Flexible Endoscopes Market Size To Touch USD 17.77 Bn By 2032

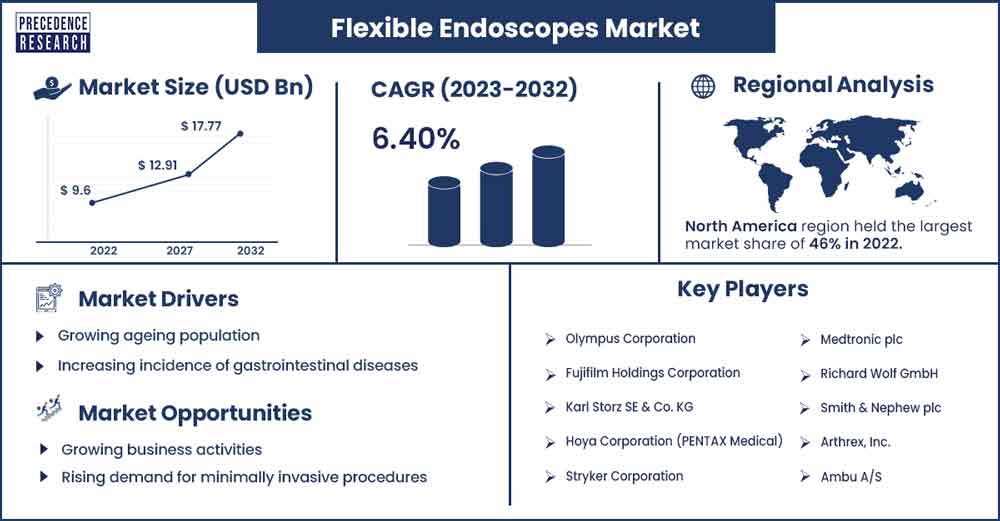

The global flexible endoscopes market size was evaluated at USD 9.6 billion in 2022 and is expected to touch around USD 17.77 billion by 2032, growing at a noteworthy CAGR of 6.40% from 2023 to 2032.

Market Overview

A flexible endoscope is a medical instrument used for the visual examination of internal organs and cavities of the body. It consists of a flexible tube with a light source and a camera at its tip, allowing physicians to view and diagnose conditions within the body without the need for invasive surgery. The flexibility of the endoscope enables it to navigate through curved and intricate pathways, providing a detailed and real-time image of the interior of organs, such as the gastrointestinal tract, respiratory system, and urinary tract.

Flexible endoscopes are commonly used in various medical specialities, including gastroenterology, pulmonology, urology, and gynecology. They play a crucial role in both diagnostic and therapeutic procedures. Diagnostic procedures involve the visual infection of tissue and organs to identify abnormalities, while therapeutic procedures may include interventions such as removing polyps, taking biopsies, or treating bleeding.

The flexible endoscopes market is driven by various factors including increasing incidence of gastrointestinal diseases, rising ageing population, preference for minimally invasive procedures, growing awareness and screening programs and rising healthcare expenditure. Furthermore, the ongoing advancements in endoscopic technologies, such as improved imaging capabilities, enhanced flexibility, and miniaturization of components, drive market growth. Innovations like high-definition imaging and three-dimensional visualization contribute to better diagnostic accuracy.

According to the Australian Institute of Health and Welfare, approximately 8,700 Australians are predicted to pass away from lung cancer in 2023. This is the leading cause of mortality from cancer.

Regional Insights

North America is expected to hold the largest revenue share over the forecast period. The market growth in the region is attributed to the growing ageing population and the increasing prevalence of various diseases such as colorectal cancer, and digestive disease. For instance, as per the data by the United States Census Bureau, between 2021 and 2022, the median age of the country rose by 0.2 years to 38.9 years.

Furthermore, multiple reports state that 62 million Americans receive a diagnosis of a digestive disease annually. Most digestive diseases become more common and more frequent as people age. Hemorrhoids, inflammatory bowel disease, and chronic liver disease are a few other outliers that are more frequent among young and middle-aged persons.

The United States hold the prominent market share in the region owing to the presence of major players such as Stryker Corporation, Arthrex, Inc., Boston Scientific Corporation and others. The constant approval of innovative products offers an enormous opportunity for market growth in the region. For instance, in February 2023, the LithoVueTM Elite Single-Use Digital Flexible Ureteroscope System, which offers real-time intrarenal pressure monitoring during ureteroscopy operations, was cleared by the FDA under the 510(k) program, according to an announcement from Boston Scientific Corporation.

Flexible Endoscopes Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 10.17 Billion |

| Projected Forecast Revenue by 2032 | USD 17.77 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.4% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Growing ageing population

The ageing population is more prone to various medical conditions, including digestive system disorders. As the global population continue to age, there is a higher demand for medical devices, including flexible endoscopes, to address age-related health issues. For instance, according to the World Health Organization, by 2030, half of the world population will be 60 years of age or older. The number of individuals over 60 will increase from 1 billion in 2020 to 1.4 billion presently. Thus, the aforementioned stats are expected to drive the market expansion over the projected timeframe.

Increasing incidence of gastrointestinal diseases

The increasing prevalence of gastrointestinal disorders, including colorectal cancer, inflammatory bowel disease, and gastrointestinal bleeding, fuels the demand for flexible endoscopes. These devices are essential for both the diagnosis and treatment of such conditions. For instance, as per the data published by Cancer Australia, bowel cancer diagnosis by the age of 85 is predicted to affect 1 in 19 (or 5.2%) people in 2022 (1 in 18 or 5.6% for males and 1 in 21 or 4.8% for females). The age-standardized incidence rate for 2018 was 54 cases per 100,000 people (46 for women and 62 for men).

Restraints

High cost

Flexible endoscopic equipment can be expensive to manufacture and maintain. The initial capital investment required for purchasing endoscopy systems and related accessories, as well as the cost associated with training healthcare professionals, can be a significant barrier to adoption, especially in resource-limited healthcare settings.

Concerns associated with infection

The reprocessing and sterilization of flexible endoscopes are critical for preventing infections. Instances of infections associated with inadequately cleaned endoscopes have raised concerns and led to increased scrutiny of reprocessing practices. Adherence to stringent sterilization protocols and regular maintenance can be resource intensive for healthcare facilities. Thus, this is expected to hamper the market growth over the forecast period.

Opportunities

Growing business activities

The increasing partnerships and other business activities among major key players of the market is expected to propel the market growth over the forecast period. For instance, in October 2022, AdaptivEndoTM, the company leading the breakthrough in single-use endoscopy technology, and OMNIVISION, a leading global developer of semiconductor solutions, including advanced digital imaging, analog, touch & display technology, announced their partnership to provide a flexible, unified platform for hybrid and single-use endoscopes, including systems used for gynecology, urology, gastroenterology, and advanced endoscopic surgery (spinal and cardiac electrophysiology). Together, the two businesses have created unified endoscope consoles that are ideal for usage both inside and outside of operating rooms for the medical sector.

The system includes streamlined controls and employs OMNIVISION image sensors for high-performance imaging. The technology is designed by clinicians at AdaptivEndo and is optimized for both cost and performance.

Rising demand for minimally invasive procedures

The global trend towards minimally invasive procedures provides a significant opportunity for the flexible endoscopes market. As patients and healthcare professionals increasingly prefer procedures that involve smaller incisions, flexible endoscopes play a crucial role in facilitating minimally invasive interventions across various medical specialties.

Recent Developments

- In June 2023, the new Olympus ETD was launched, according to Olympus. The newest model in the company's infection prevention portfolio, designated ETD Basic and ETD Premium, was created to improve cleaning and disinfection outcomes and increase the efficiency and sustainability of endoscope reprocessing. Improved usability and a simplified procedure for less burden are advantageous to healthcare workers.

- In November 2023, working jointly, Plasmapp and AdaptivEndoTM are assessing the potential uses of low-temperature hydrogen peroxide gas plasma for flexible endoscopy. The tabletop STERLINK Plus sterilization system is presently under evaluation. The AdaptivEndoTM GI endoscope platform—which uses a reposable handpiece—is the first subject of the review. (hybrid endoscopy).

- In September 2023, the IRCAD, a worldwide center for advanced research and training in minimally invasive surgery located in Strasbourg, France, and the HOYA Group, PENTAX Medical, announced a collaboration in physician education on advanced flexible endoscopy. IRCAD provides a training center that annually hosts more than 8,800 doctors from across the world practicing all surgical and GI specialities. In various training centers, the training and research institute employs over eight hundred foreign professionals.

Key Market Players

- Olympus Corporation

- Fujifilm Holdings Corporation

- Karl Storz SE & Co. KG

- Hoya Corporation (PENTAX Medical)

- Stryker Corporation

- Medtronic plc

- Richard Wolf GmbH

- Smith & Nephew plc

- Arthrex, Inc.

- Ambu A/S

- B. Braun Melsungen AG

- Boston Scientific Corporation

- CONMED Corporation

- EndoChoice Holdings, Inc. (A subsidiary of Boston Scientific)

- HOYA Corporation (PENTAX Medical)

Market Segmentation

By Offering

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscope

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Others

By End Use

- Hospitals

- Outpatient Facilities

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3325

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308