Data Integration Market Key Developments and Market Insights

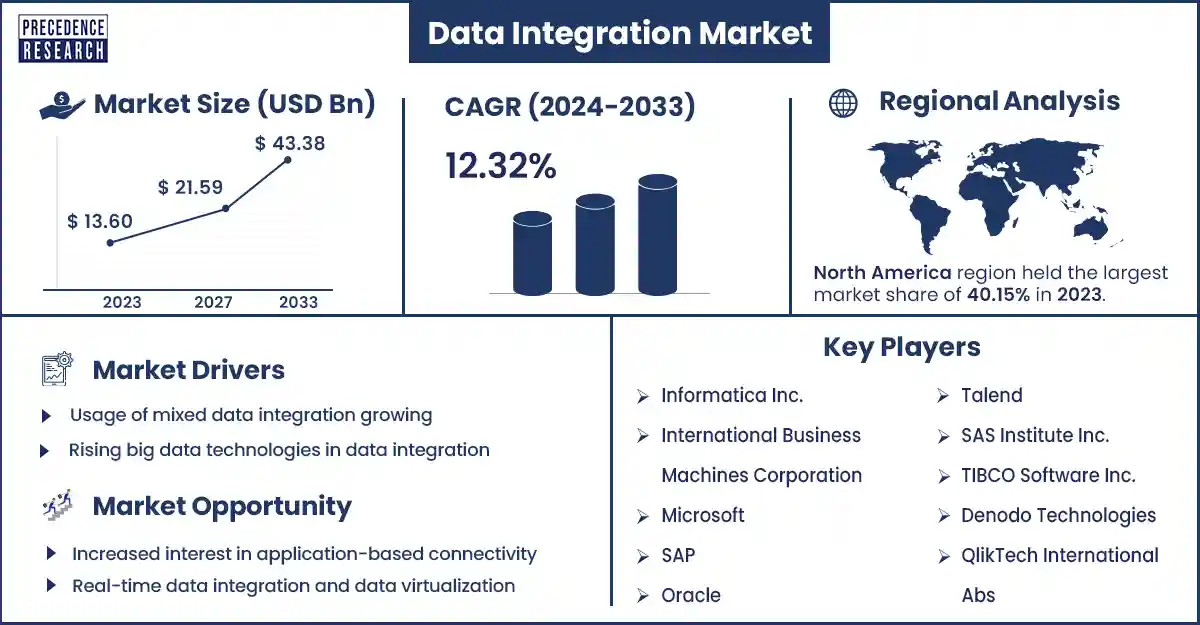

The global data integration market size surpassed USD 13.60 billion in 2023 and is expected to rise around USD 43.38 billion by 2033, expanding at a CAGR of 12.32% during the forecast period from 2024 to 2033. The increasing cloud computing technologies and big data technologies are expected to drive the growth of the data integration market.

Market Overview

The data integration market deals with the procedure of merging data from different sources into a unified, single view. Integration starts with the ingestion process and involves steps including transformation, ETL mapping, and cleansing. Data integration eventually helps analytics tools to make actionable and effective business intelligence.

The increasing focus of enterprises towards maintaining data integrity to increase the strategic role of data innovation, growing investment of businesses in data integration tools, and rising importance of data-driven strategies are anticipated to enhance the growth and demand for the market. In addition, increasing advancements in machine learning and artificial intelligence technologies are expected to drive the data integration market's growth during the forecast period.

Rising big data technologies in data integration are fueling the growth of the market

With the adoption of big technology, consumers or organizations have started to identify the advantages of executing big data with strong potential and are investing in big data technologies such as data integration. The rising big data sources involve internal data sources, including external data sources, financial transactions from various departments, customer relationship management, and enterprise resource planning. Organizations require advanced data integration to combine information.

Advanced or modern data integration tools, such as modern transformation tools provided by various vendors, are employed with advanced features, such as metadata management, data governance, data quality, data profiling, and data capture to proceed with the data post-integration, which is resulting in reliable and smooth extraction of data. These are the major factors expected to drive the growth of the data integration market.

However, data security and integration complexity may restrain the growth of the data integration market. Integrating data from various sources creates concerns about data security and data privacy. Hence, organizations can't execute accurate security measures, including compliance, access controls, and data encryption, to protect sensitive or confidential information. As data applications and sources increase, data integration becomes more complicated.

IT teams must carefully design and plan data integration procedures to ensure performance, maintainability, and scalability. In addition, data integration needs practices and clear policies to ensure accountability, compliance, and consistency, but with a lack of data governance, organizations cannot manage data integration effectively. These are major restraining factors responsible for hindering the growth of the market.

Data Integration Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 13.60 Billion |

| Projected Forecast Revenue by 2033 | USD 43.38 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.32% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Integration Market Top Companies

- QlikTech International ABs

- CDR.fyi

- Salesforce

- Denodo Technologies

- TIBCO Technologies

- SAS Institute Inc.

- Talend

- Oracle

- SAP

- Microsoft

- International Business Machines Corporation

- Informatica Inc.

Recent Innovation in the data integration market by Salesforce

- In February 2024, with the CRM giant guaranteeing innovative data integration, Salesforce launched Einstein Copilot for its users. The Einstein Copilot is grounded within a company’s metadata and data. The advanced Einstein Copilot also provided virtual guidance with an understanding and deep knowledge of customer relationships and business.

Recent Innovation in the data integration market by CDR.fyi

- In April 2024, an overview of the carbon dioxide removal market and the community-driven platform provided critical information, and CDR.fyi launched its CDR.fyi API. This provides programmatic access to flexible CDR data that could be installed directly into workflows. Custom applications can also be built to resolve restrictions for the organization.

Regional Insights

Asia Pacific is expected to grow at the fastest rate during the forecast period. The key players in Asia Pacific continuously focus on strategic partnerships, rising investments, and growing their portfolios to create robust and easy functionality. Various initiatives were executed, and it is expected that the industry will enlarge as e-commerce trade continues to rise and drive the growth of the data integration market in the region.

India, China, Japan, and South Korea are the major developing countries in the Asia Pacific region. China and India are the largest and most well-developed countries in data integration. China continuously promotes the orderly flow of data and strengthens data coverage utilization with data platforms. India has so many data integration companies and startups, such as Tray.io, Alation, Wokato, Fivetran, LINK, ZoomInfo, and many more.

Indian companies provide customers with data applications to build a data integration culture. They also focus on outsourcing solutions and delivering quality offshore to reduce the total cost of operations and ownership of IT development. These are the major factors driving the market's growth in the Asia Pacific region.

North America dominated the data integration market in 2023. The growing technical developments and increasing number of data integration major players across the region are anticipated to boost the market growth further. The U.S. and Canada are the major leading countries in North America. The U.S. is the largest and most developed country in North America. It is adopting continuous deployment of advanced technologies, including artificial intelligence, the Internet of Things (IoT), and cloud computing, to automate business processes. Due to this, the adoption of advanced technology and increasing cloud computing are driving North America's data integration market growth.

- For instance, in February 2023, an enterprise cloud data management leader, Informatica, launched the industry’s only free ETL/ELT services, integration, and cloud data loading- Informatica PayGo and Cloud Data Integration-Free. The new providing targets non-technical users and data practitioners such as sales and marketing teams built the pipelines within minutes.

Market Potential and Growth Opportunity

Real-time data integration and data virtualization

Real-time data integration helps organizations analyze and process data as it is produced, enabling faster decision-making and providing immediate insights. Advanced technologies like streaming data platforms and event-driven architectures enhance real-time integration capacities.

In addition, without physically consolidating it into a single repository, data virtualization enables organizations to generate a virtual and unified view of their data. This approach offers a real-time approach to data from different sources. Furthermore, data virtualization enables efficiency enhancement and reduces manual effort. These are the key opportunities expected to drive the growth and demand for the data integration market in the coming future.

Data Integration Market News

- In August 2023, the general availability of SnapGPT was launched by data integration vendor SnapLogic. This innovative AI generative tool enables data engineers to improve data pipelines more efficiently by enabling natural language.

- In April 2024, Surge Ventures launched an enterprise integration platform and announced the acquisition of Kovair Software for the wealth management industry. Surge Ventures' leverage platform provides an exceptional solution that empowers wealth management professionals and simplifies complex integrations with enhanced data-first abilities.

Market Segmentation

By Component

- Tools

- Services

By Deployment

- On-Premise

- Cloud

By Organization Size

- Large Enterprises

- Small & Mid-Size Enterprises

By Business Application

- Marketing

- Sales

- Operations & Supply Chain

- Finance

- HR

By End-user

- IT & Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail & E-commerce

- Government & Defense

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2744

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308