What is the Hemoglobin Testing Market Size?

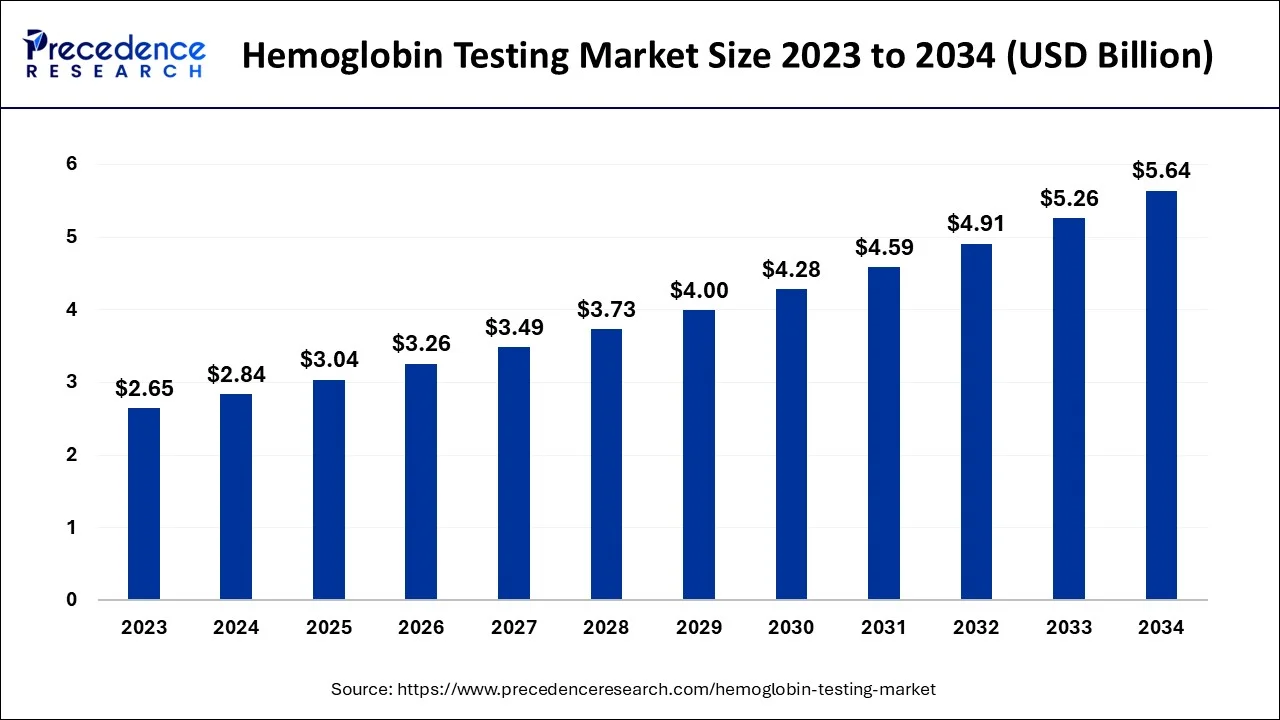

The global hemoglobin testing market size is exhibited at USD 3.04 billion in 2025 and is predicted to surpass around USD 6.02 billion by 2035, growing at a CAGR of 7.07% from 2026 to 2035.

The process of doing diagnostic tests to find out how much hemoglobin is present in a patient's blood is known as hemoglobin testing. Hemoglobin tests are frequently performed by clinicians as part of regular examinations or to assess a patient's significant medical condition.

Hemoglobin Testing Market Key Takeaways

- By geography, The Europe region is predicted to grow by 5.9% over from 2026 to 2035.

- By product, the point of care segment generated more than 82% of revenue share in 2025.

- By technology, the spectrophotometry segment captured the largest share from 2026 to 2035.

- By end use, the hospital segment is expected to grow considerably at a CAGR of 5.74%. from 2026 to 2035.

How is AI contributing to the Hemoglobin Testing Industry?

Non-invasive screening, laboratory automation, and intelligent clinical decision support are the main areas where artificial intelligence is applied to revolutionize hemoglobin testing. The AI systems used in this field perform analysis of medical images, blood smears, and diagnostic datasets for accurate hemoglobin level estimation, abnormality detection, and even support of the differential diagnosis process.

A main benefit derived from the application of these new technologies is the enhancement of workflow efficiency, and, besides, remote screening, treatment planning, and access to clinicians in resource-limited areas become possible.

Growth Factor

Doctors frequently utilize hemoglobin testing as part of regular examinations to determine whether a patient has a severe medical condition. An individual is at risk for diseases like anemia if a test shows that their hemoglobin level is lower than usual and that they have a low RBC count. A blood condition or factors like living at a high altitude, smoking, and dehydration may be to blame if the RBC count is more significant than usual. Medical testing facilities, hospitals, and research facilities are the primary end users in the hemoglobin testing industry.

The worldwide market for hemoglobin testing is significantly driven by the rising prevalence of chronic diseases, including diabetes and anemia. An estimated 490 million individuals worldwide were projected to have diabetes in 2018. An aging population, poor eating practices, sedentary lifestyles, and rising obesity rates are now driving up the incidence of diabetes.

The demand for these tests is fueled by patients with diabetes who must routinely have tests to check their HbA1c and blood glucose levels. Additionally, the industry is being stimulated by factors, including the favourable reimbursement of hemoglobin testing under different health insurance policies.

The expense of hemoglobin testing is only partially covered by medical insurance in many nations. Still, with partial payment and other coverages, consumers increasingly embrace routine and periodic tests to monitor and maintain their general health.

Additionally, it is anticipated that factors like expanding healthcare infrastructure, growing healthcare spending per person, increased awareness of blood-related illnesses, an ageing population, technological improvements, etc., would propel the worldwide hemoglobin testing market in the following years.

- A significant factor anticipated to accelerate the growth and demand of the hemoglobin testing market is the excellent reimbursement of hemoglobin testing under various health insurance plans.

- A significant factor anticipated to accelerate the growth and demand of the hemoglobin testing market is the excellent reimbursement of hemoglobin testing under various health insurance plans.

- The quick increase in the percentage of diabetics throughout the world and the surge in the popularity of home diagnostic tests are projected to boost the market's expansion.

- One of the critical aspects anticipated to propel the expansion of the hemoglobin testing market is the strengthening of the healthcare infrastructure and the increase in per capita spending on healthcare.

- The fast development of improved procedures offering quick results and ease of use, as well as the rise in healthcare costs and awareness of blood-related illnesses, are all predicted to present the market with considerable potential prospects throughout the projected period.

Market Outlook

- Industry Growth Overview:

The market growth is mainly due to the greater number of anemic patients, the need for better management of chronic diseases, and the wider use of diagnostic screening. - Sustainability Trends:

The focus of the industry is gradually moving to non-invasive testing methods that are more comfortable for the patient and have a lower risk of infection through the procedure. - Global Expansion:

Emerging economies with large healthcare investments, adoption of point-of-care, and public screening programs are the factors that will drive the global expansion quickly. - Major Investors:

Top investors are Abbott Laboratories, Roche Diagnostics, Bio-Rad, Siemens Healthineers, and Danaher Corporation. - Startup Ecosystem:

The startup companies are promoting innovation by developing portable and connected hemoglobin testing solutions that will support decentralized and home-based diagnostic care.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.04 Billion |

| Market Size by 2035 | USD 6.02 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.07% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Technology and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Hemoglobin analyzers are becoming more advanced technologically to address typical laboratory issues.

Hemoglobin testing analyzers' rapidly advancing technical capabilities are another essential aspect driving business expansion. Due to the availability of a single histogram per module, classical hematology analyzers have several difficulties separating cellular components.

Modern analyzers, on the other hand, combine cutting-edge technology to measure data from various histograms, thereby eliminating the drawbacks of conventional analyzers. Therefore, over the anticipated years, such technological advances will enhance test results and drive the market for hemoglobin testing products.

Key Market Challenges

High cost of maintenance and sampling mistakes

The market for hemoglobin testing is expected to grow slowly due to the rising costs of medical devices and the problems associated with higher maintenance costs. Still, the demand for hemoglobin testing devices may also develop slowly due to the test's limited ability to detect other molecular components besides hemoglobin levels.

The market for hemoglobin testing systems may also be constrained by user sampling errors made during blood testing and a shorter life period.

Key Market Opportunities

Increase in the number of diabetic people

Because of sedentary lives, obesity, and a lack of exercise, the number of diabetics worldwide is increasing at an alarming rate. The demand for HCT blood tests and hemoglobin testing services will increase globally since hemoglobin testing is a reliable method of determining blood glucose levels. In the next five years, the market for hemoglobin testing will experience significant expansion due to the increase in diabetes patients.

Home care testing is also becoming increasingly popular due to its benefits, which include reliable findings, quick turnaround times, and no waiting time between sample collection and analysis. One of the significant trends gaining momentum in the hemoglobin testing market size is the rising demand for at-home testing.

It is anticipated that the increasing incidence of undiagnosed diabetes in developing nations will create new lucrative business possibilities and fuel the market's rapid expansion. The development of low-cost HbA1c testing and equipment will also aid in quickening market expansion.

Furthermore, technical developments will present possibilities for the market's expansion, resulting in devices with greater accuracy and automated functions. The story of benchtops and portable appliances offers more options. As a result, the market has several prospects for expansion.

A key market trend will be people preferring home care settings more and more

The need for homecare blood testing equipment has grown over time all across the world. This is because home care testing tools offer quicker findings and aid patients in better illness management. Additionally, they cut down on trips to diagnostic labs, hospitals' outpatient departments, and total investigation time. This has prompted market merchants to stock a wide selection of diagnostic tools suitable at home, like A1CNow SELF CHECK, provided by PTS Diagnostics.

The instrument is portable, inexpensive, and only needs a small amount of blood to function. HbA1c readings are sent at home quickly and accurately. Additionally, it gauges the typical blood sugar level for 2-3 months and provides the findings in five minutes. Therefore, it is anticipated that the rising demand for home care settings will positively affect the development of the worldwide hemoglobin testing market during the projected year.

Product Insights

Equipment and consumables are included in the product section, further divided into point-of-care and laboratory-based analyzers. In 2023, 82% of the market was accounted for by the point of the care sector. Around the world, point-of-care analyzers are utilized in various healthcare settings. These analyzers deliver precise findings in a shorter amount of time, increasing product demand.

One of the most frequently used point-of-care hematology analyzers in a variety of healthcare settings, including primary care, hospitals, and blood banks, is Danaher's HemoCue. Additionally, rising public desire for minimally invasive procedures will support corporate expansion during the study period.

Technology Insights

According to market data for hemoglobin testing instruments, the spectrophotometry segment will have the largest share. Numerous technologies, including spectrophotometry, chromatography, immunoassay, and a few others, are included in hemoglobin analyzers. Analysts using spectrophotometry are anticipated to generate a maximum of $3.4 billion in revenue by 2032.

The high growth rate is related to more businesses choosing spectrophotometry as their primary method for hematological testing. For instance, big firms like EKF Diagnostics and Danaher are implementing spectrophotometry technology due to its accuracy and effectiveness in hemoglobin tests.

End Use Insights

Over the predicted years, hospitals as end users are expected to grow considerably at a CAGR of 5.74%. The end-user segment is further segmented into blood banks, clinics, hospitals, labs, home care settings, and others. Due to the availability of cutting-edge facilities, hospitals will experience tremendous expansion.

Further driving segmental development will be the population's growing preference for hospitals in developing nations due to their cost-effectiveness. Another essential aspect boosting business growth is the rising number of hospitals using hematological testing worldwide.

Regional Insights

The European hemoglobin testing device market is predicted to increase by 5.9% over the projected period. The prevalence of anemia is rising across Europe, which will significantly boost regional growth. According to the World Health Organization (WHO), the prevalence rate of anemia, for instance, was above 10% in Germany in 2018 and is expected to rise throughout the predicted period.

Additionally, anemia is more common in women than in males, with about 50% of women having low hemoglobin levels. Therefore, the growing frequency of anemia across Europe will significantly boost market growth. North America's market for hemoglobin testing systems is the most profitable because of the region's numerous diagnostic centers and well-equipped blood banks.

Due to rising public awareness of blood-related issues and the rising need for innovative diagnostic tools in hospitals and diagnostic laboratories, Europe is predicted to experience increasing demand for hemoglobin testing systems.

Because local medical device businesses are investing heavily in research & development in nations like India, China, and Japan, the Asia-Pacific region is where the market for hemoglobin testing systems is expanding at the highest rate. The need for hemoglobin testing systems in Latin America and the Middle East, and Africa is the least lucrative since people there need to be made aware of and able to pay for the significant difficulties associated with blood that might arise.

How is North America leading in the Hemoglobin Testing Market?

The market for hemoglobin testing in North America ranks the highest due to the presence of modern healthcare systems, wide adoption of diagnostics, and the ability of consumers to spend more on healthcare. The main areas of growth are predicted to be in portable testing devices, automated hematology platforms, preventive screening initiatives, and routine monitoring programs that facilitate early detection and proactive disease management.

U.S. Hemoglobin Testing Market Trends:

The U.S. is the largest market in the region, thanks to a favorable regulatory environment, large-scale diagnostic manufacturers, and public health initiatives. The growing demand for home-based testing, remote diagnostics, and self-monitoring solutions reflects the priority, maternal health screening and decentralized hemoglobin assessment technologies in the pipeline.

What are the driving factors of the Hemoglobin Testing Market in Europe?

Preventive healthcare and chronic disease management strategies are the main contributors to Europe's maintaining of large share of the market. The rising awareness of blood disorders, the opening of diagnostic laboratories, the existence of supportive research frameworks, and the aging of the population are among the factors that create opportunities for advanced hemoglobin analyzers and innovative laboratory-based diagnostic solutions.

Germany Hemoglobin Testing Market Trends:

Germany is in a good position to have a strong healthcare infrastructure that supports the adoption of laboratory and non-invasive hemoglobin testing. Demographic factors, along with the presence of powerful diagnostics and the universal acceptance of advanced analyzers in hospitals, laboratories, and preventive healthcare programs, are the main driving forces behind the consistent demand for testing.

How is Asia-Pacific performing in the Hemoglobin Testing Market?

The largest market for hemoglobin testing in the Asia-Pacific region is due to the rapid expansion of diagnostic networks, the increase in healthcare investment, and government-supported screening programs. Research expansion, medical device innovation, and higher acceptance of affordable testing solutions that target common blood disorders are among the growth opportunities.

India Hemoglobin Testing Market Trends:

India is a burgeoning market for innovative diagnostic solutions due to the high prevalence of hemoglobin disorders, the presence of public health screening programs, and the development of cost-effective diagnostics. The government's efforts in developing indigenous tests, improving laboratory access, and making rapid hemoglobin testing affordable are all contributing towards its increased adoption across India.

Hemoglobin Testing Market-Value Chain Analysis

- R&D: Measuring research effectiveness to create revolutionary hemoglobin testing methods that will align with both diagnostic needs and scientific feasibility.

Key Players: Merck & Co., Roche, Novartis, and Sun Pharma - Clinical Trials and Regulatory Approvals: Looking into trial enactment and regulation submissions to protect the patient and data, thus giving timely marketing authorization

Key Players: ICON plc, PPD - Manufacturing/Production: Maximizing the process of changing basic ingredients into high-quality diagnostic kits and devices ready for use in commercial healthcare.

Key Players: Sun Pharma, Dr. Reddy's Laboratories, Cipla, and Lupin - Packaging and Serialization: Re-engineering packaging to guarantee product protection, regulatory compliance, traceability, usability, and the presence of a strong brand.

Key Players: Kezzler and Covectra - Distribution to Hospitals, Pharmacies: Fine-tuning the interplay between logistics, storage, and distribution networks to guarantee availability, minimize damage, and reduce operational inefficiencies.

Key Players: Movianto GmbH

Top Companies in the Hemoglobin Testing Market & Their Offerings:

- DiaSys Diagnostic Systems: DiaSys is the manufacturer of hemoglobin enzymatic testing solutions, hematology analyzers, and laboratory reagents that provide very good support for clinical diagnostics.

- Masimo: Masimo creates technologies for non-invasive continuous hemoglobin monitoring that allow real-time patient assessment and management improvement.

- ARKRAY: ARKRAY sells hand-held hemoglobin meters and automated systems for supporting point-of-care testing and screening for hemoglobinopathies.

Other Major Key Players

- DiaSys Diagnostic Systems

- Masimo

- ARKRAY

- Fisher Scientific

- Bayer Medical Care

- Abbott Laboratories

- Beckman Coulter Diagnostics

- Danaher

- F. Hoffmann-La Roche

- ACON Laboratories

- Diazyme Laboratories

- Radiometer

- EKF Diagnostics Holdings

- Alere

- Epinex Diagnostics

- Bio-Rad Laboratories

- Erba Diagnostics

- Daiichi Biotech

- Sysmex Corporation

Recent Developments

- In July 2025, Erba Transasia introduced the VERTEX Hb Analyzer for accurate HbA1c testing using ion-exchange HPLC. It ensures high throughput and effective separation of hemoglobin variants, delivering reliable, IFCC/NGSP-compliant results for diabetes management in India's diabetic population.

(Source:https://medicalbuyer.co.in) - In June 2025, Artificial intelligence is enhancing workplace roles, especially in health research. Sanguina Inc. developed the Ruby Health app to diagnose anemia through a simple photo of a patient's fingernails. The app showcases AI's potential in disease management.

(Source:https://www.medscape.com)

Segments Covered in the Report

By Product

- Equipment

- Point of Care

- Portable

- Handheld

- Bench-top

- Laboratory Analyzers

- Consumables

By Technology

- Chromatography

- Immunoassay

- Spectrophotometry

- Others

By End Use

- Hospitals

- Clinics

- Laboratories

- Home Care Settings

- Blood Banks

- Others

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting