What is the Disease Management Apps Market Size?

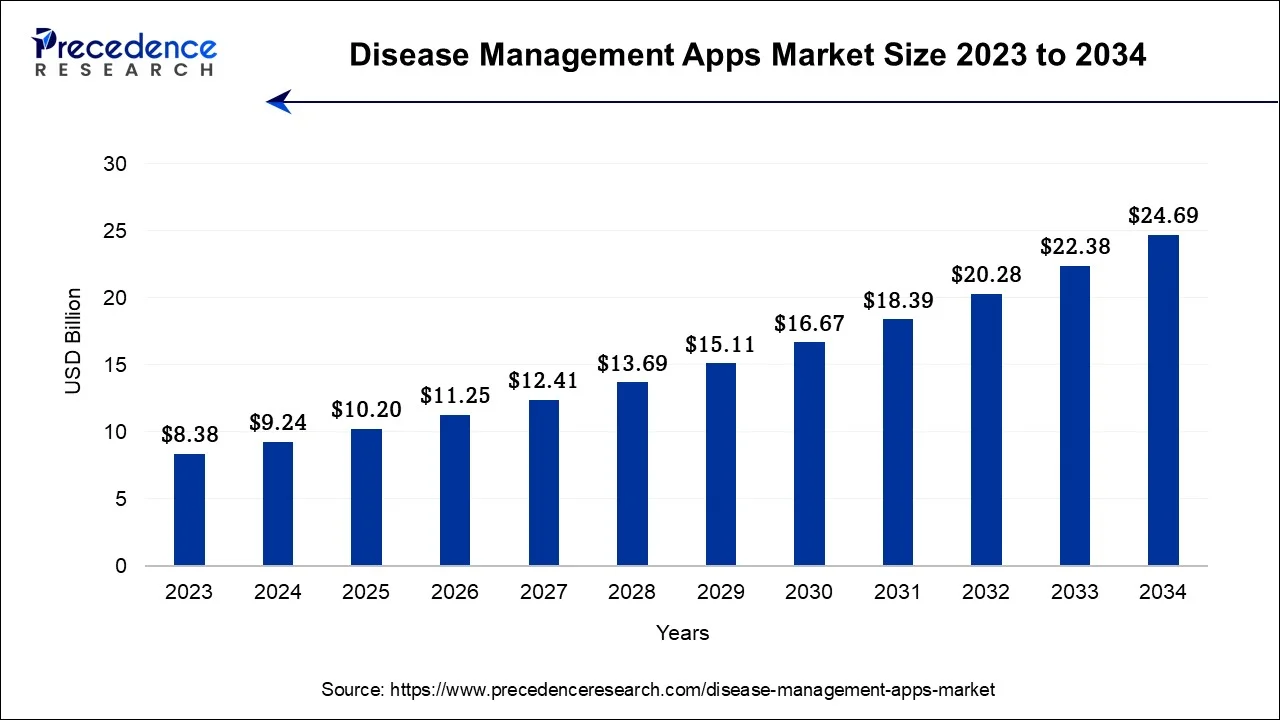

The global disease management apps market size is estimated at USD 10.20 billion in 2025 and is anticipated to reach around USD 24.69 billion by 2034, representing a notworthy CAGR of 10.32% between 2025 and 2034.

Market Highlights

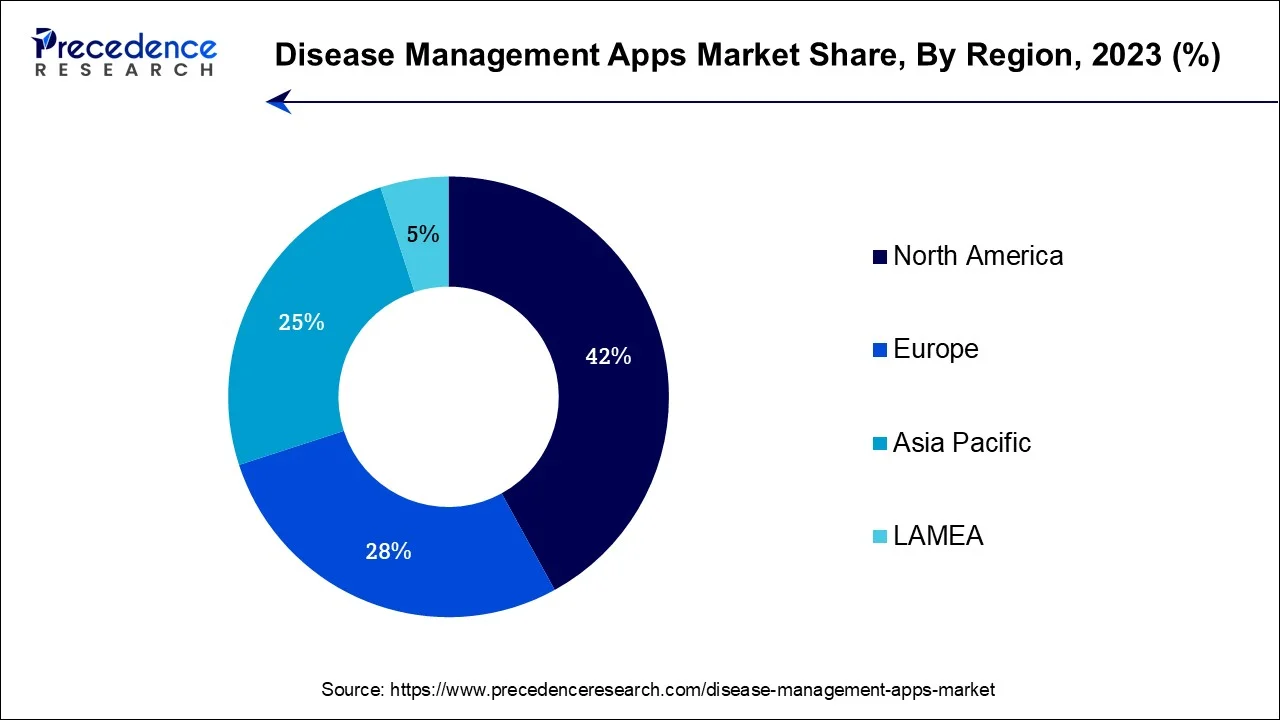

- North America generated more than 42% of revenue share in 2025.

- Asia-Pacific region is predicted to grow at a remarkable CAGR during the projected period.

- By Platform Type, the Android segment held the highest market share of 53% in 2025.

- By Platform Type, the iOS segment is expected to expand at the fastest CAGR of 7.8% between 2025 and 2034.

- By Device, the smartphone segment captured the largest market share of 56.1% in 2025.

- By Device, the wearable segment is anticipated to grow at the fastest CAGR over the projected period.

- By Indication, the obesity segment had the biggest market share of 30% in 2025.

- By Indication, the mental health segment is anticipated to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 10.20 Billion

- Market Size in 2026: USD 11.25 Billion

- Forecasted Market Size by 2034: USD 24.69 Billion

- CAGR (2025-2034): 10.32%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia-Pacific

Market Overview

The disease management apps market is defined as the segment of the healthcare technology industry that specializes in creating and providing digital applications aimed at assisting individuals and healthcare providers in monitoring, managing, and improving the health of patients with chronic diseases.

These apps typically offer features such as symptom tracking, medication reminders, lifestyle recommendations, and remote monitoring, facilitating better disease management and enhancing patient engagement.

The market's nature is characterized by rapid technological advancements, increased adoption of smartphones, and a growing emphasis on personalized and accessible healthcare solutions.

Disease Management Apps Market Growth Factors

- The disease management apps market is experiencing remarkable growth as it reshapes the healthcare landscape by offering innovative solutions for patients and healthcare providers. These apps serve as valuable tools for monitoring, managing, and improving the health of individuals dealing with chronic diseases, creating a symbiotic relationship between technology and healthcare.

- The market is witnessing several key trends and growth drivers. The widespread use of smartphones and the growing acceptance of mHealth(mobile health) technologies have significantly broadened the accessibility of disease management apps. Patients now have real-time access to their health data and can actively engage in self-care.

- Secondly, personalized healthcare is on the rise, with these apps tailoring interventions based on individual health profiles, leading to more effective disease management. Additionally, the COVID-19 pandemic accelerated the adoption of telehealth and remote monitoring, further boosting the demand for disease management apps.

- A growing aging population and the increasing prevalence of chronic diseases are significant growth factors. As chronic conditions like diabetes, hypertension, and cardiovascular diseases become more common, the need for effective disease management tools intensifies. Moreover, favorable government initiatives and policies promoting digital health solutions are stimulating market growth.

- Despite the promising growth, the industry faces challenges. Data security and privacy concerns are paramount, as these apps handle sensitive medical information. Ensuring regulatory compliance and maintaining the highest standards of data protection remain crucial.

- Furthermore, the digital divide poses an obstacle, as not all individuals have equal access to smartphones, or the digital literacy required to effectively use these apps. Overcoming these challenges is imperative for sustained market growth.

- The disease management apps market offers enticing business opportunities. Investment in research and development to create more advanced and user-friendly apps can yield significant returns. Targeting niche markets with specific chronic conditions or demographic groups presents opportunities for specialized app developers. Collaborations with healthcare providers and insurers to integrate these apps into care pathways can enhance market penetration. Additionally, expanding into emerging markets with increasing healthcare awareness and growing smartphone adoption can unlock new growth avenues.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.20 Billion |

| Market Size in 2026 | USD 11.25 Billion |

| Market Size by 2034 | USD 24.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.32% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform Type, Device, Indication, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Mobile technology ubiquity and rising chronic diseases

The ubiquity of mobile technology has significantly boosted market demand for disease management apps. These devices have evolved into indispensable healthcare tools, enabling individuals to access health data, track chronic conditions, and engage in direct communication with healthcare providers in real time.

The convenience and widespread availability of smartphones have democratized healthcare, simplifying the active management of one's health. Consequently, there has been a significant upsurge in the demand for disease management apps, as they cater to a broad and diverse user base, facilitating accessible and effective health monitoring and management.

Moreover, the surge in chronic diseases acts as a powerful catalyst for increased market demand in the disease management apps sector. With conditions like diabetes, cardiovascular diseases, and hypertension on the rise, individuals and healthcare providers seek effective tools to monitor and manage these ailments continuously.

Disease management apps provide a practical solution by offering real-time monitoring, medication reminders, and lifestyle guidance, empowering patients to actively engage in their health management. Consequently, the pressing need to address the growing burden of chronic diseases amplifies the demand for these apps, driving market expansion.

Restraints

Lack of standardization and health inequalities

The lack of standardization within the disease management apps market hinders market demand by creating ambiguity and inconsistency. Without universally accepted guidelines or quality standards, there is variability in-app functionality, data accuracy, and user experience. This lack of uniformity makes it challenging for healthcare providers and users to confidently select and trust these apps. Consequently, the absence of standardized benchmarks inhibits widespread adoption, as potential users may be skeptical about the reliability and effectiveness of disease management apps, impeding market growth.

Moreover, health inequalities act as a significant restraint on market demand for disease management apps. While these apps offer valuable tools for health management, not all individuals have equal access to smartphones or reliable internet connections, creating disparities in healthcare access. This digital divide exacerbates existing health inequalities, limiting the reach and effectiveness of these apps. Bridging this gap by addressing accessibility issues and ensuring inclusivity is essential to unlocking the full market potential of disease management apps and providing equitable healthcare solutions for all.

Opportunities

Personalized health solutions and integration with wearables

Personalized health solutions are a driving force behind the surge in market demand for disease management apps. As individuals seek tailored healthcare experiences, apps that offer highly personalized recommendations based on unique health data and preferences become increasingly appealing. They empower users to actively manage their health, fostering higher engagement and adherence. The ability to address individual needs and deliver targeted interventions not only enhances user satisfaction but also amplifies the effectiveness of these apps, positioning them as invaluable tools for comprehensive health management, thus driving heightened market demand.

Moreover, integration with wearables significantly boosts market demand for disease management apps. This integration enables users to effortlessly track essential health metrics using wearable devices such as smartwatches and fitness trackers. It enhances the apps by providing more comprehensive and real-time monitoring capabilities, driving increased demand for these disease management apps as they offer a seamless and effective healthcare solution. Patients and healthcare providers benefit from a holistic view of health data, leading to more informed decision-making and timely interventions. As wearable technology continues to gain popularity, the demand for disease management apps that integrate with these devices surged, offering a comprehensive and convenient healthcare solution.

Segments Insights

Platform Type Insights

According to the platform type, the Android segment has held 53% revenue share in 2025 Android, a widely used mobile operating system, serves as a key platform for disease management apps. These apps on Android devices empower users to monitor and manage their health conditions conveniently. Recent trends include improved app accessibility features for individuals with disabilities, enhanced user interfaces for seamless navigation, and the integration of AI-driven chatbots to provide real-time health guidance. Android's extensive reach and customizable nature make it a versatile platform for developers to create innovative disease management solutions that cater to a diverse user base.

The iOS segment is anticipated to expand at a significantly CAGR of 7.8% during the projected period. iOS, the operating system developed by Apple Inc., is a prominent platform for disease management apps. These apps are designed to run on Apple devices, such as iPhones and iPads, offering a user-friendly and secure ecosystem for healthcare management. In the disease management apps market, iOS is witnessing trends that emphasize user experience and security. These apps are increasingly integrating with Apple HealthKit for comprehensive health data management. Furthermore, the rise of wearables, like the Apple Watch, has boosted the popularity of health and wellness apps, making iOS a focal point for their development and deployment. Apple's commitment to data privacy and robust app review processes further enhances iOS's appeal for healthcare app developers.

Device Insights

The smartphone held the largest market share of 56.1% in 2025. Smartphones are portable, multifunctional mobile devices equipped with advanced computing capabilities and internet connectivity. In the context of the disease management apps market, smartphones serve as the primary platform for users to access and interact with healthcare applications, facilitating real-time health monitoring and management.

The disease management apps market is witnessing notable trends related to smartphones. Firstly, the increasing integration of wearables and sensors with smartphones allows for seamless health data collection, enhancing the effectiveness of these apps. Secondly, the development of user-friendly and intuitive mobile app interfaces is improving patient engagement and adherence. Lastly, the global proliferation of smartphones, especially in emerging markets, is expanding the potential user base for disease management apps, fueling market growth.

The wearable segment is projected to grow at the fastest rate over the projected period. Wearables are electronic devices that individuals can wear as accessories or clothing items, typically equipped with sensors and connectivity features. In the disease management apps market, wearables are integrated with apps to monitor and track health metrics, enabling users to actively manage chronic conditions and overall well-being.

Recent trends in wearables for disease management apps include the integration of advanced sensors for continuous health monitoring, such as heart rate, sleep patterns, and blood glucose levels. These devices offer real-time data synchronization with apps, enhancing user engagement and providing healthcare providers with valuable insights for personalized care plans. Additionally, wearables are becoming more stylish and user-friendly, appealing to a broader demographic and driving greater adoption for proactive health management.

Indication Insights

In 2025, the obesity segment had the highest market share of 30% on the basis of the indication. Obesity is a persistent medical condition marked by the excessive accumulation of body fat, leading to heightened health risks such as diabetes, cardiovascular ailments, and hypertension. In the disease management apps market, obesity-specific apps aim to assist individuals in weight management, tracking calorie intake, exercise routines, and providing dietary guidance. In the disease management apps market, trends for obesity management apps include AI-driven personalized weight loss plans, integration with fitness wearables, virtual coaching, and behavior modification techniques. These apps aim to combat the global obesity epidemic by offering tailored solutions for weight management and promoting healthier lifestyles.

Mental health is anticipated to expand at the fastest rate over the projected period. In the disease management apps market, mental health encompasses applications designed to address and support various mental health conditions, such as anxiety, depression, stress, and mood disorders. The market is witnessing a notable trend towards a heightened focus on mental health apps. As awareness surrounding mental health issues continues to expand, there is a surging demand for user-friendly and evidence-based apps. These applications provide valuable resources such as psychoeducation, self-help tools, mood tracking, and even virtual therapy. Consequently, they are instrumental in fostering a more accessible and comprehensive approach to mental healthcare, aligning seamlessly with the evolving landscape of mental health awareness and treatment.

Regional Insights

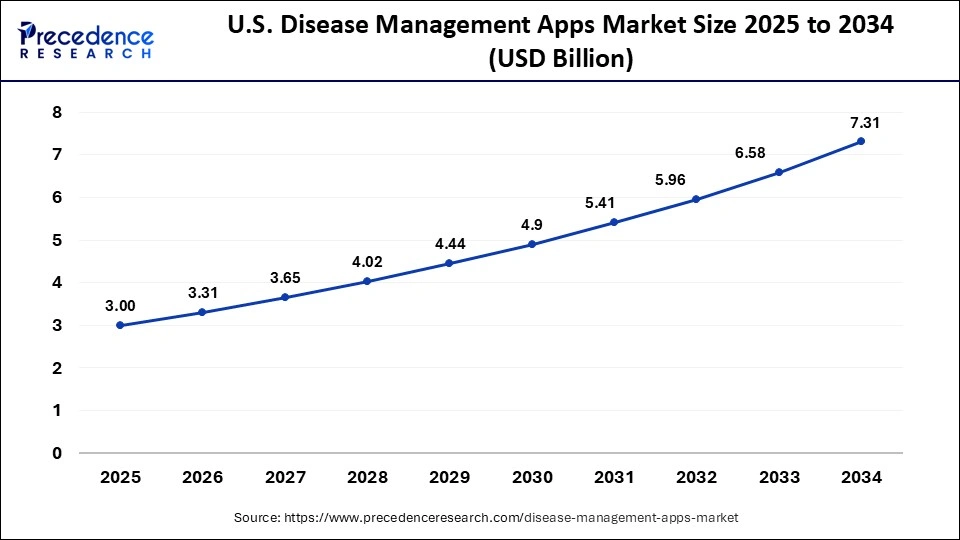

U.S. Disease Management Apps Market Size and Growth 2025 to 2034

The U.S. disease management apps market size accounted for USD 3.00 billion in 2025 and is expected to be worth around USD 7.31 billion by 2034, growing at a CAGR of 10.39% from 2025 to 2034.

North America has held the largest revenue share 42% in 2023. In North America, the disease management apps market is characterized by a growing emphasis on telehealth and remote patient monitoring, accelerated by the COVID-19 pandemic. The region's advanced healthcare infrastructure and high smartphone penetration contribute to the rapid adoption of these apps. Furthermore, there is a shift toward integrating apps with electronic health records (EHRs) for seamless care coordination. The demand for personalized health solutions and chronic disease management apps remains robust, driven by the region's rising healthcare costs and a focus on preventive healthcare measures.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the disease management apps market is witnessing notable trends. The growing adoption of smartphones and improved internet connectivity are expanding the user base. Telehealth initiatives and government support for digital healthcare solutions are driving app usage. There's a rising focus on chronic disease management, particularly for conditions like diabetes and cardiovascular diseases. Furthermore, collaborations between tech companies and healthcare providers are fostering innovation, leading to more sophisticated and user-friendly apps. The Asia-Pacific region presents a dynamic landscape for disease management app growth, with an emphasis on accessibility and improved healthcare outcomes.

Disease Management Apps Market Companies

- Teladoc Health, Inc.

- Livongo Health, Inc. (acquired by Teladoc Health)

- Welltok, Inc.

- Fitbit, Inc. (acquired by Google)

- Pear Therapeutics, Inc.

- Onduo LLC (a subsidiary of Verily, Alphabet Inc.)

- Medtronic plc

- Omada Health, Inc.

- MyFitnessPal (a subsidiary of Under Armour)

- Cerner Corporation

- McKesson Corporation

- IBM Corporation

- Microsoft Corporation

- Dexcom, Inc.

- Apple Inc.

Recent Developments

- In 2023, Teladoc Health has introduced an integrated health application, streamlining access for both patients and healthcare professionals, enhancing the ease and efficiency of healthcare delivery.

- In 2020, Teladoc Health acquired Livongo, a leading chronic condition management platform, creating a comprehensive virtual healthcare solution.

- In 2018, Apple partnered with Zimmer Biomet to develop an app using the Apple Watch's motion sensors to aid in the recovery of knee and hip replacement patients.

- In 2018,Novartis partnered with Pear Therapeutics to develop and commercialize prescription digital therapeutics for multiple sclerosis and schizophrenia.

Segments Covered in the Report

By Platform Type

- iOS

- Android

- Others

By Device

- Smartphones

- Tablets

- Wearables

By Indication

- Obesity

- Cardiovascular Issues

- Mental Health

- Diabetes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content