Disease Management Apps Market Will Grow at CAGR of 10.32% By 2032

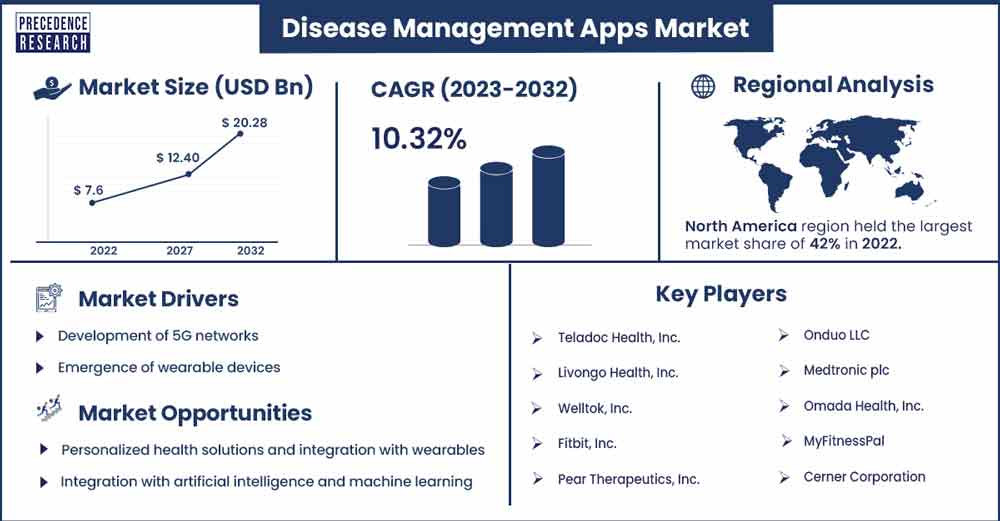

The global disease management apps market size surpassed USD 7.6 billion in 2022 and is anticipated to reach around USD 20.28 billion by 2032, growing at a CAGR of 10.32% from 2023 to 2032.

Market Overview

Disease management apps refer to mobile applications designed to assist individuals in managing various aspects of their health, particularly chronic diseases or conditions. These apps are developed to provide users with tools and resources to monitor, track, and control their health parameters, symptoms, medications, and lifestyle factors. The primary goal of disease management apps is to empower individuals to actively participate in their healthcare, improve self-management, and enhance overall well-being.

The disease management apps market is driven by several factors including the growing prevalence of chronic disease, technological advancements, focus on preventive healthcare, remote patient monitoring, government initiatives, and rising awareness and health consciousness. Furthermore, the increasing product launches are expected to propel the market growth during the forecast period.

- In January 2023, Optical heart rate technology developer Valencell announced that it would be concentrating its efforts on bringing solutions for managing chronic diseases to market by launching its own branded product line in the digital health space. The company's initial product candidate, on display at CES, aims to assist consumers in monitoring and controlling their hypertension by fusing a revolutionary over-the-counter gadget with easy-to-use software to measure blood pressure (BP) reliably from the finger without the need for a cuff or calibration.

Regional Insights

North America is expected to capture a significant market share during the forecast period. The region has a high prevalence of chronic conditions such as diabetes, cardiovascular diseases, and obesity. The need for effective tools to manage these conditions has led to increased interest in disease management apps.

According to secondary sources 2022 data, the obesity rate will have surpassed 20% in all 50 states of the US. Currently, approximately 35% of the states have a high rate of obesity. Obesity prevalence is highest in the South (36.3%), then in the Midwest (35.4%), Northeast (29.5%), and West (287.7%). Additionally, the growing healthcare spending in the region also contributes the market growth.

- For instance, the American out-of-pocket healthcare spending is third among all countries, according to data from the Organization for Economic Co-operation and Development (OECD). The only two nations where out-of-pocket expenses are higher are Malta and Switzerland.

In the North American area, the US is expected to hold a prominent share of the market during the forecast period. The market growth in the country is attributed to the growing 5G network deployment. Additionally, the widespread adoption of smartphones and digital technology in the U.S. creates a favorable environment for the growth of disease management apps. A large percentage of the population uses smartphones, facilitating broad access to health-related apps.

Disease Management Apps Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 8.38 Billion |

| Projected Forecast Revenue by 2032 | USD 20.28 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 10.32% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Development of 5G networks

5G networks offer an enhanced user experience over 4G networks by enabling quicker data transfer, reduced image distortion for video conversations, and better picture quality. The development of Wi-Fi and Bluetooth technologies will benefit the healthcare industry in the future as they will allow networked medical devices to become more widely used, creating new opportunities for digital disease management. As a result, the development of 4G and 5G networks is driving up demand for a wide range of disease management applications and expanding the market.

Emergence of wearable devices

Digital solutions, such as health applications, are very helpful in tracking weight and physical activity. Health maintenance and sickness prevention are some goals of wearable IoT devices. These technologies allow physicians and other healthcare providers to quickly manage the development of their patient's medical conditions. They may also directly affect clinical judgment. Because of this, wearable technology is widely applied in the medical field to improve patient safety. The growing usage of wearable technology is predicted to fuel the growth of the disease management app industry.

Restraints

Insufficient advice from medical professionals and providers

The effective use of wireless technologies and mobile applications may alter how digital health services and disease management apps are delivered. However, people usually find it difficult to trust healthcare applications since they receive little to no help or support from doctors. Furthermore, a lot of seasoned or established medical practitioners are hesitant to include healthcare IT solutions or applications for managing medical conditions in their daily routines.

The main cause of this resistance is an inadequate level of IT knowledge. Some medical professionals believe that these applications are time-consuming and have little to no therapeutic benefit. This is expected to limit the market's growth for disease management applications to some degree.

Security and regulatory compliance

Privacy and security are issues that are brought up by the gathering and storing of private health data. Adoption of these applications is often inhibited because patients and healthcare practitioners are concerned about utilizing apps that do not have strong security safeguards in place. Furthermore, app developers may find it difficult to comply with stringent healthcare standards and data privacy legislation. Complying with local regulations might also provide challenges, delaying the creation and implementation of applications for managing diseases.

Opportunities

Growing partnership

The growing partnership is expected to drive market growth during the forecast period. For instance, in March 2022, to expand innovation for digital health, Huma and AstraZeneca established a new collaboration. Huma and AstraZeneca have already worked together on use cases, and this collaboration reflects their shared goal of enhancing healthcare outcomes by bridging the gap between patients and physicians through digital health solutions.

As part of this collaboration, AstraZeneca and Huma will introduce companion applications for software as a medical device (SaMD) aimed at various therapeutic domains. Additionally, they will collaborate to expedite the adoption of decentralized clinical trials. The aforementioned will expand upon Huma's established technologies, which now facilitate digitally-focused healthcare services for over 1.8 million registered patients in over 3,000 medical facilities. Delivering care more effectively is made possible by Huma's technologies, which are made to interface with clinical workflows.

Integration with artificial intelligence (AI) and machine learning (ML)

Disease management applications can benefit from the use of AI and ML algorithms to improve their predictive analytics, tailored suggestions, and early health issue detection capabilities. These tools can evaluate enormous datasets and offer more precise insights into the unique needs of each patient. Thus, this is expected to offer a lucrative opportunity for market development during the projected period.

Recent Developments

- In March 2023, the launch of Philips Virtual Care Management, a broad portfolio of adaptable services and solutions to assist health systems, providers, payers, and employer groups in deeply connecting and motivating patients virtually from any location, was announced by Royal Philips, a leader in health technology worldwide. Reducing emergency department visits and lowering healthcare costs via improved management of chronic diseases are two ways that Philips Virtual Care Management may relieve the burden on hospital staff.

Key Market Players

- Teladoc Health, Inc.

- Livongo Health, Inc. (acquired by Teladoc Health)

- Welltok, Inc.

- Fitbit, Inc. (acquired by Google)

- Pear Therapeutics, Inc.

- Onduo LLC (a subsidiary of Verily, Alphabet Inc.)

- Medtronic plc

- Omada Health, Inc.

- MyFitnessPal (a subsidiary of Under Armour)

- Cerner Corporation

- McKesson Corporation

- IBM Corporation

- Microsoft Corporation

- Dexcom, Inc.

- Apple Inc.

Market Segmentation

By Platform Type

- iOS

- Android

- Others

By Device

- Smartphones

- Tablets

- Wearables

By Indication

- Obesity

- Cardiovascular Issues

- Mental Health

- Diabetes

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3344

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308