General Surgery Devices Market Size To Rise USD 28.99 Billion By 2032

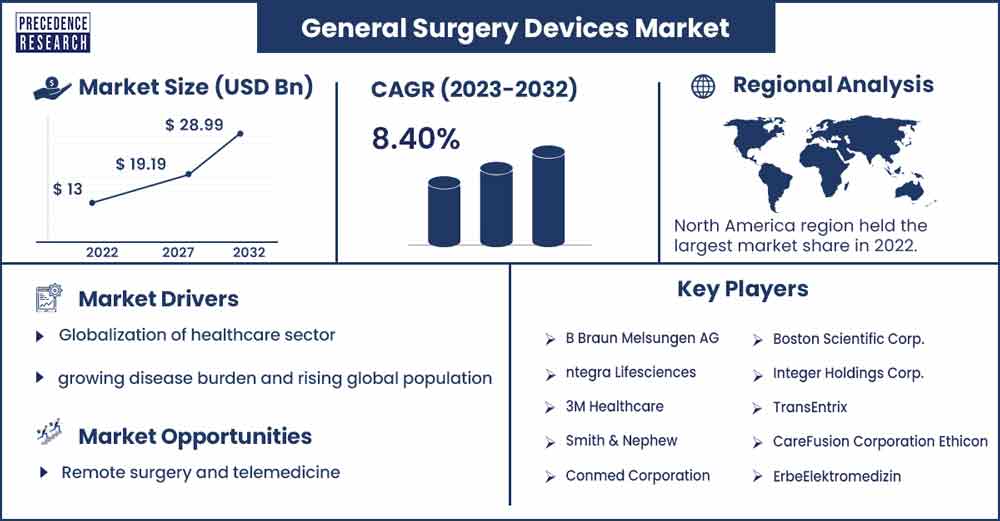

The global general surgery devices market size exceeded USD 13 billion in 2022 and is expected to rise to USD 28.99 billion by 2032, growing at a CAGR of 8.40% during the forecast period from 2023 to 2032.

Market Overview

The industry that manufactures and distributes medical equipment specially made for general surgical procedures is known as the general surgery devices market. Surgeons and other medical professionals use these devices for various surgical procedures, such as appendectomies, hernia repairs, abdominal surgeries, gastrointestinal surgeries, and other procedures involving organs and tissues inside the abdominal cavity. During surgery, instruments such as forceps, clamps, retractors, and scissors are used to cut, dissect, hold, and manipulate tissues, devices that cut or coagulate tissues using electrical currents to reduce bleeding during surgery. Tools like trocars, endoscopes, and special instruments used in laparoscopic procedures are made for minimally invasive surgery. Devices that help speed the healing process by sealing surgical wounds and incisions.

A vital part of the more significant medical device sector is the market for devices used in general surgery. Technological developments, the aging population, and the rising frequency of surgical procedures are some factors driving the need for these devices. This market is home to a variety of businesses, from big international conglomerates to more minor specialty procedures, all of which are constantly innovating to create surgical instruments that are more accurate, efficient, and require less surgery. Healthcare infrastructure, regulatory restrictions, and the changing needs of healthcare providers and surgeons impact the market dynamics.

- In November 2023, the first and only integrated solution, led by former FDA imaging experts covering the entire medical device product lifecycle, is now available thanks to the launch of MCRA's AI & Imaging Center, a privately held independent clinical research organization and advisory firm specializing in medical devices, diagnostics, and biologics.

- In December 2022, global healthcare giant Abbott introduced its Navistar, a minimally invasive transcatheter aortic valve implantation (TAVI) system, to the Indian market. This procedure is now available to patients in India with severe aortic stenosis who are at high or extreme risk of surgery.

Regional Snapshot

North America holds the largest share of the general surgery devices market. A growing ageing population, increased surgical procedures, and technological improvements have all impacted the region's market. Surgical technology is a continuously improving field via the creation of precision surgical instruments, minimally invasive techniques, and robotically assisted surgeries. Due to shorter recovery times for patients, smaller incisions, and better results, there has been a noticeable movement in surgical practices towards minimally invasive procedures.

The market for general surgery equipment has expanded as a result of an increase in both elective and non-elective surgical operations. The safety and effectiveness of equipment are guaranteed by strict regulations and standards in North America, which impact market dynamics. Furthermore, the region hosts several key players in the general surgery devices market, including B Braun Melsungen AG, Integra Lifesciences, 3M Healthcare, Smith & Nephew, Conmed Corporation, Boston Scientific Corp, Integer Holdings Corp, and TransEntrix.

- In August 2022, a definitive agreement was revealed by CONMED Corporation to buy privately held Biorez, Inc. (Biorez) for a cash consideration of $85 million at closing, subject to adjustment, and up to an additional $165 million in growth-based earnout payments over four years.

- In July 2023, the international medical technology business Smith Nephew introduced the REGENETEN Bioinductive Implant in India. With over 100,000 procedures performed worldwide since its launch, the REGENETEN implant has revolutionized how surgeons perform rotator cuff surgeries.

A growing emphasis on minimally invasive treatments, an aging population, rising rates of chronic diseases needing surgical inventions, and technological improvements impact the US market for general surgery devices. The healthcare infrastructure, reimbursement practices, and regulatory frameworks significantly impact the market. Both smaller regional firms and global corporations are involved in the market. Businesses may engage in partnerships, mergers and acquisitions, and inventions to obtain a competitive advantage. Instruments such as scalpels, forceps, scissors, and retractors are used for cutting, holding, dissecting, and adjusting tissues during surgery and sophisticated robotically aided technologies let surgeons execute precise, complex procedures.

Like many other industrialized nations, Canada's market for general surgical devices is impacted by the aging of its population, growing healthcare infrastructure, and technological improvements. Government activities and policies about medical device regulations and healthcare infrastructure partly shape the industry. Market dynamics may be impacted by the regulatory environment, including approval procedures for new technologies. Healthcare cost containment strategies may impact the market for general surgery devices by influencing healthcare purchasing decisions. Canada's population is aging, much like many other wealthy nations.

General Surgery Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 14.03 Billion |

| Projected Forecast Revenue by 2032 | USD 28.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.40% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Globalization of the healthcare sector

The market for general surgery equipment has grown and expanded thanks to globalization, which has allowed producers to access new customers and markets around the globe. International cooperation and partnerships between healthcare organizations, researchers, and device manufacturers have been facilitated by globalization.

As a result, information, technology, and best practices about general surgical devices are now shared. Harmonizing regulatory norms and regulations for medical devices, particularly those used in general surgery, has become more critical due to globalization. The simplification of laws guarantees a uniform quality standard throughout various regions and makes it easier for producers to enter the market. The rate of technological innovation in general surgical instruments has increased due to the global flow of ideas and technologies.

Restraint

Concerns about patient safety

Patients may be in danger from surgical instruments that are poorly made or of low quality. Complications during surgery may result from device malfunctions, breaks, or flaws. Inadequate adherence to regulatory norms and standards may release hazardous items onto the market. Manufacturers must follow stringent guidelines to guarantee the effectiveness and safety of their products. Errors and difficulties may arise from inadequate training for healthcare staff regarding handling surgical instruments. Medical personnel must receive extensive training on handling and using these devices safely. A lack of industry standardization and instrument design variability can cause surgery errors.

Opportunity

Remote surgery and telemedicine

Surgical robots assist surgeons in carrying out precise surgeries. The surgeon manipulates the robot from a console, which interprets their movements into accurate actions. Surgeons can now experience remote surgery more interactively due to advanced telepresence and virtual reality systems. This improves their capacity to carry out complex tasks remotely. Physicians can remotely monitor patients with wearable gadgets and sensors, which enables them to monitor the patient's post-operative recovery and take appropriate action.

Artificial intelligence tools can help surgeons with diagnosis, data analysis, and decision-making, leading to better telemedicine and remote surgery outcomes. For the surgeon to communicate real-time data, photos, and videos with the patient or medical team, fast and secure communication channels are essential.

Recent Developments

- In April 2023, Distalmotion, a company that aims to introduce its surgical robot to the US market, revealed today that it has concluded a $150 million fundraising round headed by Revival Healthcare Capital.

- In August 2023, The CK Birla Group and Intuitive India collaborated to introduce the most recent da Vinci Surgical Robot.

Key Market Players

- B Braun Melsungen AG

- Integra Lifesciences

- 3M Healthcare

- Smith & Nephew

- Conmed Corporation

- Boston Scientific Corp.

- Integer Holdings Corp.

- TransEntrix

- CareFusion Corporation Ethicon

- ErbeElektromedizin

Market Segmentation

By Type

- Open Surgery Instrument

- Disposable Surgical Supplies

- Minimally Invasive Surgery Instrument

- Energy Based & Power Instrument

- Medical Robotics & Computer Assisted Surgery Devices

- Adhesion Prevention Devices

By Application

- Ophthalmology

- Cardiology

- Orthopedic Surgery

- Audiology

- Wound Care

- Urology & Gynecology

- Plastic Surgery

- Thoracic Surgery

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1318

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308