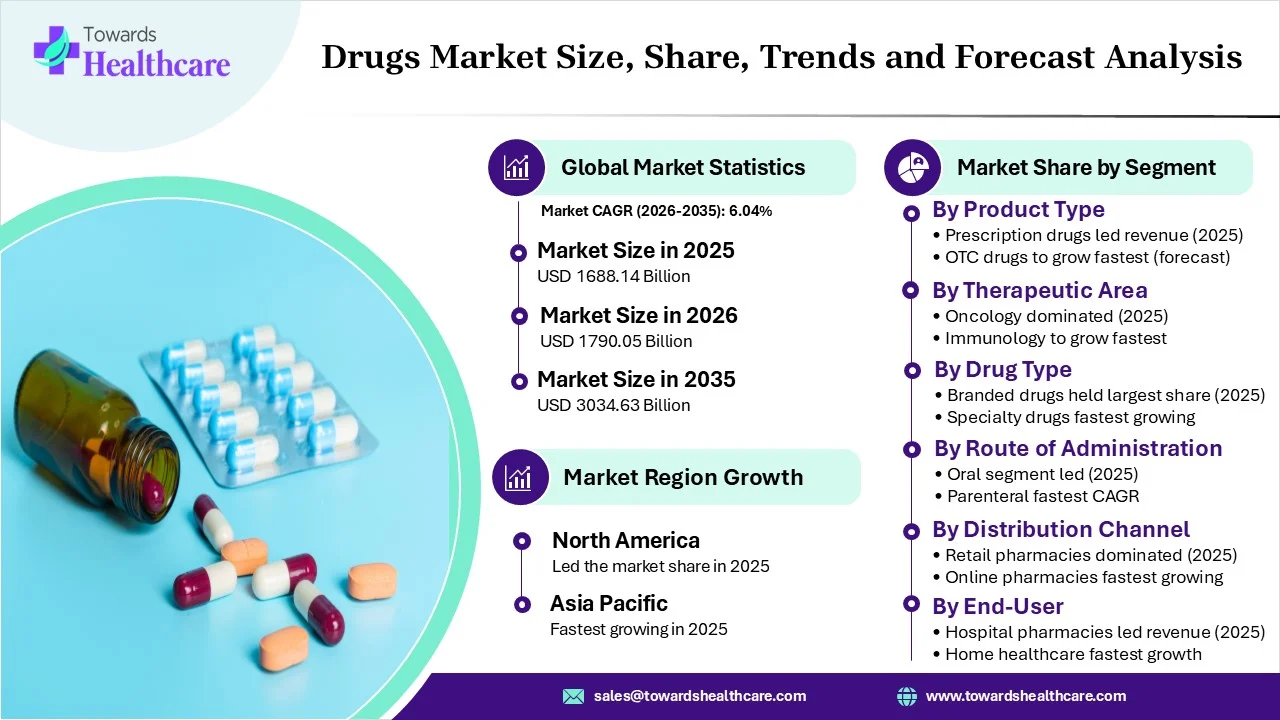

Drug Market Forecast from USD 1,688.14 Billion in 2025 to USD 3,034.63 Billion by 2035 with a CAGR of 6.04%

The global drugs market size recorded US$ 1688.14 billion in 2025, set to grow to US$ 1790.05 billion in 2026 and projected to hit nearly US$ 3034.63 billion by 2035, with a CAGR of 6.04% throughout the forecast timeline.

Segmental Outlook

Which Product Type Dominated the Drugs Market in 2024?

The prescription drugs segment was dominant in the market in 2024. Across the globe, accelerating diverse chronic issues, demand for innovative therapies and advances in GLP-1 agonists for weight loss and diabetes are driving the segmental progression. However, leading companies are developing several therapies mainly in oncology, like antibody-drug conjugates.

The over-the-counter (OTC) drugs segment will expand rapidly. Globally expanding emphasis on preventive health post-pandemic, further highly demanding vitamins, minerals, and supplements (VMS), and also, regulatory bodies are significantly approving the switch of prescription drugs to OTC to minimize healthcare spending & enhance accessibility.

How did the Oncology Segment Lead the Market in 2024?

The oncology segment captured a major share of the market in 2024. Specifically, booming cancer cases are driving demand for antibody-drug conjugates & new, bispecific antibodies. The market is focusing on AI integration, like NeoGenomics' PanTracer platform and optional therapy, including subcutaneous delivery.

The immunology segment will witness rapid expansion. The segmental progression is fueled by a rise in efforts into next-generation biologics, like IL-23, bispecifics & precision oral small molecules, emphasising increasing the efficiency ceiling in autoimmune diseases. The wider adoption of AI supports strengthening antibody discovery, affinity maturation, & the progression of new therapeutics.

Which Drug Type Led the Drugs Market in 2024?

In 2024, the branded drugs segment dominated the market. These drugs highly facilitate innovation, initial market uniqueness, extensive clinical testing data, and robust brand understanding. The globe is fostering GLP-1 transformation in cardiometabolic diseases, like Novo Nordisk’s Ozempic & Wegovy & empowerment of immunotherapy in oncology.

The specialty drugs segment will expand fastest. Their adoption is driven by their benefits, including targeted, high-efficacy treatment for complex, chronic, or rare diseases, especially cancer, MS, and rheumatoid arthritis. Alongside, they offer tailored dosing, expanded patient education, and assistance with navigating complex insurance & financial support programs.

Why did the Oral Segment Lead the Market in 2024?

The oral segment captured the biggest share of the market in 2024. This is the convenient, safe, and non-invasive nature, and also omits the pain and risks connected with injections, which enables self-administration. Numerous oral drugs are more affordable and easier to store than other forms.

The parenteral (injectable) segment will show the fastest expansion. This has a quicker onset of action, 100% bioavailability, & skips gastrointestinal absorption issues or first-pass metabolism. They are necessary for unconscious, vomiting, or uncooperative patients, which facilitates precise, reliable dosing.

How did the Retail Pharmacies Segment Dominate the Market in 2024?

In 2024, the retail pharmacies segment captured the largest share of the market. Their progression is fueled by easy access to prescription drugs, over-the-counter products, and immunizations. A recent development includes their services, such as "Test to Treat" for minor concerns, like influenza, Strep A to relieve pressure on emergency rooms.

The online pharmacies segment will expand rapidly. Their expansion is propelled by escalated accessibility for remote patients, 24/7 ordering, minimal expenditures due to lowered overhead, and broader stock selection. Nowadays, they are extensively integrating telehealth apps, which enable users to consult doctors & order medications on one platform.

Which End-User Led the Drugs Market in 2024?

In 2024, the hospital pharmacies segment registered dominance in the market. They basically offer 24/7 medication review, improved therapy, affordability, and robust patient counseling. Currently, they are leveraging automated dispensing cabinets, barcoding, & sophisticated software for inventory and prescription management to lower errors.

The home healthcare segment will show the fastest growth. They usually facilitate skilled nursing, therapy, and personal care directly to a patient's home, and enable them to skip hospitalizations or nursing home placement. Nowadays, they are increasingly using AI integrations and developing telemedicine approaches, wearable devices, smart sensors, and kits.

Regional Outlook

How did North America Dominate the Market in 2024?

Accelerating investments in biotechnology, mRNA technology, & tailored medicine, and also expanding awareness among consumers and a robust retail pharmacy network in the U.S. and Canada for the over-the-counter (OTC) are supporting the regional dominance. The U.S. is emphasizing digital technology, like telepharmacy, e-prescribing, & automated dispensing to revolutionize patient care.

How is the Asia Pacific Progressing in the Drugs Market?

Specifically, China & India are experiencing the greatest rise in obesity, diabetes, and eye disorders, which demands for specialized interventions. However, certain governments are strongly fostering generic medications to curb healthcare spending, including Japan, which has raised generic usage from 68% to 80%.

Recent Launches

- In January 2026, Sunil Kumar introduced AffordPill, an online pharmacy and healthcare platform across India.

- In October 2025, Senderra launched Pharma Navigator, a digital platform to encourage alliances among pharmaceutical manufacturers and the company.

Drugs Market Key Players

- Pfizer

- Johnson & Johnson

- Merck

- GSK

- Novartis

- Sanofi

- Amgen

- AbbVie

- AstraZeneca

- Bristol Myers Squibb

- Dr. Reddy's Laboratories

- Eli Lilly

- Roche

- Sun Pharma

- Abbott India

- Alkem Laboratories

- Cipla

- Lupin

- Mankind Pharma

- Novo Nordisk

- Zydus Lifesciences

- Aurobindo Pharma

- Divi's Laboratories

Segments Covered in the Drugs Market Report

By Product Type

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

By Therapeutic Area

- Oncology

- Cardiovascular

- Central Nervous System (CNS)

- Respiratory

- Infectious Diseases

- Gastrointestinal

- Diabetes

- Autoimmune Disorders

- Dermatology

- Ophthalmology

- Pain Management

- Urology

- Immunology

- Hematology

- Rare Diseases

By Drug Type

- Branded Drugs

- Generic Drugs

- Biosimilars

- Biologics

- Specialty Drugs

- Small Molecule Drugs

By Route of Administration

- Oral- Dominated

- Parenteral (Injectable)

- Topical

- Inhalation

- Transdermal

- Sublingual/Buccal

- Rectal/Vaginal

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Drug Stores

- Direct-to-Consumer

By End-User

- Hospital Pharmacies

- Home Healthcare

- Ambulatory Surgical Centers

- Academic & Research Institutions

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: https://www.towardshealthcare.com/insights/drugs-market-sizing