Dietary Supplements Market Size to Surge from USD 210.41 Billion in 2025 to USD 464.58 Billion by 2034

Dietary Supplements Market Size and Forecast 2025 to 2034

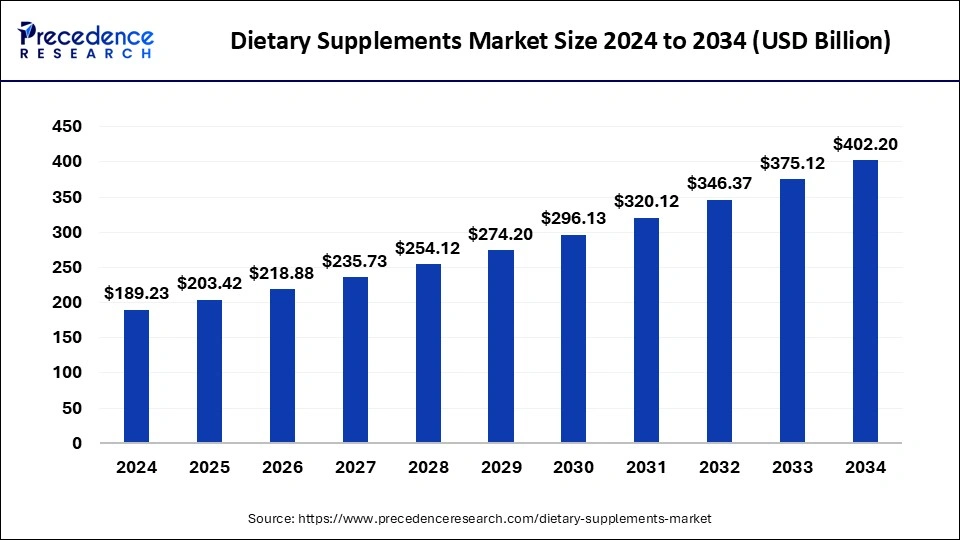

The global dietary supplements market size evaluated at USD 192.68 billion in 2024 and is projected to grow from USD 210.41 billion in 2025 to USD 464.58 billion by 2034, with an expected CAGR of 9.2% during the forecast period from 2025 to 2034. This growth is primarily driven by the increasing consumer demand for supplements that help meet daily micronutrient needs.

Dietary Supplements Market Outlook

The dietary supplements market has experienced sophisticated growth in recent years owing to factors such as the increasing health consciousness and need for an easy solution to maintain fitness. Moreover, other drivers like rising fitness culture, fast-paced lifestyle, and merging sport culture have immediately contributed to the industry potential in recent years. Also, the dominance of social media and e-commerce will provide a sophisticated consumer base to the manufacturer in the upcoming years, as per the future industry expectations.

Market Opportunities

- The development of personalized nutrition is expected to create significant industry opportunities for manufacturers during the forecast period.

- The increased demand for plant-based and clean-label products is likely to provide greater advantage to the supplement producers in the coming years.

Key Growth Factors

- The shift towards the function gummies and chewable is contributing to the growth of the market in recent years.

- The increased adoption of energy and sports supplements has driven the growth of the industry over the past few years.

Market Restraint

- The trend for copying products or duplicate products is anticipated to hinder industry growth in the upcoming market phases.

- The stricter regulatory challenges are expected to create growth barriers during the projected period.

Dietary Supplements Market Segmental Outlook

Form Type Outlook

What made the Tablet Segment Dominant in the Dietary Supplements Market in 2024?

The tablet segment generated the greatest revenue share in 2024, owing to factors such as affordability, stability, and greater acceptance. Moreover, by having easy production methods, storation, and greater distribution as compared to powder forms, the tablet segment has gained major industry attention in the past few years.

Application Outlook

The energy and weight management segment marked its dominance because of a sudden increase in global obesity rate, busy work culture, and fast food consumption. Several individuals are looking at dietary supplements as an easier and supportive pillar of fitness in recent years, as per the recent industry survey.

End User Outlook

The adult segment marked its dominance because this age group is the biggest consumer of dietary supplements, as they face lifestyle-related health issues such as stress, fatigue, obesity, and nutrient deficiencies. Adults are also more health-conscious and willing to invest in supplements for better fitness, immunity, and skin health.

Type Outlook

The over-the-counter segment marked its dominance because they are easily accessible, affordable, and trusted by consumers. People prefer buying supplements without needing a doctor's prescription, as most are seen as safe daily health boosters. Pharmacies, supermarkets, and even online platforms stock OTC vitamins, minerals, protein, and herbal supplements in bulk.

Dietary Supplements Market Geographical Outlook

Asia Pacific

Asia Pacific dominated the dietary supplements market due to factors such as the enlarged population and strong tradition of herbal and natural remedies. Also, the regional countries such as India, China, and Japan are seen in greater adoption of the sport and fitness culture. Moreover, the expansion of the e-commerce sector has gained major industry share in the region nowadays.

North America

North America is expected to emerge at the fastest CAGR during the forecast period of 2025 to 2034, due to greater access to food technology. Moreover, the presence of major dietary supplement producer companies has been actively pushing the growth of the industry in recent years. Also, the demand for clean-label product adoption and awareness of preventive health is projected to create lucrative opportunities for manufacturers in the upcoming years.

Strategic Moves by Key Players

- In March 2025, the viral wellness brand Bloom Nutrition introduced its new functional prebiotic soda, Bloom Pop, in partnership with the active health company Nutrabolt.

- Kerry Group, a worldwide frontrunner in taste and nutrition solutions, has unveiled its 2025 Supplement Taste Charts, an all-encompassing guide to changing flavour trends and advancements in the wellness sector. These charts are vital for manufacturers of supplements and nutraceuticals, aiding them in predicting market changes and developing health-focused and flavorful products.

Dietary Supplements Market Top Companies

- Amway Corp.

- Abbott

- Bayer AG

- Glanbia plc

- Pfizer Inc

- Archer Daniels Midland

- NU SKIN

- GlaxoSmithKline plc.

- Herbalife Nutrition Ltd.

- Nature's Sunshine Products, Inc.

- XanGo, LLC

- RBK Nutraceuticals Pty Ltd

Segments Covered in the Report

By Ingredient

- Vitamins

- Botanicals

- Minerals

- Protein & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Probiotics

- Prebiotics & Postbiotics

- Others

By Form

- Tablets

- Capsules

- Soft gels

- Powders

- Gummies

- Liquids

- Others

By Application

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Lungs Detox/Cleanse

- Skin/ Hair/ Nails

- Sexual Health

- Brain/Mental Health

- Insomnia

- Menopause

- Anti-aging

- Prenatal Health

- Others

By End User

- Infants

- Children

- Adults

- Pregnant Women

- Geriatric

By Type

- OTC

- Prescribed

By Distribution Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Practitioners

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5479

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com