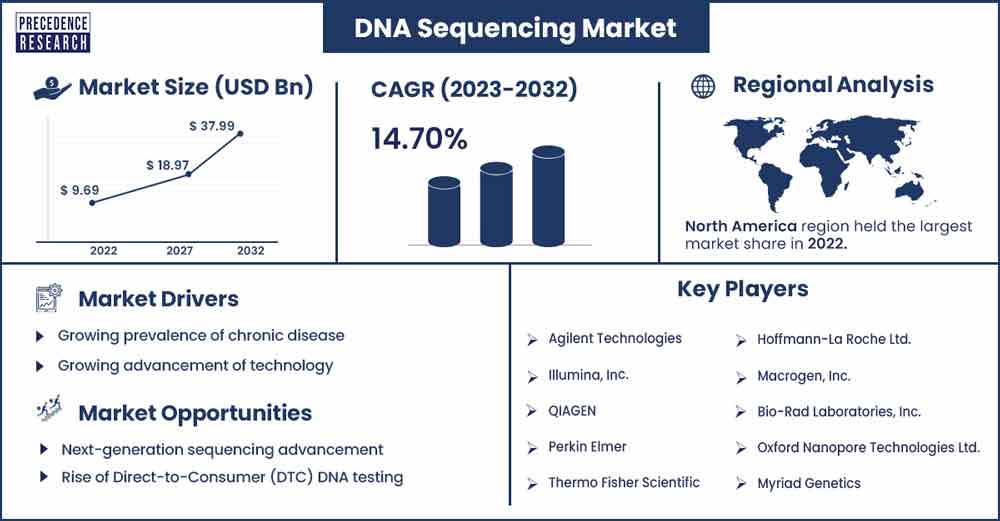

DNA Sequencing Market Will Grow at CAGR of 14.7% By 2032

The global DNA sequencing market size accounted for USD 9.69 billion in 2022 and is projected to reach around USD 37.99 billion by 2032, growing at a CAGR of 14.7% from 2023 to 2032.

DNA sequencing is the process of determining the order of nucleotides in a DNA molecule. DNA, or deoxyribonucleic acid, is the genetic material that contains the instructions for the development and functioning of living organisms. The sequence of nucleotides in DNA encodes genetic information, and deciphering this sequence is crucial for understanding biological processes, studying genetic variations, and identifying genes associated with specific traits or diseases.

With growing advancements in biotechnology and healthcare, the DNA sequencing market is gaining major popularity. The ability to decode the human genome has not only revolutionized the understanding of genetics but has also paved the way for personalized medicine, disease diagnostics, and numerous other applications. As technology continues to evolve, the DNA sequencing market is experiencing unprecedented growth, with an expanding range of players and innovative solutions.

Regional Analysis

North America acquired the most significant share of the DNA sequencing market; the region is observed to sustain its dominance for the upcoming years. The growth of the region is attributed to the surging funding and support initiatives by the government and private institutions. The growing adoption of advanced technologies and supportive policies by the government are significantly driving the growth of the industry.

Moreover, increasing advancement of technology in DNA sequencing and the launch of products are expected to proliferate the demand. Demand for the DNA sequencing market is anticipated to increase as a result of strategic actions taken by industry participants, including partnerships, mergers & acquisitions, and product launches.

In September 2022, for example, Genome Prairie and PRIESCAN officially announced the delivery of next-generation genome sequencing technology to the BioScience Applied Research Centre at Saskatchewan Polytechnic's Saskatoon campus. Researchers can learn more about the biological processes that affect humans thanks to this technique, which uses two pieces of genomic DNA sequencing equipment.

In the healthcare sector, DNA sequencing plays a crucial role in diagnostics, disease monitoring, and treatment planning. The use of genomics in research, drug discovery, and clinical trials has also driven market growth. Government initiatives, research funding, and collaborations between academic institutions and industry players have further propelled advancements in DNA sequencing technologies.

DNA Sequencing Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 11.06 Billion |

| Projected Forecast Revenue by 2032 | USD 37.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.7% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing prevalence of chronic disease

The number of cancer patients is increasing significantly. The development of DNA sequencing assists in understanding if there are any malfunctions in the body. The rising geriatric population and surging number of patients diagnosed with cancer are proliferating the demand for DNA sequencing. Due to the increase in the working population and surging lifestyle changes are leading to various health-related issues.

DNA sequencing also helps in diagnosing reproductive health issues, and personal health problems. It also allows for the development of personalized treatment plans based on the genetic profile of an individual's cancer. This approach, known as precision medicine, aims to tailor treatments to the unique characteristics of a patient's tumor, improving treatment efficacy and reducing side effects.

Growing advancement of technology

Continuous advancements in sequencing technologies, such as next-generation sequencing and third-generation sequencing platforms, have been a significant driver. These technologies offer higher throughput, faster turnaround times, and reduced costs per base pair, making DNA sequencing more accessible. Increasing investments in research and development activities in genomics and personalized medicine have promoted the demand for DNA sequencing. The technology plays a crucial role in understanding genetic variations, identifying disease markers, and developing targeted therapies.

Restraints

High cost of DNA sequencing

The cost of DNA sequencing has historically been high, especially with the introduction of first-generation sequencing technologies. However, over the years, there have been substantial technological advances leading to the development of next-generation sequencing technologies, which significantly reduced the cost per base pair. Developing and maintaining advanced sequencing technologies require substantial research and development investments. These costs, initially borne by the companies, can contribute to the overall expense of DNA sequencing services.

Regulatory and standardization hurdles

Regulatory frameworks around DNA sequencing and genomic research can be complex and vary across different regions. Stringent regulations may slow down the development and adoption of new sequencing technologies. Moreover, the lack of standardization in sequencing technologies and data formats can hinder interoperability between different platforms and datasets. Standardization efforts are essential to ensure consistency and comparability of results. Furthermore, the DNA sequencing market is competitive, and the presence of multiple players can lead to market saturation. This can result in pricing pressures and reduced profit margins for companies in the industry.

Opportunities

Next-generation sequencing advancement

Continued advancements in NGS technologies were expected, leading to increased speed, accuracy, and cost-effectiveness of DNA sequencing. The adoption of NGS in clinical applications, such as personalized medicine, oncology, and rare disease diagnosis, presented substantial growth opportunities. Companies like Pacific Biosciences and Oxford Nanopore Technologies have been at the forefront of developing third-generation sequencing technologies. These platforms offer advantages such as longer read lengths, enabling the sequencing of longer DNA fragments, and aiding in the assembly of complex genomes.

Rise of Direct-to-Consumer (DTC) DNA testing

Many individuals are interested in learning more about their ancestry and ethnic background. DTC DNA testing provides a convenient and accessible way for people to explore their genetic roots. DTC DNA testing companies expanded their services to include insights into potential health risks based on genetic markers. Consumers can receive information about predispositions to certain conditions or diseases. Some companies offer information about genetic traits, such as the ability to taste certain flavors, caffeine sensitivity, and more. This adds an element of personalization to the consumer experience.

Recent Developments

- In October 2022, The Revio long-read sequencing system and the Onso short-read sequencing system are two genome sequencing systems that PacBio said would be released. Revio also incorporates deep learning techniques to identify DNA methylation from standard sequencing libraries.

- In March 2022, technical specifications for Element Biosciences' eagerly anticipated Aviti DNA sequencer were made public. According to Element, the new benchtop equipment uses a variation on sequencing-by-synthesis chemistry that lowers reagent usage and results in expenses of about USD 7 per GB.

- In January 2023, Illumina announced that it would be collaborating with Nashville Biosciences and Amgen's deCODE Genetics subsidiary to sequence the entire genome of the biggest collection of African-American genomes to date, which consists of about 35,000 DNA samples.

Major Key Players

- Agilent Technologies

- Illumina, Inc.

- QIAGEN

- Perkin Elmer

- Thermo Fisher Scientific

- Hoffmann-La Roche Ltd.

- Macrogen, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies Ltd.

- Myriad Genetics

Market Segmentation

By Product

- Instruments

- Consumables

- Services

By Technology

- Third Generation DNA Sequencing

- Next-Generation Sequencing

- Sanger Sequencing

By Application

- Clinical Investigation

- Oncology

- Forensics & Agrigenomics

- Reproductive Health

- HLA Typing

- Others

By End-Use

- Clinical Research

- Academic Research

- Biotechnology & Pharmaceutical Companies

- Hospitals & Clinics

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1189

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308