Generic Sterile Injectable Market is Likely to Rise at 11.30% CAGR By 2030

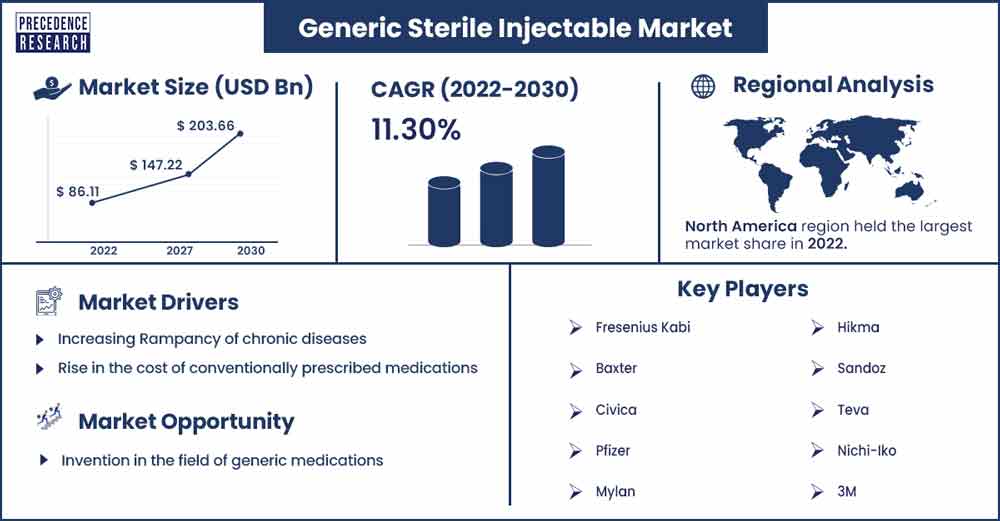

The global generic sterile injectable market size was exhibited at USD 95.82 billion in 2023 and is projected to attain around USD 203.66 billion by 2030, growing at a CAGR of 11.30% during the forecast period from 2022 to 2030.

Market Overview

Commercially available drugs can be classified into two categories: Branded drugs and generic drugs. A branded medication is usually patent protected under a specific name or trademark and sold by a specific company. On the other hand, a generic drug has the same active ingredient as its branded counterparts but with increased therapeutic efficiency and potency. Pharmaceutical companies make vast amounts of such generic medications in the form of injectables, which can be used to treat various diseases. The manufacturing of generic sterile injectables is strictly done under the regulations released by the FDA.

Chronic diseases are one of the primary reasons for the increasing rate of death as they cannot be easily diagnosed and treatable by using general healthcare medications and the vaccination process. Along with this, the geriatric population is comparatively more prone to chronic diseases than adults and the young population. According to the report of NCOA (National Council of Aging), nearly 95% of adults aged 60 or older have been diagnosed with at least one chronic disease, and approximately 80% have more than two chronic health diseases. Such health conditions often need to be observed on a regular basis to give a precise dose of medication. For such cases, the generic injectable has remarkable drug delivery into the bloodstream of patients, making it more reliable and fast-acting at the same time.

Due to these reasons, the use of generic injectables is showing a rapid growth in the healthcare sector. In addition, the integration of pharmaceutical production and cutting-edge technological advancement plays a pivotal role in maintaining high standards and the efficacy of generic injectables, which will lead to tremendous growth in the healthcare domain.

Generic Sterile Injectable Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 95.82 Billion |

| Projected Forecast Revenue by 2030 | USD 203.66 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 11.30% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot

North America has dominated the generic sterile injectable market so far. It emerged as the largest market around the globe, holding 59% of the share in 2022, and is projected to develop rapidly in the manufacturing of generic medicines as well. The reason behind its fast progression is the country's rising geriatric population, which is more prone to chronic diseases and lifestyle discomfort due to these health conditions. In a bid to combat these problems, key players in the healthcare sector have been frequently releasing new products in the market. These products tend to be more cost-effective and can loosen up the burden of huge expenses that the country's healthcare needs to hold. Currently, brand medications are much more costly than generic medications, which provide a product that is way more fast-acting and cost-effective.

- In April 2022, US-based generic sterile injectable company Custopharm Inc. was taken into possession of Hikma Pharmaceutical plc, a UK-based company. It helps strengthen the injectable 'business by adding an engaging portfolio of marketed products.

Asia Pacific is expected to grow at a robust pace during the forecast period. This region witnessed rapid growth in the generic injectable market owing to the increased investments in the healthcare sector by the key players. For instance, in July 2022, the India-based pharmaceutical company named Dr Reddy's Laboratory launched a generic injectable known as bortezomib. This injection is intravenously offered as a single dose for the treatment of cancer.

Market Dynamics

Drivers

Increasing Rampancy of chronic diseases

Chronic diseases such as cardiovascular health conditions, type 2 diabetes, cancer, etc, are rapidly growing among the population worldwide. These health conditions cannot be easily curable as it is a hereditary issue that has a long life and needs to be treated for a more extended period. In such cases, instead of relying on regularly prescribed medication, generic injectables can be a better and more convenient option for patients and physicians as they have instant drug delivery within the bloodstream, thus making them more effective and adaptable to the human system.

Cost-effective medication

The rise in the cost of conventionally prescribed medications leads to higher expenditure on the healthcare system, and it cannot be affordable by everyone as most people suffering from health conditions belong to the less privileged regions. So, they need to be more aware of the expense of health, as generic medications are way cheaper than prescribed drugs, which inclines more people towards generic medicines. That is why lower cost has been the main agenda behind the manufacturing of generic medication, leading to further market growth.

Restraint

High manufacturing cost

Developing generic injectables includes lots of research and trials on a regular basis for the advancement of medications and ease of use. It requires particular manufacturing methods that are regulated and approved by government rules, which can be an obstacle to a new competitor's entrance into the market. This makes it further difficult for an existing manufacturer to maintain development costs to launch new products in the global generic sterile injectable market.

Opportunity

Invention in the field of generic medications

The generic sterile injectable market is expanding since it has a wide range of applications in the healthcare domain that drives investors to do more research and make room for inventions in generic medications. Additionally, many patents for branded sterile injectables are near their expiry date, opening up a door for small-scale generic injectable manufacturers and further expanding the market followed by demand.

Recent Developments

- In March 2023, the multinational pharmaceutical company Hikma launched four types of sterile injectable medicines in Canada. It opens up new treatment options in the healthcare sector and paves the road for companies' growing presence in Canada's market.

- In February 2022, the generic version of pharmaceuticals VASOSTRICT vials was launched by Dr. Reddy's Laboratories Ltd. This injectable drug has been approved by the Food and Drug Administration of the US and is ready to sell in the healthcare market.

- In March 2022, a biopharmaceutical company named Nevakar Injectables Inc. launched a ready-to-use ephedrine sulphate injection. It is specifically formulated to be used for critical cases and care settings in ambulance systems.

- To control the cost of specialty generic medications, Elixir Pharma, which is an emerging pharmaceutical company that provides various commercial policy programs, has launched its co-pay solution for patients. where the company can pay a certain amount for medical treatment.

Major Key Players

- Fresenius Kabi

- Baxter

- Civica

- Pfizer

- Mylan

- Hikma

- Sandoz

- Teva

- Nichi-Iko

- 3M

- Merck & Co., Inc.

- Others

Market Segmentation

By Product Type

- Monoclonal Antibodies

- Cytokines

- Insulin

- Peptide Hormones

- Vaccines

- Immunoglobulin

- Blood Factors

- Antibiotics

- Others

By Therapeutic Application

- Cancer

- Diabetes

- Cardiovascular Disease

- Central Nervous System

- Musculoskeletal System

- Others

By Distribution Channel

- Hospitals

- Drug Stores

- Retail Pharmacies

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1214

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333