Automotive Air Suspension Market Projected to Accelerate Through 2034

Automotive Air Suspension Market Size, Demand and Trends Analysis

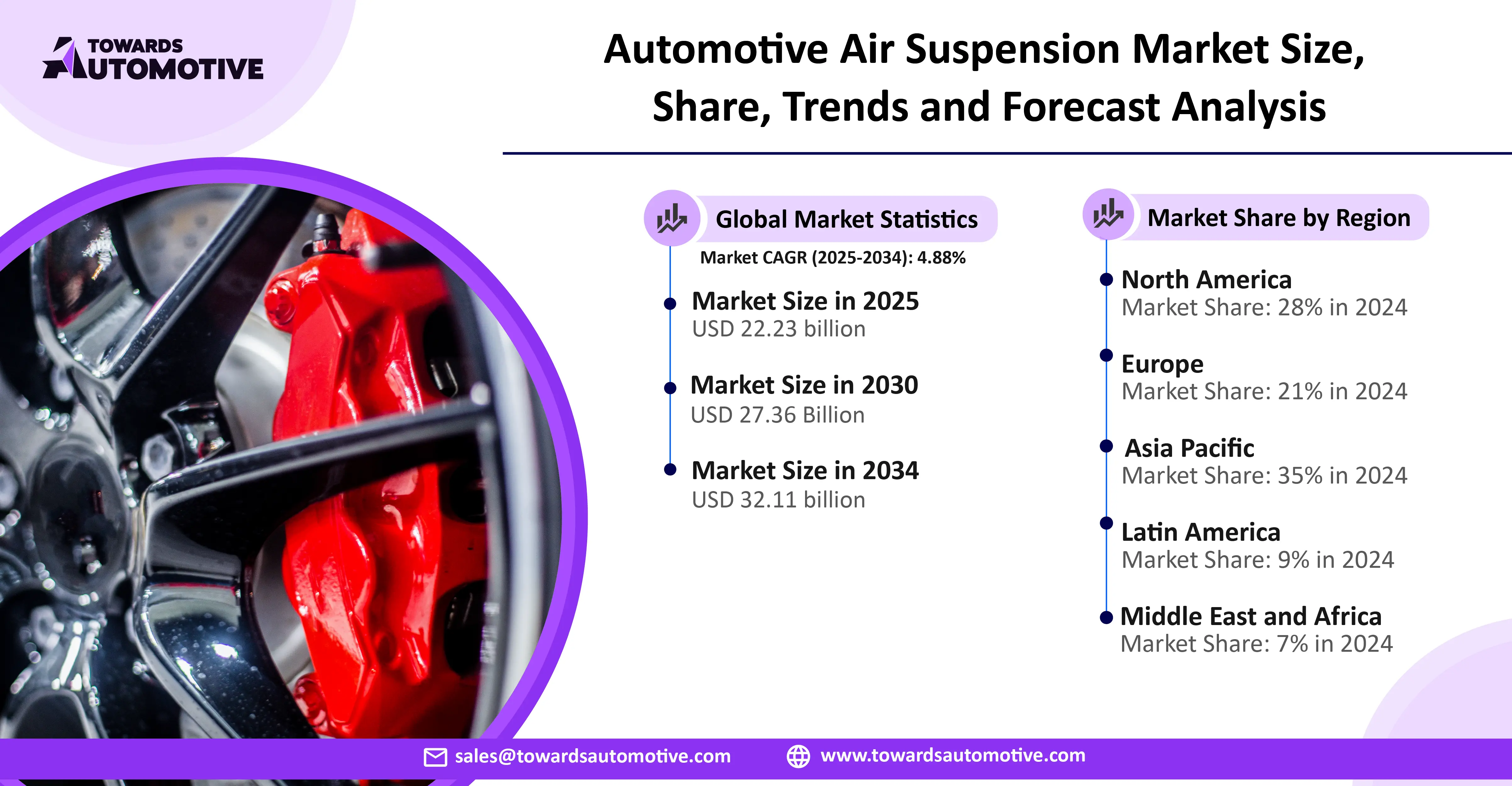

The global automotive air suspension systems market is anticipated to grow from USD 22.23 billion in 2025 to USD 32.11 billion by 2034, with a compound annual growth rate CAGR of 4.88% during the forecast period from 2025 to 2034. This market is rising due to increasing demand for enhanced ride comfort, vehicle safety, and advanced suspension technologies in luxury cars, electric vehicles, and commercial fleets.

Global Outlook

The worldwide automotive air suspension market is expected to experience strong growth as premium SUVs, electric vehicles, and high-mileage commercial fleets are prioritizing ride comfort, load levelling, and safety. The better electronically controlled air springs, compact compressors, and smart ECUs can react faster and are significantly more durable, and efficient is taking us further away from those concerns. Meanwhile, lightweight materials are very helpful for OEMs who have emissions and range and payload targets to achieve.

Demand is increasing in Europe and North America with luxury applications and stability regulations. In the Asia Pacific region, and especially China and India, urban logistics and e-commerce are igniting demand. With aftermarket upgrades on pickup trucks, vans, and motorhomes, are considered a form of recurring revenue continuously improving by utilizing connected diagnostics and predictive maintenance. Increasingly, Tier-1 suppliers are partnering with software companies to provide over-the-air tuning, and integrating with ADAS.

Market Opportunity

Shift in Consumer Demands

Opportunities have been increasing in the automotive air suspension market as the demand for luxury comfort, vehicle safety, and smart mobility continues to grow. The increased penetration of luxury passenger cars and electric vehicles presents a strong opportunity since air suspension systems improve all-around efficiency of driving, stability, and dynamics of driving. Increased penetration in commercial fleets, especially in the logistics and long-haul transport industry, represents a significant opportunity to reduce driver fatigue and increase load bearing capabilities.

Rapid urbanization in Asia-Pacific and supportive government initiatives for sophisticated mobility capabilities will spur demand for this technology. In addition, the aftermarket segment is strong, as companies continue to invest in strong customization and performance upgrades. The use of IoT is sparking interest in the market and is being discussed as integrated with air suspension, as is the discussion of using AI-driven predictive maintenance and autonomous driving platforms. Thus, air suspension is positioned to be an important enabler of next-generation automotive development.

Key Growth Factors

Increased Demand for More Comfort, Ride quality, and Comfort Features is Increasing the Popularity of Air Suspension Systems.

With manufacturers expanding their product offerings for EV and Hybrid vehicles, the trend has affected the traditional heavy-duty truck market by making vehicles lighter with energy efficient systems, which increases vehicle range, stability, ride and efficiency.

Air suspensions will make all types of loads more effective and increase wear on the trailer floor reducing maintenance costs and promoting safety in long-haul operation.

Continuous advancements in electronic air springs and ECU (electronic Control Units) including better opportunities for AM of maintenance such as IoT diagnostic tools for the use of predictive maintenance to improve safety.

Increasing government regulations for fuel consumption, batter efficiency, vehicle stability and emissions assist with the value added for more advanced suspension solutions.

Growing aftermarket and vehicle modification market for trucks with air suspensions and expanding comfort by upgrading air suspension adds to the overall vehicle refurbishment market.

Restraint

High Initial Cost

While the automotive air suspension market has a favorable outlook, it is not without many restraints that are likely to impede an accelerating the deployment of adoption across segments. The primary restraint is the high initial cost of air suspension systems, as contemporary air suspension is always more expensive than just a coil or leaf spring system. This makes it less attractive to a budget buyer and also has a negative impact on mass-market vehicles. Then there are the complex designs, and maintenance considerations. The number of times you are expected to service the equipment, not to mention how many times you may need to replace your compressor, sensors, or air springs, all of which may increase the cost of ownership.

Geographical Outlook

Germany

Germany has the largest automotive air suspension market due to the strength of its luxury car sector, strong engineering background, and major OEMs such as BMW, Audi, and Mercedes-Benz. As a leading market for high-performance vehicles with strict safety regulations, strong adoption of electronic suspension systems, and a large focus on air suspension applications, Germany’s market position and innovation stream are strong.

United States

The United States is showing solid demand for automotive air suspension systems over the next decade largely in part to a rise in SUV demand, rising pickup truck usage, and aftermarket continued modifications. Increased adoption of advanced driver assistance systems (ADAS) and increased demand for comfort upgrades and safety enhancements by consumers will continue to drive the expansion of the automotive air suspension systems market. Fleet operators prefer air suspension for logistics purposes as air suspension can enhance overall fuel efficiency and performance in long hauls throughout the country.

China

China is the fastest growing market for automotive air suspension based on rapid urbanization and development of the government’s electric vehicle agenda, and very high production volumes with strong government support in the area of smart mobility. Local OEMs are adopting air suspension at high rates into EVs (electric vehicles) luxury sedans, and premium SUVs. The country has rapid expansion and adoption towards logistics network systems, increasing disposable incomes, and an increasing demand for customization from the after-market segment will lead to China being the key driver for future adoption and expansion.

Strategic moves by key players

On June 5, 2025, ZF's Commercial Vehicle Solutions division started series production of its fifth-generation Electronically Controlled Air Suspension (OptiRide ECAS). The system consolidates the solenoid valve and pressure sensors into a compact "Smart Pneumatic Actuator," streamlining integration while enabling chassis lift/lower functions for better loading and ride comfort. It's being deployed in Hyundai buses and will also be used in the XCIENT truck model.

On September 9, 2024, DENSO unveiled plans to invest approximately ¥69 billion to build a next-generation, largely unmanned smart factory by expanding its Zenmyo Plant in Nishio City. Construction is set to start in early FY2025 and conclude by January 2027, with mass production slated for H1 FY2028. The plant will focus on high-volume production of integrated ECUs, pivotal for electrification and ADAS systems.

Source: https://www.towardsautomotive.com/insights/automotive-air-suspension-systems-market-size