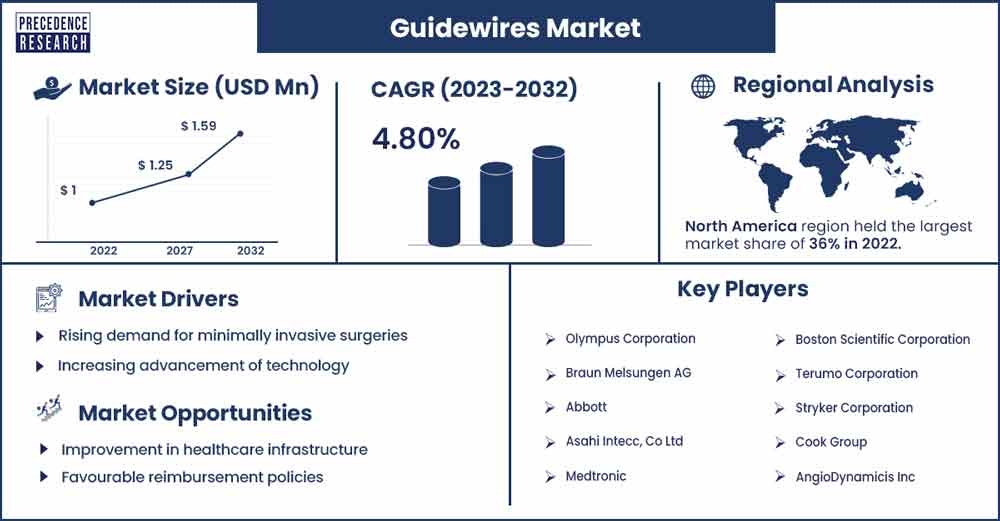

Guidewires Market To Rise USD 1.59 Billion By 2032

The global guidewires market size was estimated at USD 1 billion in 2022 and is expected to be worth around USD 1.59 billion by 2032, expanding at a CAG of 4.8% from 2023 to 2032.

Market Overview

Guidewires are medical devices used in various medical procedures, particularly in the fields of interventional cardiology, radiology, and vascular surgery. These thin, flexible wires are typically made of materials such as stainless steel, nitinol, or other alloys. Guidewires play a crucial role in guiding other medical instruments, such as catheters or stents, through the vascular system or other anatomical pathways.

The primary function of a guidewire is to provide a pathway for other medical instruments to navigate through the body's complex anatomy. During procedures like angioplasty or stent placement, for example, a guidewire helps guide a catheter to the target location within blood vessels. Once the guidewire is in place, other devices can be advanced over it, allowing physicians to perform diagnostic or therapeutic interventions.

Regional analysis

North America accounted the most prominent share in 2022. Increasing prevalence of cardiovascular diseases in coronary and peripheral treatments are supporting the growth of the region. One of the key factors driving the growth of the market is rising penetration for minimally invasive procedures including cardiothoracic.

For instance, more than 750,000 Canadians are estimated to be living with heart failure, and over 100,000 new cases of this incurable illness are identified with it annually, according to data released by the Heart and Stroke Foundation Canada in February 2022. Additionally, the region's many coronary guidewire approvals are anticipated to propel market expansion.

Moreover, the rising launch of products, high concentration of market players, and acquisitions are expected to support the growth in the region. Furthermore, Health Canada approved OpSens Inc.'s SavvyWire, a novel guidewire for transcatheter aortic valve replacement, or TAVR, operations, in April 2022.

Guidewires Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 1.04 Billion |

| Market Size by 2032 | USD 1.59 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.8% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Coating, Raw Materials |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Rising demand for minimally invasive surgeries

Minimally invasive surgeries are experiencing major popularity. These operations cause less trauma to parents as compared to invasive operations such as open heart surgery. According to various researches, invasive surgeries are extensively replaced with minimally invasive surgeries. The growing risk associated with changing lifestyle, consumption of salt, high tobacco consumption and prevalence of chronic disease illness such as obesity, and cardiovascular diseases. Moreover, busy lifestyle and lack of physical activities are also expected to drive the growth of the market.

The number of people suffering with cardiovascular disease is anticipated to surge significantly due to unhealthy lifestyle such as obesity, smoking, and other factors. Rising frequency of catheter-associated infections is also adding to the development of the industry.

Increasing advancement of technology

Awareness among healthcare professionals about the benefits of using guidewires in various medical procedures is a driving factor. Continuous education and training programs contribute to the adoption of guidewire technologies. Advances in guidewire technology, such as improved materials, coatings, and designs, contribute to better maneuverability, flexibility, and navigation during procedures. Healthcare providers and professionals are inclined to adopt innovative guidewire technologies to enhance patient outcomes and procedural efficiency.

Restraints

High cost

Full time engagement

The guidewires are produced using various materials including nitinol, stainless steel or other various hybrid polymers. Research, development, and testing of guidewires involve significant costs. Companies need to invest in advanced technologies and clinical trials to ensure the safety and efficacy of their products. High development costs can be a barrier for smaller companies and startups.

Technological challenges and complications

Advancements in medical technology are rapid, and staying at the forefront of innovation is crucial. Companies may face challenges in keeping up with the latest technologies and incorporating them into their guidewire products. Failure to adapt to technological changes can result in a loss of market share. Additionally, the use of guidewires in medical procedures carries inherent risks, including the potential for infections and complications. Issues related to the safety and efficacy of guidewires can lead to product recalls, regulatory actions, and damage to a company's reputation.

Opportunities

Improvement in healthcare infrastructure

Growing disposable income along with rising advancement in healthcare infrastructure is driving the growth of the industry. The government is taking various initiatives in order to propel the demand for medical devices. Various countries including China, Brazil, India, and South Africa have numerous cardiovascular patients. High demand for diagnostic and interventional procedures are creating lucrative opportunities in the market growth.

Moreover, rising expenditure on healthcare in developing countries and reimbursement policies are bringing significant opportunities for the manufacturer. Government is also encouraging various start-up companies in various regions including Asia Pacific is expected to boost the medical sector.

Favourable reimbursement policies

Government authorities are introducing various favourable medical policies which is further offering opportunities for the growth in the market. Moreover, the government of various economies are planning to offer tax credits, or other financial incentives to the companies engaged in research and development activities related to guidewire technology. These factors ae further expected to create potential opportunities in the market.

Recent Developments

- In April 2022, the FDA approved Transit Scientific's 510(k) application to expand the usage of its XO Cross-Support catheter technology to include coronary applications. The platform is designed to support and guide a guidewire as it is being inserted into the coronary or peripheral vasculature.

- In February 2022, Teleflex Incorporated said that an extended indication for its coronary guidewires and specialised catheters was approved by the US Food and Drug Administration for use in bridging chronic total occlusion percutaneous coronary interventions (CTO PCI).

- In June 2022, Cardio Flow, Inc. is a medical device business that specialises in developing minimally invasive peripheral vascular devices. The US FDA approved the firm's FreedomFlow Peripheral Guidewire. In order to provide support for therapeutic and diagnostic tools used to treat plaque blockages in arteries above and below the knee, the FreedomFlow guidewire was created.

- In April 2022, Boston Scientific Corporation introduced the Kinetix Guidewire, a new tool for percutaneous coronary intervention operations. The Kinetix Guidewire was promptly put into phased release by the firm, and over the course of the next quarter, it was made fully available.

- In November 2023, Us-based Xenter has introduced a novel dual-sensor experimental guidewire for use during transcatheter aortic valve replacement (TAVR) surgeries. The wireless guidewire, is said to be the first of its type, helps collect a variety of important real-time data points that are useful for clinical decision support and aortic regurgitation measurement (xAR), which enhances para-valvular leak (PVL) prediction during TAVR.

Guidewires Market Players

- Olympus Corporation

- Braun Melsungen AG

- Abbott

- Asahi Intecc, Co Ltd

- Medtronic

- Boston Scientific Corporation

- Terumo Corporation

- Stryker Corporation

- Cook Group

- AngioDynamicis Inc

- Cardinal Health

Major Market Segments Covered:

By Product

- Coronary

- Peripheral

- Urology

- Neurovascular

By Coating

- Coated

- Hydrophilic

- Hydrophobic

- Non coated

By Raw Materials

- Nitinol

- Stainless Steel

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1196

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308