What is the Prebiotic Ingredients Market Size?

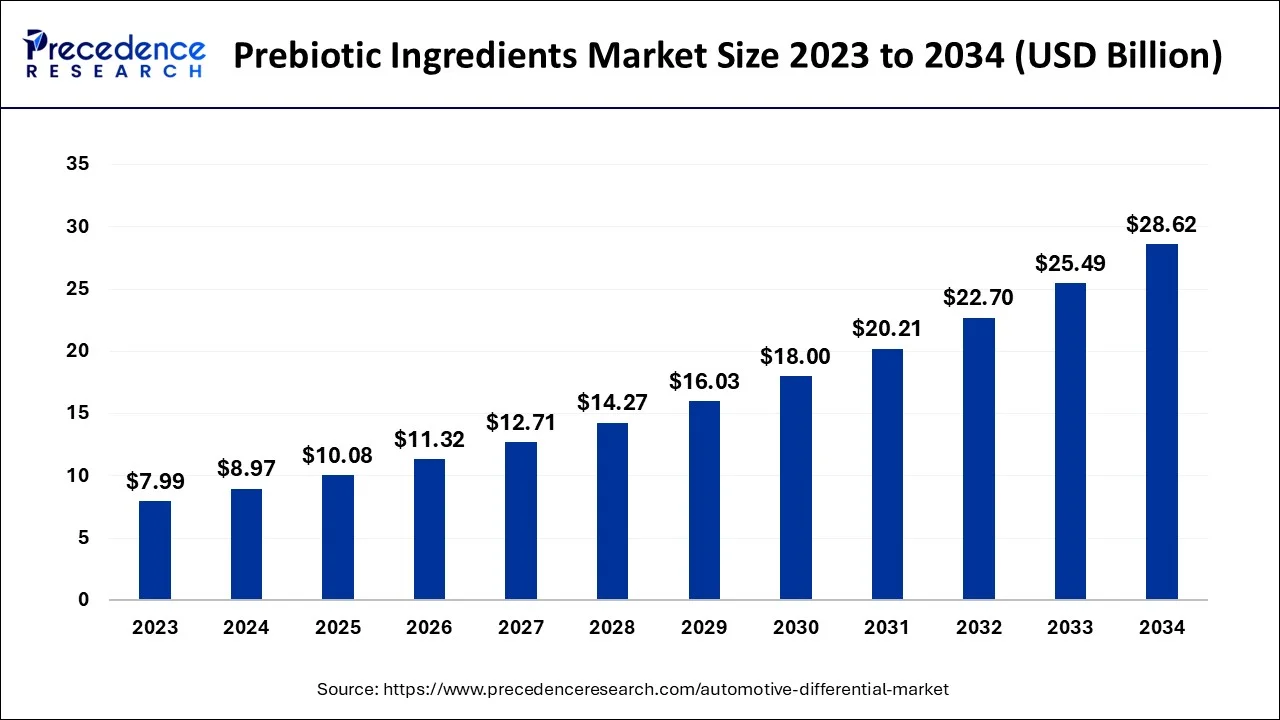

The global prebiotic ingredients market size is accounted for USD 10.08 billion in 2025 and is anticipated to reach around USD 31.75 billion by 2035, growing at a CAGR of 12.16% from 2026 to 2035.

Prebiotic Ingredients Market Key Takeaways

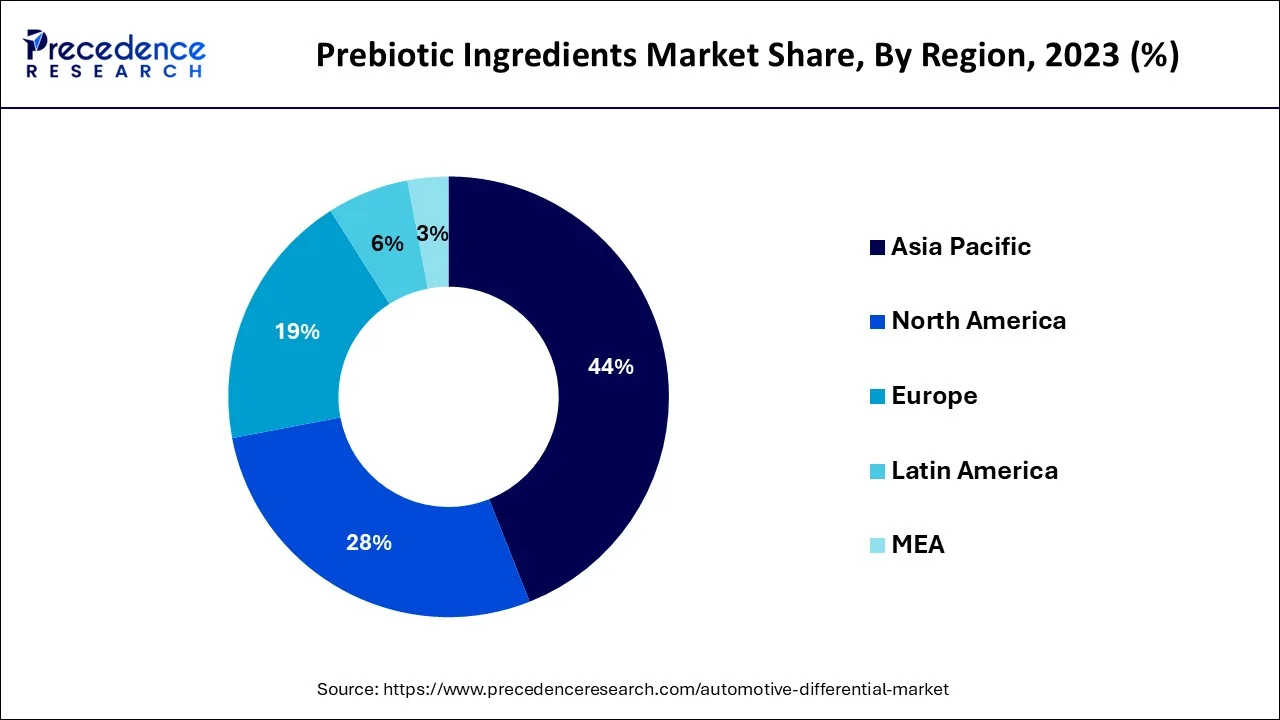

- Asia-Pacific region has garnered 44% revenue share in 2025.

- Cereals segment accounted largest revenue share of 40% in 2025.

What are Prebiotic Ingredients?

Due to an increased focus on gut health, immunity, and digestive wellness, the market for prebiotic ingredients is growing rapidly. The most popular prebiotic ingredients used across the globe are inulin, fructo-oligosaccharides (FOS), gluco-oligosaccharides (GOS), etc, which are used in functional foods and beverages, as well as nutraceutical products, and infant diets.

Increased knowledge of microbiome science and increased consumer desire for clean-label and preventative health products are factors driving increased use of prebiotic ingredients around the world; thus, prebiotic ingredients are likely to remain one of the key elements in the development of modern nutritional products.

The expanding importance of nutraceutical goods, which have become a staple in consumer's dietary planning, is credited for this growth. Prebiotic substances are in high demand, especially in the food and beverage business, as consumers become more conscious of the need of living a healthy lifestyle. During the COVID-19 epidemic, there has been an increase in demand for prebiotics. Prebiotics are carbohydrates that are not digested by digestive enzymes and acids and support the growth and function of beneficial bacteria in the human intestine. They improve intestinal barrier function, immune system strength, reduce gastric inflammation, improve overall gastrointestinal health, reduce the risk of diarrhoea, increase calcium absorption and increase bone density, Reduces risk factors for cardiovascular disease. Studies show that over 1,300 foods and beverages contain prebiotic ingredients. These are used by manufacturers in various end-use sectors to create low-calorie products that drive the growth of prebiotic ingredients. The prebiotic ingredient market is expected to grow as the demand for healthy diets containing prebiotic ingredients increases. In addition, increasing global demand for dairy products is expected to have a significant impact on the prebiotic ingredients market. Increasing the multifunctional use of prebiotic ingredients in various industries is expected to create untapped opportunities for market players from 2023 to 2032.

Prebiotic Ingredients Market Growth Factors

The size of the prebiotic food and beverage application market is expected to increase by almost 6.5% over the expected time frame. Increasing health concerns and increasing demand for functional foods such as almonds, fruit juices and soybean can drive business development. These are commonly used in drinks like kefir for immune regulation and lowering cholesterol. Spreading and raising awareness of prebiotics as a dietary supplement ingredient. These two points serve as the main drivers of growth for this market. In recent years, the trend towards prebiotics has been to incorporate these ingredients into foods and beverages. This has resulted in prebiotic ingredients market being the largest food and beverage segment in 2022. Increased lactose intolerance such as gastric spasm, flatulence, nausea and gas diarrhoea will boost demand for prebiotics. Furthermore, since 2020, the COVID-19 outbreak had a beneficial impact on overall prebiotic component increase. Because of increased health awareness and consumer comprehension of prebiotic advantages, prebiotic ingredients are in high demand in the dietary supplement and food and beverage industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 10.08 Billion |

| Market Size by 2026 | USD 11.32 Billion |

| Market Size by 2035 | USD 31.75 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.16% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Source, Function, Geography |

Prebiotic Ingredients Market Segment Insights

Type Insights

Fructo-oligosaccharide

Plant sugars are joined in chains to form fructo-oligosaccharides. They're derived from Jerusalem artichokes, soybeans and asparagus or they're created in a lab. These sugars are used to produce medication. Fructo-oligosaccharides move into the colon undigested, where they increase intestinal bulk and encourage the growth of bacteria that are regarded to be healthy. They are made up of linear fructose units connected by beta (2-1) bonds. The amount of fructose units varies from 2 and 60, and they frequently end in a glucose unit. Small intestine glycosidase do not hydrolyse dietary FOS, therefore it reaches the cecum intact. The intestinal bacteria break them down into short-chain carboxylic acids, L-lactate, CO(2), hydrogen, and other metabolites. FOS has a number of unique characteristics, including a low sweetness intensity, as well as being calorie-free, non-cariogenic, and classified as soluble dietary fibre. Fructo-oligosaccharide consumption has been linked to a number of health advantages. Their consumption boosts immunity and enhances calcium, iron, zinc, and magnesium absorption in the large intestine.

Oligosaccharides that isn't carbohydrate-based

Non-carbohydrate oligosaccharides are low molecular weight carbohydrates, essentially between monosaccharide's and polysaccharides. Carbohydrates tend to meet the criteria of the definition of prebiotics but, some substances, such as cocoa-derived flavanols, are not categorised as carbs but are recommended to be classed as prebiotics. Non-carbohydrate based oligosaccharides are said to act as dietary fibres and prebiotics, and they have crucial physicochemical and physiological features. Different populations around the world suffer from one or more forms of neurodegenerative disease, and NDO may be an adjunct complementary therapy option for these oxidative diseases.

Galacto-oligosaccharides

GOS are currently synthesised utilising lactose as a substrate by glycoside hydrolases. The conversion of lactose to GOS by GH results in a mixture containing GOS with different degrees of unreacted lactose, polymerization (DP) and monosaccharides. Due to the existence of carbon and C-C and C-H covalent bonds, Galacto-oligosaccharides are an organic chemical like the other carbohydrates. GOS are crucial storage oligosaccharides in species that can synthesise them. For other organisms that cannot produce them due to the lack of genes specific to the required enzymes, Galacto-oligosaccharides is primarily used as a source of soluble dietary fibre.

Oligosaccharides Derived from Starch and Glucose

When compared to other more frequent carbohydrates which are referred as disaccharide category, oligosaccharides are carbohydrates that contains single sugar residue and are not as common in the diet. Any sugar macromolecule can be used to make oligosaccharides, but fructooligosaccharides and galactooligosaccharides have received the most attention.

Inulin

Inulin segment accounted largest revenue share 47% in 2023 and is expected to reach at a CAGR 10% from 2024-2034. Inulin a sort of water-soluble fiber discovered in lots of vegetation has been proven to assist with intestinal health. Inulin is also fructans. It's a prebiotic, like different fructans, which means it feeds the wholesome microorganism for your intestine. Fructose is made from a sequence of fructose molecules related collectively. The molecules bond together to prevent the small intestine from being broken down, they waft to the lower intestine, in which they nourish beneficial gut microorganism.

Application Insights

Based on Food and beverage application

The food and beverages segment accounted market share of around 72% in 2025. The benefits of prebiotics for stimulating a healthy intestine are well known. From controlling pathogens to increasing natural gut bacteria, prebiotics are everything. As prebiotic research advances, new applications emerge on a daily basis, providing consumers with more options for living a healthy lifestyle. The benefits of prebiotics for stimulating a healthy intestine are well known. From controlling pathogens to increasing natural gut bacteria, prebiotics are everything. As studies into the usage of prebiotics increases, new makes use of are introduced daily, giving clients extra alternatives for wholesome living. The marketplace is gaining prominence from new and rising prebiotics, such as probability of emergence of polyphenols, neo-agaro-oligosaccharides as prebiotics, and the effects of human milk oligosaccharides. A new examine has found out the probable fitness advantages of human milk oligosaccharides (HMOs) via influencing the intestine barrier and immune function.

Based on Dietary Supplements

The dietary supplement segment is estimated to experience the fastest CAGR, by volume, during the forecast period. Increased demand in the production of symbiotic and increased application to infant formula is expected to increase over the next 10 years. Over the projected period, the increased use of FOSin dietary fibres and their capacity to prevent gastrointestinal illnesses is expected to boost market demand. Food supplements, nutritional supplements, specialist nutrients, and infant formula are all types of prebiotics dietary supplements.

Infant Formula Insights

In 2025, the global market for baby infant formula surpassed USD 58.80 billion, with a readjusted size of USD 36350 million by 2035, with a CAGR of 3% over the review period, owing to the COVID-19 pandemic. Due to their considerable spending power, the middle class is the engine of development in many emerging economies. The global baby nutrition industry is predicted to grow due to changing lifestyles, female engagement in the workforce, a lack of time and inconvenience, and a low breastfeeding rate. Toddler baby formula is given to children from one to three years old, and it is also incorporated in the diets of young children. The segment benefits from a lack of acceptable alternatives, as only breast milk is a suitable substitute for conventional milk formula in China, Indonesia, India, Brazil, Philippines and other rising countries with a significant new-born population.

Animal Nutrition Insights

Animal nutrition is concerned with the dietary requirements of animals used in food production and agriculture, as well as zoos, aquariums and wildlife management. Increase in demand for safe and nutritious animal feed, restrictive use of antibiotics, and growing producer awareness of animal health are all propelling the animal nutrition market forward. With revenue exceeding USD 1325 million in 2023, China was one of the major regional markets for feed additives. Global rise in demand for animal-derived protein is expected to treble by 2050, according to the Food and Agriculture Organization.

Prebiotic Ingredients Market Regional Insights

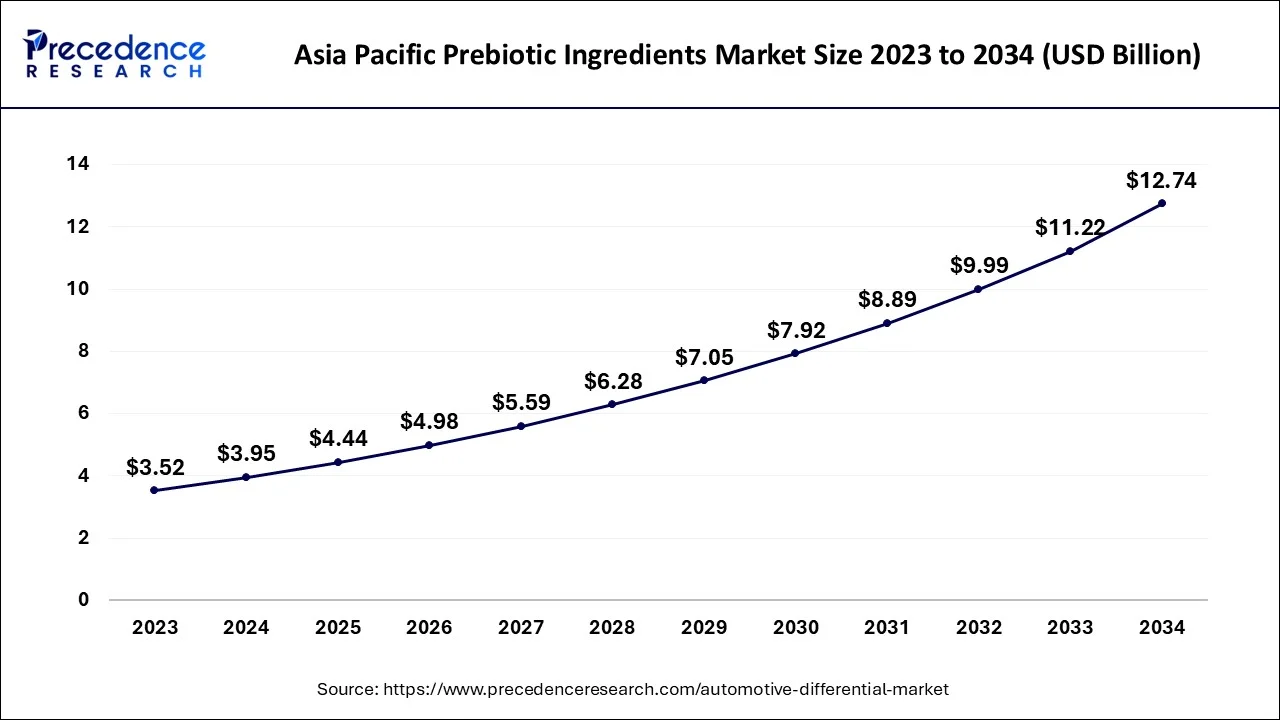

The Asia Pacific prebiotic ingredients market size is evaluated at USD 4.44 billion in 2025 and is predicted to be worth around USD 14.26 billion by 2035, rising at a CAGR of 12.38% from 2026 to 2035.

The Asia Pacific region dominated the prebiotic ingredients market and accounted largest revenue share 44% in 2025. North America region is expected to witness strong growth over the forecast period 2026 to 2035.

Asia Pacific dominated the prebiotic ingredients market with the largest share in 2025. This is mainly due to substantial production of food, beverage, and nutraceutical products, heightened awareness of digestive health, and increased demand for functional food products in China, Japan, India, and Southeast Asia. The ongoing development of innovative formulas designed to support gut health also contributes to the region's dominance.

China is a major contributor to the market. The country is leading the way in functional food production and ingredient innovation. The increasing consumer investment in products related to gut health also contributes to market expansion. Additionally, domestic manufacturing companies have established a dominant position in the market due to significant government investment in nutritional R&D initiatives.

North America continues to grow with the fastest CAGR as consumer interest in microbiome health rises and leads to more product adoption. The growth is further driven by ongoing innovation, an increasing number of academic and clinical studies related to prebiotics, and rising consumer demand for high-quality products supported by credible scientific research.

The U.S. is a major player in the market. The country has benefited greatly from a mature nutraceutical industry, along with extensive research on the gut microbiome and high consumption of functional foods. Continued growth is driven by product premiumization and increased use of technology to improve product formulation.

Europe is experiencing strong growth in the market due to increased consumer interest in functional food ingredients, consumer preferences for fiber-fortified products and foods, and the rising use of prebiotic ingredients in Western and Northern European countries. The current trend of “CLEAN LABEL” and sustainability initiatives is likely to support the increased use of prebiotic ingredients across Western and Northern European countries.

Germany leads the market due to its robust food manufacturing infrastructure and the German consumers' strong preference for natural digestive health products. Germany's solid regulatory framework, which emphasizes the quality and safety of food products, has supported the rapid growth of prebiotic ingredients in the country.

Europe's Digestive Revolution: Driving Growth in the Prebiotic Ingredient Market

Europe remains an established and innovative market for prebiotic ingredients companies due to the high level of consumer knowledge and the presence of strict regulations. Countries like Germany, France, and the Netherlands are leading the charge when it comes to microbiome research and the development of functional foods.

In addition, the demand from consumers for clean-label food products, plant-based foods, and solutions that reduce sugar consumption is driving up the usage of prebiotic ingredients in bakery items, dairy alternatives, and supplements. The level of consumer confidence in Europe in foods that have science-based evidence related to the health of the digestive system is also high.

The prebiotic ingredients market in the Middle East & Africa (MEA) is growing due to rising interest in digestive health and the increasing demand for fortified food and beverages. As consumer awareness of healthcare improves, knowledge of functional ingredients is increasing, driving market growth. The UAE is leading the market, with strong import capabilities, rapid growth in functional food offerings, and high consumer interest in wellness products. The growing consumer preference for premium nutrition is also expected to further boost the demand for prebiotic products.

The Prebiotic Ingredients Market in Latin America continues to develop rapidly as health consciousness continues to rise, the number of urbanized populations increases, and a new middle class is formed. Countries like Brazil, Mexico, and Argentina are experiencing an increase in functional dairy products, fortified beverages, and supplements that contain prebiotics

.

Food manufacturers in these countries are reformulating existing products to include ingredients based on natural fibers, along with increasing support from the government for preventive healthcare to enhance the growth of the prebiotic ingredient market in Latin America.

Value Chain Analysis

- Raw Material Procurement: Sourcing chicory root, lactose, and sugar from farmers and cooperatives for the production of plant- and dairy-based feedstocks at a volume sufficient to track and ensure consistent quality.

Key Players: Benew (Orafti), Coscura, Sensuso, Royal Cosun, and Cargill. - Raw Material Processing: Plant processing facilities extract the inulin, FOS, and GOS through enzymatic and mechanical separation processes, as well as refine, concentrate, and standardize the ingredients for sale.

Key Players: Roquette, Benweno, Coscura, and Cargill. - Contract Manufacturing and Product Supply: Contract development and manufacturing organizations (CDMOs) and co-packers are responsible for scaling up the production of prebiotic blends into finished product forms (capsules, gummies, powders, and infant formula) and oversee packaging, quality assurance, and regulatory compliance.

Key Players: Lonza (Capsugel), Catalent, Glanbia Nutritionals, and NutraScience Labs. - Distribution and Sales Support: Ingredient distributors and brokers handle B2B sales, warehousing, shipping, regulatory compliance, and provide technical support for food and supplement companies.

Key Players: Brenntag, Univar Solutions, Ingredion (distribution arm) and Sensus - Raw Material Sourcing and Processing: Prominent companies like Beneo and Cosucra focus on sustainable sourcing and utilize new technologies for extraction to achieve consistent quality and functionality for their products.

- Ingredient Development and Innovation: Companies like Ingredion and Tate & Lyle dedicated a significant amount of time and resources researching new methods to deliver specific prebiotic-type products that address challenges in reducing sugar content, increasing fibres, and improving better texturing of food.

- Distribution & End-Use Integration: Prebiotic products are generally provided to food manufacturers, supplement manufacturers, and infant feed companies through a global distribution network, therefore allowing a company to grow rapidly while remaining compliant with regulations across borders.

Prebiotic Ingredients Market Companies

- Cargill, Incorporated

- Jarrow Formulas, Inc.

- BENEO GmbH

- Royal Cosun

- Cosucra Groupe Warcoing SA

- Nexira

- Yakult Honsha Co.Ltd.

- Prenexus Health

Key Market Developments

- Tereos SA established an R&D centre in Singapore in 2018, offering innovative solutions to the Asia-Pacific food sector and using the group's vast product portfolio to meet regional demand for noodles, bakery items, confectionary, teas, sauces, snacks, and beverages.

- Because 70 percent of immune cells are present in the gut, the COVID-19 pandemic has caused a shift in consumer food behaviour, with 56 percent of European consumers linking prebiotics with immune wellness. Furthermore, firms such as Kellogg's are diversifying their gut-health portfolios with the introduction of new prebiotic cereals, paving the door for more prebiotic ingredient expansion post-COVID-19. With 70% of immune cells present in the intestine, the COVID-19 pandemic promotes dietary changes in consumers, with 55% of European consumers linking prebiotics to immune health. In addition, companies like Kellogg have diversified their gut health portfolio with the launch of new prebiotic cereals, paving the way for further expansion of prebiotic components after COVID-19.

- According to Census, 328 new products were introduced to the European confectionery market last year, with labels showing oligofructose, chicory root fiber, or inulin. The UK accounted for 11% of these launches. Increasing acceptance of dietary supplements among the elderly and increasing prevalence of lifestyle problems are driving the European dietary supplement industry. To address health issues, healthcare professionals in the region provide patients with dietary supplements containing prebiotic ingredients. Rising urbanisation and change in lifestyles of consumers are driving the bakery business. Over the last two decades, there has been a significant transformation in worldwide lifestyles and eating patterns. Emerging nations in Central and South America, as well as Asia Pacific, are proving to be lucrative markets for baked products.

Prebiotic Ingredients MarketSegments Covered in Reports

By Type

- Fructo-oligosaccharide

- Oligosaccharides that aren't carbohydrate-based

- Galacto-oligosaccharides

- Oligosaccharides Derived from Starch and Glucose

- Insulin

- Others

By Application

- Food and Beverage

- Dietary Supplements

- Infant formula

- Animal Nutrition

- Ruminant

- Poultry

- Swine

- Aquaculture

- Other

By Source

- Roots

- Grains

- Vegetables

By Function

- Gut Health

- Bone Health

- Immunity

- Heart Health

- Weight Management

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting