Continuous Bioprocessing Market to Hit USD 1.93 Bn by 2034, Fueled by Vaccines and Advanced Therapies

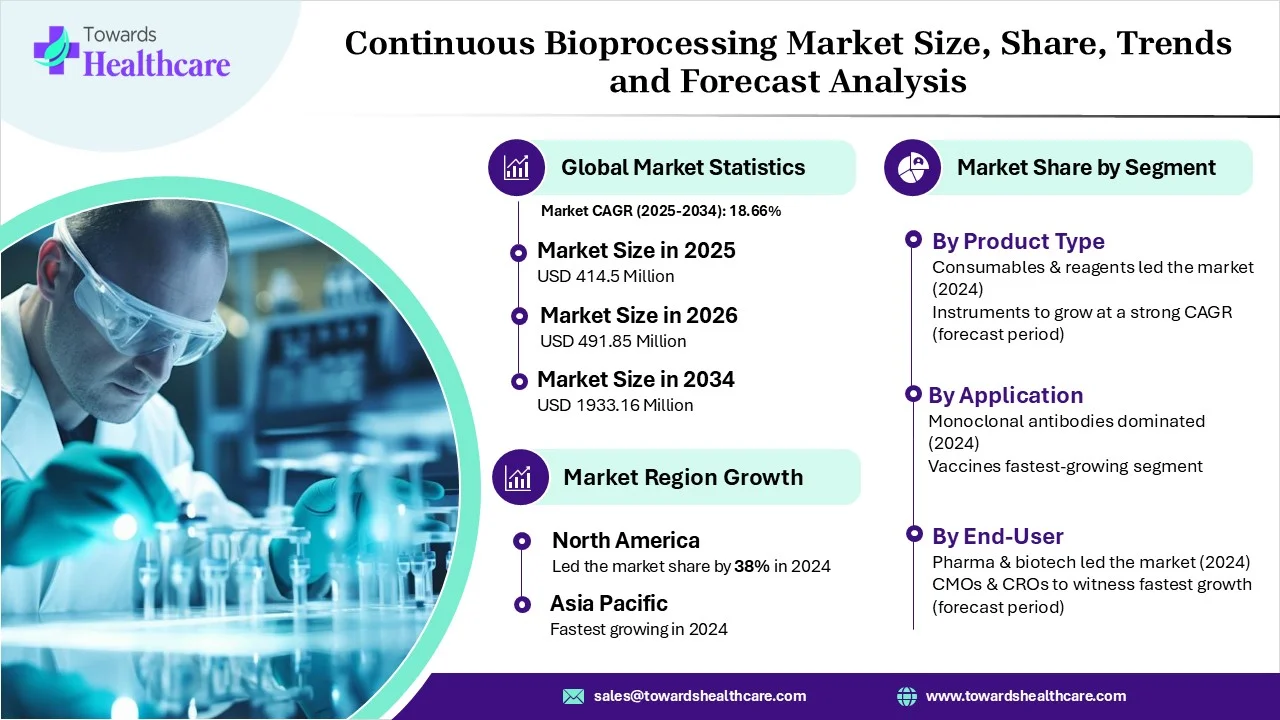

The global continuous bioprocessing market size is calculated at USD 349.32 million in 2024, grew to USD 414.5 million in 2025, and is projected to reach around USD 1933.16 million by 2034. The market is expanding at a CAGR of 18.66% between 2025 and 2034. The worldwide increasing demand for varius biologics and the expanding outsourcing trend impact the market progression.

Segmental Outlook

Which Product Type Led the Continuous Bioprocessing Market in 2024?

The consumables & reagents segment registered dominance in the market in 2024. Globally rising demand for monoclonal antibodies (mAbs), recombinant proteins, and biosimilars & the use of disposable assemblies, tubing, and bioreactors in continuous flows are support widening adoption of related materials. Ecolab DurA Cycle, Sartobind Rapid A, etc., are examples of the latest consumables.

The instruments segment will expand notably. This mainly includes bioreactors, filtration systems (TFF), chromatography units, Process Analytical Technologies (PAT) (sensors), centrifuges, and incubators. Companies are emphasizing integration of AI-enabled automation, single-use perfusion systems, and modern process analytical technology for real-time monitoring.

How did the Monoclonal Antibodies Segment Lead the Market in 2024?

In 2024, the monoclonal antibodies segment captured the largest share. This bioprocessing reduced expenditure, smaller facility footprints, accelerated productivity, improved product quality, and increased flexibility. Recently, Amgen performed trials of continuous bioprocessing lines at its Rhode Island and Shanghai facilities to speed up mAb production.

The vaccine segment will grow fastest. The worldwide escalating pandemic cases and innovations in mRNA, viral vector, and recombinant protein support the overall vaccine development. Utilisation of combined continuous manufacturing for rVSV-vectored vaccines demonstrated a 2.55-fold rise in space-time yield with consistent harvesting and purification.

Which End Use Dominated the Continuous Bioprocessing Market in 2024?

The pharmaceutical and biotechnology segment was dominant in the market. Rising demand for diverse biologics, and benefits of bioprocessing, like increased yields, minimal operational spending, and minimal resource use & waster generation, are fueling the expansion of these firms. They are stepping into end-to-end continuous systems, i.e. upstream and downstream integrated with Industry 4.0 automation.

The CMOs & CROs segment will witness rapid expansion. A rise in outsourcing trends and the need for rapid, more efficient, and affordable drug manufacturing are impacting CMOs &CROs. Recently, Enzene Biosciences inaugurated its first U.S. facility in New Jersey, which uses its proprietary EnzeneX continuous manufacturing platform.

Regional Outlook

Why did North America Dominate the Market in 2024?

Accelerating demand for biopharma, technology adoption, like single-use, PAT, AI, and CDMO progression, fueled North American market dominance. Leveraging FDA incentives and approvals for continuous manufacturing (CM) pathways is fostering the transition from batch processes. The FDA implemented a risk-based guideline for real-time release analytics, which is vital for continuous, automated workflows.

How is the Asia Pacific Booming in the Market?

APAC will expand fastest, as it is promoting the outsourcing trend. Whereas, China’s National Medical Products Administration (NMPA) published a "Pilot Program for Segmented Production of Biological Products". Many firms are highly investing in AI-assisted, automated, and IoT-driven systems to gain real-time monitoring and improved quality, with China encouraging this adoption. CDMOs in Korea and China are establishing the capacity to facilitate Turnkey, continuous, single-use solutions.

Recent launches

- In October 2025, Invert unveiled Invert Assist, an AI-enabled analysis interface for bioprocess.

- In March 2025, Pow.Bio launched a novel continuous fermentation demo facility in Alameda, CA.

Key Players

- Thermo Fisher Scientific Inc.

- Danaher

- WuXi Biologics

- Sartorius AG

- Asahi Kasei Bioprocess America, Inc.

- Ginkgo Bioworks

- GE Healthcare

- Repligen Corporation

- Merck KGaA

Segments Covered in the Report

By Product

- Instruments

- Bioreactors

- Filtration Systems

- Chromatography Systems

- Process Analytical Technologies

- Others

- Consumables & Reagents

- Media & Buffers

- Filters & Membranes

- Resin

- Tubing & Bags

- Others

By Application

- Monoclonal antibodies

- Vaccines

- Cell and gene therapy

- Research & Development

- Other applications

By End Use

- Pharmaceutical and biotechnology companies

- CMOs and CROs

- Research and academic institutes

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazila Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: Towards Healthcare