Application Development Software Market Size To Rise USD 328.3 Bn By 2032

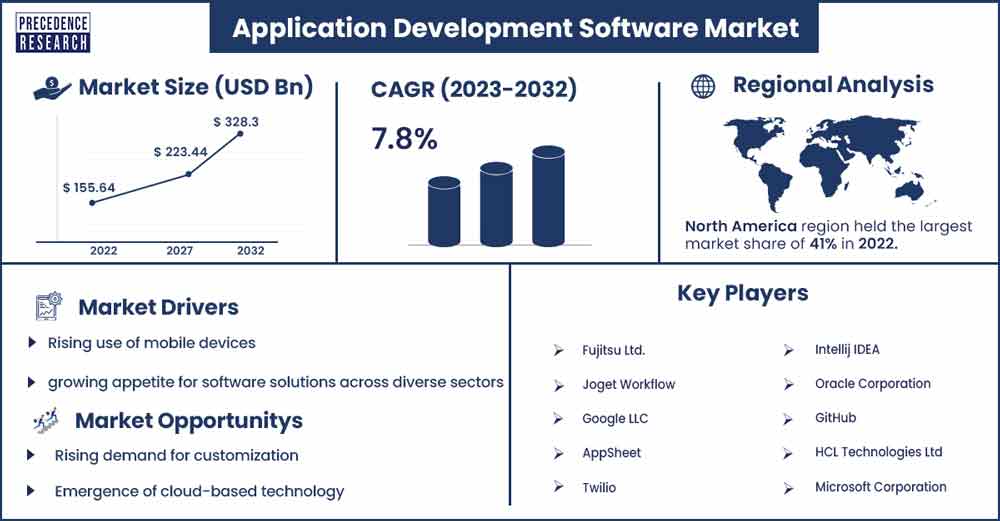

The global application development software market size surpassed USD 155.64 billion in 2022 and is projected to rise to USD 328.3 billion by 2032, anticipated to grow at a CAGR of 7.8 percent during the projection period from 2023 to 2032.

Market Overview

The procedures involved in designing, creating, installing, using, and maintaining computer software are collectively referred to as application development software. It is common for computer programmers to do this. Computer software is a collection of instructions or commands that tell a computer to perform different tasks, including word processing or web surfing apps. It is distinct from hardware. Either a single independent developer or big companies with significant teams working on projects may accomplish it. Application development outlines the procedure for creating an application and often adheres to a set approach.

Experts in the industry projected that by 2024, there will be 500 million downloads of mobile apps per day. By the end of that year, there will have been 184 billion app downloads, double that of 2020. Furthermore, secondary data analysis indicates that worldwide user spending on mobile applications on Google Play and Apple's App Store will increase significantly in the upcoming years.

The global application development software market is driven by several factors including the growing digital transformation, growing adoption of cloud computing, rising technological advancements, rising smartphone usage and others. In addition, the market growth is also propelled by the growing demand for mobile apps.

According to Oberlo, there will be 5.25 billion smartphone users worldwide by the end of 2023, a rise of 4.9% per year. Additionally, it represents a 98% increase from the 2.6 billion smartphone users in 2016, which was only seven years ago.

According to buildfire, an average smartphone user utilizes their gadget for three hours and ten minutes per day. Roughly 90% of smartphone usage is accounted for by applications, thus 2 hours and 51 minutes are spent using them.

Regional Insights

North America is expected to dominate the market over the forecast period. The region is home to a robust technological ecosystem, with major technology hubs in Silicon Valley (California), the Pacific Northwest, and the Northeastern United States. These areas are hubs for innovation, drawing in both new and well-established tech firms that depend on application development software.

- In October 2023, the world's top supplier of corporate open-source solutions, Red Hat, and Mendix, a Siemens company, announced their partnership. Mendix and Red Hat OpenShift will work together to combine the scalability and flexibility of Red Hat OpenShift with the agility and speed of the Mendix low-code platform, enabling enterprises to confidently embrace digital transformation.

In the region, the United States and Canada have some of the highest smartphone penetration rates in the world, and the demand for mobile app development tools remains strong.

- The United States witnessed a 47% increase in online traffic from mobile devices. With over 116 million iPhone users, Apple is the most popular smartphone in the United States. Therefore, this is expected to propel the market growth in North America in the upcoming period.

Application Development Software Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 167 Billion |

| Projected Forecast Revenue by 2032 | USD 328.3 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.8% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising use of mobile devices

One of the main factors driving the rise of mobile application development is the expansion of platforms for developing mobile applications in the business sector. Smartphones are used by businesses to improve customer service and maintain strong contact with suppliers and consumers. They also promote productivity, mobility and safety for staff members. Employees may now operate effectively and remotely due to this. The need for mobile apps is driven by the growing requirements of companies and the growth in the use of mobile phones in the commercial sector. As a result, the market for software used to create mobile applications is expanding along with the number of mobile devices.

Digital transformation

Organizations across various industries are undergoing digital transformation initiatives to remain competitive and meet the evolving needs of their customers. Application development software is crucial for building and updating digital solutions. For instance, according to the World Economic Forum, digital transformation is expected to bring $100 trillion to the global economy by 2025. Furthermore, it is anticipated that by 2025, platform-driven interactions will allow about two thirds of the $100 trillion in value that digitization holds.

Restraints

Growing cost and technical difficulties

Despite this, the market for developing mobile applications is expanding quickly. The market expansion is being hampered by rising prices and technological challenges in the mobile application development platform. Even with the use of a mobile application development platform, creating a mobile application is a difficult process that requires a high degree of technical expertise. The corporations are being forced to invest in third-party developers due to the technological challenges involved in producing the apps. Thus, this is expected to hamper the market growth.

Security concerns

Security is a significant concern in application development. As the sophistication of cyber threats increases, developers must prioritize security, which can slow down the development processes. Therefore, security concerns might be impacting the growth of the market over the forecast period.

Opportunities

Emergence of cloud-based technology

The development of mobile apps will heavily rely on cloud technologies. App developers will need to concentrate on making their apps compatible with many devices, as the use of wearable technology and numerous mobile devices increases. With the help of cloud techniques, developers will be able to create apps that have the same features, functionalities, and data across many devices.

Furthermore, mobile app developers may launch their apps concurrently on several platforms, such as IOS and Android, by utilizing cloud technology, since the programs would function flawlessly on both. Additionally, there will be less work for application developers, which facilitates wider adoption and easier implementation.

Expansion of machine learning

The general population has been exposed to machine learning (ML) as a disruptive technology that is affecting several commercial areas. Applications of practical machine learning include personalized suggestions and advertisements, speech and picture recognition, chatbots and virtual assistants, fraud detection software, self-driving automobiles, and predictive analytics. As could be expected, more businesses desire to leverage machine learning (ML) technology by integrating it into their operations. Thus, the expansion of machine learning is expected to propel the market growth during the forecast period.

Recent Developments

- In October 2023, Open-source software usage was the subject of the most recent survey conducted by Perforce Software, a company that offers solutions to corporate teams that need to be productive, visible, and scalable across the development lifecycle. In addition to the Open Source Initiative (OSI), which is taking part in the survey for a third year, this year marks the first year of partnership with the Eclipse Foundation. To guarantee a more thorough representation of open-source users across communities, the Eclipse Foundation has been included, and cooperation with OSI has been maintained.

- In October 2023, the business that develops enterprise AI application software, C3 AI, stated that Shell's predictive maintenance software is now part of the C3 AI Reliability application. Because the two businesses work closely together, Shell's predictive maintenance technology will continue to operate on C3 AI Reliability. In addressing global business data, automation, and usability concerns, Shell has worked with C3 AI to build cutting-edge models and application functions that predict maintenance needs for control valves and key equipment. To further establish C3 AI Reliability as the industry standard for predictive maintenance, C3 AI will now include this predictive maintenance technology into the C3 AI Reliability application and make it accessible to other customers.

- In April 2023, the long-term collaboration between Siemens Digital Industries Software and IBM is being extended through the development of a unified software solution that combines the two companies' products for asset management, service lifecycle management, and systems engineering.

- In May 2023, the AI-powered next-generation composable software creation platform, Builder.ai, which is so easy to use and accessible that anybody can convert their ideas into software, announced a strategic partnership with Microsoft that includes a financial investment in Builder.ai. The two organizations will work together to build AI-powered solutions that enable enterprises to create applications and become digital natives without requiring any technical knowledge.

Major Key Players

- Fujitsu Ltd.

- Joget Workflow

- Google LLC

- AppSheet

- Twilio

- Intellij IDEA

- Oracle Corporation

- GitHub

- HCL Technologies Ltd

- Microsoft Corporation

- SAP SE

- Datadog Cloud Monitoring

- zoho corporation

- Wipro Ltd.

Market Segmentation

By Deployment Mode

- On Premise

- Cloud

By Platform

- Low Code Development Platforms

- No Code Development Platforms

By Enterprise Size

- Large Enterprise

- Small and Medium-Sized Enterprise (SMEs)

By Industry Vertical

- Travel and Tourism

- BFSI

- Media and Entertainment

- IT and Telecom

- Healthcare

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3280

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333