Automotive Electronic Control Unit Market Size and Forecast 2025 to 2034

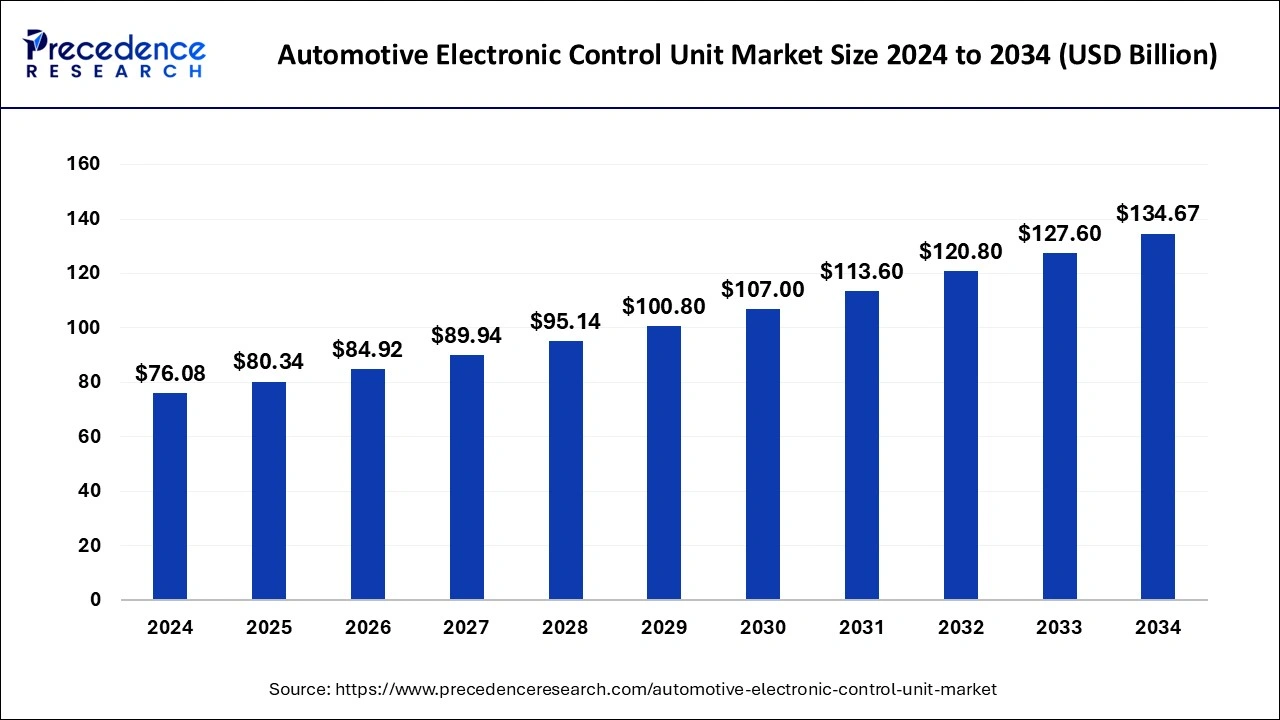

The global automotive electronic control unit market size was estimated at USD 76.08 billion in 2024 and is anticipated to reach around USD 134.67 billion by 2034, expanding at a CAGR of 5.87% from 2025 to 2034.

Automotive Electronic Control Unit Market Key Takeaways

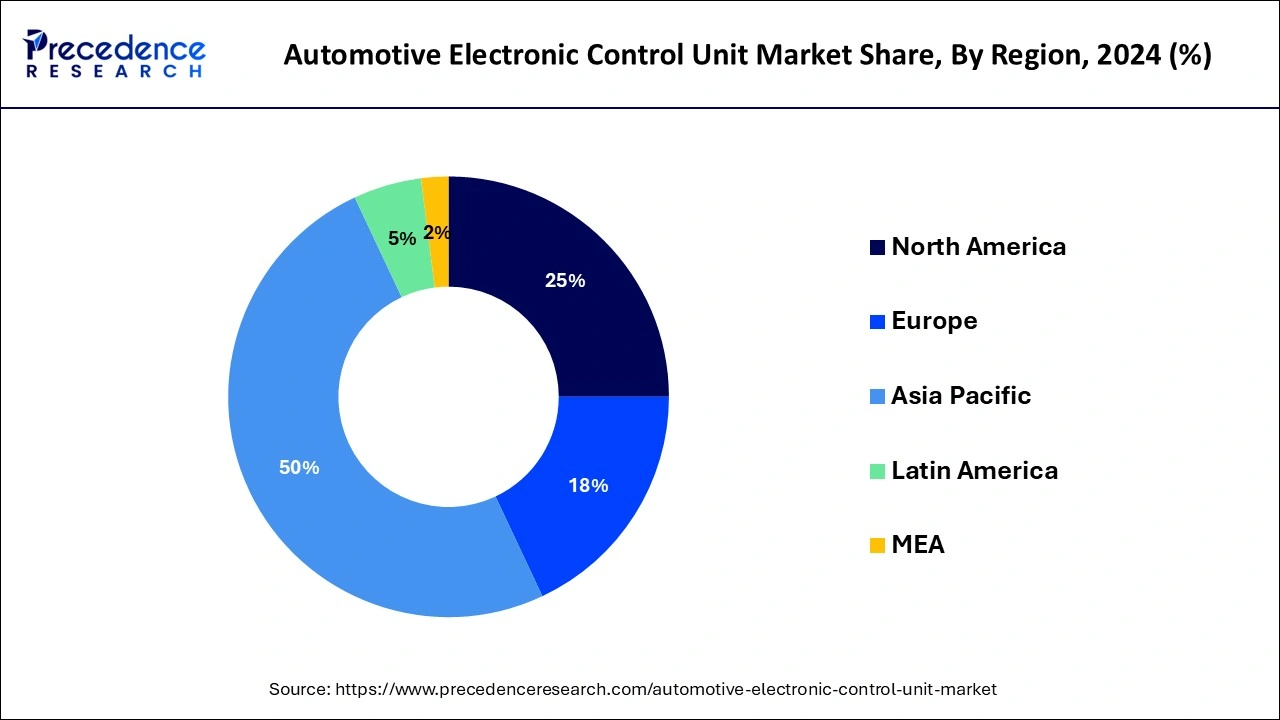

- Asia Pacific led the global market with the highest market share of 50.14% in 2024.

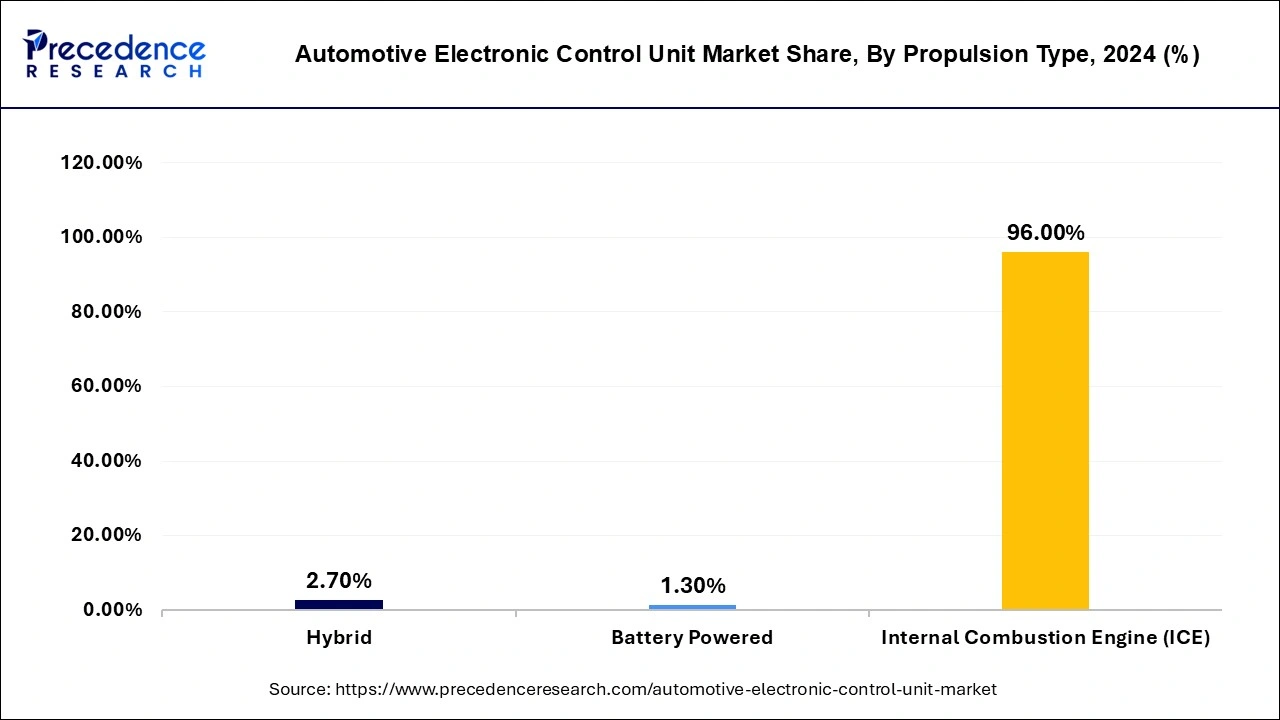

- By Propulsion Type, the Internal Combustion Engine (ICE) segment has held the largest market share of 96% in 2024.

- By Propulsion Type, the hybrid vehicles segment is anticipated to grow at a remarkable CAGR between 2024 and 2034.

- By Vehicle Type, the Passenger cars segment generated over 88% of revenue share in 2024.

- By Application, the ADAS & safety system segment had the largest market share of 35% in 2024.

- By Application, the Infotainment segment is expected to expand at the fastest CAGR over the projected period.

AI in the Market

Artificial intelligence is transforming the automotive ECU market, making it safer, more efficient, and based on user experiences. AI driver-assistance systems watch the surroundings, identify hazards, and intervene, thus reducing the risk of accidents. AI is used in aerodynamics, energy management, and diagnostics so that cars can be more fuel-efficient and subjected to predictive maintenance. Driver experiences become personalized through adaptive settings from infotainment to navigation. On the manufacturing side, AI optimizes plant layouts, anticipates mishaps, and rationalizes supply-chain developments. It cuts from quality control down to warranty expenses-never LOIP-analyzing customers' preferences.

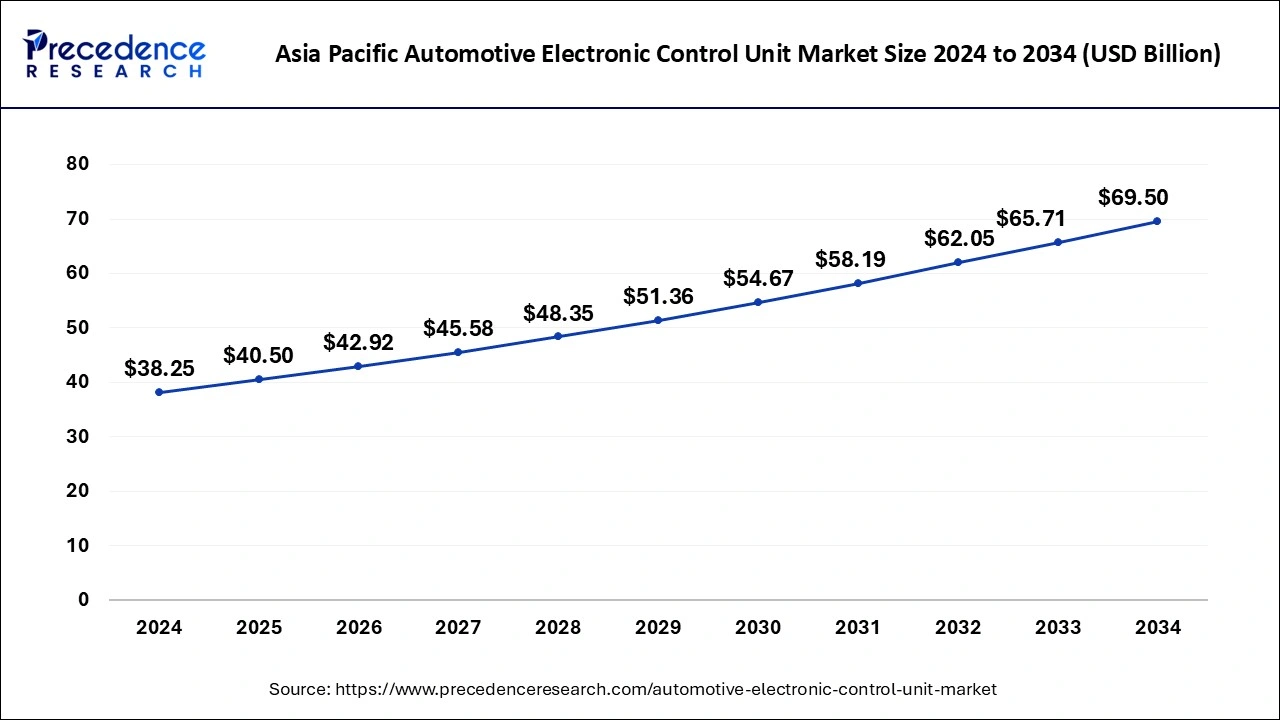

Asia Pacific Automotive Electronic Control Unit Market Size and Growth 2025 to 2034

The Asia Pacific automotive electronic control unit market size was exhibited at USD 38.25 billion in 2024 and is projected to be worth around USD 69.50 billion by 2034, growing at a CAGR of 6.15% from 2025 to 2034.

The Asia Pacific emerged as the global leader in the global automotive ECU and accounted for more than half of the overall revenue share in 2024. In addition, the region poised to grow at the fastest growth rate over the forecast period. The significant growth of the region is primarily due to rising demand for in-vehicle communication and infotainment applications in passenger vehicles.

Moreover, the rapid growth of China in the market is mainly driven by the significant growth of automotive industry in the country that offers ample opportunity for the incorporation of ECU in the new vehicles. Increasing population along with the rising disposable income again triggered the growth of automotive ECU in the region.

- According to the report published by the India Brand Equity Foundation (IBEF), in the first quarter of 2023-24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was 6.01 million units.

- In June 2023, General Motors Co. announced its plan to invest USD 632 million in Fort Wayne Assembly to prepare the plant for the production of the next-generation internal combustion engine (ICE) full-size light-duty trucks. This investment will enable the company to strengthen its industry-leading full-size truck business.

Automotive Electronic Control Unit Market Growth Factors

- ECU demand is principally driven by the increased adoption of advanced driver-assistance systems and autonomous driving technologies.

- The fast-growing trend of electric vehicles is providing impetus for sophisticated ECUs to efficiently control systems.

- Another factor contributing to market growth is the increasing integration of V2V communication and connected car features.

- OEM collaboration in ECU consolidation will bring reduced vehicle weight, space saving, thus improving fuel efficiency.

- Continuing innovation in ECU systems depends upon growing consumer demand for fuel-efficient, safe, and highly technological cars.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 76.08 Billion |

| Market Size in 2025 | USD 80.34 Billion |

| Market Size by 2034 | USD 134.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.87% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Value Chain Analysis

- Raw Material Procurement: The process whereby unprocessed or semi-processed materials like steel, plastics, and various electronic components are sourced from suppliers and used in manufacturing.

Key players: Robert Bosch GmbH, Continental AG

- Component Manufacturing (Engines, Transmissions, etc.): Proceeding with the manufacture of larger, complex finished parts from raw materials and sub-components, such as engines and transmissions, for assembly into the final product.

Key players: DENSO Corporation, ZF Friedrichshafen AG

- Vehicle Assembly and Integration: This process mounts all manufactured components and sub-systems, including the ECU, upon a single chassis to fabricate the complete finished vehicle.

Key players: Friedrichshafen AG, Denso Corporation, Aptiv, and Hitachi Astemo

- Testing and Quality Assurance: Ensuring the vehicle undergoes systematic inspection and validation concerning each attribute, including electronic systems, to make sure all safety, performance, and reliability criteria are met.

Key players: Robert Bosch, Continental, Denso, and Aptiv

- Retail Sales and Financing: The vehicles are sold directly to the end-users on a retail basis through dealerships, who, in many cases, assist the consumers in arranging loans or any other form of financial services to enable the purchase.

Key players: Bosch, Continental, Denso, ZF Friedrichshafen, and Aptiv

Propulsion Type Insights

Internal Combustion Engine (ICE) vehicles led the global automotive electronic control unit (ECU) market with significant revenue share proportion in the year 2024, accounting for nearly 96%. Further, the segment expected to dominate the overall automotive ECU market during the forecast period. This is majorly attributed to the rising production of ICE vehicles across developing countries especially in China and India. However, the segment projected to exhibit minimal growth rate over the analysis period due to increasing penetration of electric and hybrid vehicles.

Hybrid vehicles anticipated to flourish prominently with remarkable CAGR over the forecast period owing to low carbon emission, enhanced fuel efficiency, and extended driving range. On the contrary, battery-powered vehicle encountered the fastest growth in the coming years. The segment growth is mainly because of the increasing government initiatives to control pollution along with rising consumer awareness for energy-efficient vehicles.

- In July 2024, Toyota unveiled a new and in-development internal combustion engine (ICE) that the company itself calls a “game-changer". These 1.5-litre and 2.0-litre four-cylinder engines are designed to be much more efficient than current offerings.

Vehicle Type Insights

Passenger cars is the most promising segment that dominated the global automotive ECU market and likely to expand at an attractive CAGR during the forecast period. The passenger cars segment accounted for around 88% of the revenue share in the overall market in the year 2023. Besides this, the global automotive industry witness a shift in consumer preference for hybrid and luxury vehicles with advanced safety and electronic features. Luxury vehicles seek high implementation of ECUs x compared to other vehicles owing to high demand for advanced features supporting their vehicle management systems. On an average, 15-20 ECUs are deployed in a standard car whereas the number of ECUs crosses 100 in a premium or luxury cars. Rise in purchasing power along with improved lifestyle has triggered the growth of premium luxury cars.

- According to the Society of Indian Automobile Manufacturers (SIAM), the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycle in April 2023 - March 2024 was 2,84,34,742 units. Passenger vehicle sales were 42,18,746 units in April – March 2024. From April 2022 to March 2023, passenger vehicle exports increased from 5,77,875 to 6,62,891 units.

Application Insights

Automotive ECUs are used in various applications that include powertrain electronics, chassis electronics, ADAS &Safety System, infotainment systems, and others. ADAS & safety system application led the global automotive ECU market accounting for a revenue share of around 35% in the year 2023. It includes monitoring and control features such as LDW, ABS, AEB systems, Tire Pressure Monitoring System (TPMS), blind-spot detection, and Electronic Stability Control (ESC).

On the other hand, Infotainment application predicted to emerge as the rapidly growing segment during the forecast period. The prime factor driving the growth of the segment is increasing demand for in-vehicle infotainment systems. In addition, luxurious cars or smart vehicles incorporate advanced ECUs that provide a combination of both information and entertainment to offer enhanced in-vehicle experience.

Automotive Electronic Control Unit Market Companies

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Delphi Technologies

Recent Developments:

- In November 2024, Marelli introduced the VEC_480, an advanced Electronic Control Unit supporting real-time AI applications for motorsport vehicles, enhancing computational performance and enabling complex functions like neural virtual sensors, predictive analysis, and real-time video processing.

- In February 2025, TDK Corporation announced the expansion of the ADL4532VK series of wire winding inductors for automotive power-over-coax (PoC). Advanced driver-assistance systems (ADAS) are specifically designed to enhance vehicle safety by using automotive cameras and sensors that monitor the driving environment. These systems rely on multiple cameras, typically installed at the rear, front, and sides of the vehicle, to capture real-time imagery for safe and secure driving.

- In January 2025, Tata Elxsi, Inc. collaborated with Qualcomm Technologies, Inc. to develop and leverage virtual models of Snapdragon Digital Chassis solutions for cloud-native application development. Through the intended technology partnership, Tata Elxsi will develop a virtual electronic control unit (ECU) platform for automakers and Tier-1 suppliers using Snapdragon virtual system-on-chips (VSoCs) for the next generation of mobility solutions for passenger, commercial, and off-highway vehicle segments.

Segments Covered in the Report

By Propulsion Type

- Hybrid

- Battery Powered

- Internal Combustion Engine (ICE)

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Capacity

- 64-Bit

- 32-Bit

- 16-Bit

By Application

- Body Electronics

- ADAS & Safety Systems

- Infotainment

- Powertrain

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting