DNA Vaccine Market 2026 Demand for Safer and More Stable Vaccines

DNA Vaccine Market Size, Trends, Shares and Competitive Analysis

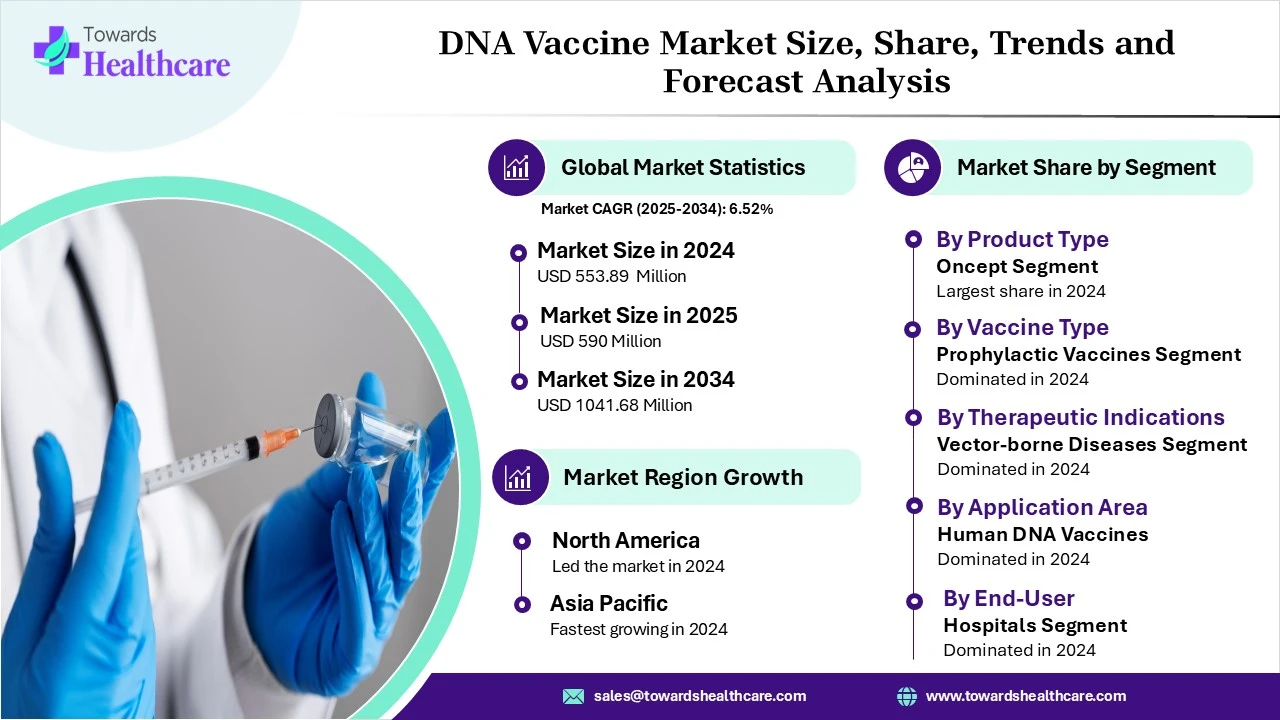

According to Towards Healthcare research, the global DNA vaccine market size was estimated at USD 553.89 million in 2024 and is anticipated to reach around USD 1041.68 million by 2034, growing at a CAGR of 6.52% from 2025 to 2034. The DNA vaccines are in high demand due to their enhanced safety, stability, and ease of production over conventional vaccines.

Global Outlook

What is the DNA Vaccine?

The DNA vaccines are experiencing a significant growth through a huge adoption in oncology and veterinary sectors. Advancements in genetic engineering, gene delivery methods, and RNA technology drive the superior stability of DNA vaccines. The rapidly growing DNA vaccine market offers unique advantages like reduced dependency on the cold chain and lower distribution costs. Research mainly focuses on the therapeutic applications of DNA vaccines in oncology for personalized cancer vaccines and on infectious diseases.

Market Opportunity

What is the Future of the Market?

There are notable advancements in delivery methods and enhanced delivery systems, including personalized neoantigen vaccines and combination therapies. The integration of AI into the vaccine design and development process fuels antigen selection, prediction of immune responses, and optimization of vaccine delivery systems.

Key Growth Factors

- The expanding therapeutic applications, such as cancer immunotherapy, personalized medicine, and infectious disease detection, are the major growth areas of the DNA vaccine market.

- The nanoparticle-based delivery, needle-free injection systems, electroporation, and self-amplifying DNA drive technological advancements in delivery methods.

Market Restraint

What are the Potential Challenges in the Market?

The major challenges are related to immunogenicity and efficacy of DNA vaccines, which include antigen variability, poor translation to humans, and variable T-cell response. The nanoparticle delivery complexity, safety, and public perception are also challenging factors. The manufacturing and regulatory issues revolve around manufacturing complexity and regulatory uncertainty.

Segmental Outlook

How does the Oncept Segment Dominate the DNA Vaccine Market in 2024?

The oncept segment dominated the market in 2024, owing to the efficient role of oncept as a specialized DNA vaccine for the treatment of melanoma in dogs and in veterinary medicine. The oncept helps in DNA vaccine development, driving advancements in human DNA and mRNA vaccine development. It helps to develop human medicines by using different delivery technologies.

The Apex-IHN segment is expected to grow at the fastest CAGR in the market during the forecast period due to the potential of Apex-IHN as a commercially established DNA vaccine for salmonids that remains crucial for the evaluation of new infectious hematopoietic necrosis virus (IHNV) vaccines. It was the first commercially approved DNA vaccine for veterinary use, which provides a strong and long-lasting immune response. It can effectively reduce mortality in Atlantic salmon.

What made Prophylactic Vaccines the Dominant Segment in the DNA Vaccine Market in 2024?

The prophylactic vaccines segment dominated the market in 2024, owing to their extensive use in infectious diseases for both animals and humans. These vaccines are widely adopted and more established in veterinary medicine. They are commercialized vaccines holding animal health applications.

The therapeutic vaccine segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to advancements in cancer immunotherapy and wide therapeutic applications. The rising demand for personalized vaccines and combination therapies makes cancer immunotherapy a promising area for therapeutic DNA vaccines. Several advanced technologies, like improved delivery systems, gene-encoded adjuvants, and increased R&D investments, enhance the role of therapeutic DNA vaccines in the market.

How did the Vector-borne Diseases Segment Dominate the DNA Vaccine Market in 2024?

The vector-borne diseases segment dominated the market in 2024, owing to stability, safety, immunogenicity, rapid production, and design flexibility of DNA vaccines. The DNA vaccines combat vector-borne diseases and induce cellular immunity. Advancements in DNA vaccine technology and the ongoing research focus on exploring the use of DNA vaccines in addressing vector-borne pathogens.

The cancer segment is anticipated to grow at a notable rate in the market during the upcoming period due to the efficient functions of DNA vaccines in gene delivery, protein expression, and immune response. Personalized approaches are on the rise due to the excellence of next-generation sequencing to identify unique tumor-specific mutations. The integration of DNA vaccines with other therapies or treatments helps to overcome the immunosuppressive environment created by tumors.

Which Segment by Application Area Type Dominated the DNA Vaccine Market in 2024?

The human DNA vaccines segment dominated the market in 2024, owing to their thermal stability and rapid scalability. The DNA-encoded monoclonal antibodies offer durability and versatility with potential applications in treating cancer, metabolic disorders, and infectious diseases. Targeting cancer and personalized medicine is the most promising area of DNA vaccine development, which helps researchers create a highly personalized immunotherapy approach.

The animal DNA vaccines segment is predicted to grow at a rapid rate in the market during the studied period due to commercial and approved products and significant R&D efforts. The R&D in animal DNA vaccines targets emerging threats, improves delivery systems, and combats animal diseases. The increased need for vaccine efficacy, safety, and improved storage drives the adoption of animal DNA vaccines.

How does the Hospital Segment Dominate the DNA Vaccine Market in 2024?

The hospital segment dominated the market in 2024, owing to clinical applications of DNA vaccines in research hospitals across cancer immunotherapy and infectious disease research. The limited number of human-approved products drives the demand for DNA vaccines in standard hospital procedures. The primary role of DNA vaccines in hospitals lies in the ongoing clinical trials for treating cancer and certain infections.

The academic institutes and research organizations segment is expected to grow at the fastest CAGR in the market during the forecast period due to core research areas and innovations across delivery systems, vector optimization, adjuvants, and bioinformatics. The key applications of DNA vaccines revolve around clinical trials and vaccine development. The huge adoption of DNA vaccines in research aims to overcome poor immunogenicity challenges.

Geographical Outlook

North America

How does North America Dominate the DNA Vaccine Market in 2024?

North America dominated the market in 2024, owing to the significant policies and funding for vaccine research. This region experienced the launch of multiple vaccine-related programs. There is a strong public health infrastructure and novel vaccine development strategies for COVID-19, influenza, and many other vaccines. The government sets annual immunization schedules, national immunization programs, and national vaccination campaigns. The government also supports global vaccine equity and focuses on collaborations that empower vulnerable groups.

U.S. DNA Vaccine Market Trends

In August 2025, Pfizer and BioNTech’s COMIRNATY received the U.S. FDA approval for people aged 5 to 64 and adults aged 65 and older who are at increased risk of severe COVID-19. The U.S. Department of Health and Human Services (HHS) initiated its mRNA vaccine development activities in support of the Biomedical Advanced Research and Development Authority (BARDA) in August 2025. In May 2025, the HHS and the National Institutes of Health (NIH) launched the next-generation universal vaccine platform for pandemic-prone viruses.

What is the Potential of the DNA Vaccine Market in the Asia Pacific?

The Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by government-led DNA vaccine programs, genomic and biotechnology research, and expanding access to existing vaccines. The 7th Vaccine World Asia Congress 2025-SouthEast Asia focused on uniting researchers, leading vaccine experts, policymakers, regulators, and industry leaders from the SouthEast Asia region.

The International Vaccine Institute (IVI) in the Republic of Korea signed an MoU with the Zambia National Public Health Institute to advance the vaccine manufacturing ecosystem in Zambia. The IVI-led CAPTURA consortium released its first country report on antimicrobial resistance (AMR) surveillance data in Bangladesh and Asia. This report represents stakeholders engaging in policy, research, regulatory decision-making, and infectious disease prevention and control programs in Asia and Bangladesh.

India DNA Vaccine Market Trends

India is emerging as a hub for affordable and high-quality medicines while leading in global health. The Ministry of Science and Technology focuses on vaccine equity and technology transfer to improve vaccination efforts. The government provides funding for vaccine and biotechnology initiatives through several programs, such as the Biotechnology Industry Research Assistance Council (BIRAC) and the National Biopharma Mission (NBM).

Strategic Moves by Key Players

- In July 2025, Merck planned to present new data on research advancements across its HIV prevention and treatment area at the 13th International AIDS Society Conference on HIV Science (IAS).

- In September 2025, Pfizer proclaimed the safety and efficacy of COVID-19 vaccines and introduced resources that support its impact on global health.

Top Companies in the DNA Vaccine Market

- Inovio Pharmaceuticals

- Zydus Cadila

- Merck & Co.

- GeneOne Life Science

- Pfizer

- Sanofi

- Johnson & Johnson

- GlaxoSmithKline (GSK)

- AstraZeneca

- VGXI

- Applied DNA Sciences

- Entos Pharmaceuticals

- Takis Biotech

Segments covered in the report

By Product Type

- Oncept

- West Nile-Innovator

- Apex-IHN

By Vaccine Type

- Therapeutic Vaccines

- Prophylactic Vaccines

By Therapeutic Indications Type

- Vector-Borne Diseases

- Cancer

By Application Area Type

- Human DNA Vaccines

- Animal DNA Vaccines

By End User

- Hospital

- Clinics

- Academic Institutes and Research Organizations

- Other End Users

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait