What is the Potato Protein Market Size?

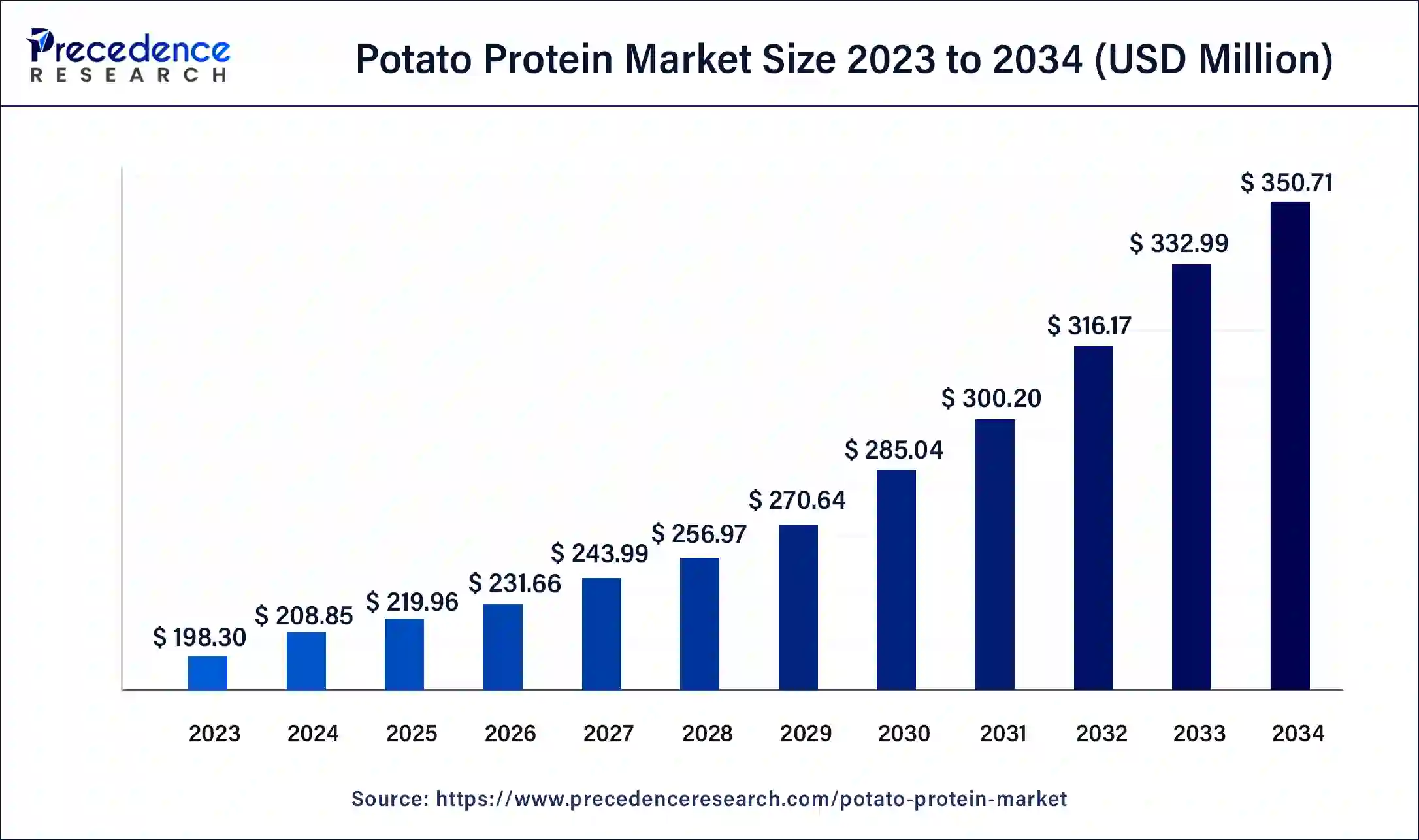

The global potato protein market size was estimated at USD 219.96 million in 2025 and is predicted to increase from USD231.66million in 2026 to approximately USD 350.71 million by 2034, expanding at a CAGR of 5.32% from 2025 to 2034.

Potato Protein Market Key Takeaways

- In terms of revenue, the global potato protein market was valued at USD 208.85 billion in 2024.

- It is projected to reach USD 350.71 billion by 2034.

- The market is expected to grow at a CAGR of 5.32% from 2025 to 2034.

- Asia Pacific held the largest share of the market in 2024.

- By type, the isolates segment dominated the global market in 2024.

- By type, the concentrates segment is expected to see notable growth in the market during the forecast period between 2025 and 2034.

- By application, the food & beverages segment contributed the largest market share of 54% in 2024.

- By application, the feed segment is expected to see notable growth in the market during the forecast period between 2025 and 2034.

What are the Vital Biotechnological Groundbreakings in Potato Protein?

Potato protein refers to protein extracted from the tuber and industrial potato waste products. There are several extraction techniques such as ion exchange and expanded bed absorption that help easily isolate and modify potato protein. In addition, hydrolyzing proteins into smaller peptide chains has been proven beneficial to enhance the proteins' functional abilities. Potatoes have high starch content, and several nutritionally beneficial proteins, fiber, vitamins and organic acids. Potato proteins are shown to be equally nutritious as soy and egg proteins.

Potatoes are a staple of many cultures and one of the most consumed food crops in the world after rice, wheat, and maize. Biotechnological innovations in potato proteins present a good opportunity for new businesses to create more soluble and stable formulations. Due to the widespread availability of protein, sophisticated extraction techniques will lead to widespread adoption. Potatoes are also the second largest protein-supplying crop per hectare. New research on potato proteins has helped develop new technologies to produce food-grade potato protein.

The potato protein market has seen growth in the past few years due to the rising popularity of plant-based and vegan protein alternatives. The number of people switching to a vegan diet has grown substantially in the last decade. Research into potato protein is still nascent, with potato protein still seeing limited integration into broad food product formulations. There is also limited knowledge about potato storage proteins in the food industry. These factors serve as a challenge for growth in the market.

How Artificial Intelligence is Transforming the Potato Protein Market?

Artificial intelligence is transforming the potato protein market with innovations in protein structure prediction and de novo protein design. AI tools, such as AlphaFold2, RoseTTAFold, and ESMFold, help with accurate protein modeling. There have also been several breakthroughs in protein-aggregation mechanisms, the pathogenesis of protein misfolding, and disease. In the study of the synthesis of potato proteins, deep learning-based protein design tools are helping characterize the chemical and biological properties of patterns, the major potato storage proteins. Artificial intelligence is also being used to undertake more efficient potato production, leading to the early identification of diseases in the potato leaf.

- Researchers at the PMAS-Arid Agriculture University in Pakistan have used Convolutional Neural Network methods to categorize plant leaf diseases into 15 classes, with three classes for healthy leaves. Out of the 15 classes, several were reserved for plant diseases such as fungal and bacterial infections, among others. The proposed models were trained and tested, achieving approximately 98% accuracy.

Potato Protein Market Growth Factors

- A growing number of people now identify as vegan, and a shift in consumer preferences towards a plant-based diet.

- New biotechnological innovations in potato protein extraction techniques are spurring growth in the potato protein market.

Potato Protein Market Outlook:

- Global Expansion: Specifically, a rise in demand for plant-based and sustainable food ingredients, the rising vegetarian and vegan population, and its use in animal feed and sports nutrition are propelling further expansion.

- Major Investors: Many food ingredient companies and specialized startups, like Avebe, Roquette Frères, and PoLoPo, are investing in supporting the increasing demand for plant-based, allergen-free, and sustainable protein sources.

- Startup Ecosystem: The Better Meat Co., a US-based food tech startup, unveiled a method to produce mycelium (fungi) protein using potato processing waste streams as a feedstock.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 350.71 Million |

| Market Size in 2025 | USD 219.96 Million |

| Market Size in 2026 | USD 231.66 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising number of people identifying as vegan and switching to plant-based protein diets

A shift towards more environmentally and health-conscious food consumption among the world's population is driving demand for plant-based proteins and diets. Consumer awareness around the negative influence of livestock rearing on global greenhouse gas emissions and meat on human health is spurring individuals to look for vegan and plant-based protein options. Thus, a rising demand for plant-based protein alternatives is spurring growth in the potato protein market.

- According to GlobalData, the number of U.S. consumers identifying as vegan grew from 1% to 6% between 2014 and 2017, a 600% increase. Sales of plant-based alternatives surged, amounting to over US$ 3.7 billion in 2021. The plant-based food industry is expected to see substantial growth, forecasted to be valued at US$ 162 billion by 2030.

Restraints

Limited awareness of potato proteins and few stable extraction techniques

Demand for potato protein is restricted by limited knowledge about potato storage proteins, hindering their widespread adoption in the food industry. Potatoes have a low protein concentration compared to other plant-based sources. Potatoes contain a mere 1.5% protein concentration, requiring a large quantity for protein ingredient production. Processing methods to remove certain compounds without affecting protein functionality and stability also significantly increase the cost of production. With current extraction processes, the acid and thermal treatments cause protein denaturation. Thus limiting the growth of the potato protein market.

Opportunities

Developments in the production process

Potatoes are one of the most widely produced primary crops in the world. Developing scalable protein extraction will lead to widespread adoption in baking, confectionery, and processed meat and dairy products. Further research and development investments will lead to the development of effective methods of protein isolation and, eventually, commercial production of the potato protein market products. New research has shown that using processes such as precipitation with (NH4)2SO4, FeCl3, or ethanol instead of acid and thermal treatments results in higher yields and purity and reduced sensitivity to pH and temperature changes. Biotechnology research into improving protein content in potatoes can further improve the efficiency of extraction processes.

- In 2024, Israeli biotech startup ReaGenicshas used cellular agriculture to develop tubers with 31% protein content. The high-protein potatoes have a significant advantage over pea or soy proteins. The firm states the protein content could potentially be boosted to 40%, opening up

Type Insights

The isolates segment dominated the global potato protein market in 2024. Protein isolates are a refined form of protein containing a greater amount of protein with high digestibility. Protein isolates are widely produced from deoiled cakes of legumes such as peanuts, soybeans, potatoes, etc. Isolates can be incorporated into various food products asfood ingredients. Some techniques of potato protein isolate production, such as FeCl3 precipitation, result in the highest purification factor and isolates with the lowest relative proportion of high MW proteins (<4.6%).

The concentrates segment is expected to see notable growth in the potato protein market during the forecast period between 2024 and 2033. Potato protein concentrates are made by precipitating the proteins with a combined acidic heat treatment (thermal coagulation) of the potato fruit juice. Potato protein concentrates have low levels of cholesterol and lactose but high amounts of proteins. Concentrates are widely used in functional foods, such as cereals and yogurt. The unique nutritional properties of potato protein concentrates are set to drive demand in the market segment.

Application Insights

The food & beverages segment made up the largest share of the potato protein market in 2024. Potato protein derivatives are increasingly seen as a replacement for high-quality animal proteins such as whey protein isolate, egg white and egg yolk in meat and meat substitutes, dairy-free cheese, confectionery products, ice cream, and dressings. Certain potato proteins have foaming properties that make them a potential replacement for egg whites.

The feed segment is expected to see notable growth in the potato protein market during the forecast period between 2024 and 2033. For instance, in horses' potato protein concentrate is seen as beneficial for muscle growth and future exertion. Diets containing potato protein were reported to sustain the performance of weanling animals. Potato protein reportedly benefits young horses during early training and athletic horses during training and competition periods. It also benefitted convalescent horses with a loss of muscle or older horses with difficulties eating and digesting proteins. Potato protein is also suitable for high-grade animal feed applications in piglets and calves, poultry, and pets.

Regional Insights

Why did the Asia Pacific Dominate the Market in 2024?

Asia Pacific held the largest share of the potato protein market in 2024, the region is seen to sustain the position during the forecast period. Increasing awareness about protein supplements and the presence of a growing vegan population in the region are likely to boost demand. The abundant supply of raw material with availability of suitable environment for all relative process of forming potato protein create a significant potential for Asia Pacific to sustain its dominance in the upcoming years. Along with this, strong consumer base and presence of major manufacturers promote the growth of the market in several Asian countries.

According to data from the Food and Agriculture Organization of the United Nations, China was the largest producer, accounting for 25.5% of world production, followed by India at 15.0%.

Rise in Emphasis on Plant-Based Protein Substitutes is Fueling Europe

Europe is observed to grow at a notable rate in the potato protein market during the forecast period. Potatoes are a staple of many European cuisines. Increasing awareness around plant-based protein substitutes and the presence of prominent firms in the space are all factors of growth. The presence of notable potato protein production businesses, such as Royal Avebe (based in the Netherlands) in the region and the growing research and development spending are reasons for Europe's dominance in the market. In 2020, Germany was the largest producer of potatoes in the EU at 11.7 million tons, making up 21.2 % of the European production.

Exclusive Government Initiatives: Spurs the Indian Market

In 2024, India captured a major share of the market due to the rising government efforts in potato protein developments, such as the Indian government's approval of the development of the South Asia regional center of the Peru-based International Potato Center (CIP) in Agra, Uttar Pradesh. Also, in 2025, the Indian Council of Agricultural Research (ICAR)-CPRI unveiled 'Kufri Chipbharat-1', a new high-yield potato processing variety, to offer better raw material for processing industries.

Immersive Retailer Strategy: Elevates the German Market

With a lucrative growth, German retail giant REWE Group introduced a new "protein split" strategy, setting a goal for 60% plant-based sales by 2035 and advocating for a national protein plan in Germany. This explores a crucial pull from major retailers for plant-based proteins, like potato protein, to meet sustainability and consumer health demands.

Exploration of Trade Events is Fostering MEA

The potato protein market in MEA is fueled by the significant food processing events, including Gulfood Manufacturing in Dubai and Fi Africa in Cairo, which serve as major platforms for global ingredients and processing companies to present their solutions to the regional market.

Recent Potato Research: Encourages the African Market

In May 2025, the African Potato Conference showcased novel high-yield potato varieties established by the National Agricultural Research Organisation (NARO) in Uganda, which focuses on optimizing food security and nutrition. Alongside, they develop the foundational agricultural science and supply for future protein extraction.

Potato Protein Market: Value Chain Analysis

- Raw Material Procurement

This mainly covers sourcing high-quality potatoes and processing them to extract the protein as a major by-product of potato starch manufacturing.

Key Players: Emsland Group, Roquette Frères, AGRANA Beteiligungs-AG, etc. - Processing and Preservation

This includes separation from potato juice, often using acidic heat precipitation, membrane separation (ultrafiltration and diafiltration), or ion exchange chromatography to remove impurities, and preservation through drying (like freeze-drying), which can be used for products like protein powders.

Key Players: Südstärke GmbH, KMC Kartoffelmelcentralen a.m.b.H., Tereos Group, etc. - Waste Management and Recycling

The market uses microbes to convert waste into high-protein biomass, or through physicochemical methods, as well as composting potato peels or processing waste into other value-added products, such as bioplastics, biofuels, or animal feed.

Key Players: Colubris Cleantech, TOMRA, HeartFoods Group, etc.

Top Companies and Their Contributions to the Market

- Avebe: Focuses on extracting high-value protein from potato starch processing, offering functional food ingredients.

- Bioriginal Food and Science Corp.: Integrates potato protein in its broad portfolio of nutritional ingredients for global food manufacturers.

- Roquette Freres: Invests heavily in research and production, providing specialized potato proteins for performance nutrition and dietary uses.

- Agrana Beteiligungs AG: Produces organic and conventional potato protein isolates as part of its natural ingredients segment.

- Pepees Group: Utilizes advanced processing techniques to recover and commercialize high-quality potato protein as a co-product of their starch operations

Potato Protein Market Companie

- Emsland Group

- KMC Ingredients

- AKV Langholt

- PPZ Niechlow

- Sudstarke

Recent Developments

- In 2022, Branston, one of the United Kingdom's largest potato suppliers, proposed to set up a new potato protein extraction facility in 2024. The company reportedly invested around £6 million in the project, which will exclusively use potatoes grown in the UK.

- In 2022, Researchers at Maastricht University conducted a study to evaluate how potato proteins foster anabolic reactions aimed at increasing muscle mass. The study found that the ingestion of 30 grams of potato protein concentrate increases muscle protein synthesis rates at rest and during recovery from exercise in healthy, young males.

Segments Covered in the Report

By Type

- Isolates

- Concentrates

By Application

- Food & beverages

- Feed

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting