What is the Hemoglobin A1c Testing Devices Market Size?

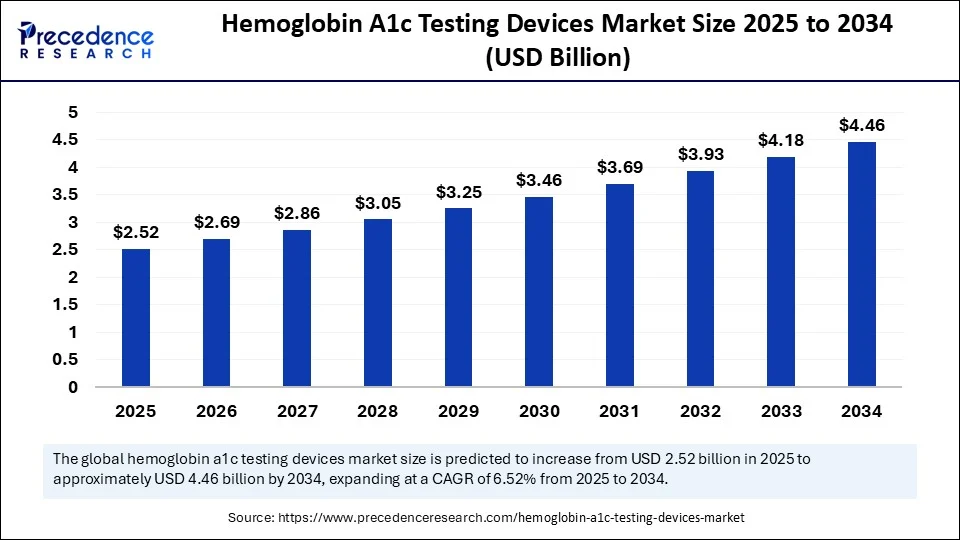

The global hemoglobin A1c testing devices market size is accounted at USD 2.52 billion in 2025 and predicted to increase from USD 2.69 billion in 2026 to approximately USD 4.46 billion by 2034, expanding at a CAGR of 6.52% from 2025 to 2034. The growth of the market is driven by the rising prevalence of diabetes, technological advancements in medical devices, and growing demand for cost-effective monitoring solutions.

Hemoglobin A1c Testing Devices MarketKey Takeaways

- The global hemoglobin A1c testing devices market was valued at USD 2.37 billion in 2024.

- It is projected to reach USD 4.46 billion by 2034.

- The market is expected to grow at a CAGR of 6.52% from 2025 to 2034.

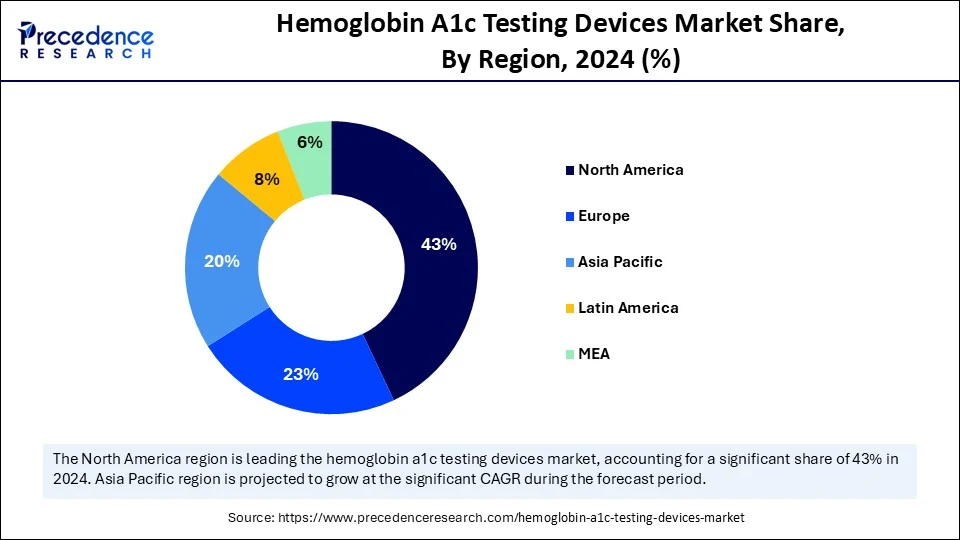

- By region, North America accounted for the largest share of the hemoglobin A1c testing devices market in 2024.

- By region, Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By type of device, the point-of-care testing devices segment held the largest market share in 2024.

- By type of device, the laboratory-based testing devices segment is anticipated to show considerable growth in the market over the forecast period.

- By technology, the immunoassays segment held a significant share in 2024.

- By technology, the high-performance liquid chromatography segment is anticipated to show considerable growth in the market over the forecast period.

- By end-user, the hospitals & clinics segment held the largest share in 2024.

- By end-user, the homecare settings segment is anticipated to show considerable growth in the market over the forecast period.

What are Hemoglobin A1c Testing Devices?

Hemoglobin A1c (HbA1c) devices measure the percentage of glycated hemoglobin in circulation to provide vital information about the average blood glucose levels of patients. These devices play a critical role in the diagnosis and monitoring of diabetes, as they allow a medical practitioner to evaluate long-term glycemic control and implement measures to regulate the treatment. These tools promote the proactive management of diabetes by measuring HbA1c to adjust therapies accordingly, enabling customization of therapies.The increasing focus on preventive care, coupled with government efforts to raise diabetes awareness and the growing adoption of regular screening programs, significantly fuels market growth. The integration of HbA1c testing with digital health platforms and mobile health applications is also broadening its scope and effectiveness. The demand for more convenient and less invasive solutions from patients and providers is likely to attract investment in innovation, thereby supporting market growth.

How is AI Integration Impacting the Hemoglobin A1c Testing Devices Market?

The integration of artificial intelligence (AI) algorithms in Hemoglobin A1c (HbA1c) testing devices significantly enhances diagnostic accuracy, optimizes productivity, and enables personalized patient treatment. This facilitates improved treatment strategies and better long-term outcomes for diabetic patients. AI has the ability to interpret data in real time and integrate with electronic health records to streamline patient monitoring. Furthermore, AI supports the development of remote monitoring tools, allowing for home-based testing solutions connected to telemedicine platforms.

What are the Growth Factors of the Hemoglobin A1c Testing Devices Market?

- Technological Advancements: Miniaturization, automation, rapid analysis, and integration with electronic health records have enhanced the effectiveness and user-friendliness of these devices. Point-of-care testing, enabling quick and easy analysis in various settings, including resource-poor communities, represents a significant innovation.

- Preventive Healthcare: The global shift toward preventive medicine and early disease detection is driving the demand for routine HbA1c testing. Governments, healthcare organizations, and insurers are increasingly promoting the implementation of diabetes screening programs.

- Need for Home-based Tests: The rising popularity of telehealth and increased focus on self-monitoring are boosting the demand for at-home HbA1c testing devices.

- Increased Healthcare Spending: Rising healthcare expenditure, particularly in emerging economies, supports the adoption of advanced diagnostic tools like HbA1c testing devices.

Hemoglobin A1c Testing Devices Market Outlook

- Industry Growth Overview: The hemoglobin A1c testing devices market is forecast to grow steadily from 2025 to 2030 with increasing prevalence of diabetes, greater screening rates, and increased usage of point-of-care analyzers. The growth is backed by robust demand from hospitals, diagnostic laboratories, and home testing consumers, particularly in Asia-Pacific and North America.

- Sustainability Trends: Sustainability is influencing device manufacturing with energy-efficient analyzers, reduced-waste cartridges, and recyclable test components. Companies are investing in greener biomaterials and low-chemical reagents, in light of stricter regulatory expectations, particularly in Europe and Japan.

- Global Expansion: The leading players are increasing their footprint in Southeast Asia, LATAM, and the Middle East by looking to address a growing diagnostic need and to benefit from sound health policy. Companies are establishing local distribution networks and regional manufacturing facilities to shorten supply chains and lower operational expenses.

- Major Investors: Private equity and strategic healthcare investors are becoming more active in the space as a result of steady demand, utilization of devices, and strong recurring revenue from consumables. Investment groups have recently identified targeted portfolios of diagnostic equipment focused on chronic disease monitoring.

Startup Ecosystem: Innovation is on the rise in small, connected A1c testing platforms, AI-enabled analyzers, and low-sample microfluidic devices. Startups in the U.S., India, and Europe are gaining VC interest for their affordable, quick, and home-friendly A1c testing devices that align with global preventive-care trends.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.46 Billion |

| Market Size in 2025 | USD 2.52 Billion |

| Market Size in 2026 | USD 2.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Device, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased R&D Efforts

Increased research and development activities are driving the growth of the hemoglobin A1c testing devices market. As the demand for sophisticated diagnostics tools is rising, manufacturers are focusing on innovative devices to meet the evolving demands of healthcare providers and patients alike. Additionally, manufacturers are focusing on developing more compact, portable HbA1c devices like analyzers, as portability has become the preferred choice of healthcare providers seeking convenience and efficiency.

The rising development of new devices with better automation and enhanced accuracy, promising quick turnaround times, and minimal intervention of humans further boosts the growth of the market. Collaborations between medical device manufacturers, healthcare providers, and technology companies can drive innovation and market expansion.

Restraint

Supply Chain Disruptions and High Cost

Significant challenges in the global hemoglobin A1c testing devices market include major disruptions to supply chains. Accessibility to diagnostics solutions can be reduced due to production delays driven by transportation bottlenecks, hindering the movement of raw materials required. These disruptions caused delays in purchases and availability of HbA1c testing devices, particularly in countries reliant on imported diagnostic equipment and components. Moreover, the initial cost of HbA1c testing devices and the ongoing expenses associated with maintenance can be a barrier, particularly in settings with limited resources.

Opportunity

Rising Demand for Home-Based HbA1c Testing Solutions

The increasing focus on patient-centered care and rising diabetes cases create immense opportunities for home-based HbA1c testing solutions. With more patients seeking convenient, cost-effective, and accessible methods to manage their condition, home A1c testing devices are becoming popular as a viable alternative to traditional lab-based methods. These devices enable individuals to measure their HbA1c at home, eliminating the need for regular clinic visits and improving compliance with routine monitoring.

The pandemic accelerated this shift to home testing as patients and providers sought ways to reduce in-person interactions while maintaining necessary care. This transition is expected to have a long-term impact, driving investment in user-friendly, reliable, and interconnected home testing technologies. Advancements in diagnostic technologies, miniaturization, and the sensitivity of biosensors are likely to enhance the stability of these solutions and their commercial adoption.

Type of Device Insights

Why Did the Point-of-Care Testing Devices Dominate the Market in 2024?

The point-of-care testing devices segment dominated the hemoglobin A1c testing devices market with the largest revenue share in 2024. This is mainly due to the increased demand for rapid diagnosis and timely intervention. POC devices significantly reduce waiting times in hospitals, leading to greater efficiency in the care process and making them highly appealing. There is a growing demand for portable, easy-to-use diagnostic devices, especially in areas with limited access to laboratories.

Further advancements in accuracy and automation, and digital connectivity of POC devices have increased their feasibility. Integration with mobile health applications and electronic health records (EHR) also enhances remote monitoring and management of chronic diseases. The segment's growth is also reinforced due to increased patient preference for rapid and reliable tests in primary care settings and home healthcare.

The laboratory-based testing devices segment is expected to grow at a significant CAGR over the forecast period. Laboratory-based HbA1c tests are known for their high precision and reliability, making them the preferred choice for clinical diagnosis and patient management. Technologies like high-performance liquid chromatography (HPLC) and immunoassay systems have improved test accuracy and processing speed. The growing popularity of automated analyzers has led diagnostic laboratories to invest in these systems to efficiently handle increasing test volumes. Supportive healthcare policies and the expansion of diagnostic infrastructure, particularly in developing markets, also drive segmental growth.

Technology Insights

How Does the Immunoassays Segment Dominate the Market?

The immunoassays segment dominated the hemoglobin A1c testing devices market with a major revenue share in 2024. The low cost and quick turnaround time make this method especially popular in point-of-care applications. Immunoassays are widely used in outpatient clinics and diagnostic centers, making them very convenient and accessible for routine diabetes monitoring.

Immunoassays are helpful in identifying other diabetes-related biomarkers like insulin, C-peptide, and beta-cell autoantibodies, which aid in comprehensive diabetes classification and management due to their flexibility. The high adoption rate of immunoassays is also due to their low operational complexity and costs, increasing their usability in most clinical settings.

The high-performance liquid chromatography segment is expected to grow at the fastest rate in the upcoming period. HPLC is considered the gold standard for HbA1c measurement, unmatched in precision, reproducibility, and detailed molecular analysis. HPLC is highly sought after in specialized diabetes clinics, high-quality diagnostic labs, and scientific centers. The increasing demand for standardized, precise, and consistent diagnostic methods is expected to drive the adoption of HPLC systems.

End-User Insights

What Made Hospitals & Clinics the Dominant Segment in the HbA1c Testing Devices Market in 2024?

The hospitals & clinics segment dominated the hemoglobin A1c testing devices market with the largest revenue share in 2024. These medical centers are the initial point of contact for most patients needing medical care and are crucial in mass diabetes screening programs and long-term management of glycemic control. Hospitals and clinics have quality laboratory facilities and well-trained healthcare workers.

Government-sponsored awareness programs and health initiatives have also increased diabetes testing in hospitals and clinical settings. Improvements in hospitals and clinics allow effective diabetes management, with HbA1c examinations included in services for chronic illness patients, improving patient outcomes and simplifying treatment plans.

The homecare settings segment is expected to grow at a significant CAGR over the forecast period. This is mainly due to the rising prevalence of diabetes worldwide and the growing demand for patient-centered care, which emphasizes convenience, affordability, and independence. Home hemoglobin A1c testing allows individuals to actively participate in their treatment, regardless of attending medical facilities, and it is more affordable. These innovations are user-friendly and provide consistent and precise results. Digital health platforms, like mobile apps and remote patient monitoring, improve communication with healthcare facilities and provide access to data-driven care at home.

Regional Insights

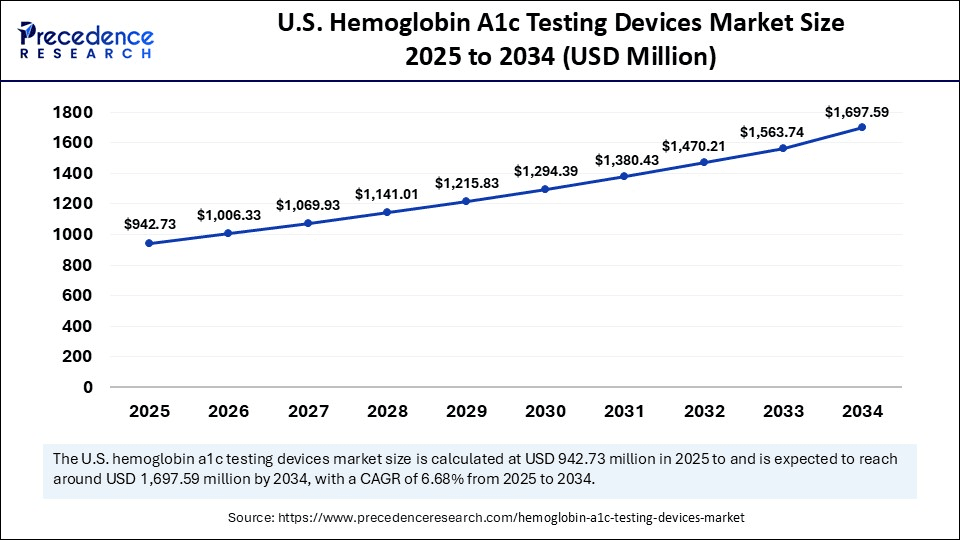

U.S. Hemoglobin A1c Testing Devices Market Size and Growth 2025 to 2034

The U.S. hemoglobin A1c testing devices market size is exhibited at USD 942.73 million in 2025 and is projected to be worth around USD 1,697.59 million by 2034, growing at a CAGR of 6.68% from 2025 to 2034.

Why Did North America Dominate the Hemoglobin A1c Testing Devices Market in 2024?

North America dominated the hemoglobin A1c testing devices market with the largest share in 2024. This is mainly due to the high prevalence of diabetes in this region, with a constant need for precise HbA1c measurements to ensure proper glycemic control. The region is at the forefront of technological innovations in healthcare, leading to the development of more effective, mobile, and user-friendly testing devices, making them more appealing in clinical practice and point-of-care settings.Government programs, favorable healthcare policies, and reimbursement systems that aim to improve diabetes diagnosis and control also play a major role in market growth. Additionally, North America has a well-developed healthcare system, facilitating easy access to new diagnostic equipment. U.S. healthcare providers prioritize early diagnosis and individual diabetes management, increasing the demand for accurate and rapid testing services.

What Factors Contribute to the Hemoglobin A1c Testing Devices Market Within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This is mainly due to the rising incidence of diabetes in the region, leading to high demand for diabetes screening and monitoring. The International Diabetes Federation (IDF) estimates that by 2035, there will be approximately 382 million diabetes patients globally, with over 60% in Asia. Growing healthcare spending, increased access to diagnostic facilities, and greater awareness of the importance of early diabetes detection also drive the growth of the market. China and India are major players in the market due to the rising number of diabetics and continuous investments in healthcare infrastructure.

What Opportunities Exist in the European Hemoglobin A1c Testing Devices Market?

Europe is considered to be a significantly growing area. The growth of the market in the region can be attributed to the presence of advanced healthcare infrastructure and a strong focus on patient-centered care. Active management of chronic conditions, including diabetes, has always been a primary concern, and HbA1c testing is crucial for effectively managing and monitoring blood sugar and the disease. The increasing incidence of diabetes further drives the need for high-quality, accurate HbA1c testing devices. Additionally, the well-developed distribution networks and qualified medical workforce in Europe support the widespread use of this diagnostic equipment in hospitals, clinics, and specialized diabetes centers.

What made the Latin American Region Grow at A Significant Rate in the Hemoglobin A1c Testing Devices Market?

Latin America was expected to undergo significant growth due to the increased prevalence of diabetes, prompting governments and clinics to improve access to testing. Many nations upgraded their existing diagnostic laboratories and began utilizing low-cost point-of-care A1c devices. Urban populations demonstrated higher awareness of the importance of early screening, while rural areas slowly created new testing programs. There were opportunities created for providers to offer low-cost portable analyzers, pharmacy testing programs, and digital platforms to help patients identify and maintain their long-term glucose and A1c levels through expanded outreach and better regional healthcare funding efforts.

Brazil Hemoglobin A1c Testing Devices Market Trends

Brazil remained the leading country in Latin America due to having the largest diabetes population and strong public healthcare programs. The government advocated for early testing and better access to A1c devices in laboratories and pharmacies. Urban areas utilized more point-of-care analyzers, leading to more frequent A1c testing. Brazil also had significant advancement in digital health tools, making it easier for patients to monitor glucose and A1c levels.

Why has the Middle East & African Region Been Expanding at A Significant Rate in the Hemoglobin A1c Testing Devices Market?

The Middle East and Africa were projected to expand at a significant rate due to the increase in diabetes and the continued demand for regular A1c testing. Countries committed capital to build additional diagnostic centers, modern lab equipment, and affordable point-of-care testing devices. Urban regions adopted testing quickly than rural regions, but rural regions are making progress with improving access. Several opportunities also emerged with portable analyzers, pharmacy-based screening, and digital health platforms aimed at promoting ongoing monitoring.

Saudi Arabia Hemoglobin A1c Testing Devices Market Trends

Saudi Arabia was the highest country in the region because it put a significant amount of investment into modernized healthcare infrastructure and advanced diabetes-testing technology. Hospitals and clinics adopted automatic A1c analyzers, and screening programs served several metropolises. Rising lifestyle diseases have led more adults to test regularly. The country also adopted or expanded digital health platforms that at least enhanced remote monitoring. The investments in equity and access to care ensured that there was steady demand across the country for accurate and connected A1c testing devices.

Recent Developments

- In May 2025, Tosoh Bioscience - Diagnostics EMEA released the new GR01 HbA1c analyzer, a small, high-throughput analyzer that measures glycated haemoglobin using ion-exchange HPLC technology. The new analyzer is part of the HLC-723 2 series of analyzers. A product that suits the requirements of clinical laboratories, GR01 provides highly precise, reproducible results, workflows that are suited and optimized, and supports both high throughput and better patient care concerning diabetes.

- In February 2024, HemoCue partnered with Novo Nordisk to improve access to point-of-care diagnostic testing of children with type 1 diabetes in low- and middle-income nations. It is planned to introduce HemoCue HbA1c 501 Systems in 30 countries to ensure better diabetes control and access to 100,000 children by 2030.

- In April 2023, FIND has joined forces with Abbott, i-SENS Inc., and Siemens Healthineers to provide discounted point-of-care HbA1c test kits in low- and middle-income countries in an attempt to enhance the extent of diabetes diagnosis and control in underserved areas to be deployed.

- In April 2023, Healthcare start-up Orange Biomed unveiled its pocket-sized, reusable OBM rapid A1c test in the U.S. to fill the testing gaps for people with pre-diabetes and diabetes.

(Source: https://www.selectscience.net)

(Source: https://hemocue.com)

(Source: https://www.finddx.org)

(Source: https://www.medicaldevice-network.com)

Hemoglobin A1C Testing Devices Market Companies

- Bio-Rad Laboratories, Inc.

- Abbott

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers AG

- HUMAN

- Trinity Biotech

- Menarini Diagnostics s.r.l

- SAKAE CO., LTD.

- Ceragem Medisys Inc

- SEKISUI MEDICAL CO., LTD.

Segments Covered in the Report

By Type of Device

- Laboratory-based testing devices

- Point-of-care (POC) testing devices

By Technology

- Immunoassays

- Chromatography

- Enzymatic assays

- Boronate affinity chromatography

- High-performance liquid chromatography

- Others

By End-User

- Hospitals & clinics

- Diagnostic laboratories

- Homecare settings

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting