Hybrid Vehicle Market Drive cleaner mobility with fuel-efficient hybrids and Asia-Pacific momentum

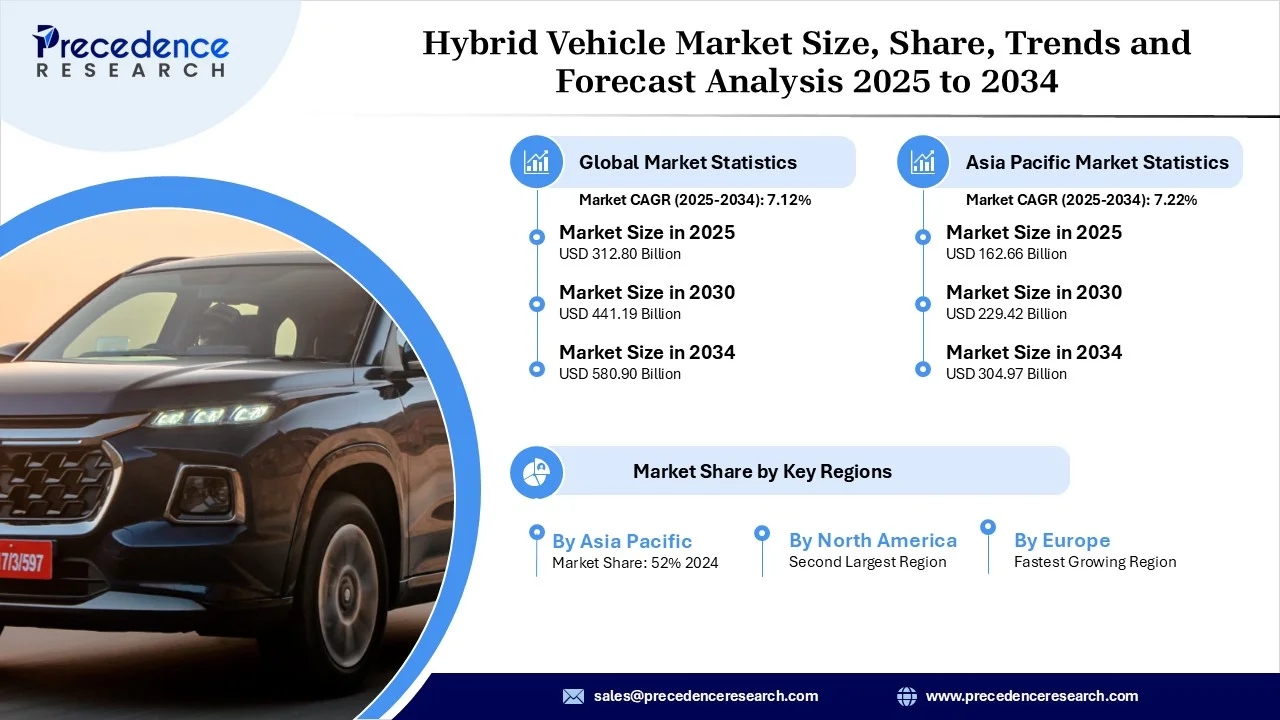

The global hybrid vehicle market size was estimated at USD 292.01 billion in 2024 and is anticipated to reach around USD 580.90 billion by 2034, growing at a CAGR of 7.12% from 2025 to 2034. A growing focus on sustainability is driving the growth of the hybrid vehicle market.

Global Outlook

The hybrid vehicle market has experienced significant growth in recent years owing to the sudden increase in demand for fuel-efficient vehicles worldwide. The sudden shift towards sustainability has played a major role in the expansion of the hybrid vehicle industry in recent years. Furthermore, the global government push for eco-friendly automakers is expected to provide huge industry attention in the upcoming years, as per the future market expectations.

Market Opportunity

The business expansion in the developing region is expected to create lucrative opportunities for manufacturers in the upcoming years. Moreover, these countries are actively seeking fuel-efficient transportation where the manufacturer can take advantage in the future period. By establishing a domestic production unit in these developing economies, manufacturers can get the advantages of minimum import costs and low labor costs in the upcoming years.

Key Growth Factors

- The manufacturers have been increasing their focus on affordable micro-hybrids in recent years. Also, the requirement of minimum space instead of big batteries, the micro hybrid can capture a huge share of the industry during the forecast period.

- The increased demand for vehicles that have advanced batteries is driving the market growth, as these batteries are offering greater mileage and efficiency.

Market Restraint

The higher production cost of hybrid vehicles is expected to hinder the industry's growth in the upcoming years. Furthermore, building cars with dual engines can be costlier sometimes, as advanced electronics and complex designs require. Furthermore, having a higher cost than traditional cars is discouraging manufacturers' buying ability, which can raise major concerns for the manufacturers in the coming years.

Segmental Outlook

By Hybridization Type

What made the fully hybrid segment dominant in the hybrid vehicle market in 2024?

The fully hybrid segment generated the highest revenue share in 2024, owing to the advantage that the owner of these vehicles can use both services, such as the engine and the electric motor independently. Moreover, these facilities are actively providing a wider consumer base in the current period, as per the recent industry survey.

The micro hybrid segment is expected to grow at the fastest CAGR during the projected period of 2025 to 2034, due to properties like affordability and easy adoption. Furthermore, the requirement for smaller spaces due to the smaller battery size, the micro hybrid is anticipated to gain major industry share in the upcoming years, as per the future industry expectations

By Drivetrain Type

The parallel drive train segment marked its dominance because it allows the engine and electric motor to work together to power the vehicle. This setup improves fuel efficiency and performance while keeping costs relatively lower compared to other drive train systems. Many leading hybrid vehicles, including models from Toyota and Honda, use this technology because it is simple, effective, and reliable.

The series drive train segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034, because it relies entirely on the electric motor for driving, while the engine only works to recharge the battery. This makes them more energy-efficient and suitable for urban driving, where frequent stopping and starting occur.

By Vehicle Type

The passenger car segment generated the highest revenue share in 2024 because these vehicles are most in demand among everyday consumers. Rising fuel prices, strict emission rules, and the need for affordable, eco-friendly options encouraged people to choose hybrid passenger cars. Automakers also focus more on passenger cars since they cover a large customer base compared to buses or trucks.

By Propulsion Type

The HEV segment generated the highest revenue share in 2024, because these vehicles are most in demand among everyday consumers. Rising fuel prices, strict emission rules, and the need for affordable, eco-friendly options encouraged people to choose hybrid passenger cars. Automakers also focus more on passenger cars since they cover a large customer base compared to buses or trucks.

By Component Type

The battery segment generated the highest revenue share in 2024, because batteries are the most critical component for powering electric motors and improving fuel efficiency. High-capacity lithium-ion and nickel-metal hydride batteries are widely used in hybrid cars to store and deliver energy effectively. As technology improved, batteries became more durable, compact, and affordable, making them the preferred choice for automakers. Without advanced batteries, hybrid vehicles could not provide better mileage or reduced emissions.

The electric motor segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034, as hybrid vehicles shift toward higher electrification. Motors are becoming more efficient, powerful, and affordable, which allows better performance and longer electric-only driving ranges. As governments push for lower carbon emissions, electric motors will play a bigger role compared to fuel engines.

Geographical Outlook

Asia Pacific

Asia Pacific dominated the global hybrid vehicle market owing to factors such as the presence of major automakers and increased awareness of fuel efficiency in the region. Furthermore, the stronger support from the regional government has provided wider consumer access to the manufacturer in recent years. Moreover, the regional counties such as Japan, India, and China are actively seen under putting heavy investment into the research and development of hybrid vehicles in recent years.

China

China stands as a dominant country in the Asia Pacific business landscape due to its current heavy investments in green mobility. Moreover, manufacturing is benefiting from the government's support for sustainability as the government is seen as providing attractive benefits to the buyer and manufacturers, such as attractive subsidies and tax reduction in recent years. Moreover, the domestic consumption and production of China are likely to contribute immensely to the growth of the industry in the upcoming years.

North America

North America is expected to emerge at the fastest CAGR during the forecast period of 2025 to 2034, owing to greater support from the government for the low-carbon transport initiative. Furthermore, the regional countries such as the United States and Canada are seen under the heavy development of the EV charging infrastructure while putting sophisticated investment in the R&D for hybrid vehicles in recent years.

Strategic moves by key players

- In January 2025, Chinese automaker BYD is planning to introduce its first plug-in hybrid vehicle in Japan within the year. This move is part of BYD’s strategy to enhance its product offerings and dealer network in Japan. Plug-in hybrids, which combine a battery with a traditional fuel engine, are designed to run on either power source.

(Source: https://www.techinasia.com) - In October 2024, in the near future, Hyundai Motor India Limited (HMIL) intends to launch hybrid automobiles in the Indian market. The nation's second-largest automaker is certain that its selection of engine alternatives will satisfy consumer preferences, even if the precise timetable has not yet been announced.

Hybrid Vehicle Market Companies

- Toyota Motor Company

- Honda Motor Company

- BYD Company Ltd

- Lexus

- Ford Motor Company

- Kia Motors Company

- Nissan Motor Company

- Volkswagen AG

- AB Volvo

Segments covered in the report

By Hybridization

- Fully hybrid

Micro hybrid

Mild hybrid

By Drivetrain

- Parallel drivetrain

- Series drivetrain

By Vehicle

- Passenger car

- Commercial vehicles

By Propulsion

- HEV

- PHEV

- NGV

By Component Type

- Battery

- Electric Motor

- Transmission

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

(Source: Hybrid Vehicle Market Size to Reach USD 580.90 Billion by 2034)