Hemoglobin Testing Market To Attain Revenue USD 4.91 Bn By 2032

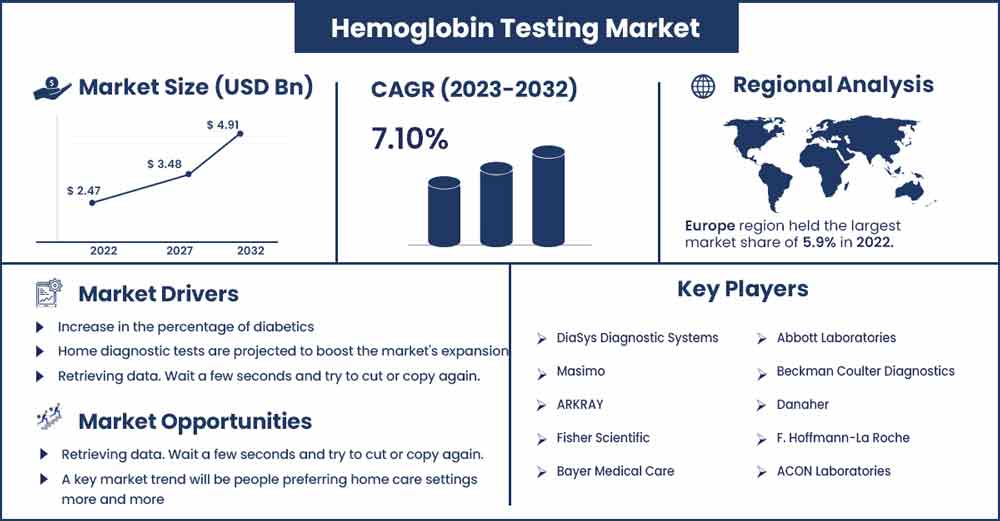

The global hemoglobin testing market size was evaluated at USD 2.47 billion in 2022 and is expected to attain around USD 4.91 billion by 2032, growing at a CAGR of 7.10% from 2023 to 2032.

In human red blood cells, hemoglobin is an iron-based metalloprotein. The movement of oxygen from the human body’s lungs to the rest of the body is its main job. Red blood cells are counted or the quantity of hemoglobin is measured by a hemoglobin test. Doctors and medical professionals frequently employ these tests to identify any treatment situations in patients. The likelihood of individuals becoming anemic increases if the test results show a reduced concentration of hemoglobin in the bloodstream.

One of the main drivers of the global increase in the prevalence of anemia is the need for hemoglobin testing instruments. The development of hemoglobin analyzers for the identification of blood-related illnesses dates back to the late 1950s.

A single histogram per module was first introduced into hemoglobin analyzers, which causes mistake when measuring the overall cell count. Therefore, unique VCSn (volume, conductivity, light scatter) hemoglobin analyzers utilizing this technology were created to address these issues. One of the main forces propelling the sector is such technical innovation. There are several businesses competing in the fragmented market for hemoglobin testing equipment.

The development of point-of-care hemoglobin analyzers has also accelerated corporate expansion. For instance, in 1991 HemoCue Inc. unveiled the HemoCue analyzer, a hematological analyzer based on the point of care for the detection of anemia. Therefore, the aforementioned elements are crucial in propelling the sector.

Regional Snapshots:

Due to its abundance of diagnostic facilities and faculties for blood banks with solid infrastructure, North America is the most attractive market for hemoglobin testing equipment. Due to increasing public awareness related to blood-related issues and also the rising demand for cutting-edge diagnostic equipment in hospitals and diagnostic labs, Europe is predicted to experience an increase in the market for hemoglobin testing systems. The Asia-Pacific region is where the market for hemoglobin testing systems is growing at the fastest rate since local medical device manufacturers are spending extensively in R&D in countries like India, China, and Japan. Latin America, the Middle East, and Africa have the least profitable hemoglobin testing system marketplaces since people there are uninformed of and unable to afford any potential significant problems with blood.

Hemoglobin Testing Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.65 Billion |

| Projected Forecast Revenue by 2032 | USD 4.91 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.10% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- Over the forecasted period, the market for hemoglobin testing devices in Europe is expected to grow considerably by 5.1%. Anemia is becoming more common in Europe, which will significantly enhance regional growth.

- Hospitals as an end use are anticipated to increase significantly during the anticipated years at a CAGR of 5.5%. The availability of state-of-the-art facilities will lead to a significant increase of hospitals. The population's increased demand for hospitals in emerging countries due to their cost efficiency would further propel segmental growth.

- The spectrophotometry category will have the greatest proportion of the market for hemoglobin testing equipment. The rapid growth rate is due to more companies using spectrophotometry as their main hematological testing technique.

- Point-of-care analyzers are used in a range of healthcare settings all around the world. These analyzers speed up the delivery of accurate results, driving up demand for the product.

- Due to growing medical device costs and concerns about high maintenance costs, the market for hemoglobin testing is expected to grow slowly. On the other hand, the absence of other molecular components other than hemoglobin levels that may be identified by this test might be a threat to market expansion.

- The market for hemoglobin testing is anticipated to expand slowly due to rising medical device costs and worries about high maintenance costs, while the absence of additional molecular components other than hemoglobin levels that may be detected by this test can pose a threat to market expansion.

Market Dynamics:

Drivers:

The market for hemoglobin testing systems is expected to develop as blood illnesses are becoming more common and more sophisticated and advanced technologies become available. The ability to provide rapid and fast findings, which aids doctors in providing the right treatment for ailments, is likely to drive up demand for hemoglobin testing systems during the course of the forecast year. The market for hemoglobin testing systems is also anticipated to develop in the approaching days as awareness of blood testing programs and blood donation drives rise. The market for hemoglobin testing systems may be constrained by user sampling mistakes during blood testing, a shorter lifespan, a test system that is less sensitive, higher kit reagent costs, and other factors.

Such a factor may propel the expansion of the hemoglobin testing systems market in the future. Regional government initiatives in emerging nations like India, Venezuela, and Vietnam to manage anemia also helping the hemoglobin testing market during the forecast year.

Restraints:

While the lack of the ability to detect other molecular components other than hemoglobin levels with this test may pose a challenge to the growth of the hemoglobin testing device market, it is anticipated that rising costs associated with medical devices and problems related to increased maintenance costs will slow the growth of the hemoglobin testing market.

The market for hemoglobin testing systems might be constrained errors caused due to user sampling methods that re made during blood testing and a small life period.

Opportunities:

An important aspect driving this market's expansion is consumers' increasing demand for direct-to-consumer testing. In this industry, direct-to-consumer testing is becoming more popular as patients increasingly choose at-home treatment over laboratory testing. In this type of testing, the subject is not required to travel to labs or hospitals for tests since the laboratories send a trained expert to the subject's door to take a blood sample using special equipment. The laboratory electronically returns the test results to the person when the tests are completed and the results are received. Direct-to-consumer testing would be highly preferred over the projected period due to benefits including convenience of testing and the availability of rapid test results.

In a relatively short amount of time, point-of-care testing in hematology saw continual increase. Numerous hemoglobin testing devices have grown and developed as a result of the quick development of technology and its widespread use. Hemoglobin testing technologies now are quick and non-invasive compared to the older approach, which could only deliver findings in 30 seconds.

Challenge:

The market for hemoglobin testing is expected to grow, but factors like rising medical device costs and concerns about high maintenance costs are expected to restrain it. In addition, this test only detects hemoglobin levels; the market for hemoglobin testing may also face difficulties as a result of this test's inability to detect other molecular components.

Recent Developments:

- Abbott unveiled an Afinion 2 analyzer in United States in May 2018. The portable, quick, multi-assay Afinion 2 analyzer makes it simpler to assess hemoglobin A1c levels in human blood and generates precise results immediately during the point of treatment. These tactical moves allowed the company to diversify its selection of hemoglobin testing equipment.

- In February 2016, a company called Abbott completed the full acquisition of Alere Inc., a well-known producer of point-of-care diagnostics. Thanks to this initiative, the company was able to expand its market presence in point-of-care testing sector.

Major Key Players:

- DiaSys Diagnostic Systems

- Masimo

- ARKRAY

- Fisher Scientific

- Bayer Medical Care

- Abbott Laboratories

- Beckman Coulter Diagnostics

- Danaher

- F. Hoffmann-La Roche

- ACON Laboratories

- Diazyme Laboratories

- Radiometer

- EKF Diagnostics Holdings

- Alere

- Epinex Diagnostics

- Bio-Rad Laboratories

- Erba Diagnostics

- Daiichi Biotech

- Sysmex Corporation

Market Segmentation:

By Product

- Equipment

- Point of Care

- Portable

- Handheld

- Bench-top

- Laboratory Analyzers

- Consumables

By Technology

- Chromatography

- Immunoassay

- Spectrophotometry

- Others

By End Use

- Hospitals

- Clinics

- Laboratories

- Home Care Settings

- Blood Banks

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2576

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333