely on it.

Non-PGM Catalysts (Fe-N-C, Co-N-C): Non-PGM catalysts (cost reduction & sustainability push) are the fastest-growing because businesses strive to lower system costs and reduce their dependency on precious metals. Strong performance potential is demonstrated by materials such as iron, nitrogen carbon at a fraction of the price. Environmental concerns are also driving a move toward more sustainable catalyst choices. Commercialization prospects are accelerating due to increased global research funding.

Application Insights

Automotive (FCEV passenger cars, buses, trucks): The automotive segment leads the PEM fuel cell market, driven by expanding hydrogen EV programs and demand for long-range, fast-refueling mobility solutions. Fuel cell cars and buses benefit from strong government backing in Asia, Europe,and North America. Automakers are ramping up production, boosting demand for PEM stacks. The sector also supports high-volume fuel cell manufacturing, reinforcing its dominance.

Industrial & Material Handling (forklifts, AGVs): Heavy-duty vehicles & industrial forklifts are growing rapidly, as PEM systems are ideal for commercial use thanks to high power, long operating cycles, and fast refueling. For greener operations, logistics and warehousing, girls are quickly switching from diesel to hydrogen. Because fuel cells are reliable in continuous-duty applications, industrial fleets favor them.

Materials for PEM Fuel Cells Market Regional Insights

The Asia Pacific region dominated the materials for PEM fuel cells market in 2024 due to aggressive national hydrogen strategies, large-scale government incentives, and strong policy ecosystems supporting fuel cell vehicle deployment. Countries like China, Japan, and South Korea invested heavily in hydrogen refueling stations, green hydrogen production, and localized stack manufacturing, creating a tightly integrated supply chain for membranes, catalysts, and gas diffusion layers.

The region also benefits from a dense concentration of OEMs and component manufacturers, enabling rapid commercialization of PEM systems in both mobility and stationary power segments. Early adoption programs for fuel cell buses, commercial fleets, and distributed energy systems accelerated industrial demand for high-performance PEM materials. This leadership is further reinforced by continuous government-backed demonstrations, long-term decarbonization roadmaps, and stable policy commitments that sustain deployment momentum across emerging applications.

India Materials for PEM Fuel Cells Market Trends

India dominates the region due to the government strong push for green hydrogen, the rapidly growing number of pilot projects, and increasing interest in PEM fuel cell adoption from automakers and industrial OEMs. The nation is investing in domestic stack manufacturing and quickly constructing hydrogen hubs. Its leadership is further reinforced by the National Green Hydrogen Mission supportive policies. On-the-ground deployment is accelerating as public-private partnerships grow.

Europe has seen notable growth in the materials for PEM fuel cells market due to its strong regulatory push toward decarbonization, national hydrogen strategies, and large-scale investments in green hydrogen production under frameworks such as the EU Hydrogen Strategy (2020) and REPowerEU (2022). Countries including Germany, France, the Netherlands, and Denmark are expanding electrolyzer capacity and accelerating the deployment of fuel cell systems in heavy mobility, maritime transport, and industrial energy applications, which increases demand for advanced membranes, catalyst layers, and gas diffusion materials.

Europe also hosts several leading PEM technology developers and research institutions focused on improving membrane durability, platinum-group metal (PGM) efficiency, and high-temperature PEM designs, thereby strengthening the regional materials pipeline. Strong public funding under programs like Horizon Europe and IPCEI Hydrogen supports pilot projects and scale-up of manufacturing. At the same time, the growth of fuel cell truck corridors and hydrogen-powered rail networks further amplifies material consumption. Collectively, these structural drivers position Europe as a rapidly advancing and innovation-driven market for PEM fuel cell materials.

U.K. Materials for PEM Fuel Cells Market Trends

The U.K. is the fastest-growing country, driven by the strong hydrogen strategies, heavy investment in clean mobility, and expanding trials for fuel cell buses, trucks, and industrial vehicles. The governments hydrogen roadmap is encouraging large-scale adoption of PEM fuel cells. New research centers and manufacturing sites are also boosting growth. Rapid decarbonization goals make the U.K. a high-potential market.

The Middle East and Africa region is emerging as an important hub for PEM fuel cell materials, driven by its extensive portfolio of government-backed hydrogen megaprojects and rapidly expanding green hydrogen production capacity. Gulf nations such as Saudi Arabia, the UAE, and Oman are developing multi-gigawatt electrolysis facilities, including landmark projects like NEOMs green hydrogen plant in Saudi Arabia, which directly increases long-term demand for high-performance membranes, catalysts, and gas diffusion layers used in PEM technologies. These countries are also investing heavily in hydrogen transport corridors, industrial decarbonization pilots, and ammonia export terminals, making PEM fuel cells a natural extension of their clean energy strategies.

The regions market presence is strengthened by growing interest in fuel-cell mobility for logistics fleets, port operations, and heavy transport in high-temperature environments where hydrogen-based applications offer operational advantages. Additionally, several MEA economies are positioning themselves as future global exporters of green hydrogen and hydrogen-derived fuels, encouraging parallel domestic adoption of PEM systems in power generation and backup energy solutions. Collectively, these initiatives, combined with strong state-level funding and long-term economic diversification agendas, are creating a favorable ecosystem for sustained growth in PEM fuel cell materials across the Middle East and Africa.

UAE Materials for PEM Fuel Cells Market Trends

The UAE is emerging as one of the fastest-advancing markets for PEM fuel cell materials in the Middle East, driven by its strong national hydrogen roadmap, large-scale clean energy investments, and rapid acceleration of hydrogen megaprojects. The countrys strategic initiatives, including the UAE Hydrogen Leadership Roadmap and the national goal to become a top global hydrogen producer by 2031, are creating sustained demand for high-performance membranes, catalyst layers, and gas diffusion media required for PEM systems. The UAE is also expanding partnerships with international technology developers to localize components of the hydrogen value chain, including early discussions around membrane and catalyst manufacturing capabilities to support domestic deployment.

Adoption is further supported by flagship projects such as the green hydrogen pilot at the Mohammed bin Rashid Al Maktoum Solar Park, which demonstrates the integration of PEM electrolyzers with large renewable power capacity. The UAE is also exploring fuel-cell applications in heavy transport, logistics fleets within free-trade zones, and hydrogen-powered mobility initiatives at ports like Jebel Ali.

Latin America is the fastest-growing region in the materials for PEM fuel cells market due to the rapid emergence of early-stage hydrogen economy projects, expanding renewable energy capacity, and rising industrial interest in clean power technologies. Countries such as Chile, Brazil, and Colombia are implementing national hydrogen strategies that prioritize the deployment of PEM electrolyzers for large-scale green hydrogen production, thereby increasing demand for advanced membranes, catalysts, and gas diffusion layers. Chiles National Green Hydrogen Strategy and its high solar irradiance in the Atacama Desert make it one of the worlds most cost-competitive locations for green hydrogen, directly accelerating PEM-related investments.

Regional industries are exploring PEM fuel cells for mining haul trucks, autonomous vehicles, and distributed power systems, particularly in mining-intensive countries such as Chile and Peru, where decarbonizing heavy transport is a priority. The regions market expansion is further supported by international partnerships with European and Asian hydrogen technology developers, which are helping build early manufacturing and testing capabilities. Supportive government incentives, pilot-scale hydrogen corridors, and increasing private-sector adoption of clean industrial technologies are also encouraging steady uptake of PEM systems. Collectively, these structural drivers position Latin America as a high-velocity growth region for PEM fuel cell materials over the coming decade.

Next Gen PEM Fuel Cell Materials: Futuristic Trends You Can't Ignore

| Trend/Innovation | Why it's Game Changing |

| Wearable Hydrogen Power | Ultra-thin, flexible membranes could power wearable electronics or smart textiles, creating a new personal energy market. |

| Self-Healing Membranes | Advanced polymers can autonomously repair microcracks, dramatically extending fuel cell lifetime. |

| Hydrogen-Powered Drones & UAVs | Lightweight, high-energy-density materials enable long-endurance flight for logistics, surveillance, and delivery services. |

| Platinum Recovery & Circular Catalyst Tech | Innovative recycling technology enables full recovery of platinum from spent MEAs, reducing costs and supporting sustainability. |

| Membranes That Generate Water | Novel PEMs can capture and recycle water produced in the reaction, improving efficiency in arid or remote locations. |

| AI-Optimized Hybrid Stacks | Combines PEM with other fuel cell types or batteries, using AI to dynamically optimize performance under variable load. |

| Space & Deep-Sea Fuel Cells | Extreme-resistance membranes allow energy systems for satellites, submarines, and remote exploration missions. |

Materials for PEM Fuel Cells Market Companies

Specializes in PEM fuel cell stacks and systems for heavy-duty motive applications (buses, trucks, marine).

Provides vertically integrated hydrogen ecosystems, including fuel cells for material handling equipment and stationary power.

A diversified power solutions provider offering PEM fuel cells through its zero-emissions business unit.

A global leader in sustainable technologies, supplying high-performance catalysts and membrane electrode assemblies (MEAs).

A materials technology group that produces advanced catalysts (HyProGen) for PEM fuel cells in the automotive sector.

A key manufacturer of high-performance polymer electrolyte membranes (PEMs) and MEAs.

Supplies innovative components to the fuel cell industry, including advanced membrane and catalyst technology.

A leading manufacturer of carbon-based materials like gas diffusion layers (GDLs) and bipolar plates.

A composite material manufacturer that produces carbon paper for gas diffusion layers.

Recent Developments

- In May 2025, the ECOPEM Project launched a major program to develop next-generation non-fluorinated membranes and components for PEM fuel cells and electrolysers. This initiative aims to reduce dependence on PFSA-based materials and accelerate the shift toward greener, safer fuel-cell technologies.(Source: https://ife.no)

- In October 2025, Hyundai Motor broke ground on a large-scale hydrogen fuel cell production plant in Ulsan, South Korea, with capacity for 30,000 units annually. The facility is designed to strengthen Hyundais global hydrogen ecosystem and support the rapid adoption of PEM systems in vehicles and industry.(Source:https://www.hyundai.com)

Materials for PEM Fuel Cells MarketSegments Covered in the Report

By Material Type

- Catalyst Materials (Pt-based & non-Pt)

- Membrane Materials (PFSA, hydrocarbon membranes)

- Gas Diffusion Layers (Carbon paper, carbon cloth)

- Bipolar Plates (Metallic, graphite, composite)

- Sealing / Gasket Materials

- Proton Exchange Polymers

- Others (porous transport layers, coatings, etc.)

By Catalyst Type

- Platinum-based Catalysts (Pt/C)

- Platinum Alloy Catalysts (Pt-Co, Pt-Ni, Pt-Fe)

- Non-PGM Catalysts (Fe-N-C, Co-N-C)

By Application

- Automotive (FCEV passenger cars, buses, trucks)

- Stationary Power (backup power, micro-CHP)

- Portable Power

- Industrial & Material Handling (forklifts, AGVs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting