Containerboard Top Companies Analysis with Segments Outlook

Containerboard Top Companies and Segments Analysis

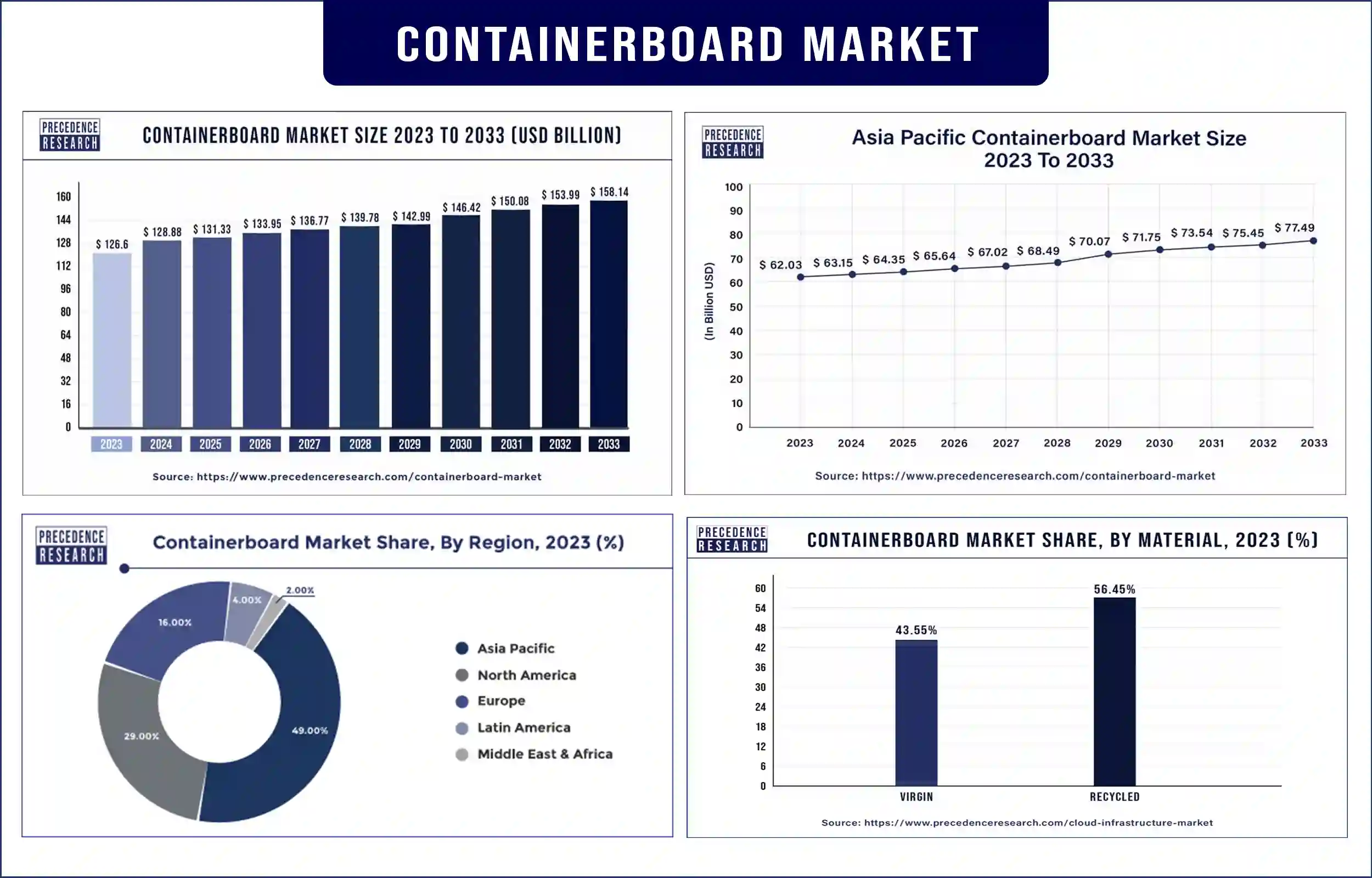

The global containerboard market size was valued at US$ 126.6 billion in 2023 and is projected to reach around USD 158.14 billion by 2033, at a CAGR of 2.30% from 2024 to 2033. The increasing growth in the pharmaceutical sector is expected to drive the growth of the containerboard market.

Market Overview

The containerboard market deals with the type of paperboard packaging made from recycled paper or wood fiber, which is used in making packaging materials such as corrugated and cardboard boxes. The durable, highly versatile, and lightweight nature of containerboard is boosting its growth and demand for packaging applications in major industries such as electronics, electricals, personal care, cosmetics, pharmaceuticals, and food & beverages, which has enhanced the market growth. The increasing demand for poultry products, including broiler chicken, has surged the production level of such products.

The increasing consumption of electronic products in food & beverages fuels market growth. In addition, increasing preference towards changing lifestyles and increasing demand for packaged, frozen, and ready-to-eat meals are further anticipated to enhance the growth of the containerboard market during the forecast period.

Containerboard Market Trends

- The increasingly rapid growth in the e-commerce platform is expected to drive the growth of the containerboard industry.

- The growing awareness about environmental sustainability and consumer choices toward eco-friendly packaging solutions help drive market growth.

- Continuous technological advancements in manufacturing processes have enhanced the quality and efficiency of containerboard production.

- The growing trend in industrialization and urbanization, particularly in emerging countries, is driving the growth and demand for the containerboard industry.

- The increasingly strict government regulations regarding waste management and packaging materials further enhance the growth of the market.

The increasing prevalence of online purchasing and growing demand for the food & beverages industry fuel the market growth

Over the globe, billions of people have purchased necessary products online and through e-commerce platforms in recent years. Various types of products are ordered online, and these products are carried from one place to another from the manufacturing facilities. Therefore, to prevent or avoid the huge possibility of damage, containerboards have various advantages.

It has spurred the growth and demand for the higher production of container boards due to the growing inclination of the global population toward online purchasing. In addition, in emerging countries, there are millions of tons of paper & paperboard produced. In addition, fast-food outlets, hotels, restaurants, pubs, catering companies, and many more platforms use containerboard packaging for many purposes, such as moving, cooking, transportation, and serving food and drinks. These factors are expected to drive the growth of the containerboard market.

However, government regulations on the use of natural resources may restrain the growth of the market. The major factor challenging market growth is the strict regulations that the government has passed on natural resource exploitation. The production of virgin containerboards requires the use of natural wood fiber, which increases the burden on the environment. Natural containerboards are suitable for packaging delicate and heavy objects on account of their excellent stacking ability and strength to handle heavy weights. The production of these container boards emits harmful greenhouse gases and exploits natural resources, increasing the final cost. Government regulations imposed on tree-cutting are also restraining market growth. Hence, the above major factors are challenging the growth of the containerboard market.

Containerboard Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 128.88 Billion |

| Market Revenue by 2033 | USD 158.14 Billion |

| Market CAGR | 2.30% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Containerboard Market Top Companies

- KapStone Paper and Packaging Corporation

- Siam Cement Group Packaging (SCGP)

- Pratt Co., Ltd.

- Svenska Cellulosa AB (SCA)

- Packaging Corporation of America

- Lee & Man Paper Manufacturing Ltd.

- Oji Holdings Corporation

- Georgia-Pacific LLC

- Cascades

- Nine Dragons Paper Holdings Limited

- DS Smith Plc

- Mondi Group

- Smurfit Kappa Group

- WestRock Company

- International Paper Company

Recent Innovation in the Containerboard Market by Mondi Group

- In June 2024, a sustainable packaging and paper manufacturing company, Mondi, launched its new containerboard grades SmartKraft Brown and White. These new containerboards are 100% fresh and recycled fibers. In addition, these two grades offered strength and enhanced printability and runnability to address diverse packaging needs without compromising performance and quality.

- Recent Innovation in the Containerboard Market by Cascades

- In January 2024, Quebec and Kingsey Falla-based Cascades Inc. launched new produce baskets designed for the produced sector. These new baskets are made from 100% recycled fibers and also these baskets are manufactured as a sustainable alternative to hard-to-recycle packaging. These new containerboard basket formats for fresh vegetables and fruits enhance innovative products.

Regional Insights

North America is expected to grow fastest during the forecast period. Rising residential development, increasing infrastructure projects, and increasing demand for energy-efficient and sustainable building solutions are expected to drive the growth of the region's market. In addition, rising innovation in materials and construction practices, growing focus on modernizing existing structures, increasing government initiatives, and favorable economic conditions further contributed to propelling the market growth.

The U.S. and Canada are the major countries in North America. As compared to other regions, the U.S. is the top exporter of containerboard, particularly kraft liners and corrugated containers. The U.S. manufactures a large amount of containerboard packaging with 50% recycled fibers. In the U.S., 70-75% of the containerboard boxes are received for recycling, out of 100 million boxes are produced. These are the major factors expected to enhance the growth of the market in North America.

Asia Pacific dominated the containerboard market in 2023. The increasingly rapid growth in e-commerce platforms, increasing consumer demand for packaged foods, increasing preferences towards changing life, growing robust industrialization, and growing rapid economic growth in emerging countries are estimated to drive the growth of the market in the region. In addition, the ongoing middle class with increasing purchasing power and increasing demand for the food & beverages industry contributed to propel the market growth. China, India, Japan, and South Korea are the major leading companies in the Asia Pacific. China and India are dominant countries and have the largest market share.

For instance, in India, there are 60-90% of imported wastepaper can be manufactured into produced paper and converted into productive packaging materials such as paper bags, cardboard, and containerboard. About 20% of wastewater paper is used as an optional fuel for recycling energy. As a result, India is expected to drive the growth of the containerboard market in Asia Pacific.

Market Potential and Growth Opportunity

Increasing adoption of artificial intelligence in containerboard

By enabling companies, artificial intelligence is likely to revolutionize the packaging industry to improve their processes and reduce costs while improving customer satisfaction and efficiency. Artificial intelligence is currently being used in containerboard packaging in terms of quality control because it can be used to monitor the quality of finished products and packaging materials.

AI can help companies improve their containerboard packaging processes, reducing the cost and time associated with transportation, storage, and production. In addition, artificial intelligence can help companies design recyclable containerboard materials, reduce waste, and be environmentally friendly. These opportunities are expected to enhance the growth of the containerboard market in the future.

Containerboard Market News

- In February 2023, an initiative of Yash Pakka, CHUK launched compostable delivery containerboards. These new containers were available in four different sizes such as 1000 ml, 750 ml, 500 ml, and 350 ml. These new containerboards are not biodegradable or industrial compostable and these are 100% recyclable and have the highest standard of eco-friendly packaging.

- In April 2022, in Spain, the Papresa’s CEO was pleased to announce that the PM 5 at the paper mill of the company manufactured its first jumbo roll of containerboard machine. The machine formerly manufactured newsprint and was recycled to make corrugated packaging material. The PM 5 has the capacity to manufacture 205,000 tpy of test liner and fluting, particularly in lightweight grades.

Segments Covered in the Report

By End-use

- Food & Beverage

- Personal Care & Cosmetics

- Industrial

- Others

By Material

- Virgin

- Recycled

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3667

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308