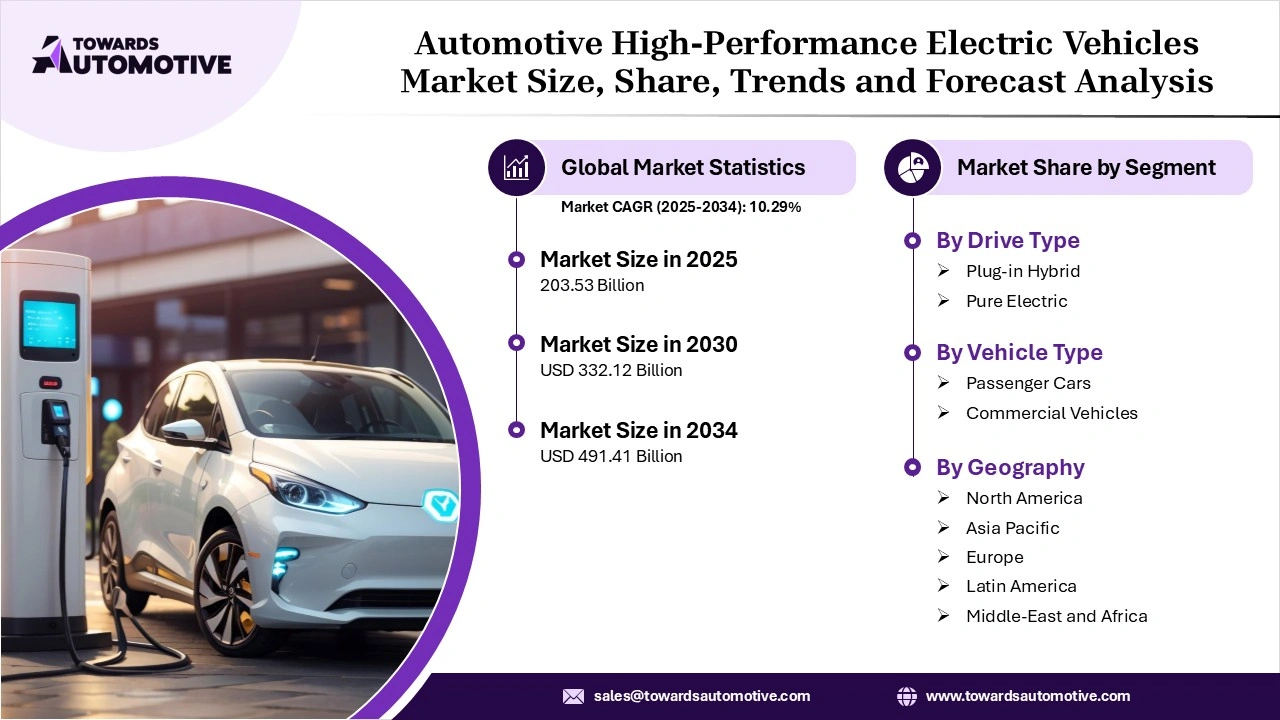

Automotive High-Performance Electric Vehicles Market to Reach $491.41 Billion by 2034

The automotive high-performance electric vehicles market is projected to reach USD 491.41 billion by 2034, growing from USD 203.53 billion in 2025, at a CAGR of 10.29% during the forecast period from 2025 to 2034.

Global Outlook

Ongoing reductions in battery pack costs, swift spread of 800 V platforms, and an emergence of tri- and quad-motor models set the stage for continuous double-digit growth in the high-performance EV market. Consumer fascination with cars that offer both near-silent performance and supercar-level acceleration is bolstering premium pricing strength, as governments utilize zero-emission regulations and purchase incentives to stimulate demand.

Market Opportunity: Technological Advancement Expanding the Market

Technological progress in battery technology, charging infrastructure, and powertrain systems are crucial factors propelling the Automotive High-performance Electric Vehicle Market. Advancements like rapid charging options and improved energy storage solutions allow for extended driving distances and quicker charging periods, increasing the attractiveness of high-performance EVs for buyers. Industry pioneers are persistently developing state-of-the-art battery technologies, lightweight materials, and sophisticated driver-assistance systems to boost vehicle efficiency and safety.

Key Growth Factors

The Automotive High-performance Electric Vehicle Market is witnessing considerable expansion fueled by an increasing need for eco-friendly transportation options. Shifts in consumer preferences for environmentally-friendly choices are driving manufacturers to create and develop electric vehicles (EVs) with improved performance features.

Tighter governmental rules regarding emissions are greatly driving the Automotive High-performance Electric Vehicle Market. Laws designed to cut greenhouse gas emissions are motivating car manufacturers to innovate and create more electric vehicles.

Market Restraint: High Costs Impeding the Market Growth

A significant obstacle related to the adoption of EVs is the upfront expense of electric vehicles. The declining prices of batteries demonstrate that EVs are typically much more expensive than vehicles with conventional gasoline internal combustion engines. This explains the significantly elevated price of EVs primarily due to the expensive batteries employed to operate the vehicle. Potential buyers are nonetheless put off by the elevated price tags linked to vehicles.

Segmental Outlook

By Drive Type

Pure electric segment dominated the market in 2024, due to their immediate torque, smoothness, and quiet functioning, resulting in better driving dynamics than conventional internal combustion engine (ICE) vehicles. Additionally, improvements in battery technology and strong, efficient electric motors facilitate high-performance uses, while the absence of a transmission and other internal combustion engine parts permits a more straightforward and powerful power delivery, boosting performance traits.

Plug-in-hybrid segment is observed to grow at the fastest rate during the forecast period, due to a distinct blend of advantages: delivering a significant electric-only range for efficiency and lower emissions, while the gasoline engine offers an extended range for high performance and longer journeys, alleviating range anxiety. This adaptability responds to consumer worries regarding the limitations of charging infrastructure and delivers strong acceleration from electric motors.

By Vehicle Type

Commercial vehicles segment led the market in 2024, experiencing swift growth driven by a rising need for clean, efficient, and economical transportation options. With cities and companies working to achieve sustainability goals, the use of electric commercial vehicles is steadily increasing. In addition, rules regarding carbon emissions are becoming stricter, pushing industries to adopt more environmentally friendly options.

Passenger cars segment is seen to grow at a notable rate during the predicted timeframe. The need for high-performance electric vehicles in passenger cars is increasing quickly and is expected to remain strong throughout the forecast period. OEMs are currently producing electric vehicles that offer an extended driving range exceeding 200 miles on a single charge. The presence of various electric passenger car models, such as favored body styles like SUVs and sedans, addresses diverse consumer preferences and requirements, expanding the market attractiveness.

Regional Outlook

North America

North America dominated the market in 2024. This increase can be linked to favorable government policies and incentives encouraging the use of electric vehicles (EVs). The U.S. government has introduced several programs, including tax credits and rebates, to enhance the affordability of EVs for consumers. Moreover, aspirational goals like ensuring that 50% of all new vehicle sales consist of zero-emission vehicles (ZEV) by 2030 highlight the dedication to shifting toward electric transportation. These policies motivate consumers to think about EVs and push manufacturers to invest in EV technology and infrastructure.

United States

Government policies and incentives in the United States are crucial factors in the high-performance EV market. The Clean Energy Plan from the Biden Administration aims to speed up the adoption of electric vehicles, targeting 50% of new car sales to be electric by 2030. With increasing awareness of environmental issues, consumers increasingly seek cars that are both eco-friendly and high-performing. Vehicles like the Tesla Model X Plaid and Rivian R1S combine performance, luxury, and utility, appealing to buyers who want both rapid acceleration and the functionality of an SUV.

Asia Pacific

The high-performance electric vehicle (EV) market in the Asia Pacific is expanding quickly, fueled by robust consumer interest, government incentives such as subsidies and tax benefits, and progress in battery and motor technology, especially in China. The area is a frontrunner, representing a substantial share of worldwide high-performance EV earnings, with major markets such as China, Japan, and South Korea. Elements like growing disposable incomes, heightened environmental consciousness, and the development of charging infrastructure are additionally driving this growth.

Strategic Moves by Key Players

In June 2025, Mullen Automotive, an electric vehicle manufacturer, relaunched the ultra-high-performance Mullen FIVE RS EV Crossover with vehicle sales planned for Germany in December 2025. The Company expects to release the FIVE RS for sale in Germany in December 2025, and plans to launch the FIVE RS in other EU countries, the UAE and South Africa in 2026.

Automotive High Performance EVs Market Leaders

- BMW Group

- Daimler AG

- General Motors

- Nissan Motor Company Ltd

- Ford Motor Company

- Renault

- Rimac Automobili

- Telsa Inc.

- Kia Motor Corporation

- Mitsubishi Motors Corporation

- Peugeot

- Volkswagen AG

Market Segmentation

By Drive Type

- Plug-in Hybrid

- Pure Electric

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- United States

- Canada

- Rest of North America

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa