What is Power Strip Market Size?

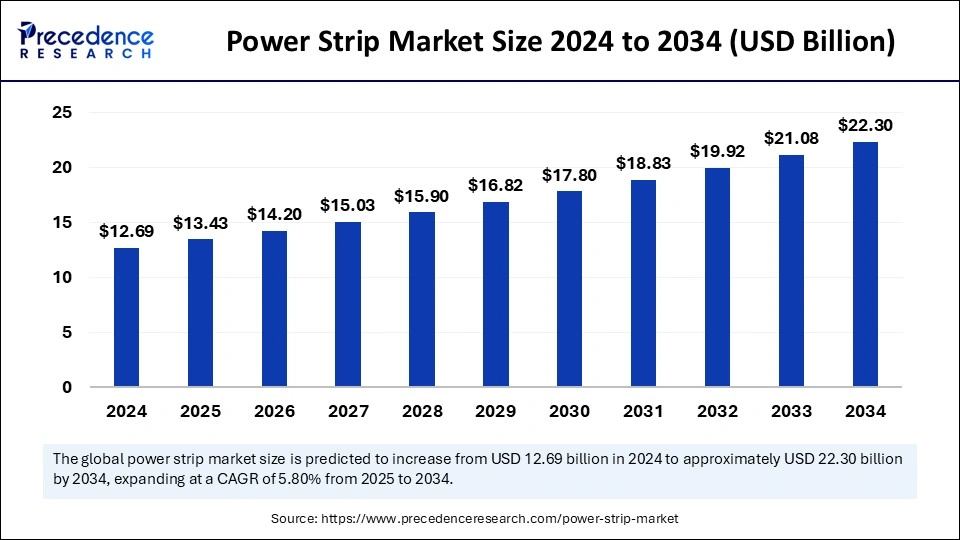

The global power strip market size accounted for USD 13.43 billion in 2025 and is predicted to increase from USD 14.20 billion in 2026 to approximately USD 22.30 billion by 2034, expanding at a CAGR of 5.80% from 2025 to 2034. The rising adoption of smart electronics devices, surging demand for a stable power supply, focus on workplace digitization, and increasing improvements in power strip technology are expected to drive the growth of the power strip market throughout the projected period.

Market Highlights

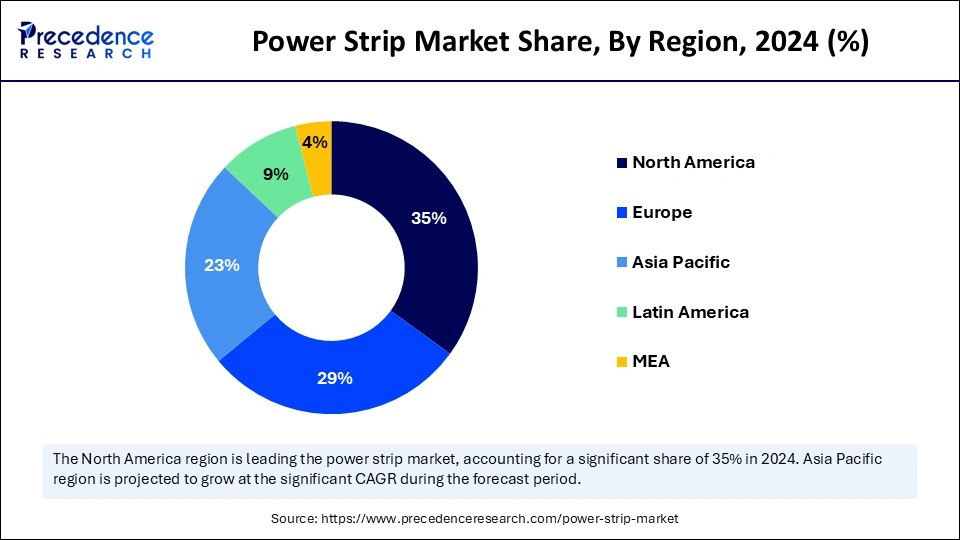

- North America led the global market with the largest market share of 35% in 2024.

- Asia Pacific is expected to expand at a CAGR of 7.3% during the forecast period.

- By type, the common power strips segment held the biggest market share of 58% in 2024.

- By type, the smart power strips segment is projected to grow at a notable CAGR of 6.3% during the projection period.

- By protection, the surge protection segment led the market in 2024.

- By protection, the fuse-based protection segment is expected to witness notable growth in the coming years.

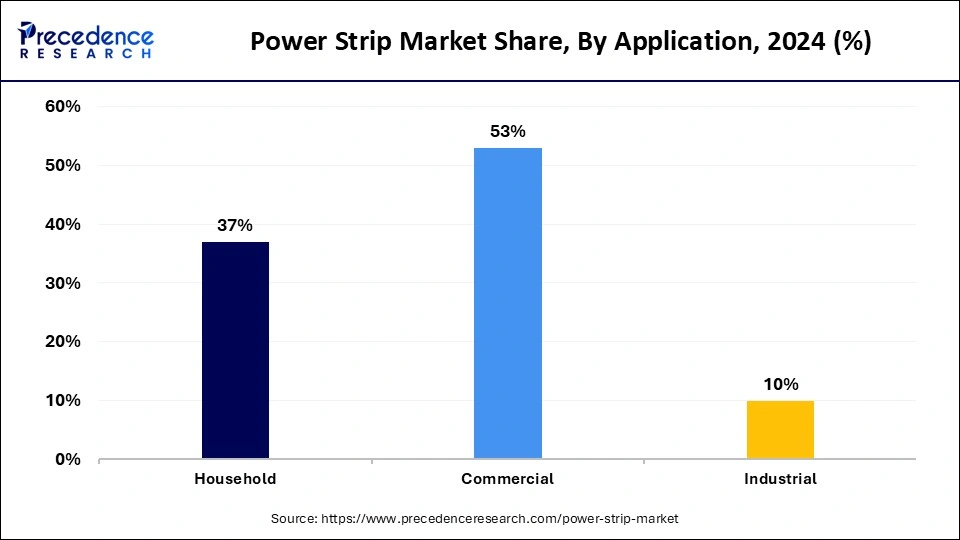

- By application, the commercial segment contributed the highest market share of 53% in 2024.

- By application, the household segment is likely to grow at a significant rate over the forecast period.

Strategic Overview of the Global Power Strip Industry

Power strips are also known as extension cords or power boards. A power strip is an electrical device that connects to a standard power outlet and expands the cord length from the wall socket to connect several devices. Power strips provide AC power to computers, appliances, or any other electrical device. It is most widely used where electrical appliances nearby require more power outlets than are available. Power strips are extensively used when multiple devices need to be connected to a single power source and can be easily used anywhere, ranging from casual home environments to critical healthcare settings. They are commonly used in offices, households, and commercial settings to accommodate the increasing number of electronic devices, which require a continuous power supply.

How does Artificial Intelligence (AI) Impact Electronic Products?

In the era of a rapidly evolving digital landscape, artificial intelligence is emerging as a driving force. AI can significantly enhance the capabilities of electronic products, including power strips. AI's predictive maintenance capability can identify potential failures before they occur, enabling timely repair and reducing downtime. It also optimizes energy consumption to meet evolving customers' needs and comply with safety standards and regulations. AI has paved the way for the development of smart electronics. As the demand for advanced electronic devices rises, AI integration is paving the way for the development of smart power strips for safety, convenience, and energy efficiency. Smart power strips automatically cut power to devices when they're no longer in use, saving energy. Therefore, AI has the potential to revolutionize the power strip market..

Power Strip Market Growth Factors

- The rising popularity of smart power strips is expected to boost the growth of the power strip market during the forecast period. Smart power strips offer features like surge protection, scheduling, and energy monitoring. The smart technology integration into power strips enables users to monitor power usage and remote control via smartphone apps or voice commands.

- The increasing adoption of smart technologies is boosting the demand for power strips.

- The increasing emphasis on adhering to safety standards and regulations to ensure the safety and smooth functionality of power strips contributes to the overall growth of the market.

- The growing awareness of electrical safety standards and the need for energy-efficient power solutions bolster the market's growth.

- Rapid urbanization and industrialization, rising investment in infrastructure development, and increasing consumer spending on electronic devices further support market growth.

- The increasing integration of smart features such as USB charging ports, voice-controlled assistants, and remote-control capabilities in modern power strips is expected to fuel the market's growth in the coming years.

- The rising adoption of electronic devices across residential, commercial, and industrial sectors propels the demand for power strips with surge protection. These strips help safeguard equipment from voltage surges and ensure an uninterrupted power supply.

Market Outlook

- Market Growth Overview: The Power Strip market is expected to grow significantly between 2025 and 2034, driven by the increasing number of electronic gadgets in residential, commercial, and industrial settings, the rise of smart home technology, and enhanced safety and protection features.

- Sustainability Trends: Sustainability trends involve advanced power strips and standby power elimination, smart technology for energy management, and eco-friendly materials and design.

- Major Investors: Major investors in the market include BlackRock, Inc., The Vanguard Group, Inc., State Street Corporation., Capital Group Companies, Inc., and JPMorgan Chase & Co.

- Startup Economy: The startup economy is focused on smart power strips and IoT integration, energy management and efficiency solutions, niche product design and e-commerce brands.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD13.43 Billion |

| Market Size in 2026 | USD 14.20 Billion |

| Market Size By 2034 | USD 22.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.80% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Protection, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing Reliance on Electronic Devices

The growing dependence on electronic devices is a major factor driving the growth of the power strip market. Power strips typically feature multiple electrical outlets and are most extensively used in offices, households, and other commercial settings to accommodate multiple electronic devices requiring uninterrupted power. The adoption of power strips has greatly increased in emerging countries due to the rise in the use of electronic appliances, such as personal computers, laptops, LEDs, televisions, printers, microwaves, and washing machines. Power strip plays a critical role in providing safe and convenient electrical solutions for modern living and workspaces. The use of power strips in workplaces and homes has significantly increased due to the surge of voice-controlled assistants and user-friendly connected gadgets, contributing to the market's growth.

Restraint

Stringent Rules and Regulations

Stringent rules and regulations associated with the power strips are anticipated to hamper the growth of the power strip market. Manufacturers are required to follow various standards while manufacturing power strips. These standards differ from country to country, creating challenges in the market. Moreover, volatility in raw material prices leads to increased cost of power strips, limiting their adoption.

Opportunities

Strong Emphasis on Energy Efficiency

The growing focus on energy efficiency is projected to offer lucrative growth opportunities in the power strip market. Power strips are useful for energy saving as they can prevent standby power from being used by the devices connected to it. Several manufacturers increasingly prioritize energy-efficient and safe design features to cater to evolving consumer preferences and meet regulatory requirements. The demand for power strips with cutting-edge safety features, including fire-resistant casing, surge protection, and automatic power cutoff, is increasing. Additionally, advancements in power strip technology have led to the development of smart power strips, which are highly effective and more practical to use with advanced features such as voice control compatibility, remote operation, scheduling, and energy monitoring.

Segment Insights

Type Insights

The common power strips segment accounted for the dominant market share in 2024. This is mainly due to the increased usage of common power strips across commercial, residential, and industrial applications. These power strips are favored for their ease of use and compatibility with multiple electronic devices. Moreover, they are more cost-effective than others.

The smart power strips segment is expected to grow at the fastest rate during the forecast period. Smart power strips automatically cut the power to idle devices, reducing energy consumption and utility bills. The rapid improvement in power strip technology has led to the development of smart power strips that are equipped with advanced features, such as energy monitoring, voice control compatibility, and remote operation. With the rise in smart homes and connected devices, manufacturers are increasingly focusing on enhancing the capabilities of smart power strips to meet evolving consumer preferences. In addition, the increasing adoption of home automation systems, rising integration of IoT-enabled devices, and rising demand for energy-efficiency solutions are anticipated to propel the growth of the segment in the coming years.

Protection Insights

The surge protection segment dominated the power strip market in 2024. Surge protectors are widely used to safeguard connected devices from damage, extend the shelf life, and save the cost of replacing damaged equipment. Surge protectors are designed with advanced energy-saving features that assist in saving money and reducing energy usage. The segment's growth is driven by the rising focus on safeguarding electronic devices from voltage surges, potential electrical accidents, and circuit-breaker tripping.

The fuse-based protection segment is expected to witness notable growth during the projection period owing to the growing need for electrical safety and compliance with stringent regulatory standards. These power strips are highly preferred in certain environments, such as industrial settings or areas with unstable power supply. Therefore, its adoption has significantly increased in places where controlled power distribution and circuit protection are crucial.

Application Insights

The commercial segment held the largest share of the power strip market in 2024. This is mainly due to the heightened use of power strips in commercial places like offices, retail spaces, education institutions, and data centers. Commercial-grade power strips offer temperature and weather resistance and can withstand harsh environments. Power strips with numerous specialty outlets, including modem ports and USB, are often utilized in corporate offices to support multiple electronic devices.

The household segment is expected to grow at a significant rate in the coming years. The increasing adoption of smart home devices and the surging number of electronic devices in residential settings, such as LCDs, washing machines, laptops, LED televisions, and microwaves, are spurring the demand for power strips with advanced convenience and utmost safety features. Additionally, manufacturers are increasingly focusing on designing compact, multifunctional solutions for modern households, boosting the segment's growth.

Regional Insights

U.S. Power Strip Market Size and Growth 2025 to 2034

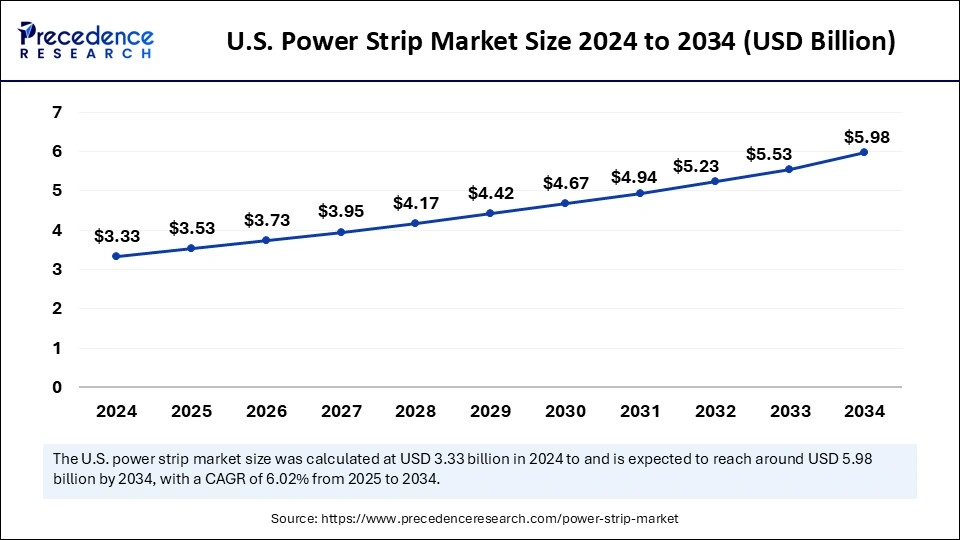

The U.S. power strip market size is exhibited at USD 3.53 billion in 2025 and is projected to be worth around USD 5.98 billion by 2034, growing at a CAGR of 6.02% from 2025 to 2034.

U.S. Power Strip Trends:

The U.S.'s increasing reliance on a multitude of electronic gadgets in residential, commercial, and industrial settings necessitates more power outlets and reliable power distribution solutions. Rise of remote work offices, demand for device protection, and integration of smart technologies fuel the market growth.

North America dominated the power strip market with the largest share in 2024. This is mainly due to the high adoption of smart home devices, high disposable income, and increased demand for energy-efficient power distribution solutions. Smart power strips with advanced safety features have gained immense popularity in the region. The high dependency on electronic devices and stringent safety regulations have compelled manufacturers to develop innovative power strips with enhanced safety features, bolstering regional market growth.

The U.S. is a major contributor to the North American power strip market. The rising usage of electronic devices in commercial and residential spaces is boosting the demand for reliable and uninterrupted power distribution solutions. Several households and offices are increasingly adopting surge-protected power strips to protect electrical equipment from power fluctuations. Moreover, rising disposable income, increasing adoption of smart home technologies, and increasing demand for energy-efficient electrical solutions are anticipated to bolster the market's growth in the country during the forecast period.

The market in Asia Pacific is expected to expand at a rapid pace during the forecast period. Rapid technological advancements and the presence of leading electronics manufacturing companies drive the market's growth. Countries like China, Japan, India, and South Korea can have a stronghold on the Asia Pacific power strip market. This is mainly due to the increasing demand for smart home technologies, rapid urbanization, and the growing use of electronic devices in commercial and residential settings. The rising usage of laptops, LCDs, washing machines, LED televisions, and microwaves in developing nations is spurring the demand for advanced power strips. In addition, the growing demand for a steady power supply and the increasing use of power strips with safety features across various sectors, such as manufacturing, construction, and healthcare, are expected to accelerate the market growth during the forecast period.

Europe is observed to grow at a considerable growth rate in the upcoming period. The growth of the regional market is attributed to the increasing demand for energy-efficient electronic devices, rising demand for smart home solutions, and the presence of well-known electronic device manufacturers. The increasing number of households adopting electronic devices, such as LCDs, laptops, LED televisions, washing machines, smartphones, and microwaves, further supports market growth. Electronics manufacturers in the region are focusing on developing energy-efficient power strips with advanced features such as energy-saving modes, automatic shutdown, and power surge protection to meet the evolving consumer demand for energy-efficient electrical products. Moreover, stringent safety regulations and energy efficiency standards in various European countries, such as the UK, Germany, Spain, and France, contribute to the growth of the power strip market in Europe.

Power Strip Market Value Chain Analysis

- Raw Material Sourcing and Component Production

This initial stage involves the procurement of essential raw materials like various plastics (e.g., ABS, PVC, flame-retardant polymers), copper wiring, aluminum, and electronic components such as circuit breakers, surge protectors (MOVs), switches, and integrated circuits for smart features.

Key Players: TE Connectivity and Murata Manufacturing. - Design, Engineering, and Manufacturing

In this crucial stage, the power strip is designed for functionality, safety, and aesthetics, followed by mass production and assembly.

Key Players: Belkin International, Eaton Corporation, Schneider Electric SE, Legrand SA, and CyberPower Systems (USA), Inc. - Distribution, Sales, and Marketing

This stage focuses on getting the finished products to market through efficient logistics, warehousing, and strategic marketing campaigns.

Key Players: Walmart and Home Depot, and Amazon. - End-User Application and Operation

The final stage is where consumers in residential, commercial, or industrial settings use the power strip to power and protect their electronic devices.

Key Players: homeowners, businesses, and industrial facilities. - End-of-Life Management and Recycling

This stage involves the eventual disposal or recycling of the power strip after its useful life (typically 5-10 years).

Key players in Power Strip Market and their Offerings

- General Electric Company (GE): GE licenses its brand for a wide range of consumer and commercial electrical products, contributing a recognizable and trusted name to the power strip market through its partners. Their involvement ensures the availability of reliable, certified power distribution products in many retail channels.

- Siemens AG: A global technology powerhouse, Siemens contributes to the market through its energy management expertise and commitment to quality and safety standards. They offer robust power distribution products for commercial and industrial applications, focusing on reliability and innovation.

- ABB Ltd: ABB provides a variety of electrification products, including components and solutions for power distribution systems used in residential and commercial buildings. Their contribution is primarily in providing safe, reliable, and energy-efficient electrical infrastructure components that may be integrated into power strip solutions.

- Panasonic Corporation: Panasonic contributes to the market with high-quality power strips that often feature sleek designs and advanced safety features, appealing to consumers seeking reliable Japanese engineering. They serve both consumer and commercial needs across global markets, particularly in Asia.

- Belkin International: A dominant consumer brand, Belkin drives innovation in the power strip market with a focus on surge protection, integrated USB ports, and smart home connectivity. Their extensive product line caters to the modern user's need for reliable power and device charging solutions.

- Leviton Manufacturing Co., Inc.: Leviton contributes to the electrical infrastructure market by providing a range of wiring devices, including sophisticated power strips for commercial, industrial, and residential use. Their focus is on high safety standards and commercial-grade durability.

- Schneider Electric: Schneider Electric is a global specialist in energy management and automation, contributing a broad range of power distribution products from basic power strips to advanced smart solutions for homes and data centers. Their products focus on safety, efficiency, and seamless integration into smart systems.

- Legrand: Legrand offers a wide variety of power distribution units (PDUs) and power strips for commercial, industrial, and residential use, with a strong emphasis on design aesthetics and functionality. They cater to a broad market with solutions that blend into modern interiors while providing reliable power.

- Koninklijke Philips N.V.: While renowned for lighting and healthcare, Philips offers power strips that leverage its brand reputation for quality and safety. Their products typically include consumer-focused designs with surge protection and USB charging capabilities.

- Cyber Power Systems, Inc.: A key player specializing in power protection and management products, CyberPower contributes extensively to the power strip market with robust surge protectors and advanced power distribution units for home offices, data centers, and IT environments.

- Delixi Electric: A major Chinese electrical equipment manufacturer, Delixi Electric contributes significantly to the vast Chinese and Asian markets with a wide array of power strips, known for their competitive pricing and fulfillment of local safety standards (CCC certification).

- Falconer Electronics: This company specializes in contract manufacturing and custom power strip solutions, contributing primarily to industrial and OEM markets that require bespoke designs and specialized production capabilities. They cater to niche B2B needs rather than the mass consumer market.

Recent Developments

- In March 2025, Anker launched the new USB Power Strip (12-in-1, 20W) for European markets. This tower-shaped model features a combination of AC outlets and USB-C and USB-A ports. It also has a built-in power switch, surge protection, and a range of other safety features.

- In January 2025, Portronics launched two new extension boards, the Power Plate 23 and Power Plate 22, in the Indian market. These power strips offer versatile features for safe and efficiently powering multiple devices simultaneously.

- In December 2024, TESSAN, a global technology leader in power management solutions, unveiled its new product, TESSAN Tower Power Strip, engineered to respond to modern dwelling and work environments' changing power demands. TESSAN Tower Power Strip combines innovation and safety.

Segments Covered in the Report

By Type

- Smart Power Strip

- Common Power Strip

- Specialized Power Strip

By Protection

- Surge Protection

- Fuse-based Protection

- Others

By Application

- Household

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting