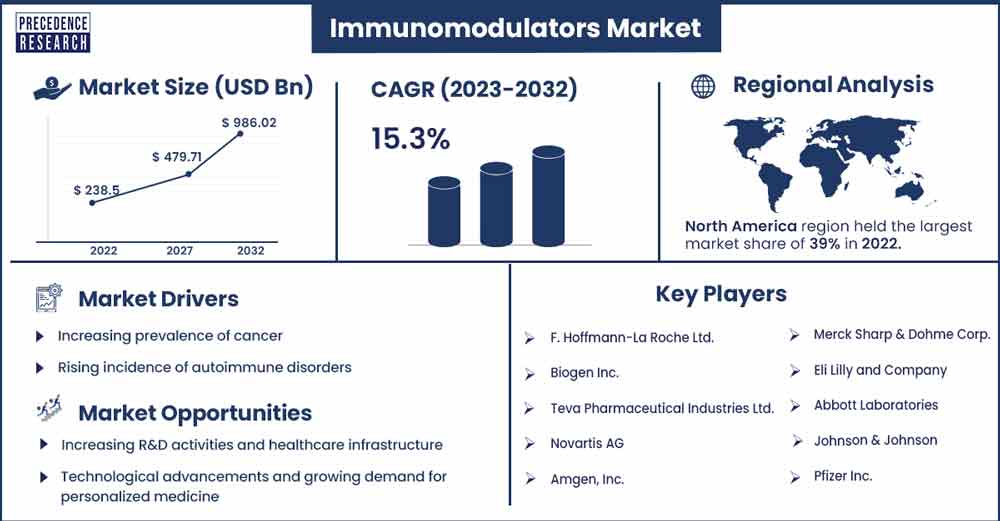

Immunomodulators Market Will Grow at CAGR of 15.3% By 2032

The global immunomodulators market size surpassed USD 238.5 billion in 2022 and is anticipated to reach around USD 986.02 billion by 2032, growing at a CAGR of 15.3% from 2023 to 2032.

Market Overview

The immune system is a complex network of cells, tissues, and proteins. Immunomodulators are the drugs that affect the immune system for the treatment of various health conditions, including cancer and autoimmune disorders and others. Immunomodulators are available in several different forms. Some are relatively small molecules, and others may take the form of larger proteins such as monoclonal antibodies, also called moAbs or mAbs. These molecules can either function as immunostimulants or immunosuppressants. It is said that immunomodulators boost the immune system as it help to respond to an illness and are widely used in treating cancer patients.

The growth of the global immunomodulators market is driven by several factors, including growth in healthcare infrastructure, technological advancements in biotechnology, increasing demand for personalized medicine, rise in drug discovery and development, increase in clinical trials, and rising investment in research and development activities.

In addition, the increasing rate of diseases post-COVID has positively impacted the immunomodulator market. Furthermore, the market is growing as a result of the rising cases of chronic diseases such as cancer, autoimmune disorders, lupus, rheumatoid arthritis (RA), multiple sclerosis (MS), psoriasis, Sjögren’s disease, inflammatory bowel disease (IBD), Crohn’s disease, and others. The surge in chronic diseases has propelled the demand for advanced immunomodulatory therapies to modify immune system responses.

- In September 2023, Astellas Pharma announced an investment of €330 million in Tralee, Ireland. The company's investment is to build a new state-of-the-art facility to contribute to developing and commercializing antibody drugs. Furthermore, the new 44.7-acre facility in Ireland will reinforce stable production for global supply and is also expected to offer approximately 350 jobs.

- In November 2023, Poolbeg Pharma, a biopharmaceutical company focusing on the development and commercialization of innovative medicines targeting diseases to meet an increasing unmet medical demand, unveiled that the Japanese Patent Office has notified the Company of its official decision to grant Poolbeg's Immunomodulator II patent application. Poolbeg has a global license for POLB 001 for treating severe influenza in hospitalized patients in combination with antiviral compounds.

- In August 2023, AVM Biotechnology announced that 28 solid tumor and blood cancer patients have been treated with immunomodulatory aVM0703 through Expanded Access (EAP)/Compassionate Use (CUP) programs. Immunomodulatory AVM0703's relatively broad anti-cancer activity is hypothesized to be due to the mobilization of a highly active gamma/delta T-cell receptor expressing immune cell, which is programmed to recognize special stress signals produced by most cancer cells but not normal cells.

- In May 2022, Artax Biopharma, Inc., a clinical-stage biotechnology company focused on transforming the treatment of T Cell-mediated pathologies announced the close of a USD 26 million financing round to develop AX-158, the Company's first oral small molecule immunomodulating agent.

- In August 2023, The Food & Drug Administration (FDA) granted approval to elranatamab-bcmm (Elrexfio) for treating adult patients with relapsed or refractory multiple myeloma who have previously received at least four lines of therapy, including a proteasome inhibitor (PI), an immunomodulatory agent (IMiD), and an anti-CD38 monoclonal antibody.

Regional Insights

North America is expected to retain the largest market share over the period owing to the presence of sophisticated healthcare infrastructure, rising research and development expenditure, favorable government initiatives, and an increasing number of pharmaceutical and biotechnology companies. The presence of prominent companies operating in the region, including Pfizer Inc., Acrotech Biopharma, LLC, Biogen Inc., Horizon Therapeutics plc, Abbott Laboratories, Johnson & Johnson, and others, is expected to fuel the market's expansion.

The United States is the largest contributor to the market due to significant healthcare expenditures, increasing demand for immunomodulatory therapies, rising awareness regarding advanced therapies, growing prevalence of autoimmune disorders, and high cancer burdens. Cancer is a leading cause of death in the country, and the cases are increasing rapidly over the years. According to the 2023 estimates of the American Cancer Society, 1,958,310 new cancer cases and 609,820 cancer deaths are expected to occur in the United States. The strategic collaboration among prominent market players in the country also fosters the market's growth.

- In January 2023, Fosun Pharma entered into an agreement with Shanghai Henlius Biotech, Inc. to commercialize Henlius's independently developed anti-PD-1 monoclonal antibody, Serplulimab, in the US. Fosun Pharma has obtained the right to commercialize Serplulimab in the United States upon approval, and Henlius retains the responsibility for growth, manufacturing, and supply.

Immunomodulators Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 273.80 Billion |

| Projected Forecast Revenue by 2032 | USD 986.02 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.3% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of cancer

The rising prevalence of cancer across the globe has led to the increasing adoption of immunomodulator therapy for the treatment of the disease. Cancer causes nearly one in every six deaths globally. For instance, In the last three decades, cancer cases below 50 have risen by about 80%. According to a study published in BMJ Oncology journal, more than a million people below 50 die of cancer per year. The same data projects another 21% rise in cases by 2030. Immunostimulants help increase the immune response in destroying cancer cells for cancer treatment. Therefore, with rising cancer instances, the demand for immunomodulators is anticipated to fuel the growth of the global immunomodulators market in the coming years.

Rising incidence of autoimmune disorders

The rapidly rising incidence of autoimmune disorders is anticipated to fuel the market’s expansion in the coming years. According to the results of a new population-based study published in The Lancet, of the 22 million individuals studied, about 1 in 10 people are affected by autoimmune disorders. Immunosuppressants are a class of immunomodulators that help reduce immune system activity and are thus extensively used to treat autoimmune disorders. Therefore, the increasing cases of autoimmune disorders are expected to drive market growth during the forecast period.

Restraints

Stringent government regulations

Implementing stringent government regulations is projected to hamper the growth of the immunomodulators market. Governments of various regions tend to impose different rules for the approval of immunomodulator antibodies. Over the projected period, the immunomodulators market's expansion is anticipated to be constrained by these unfavorable regulatory policies. In addition, the immunomodulators market's expansion is expected to be constrained by the high cost associated with immunomodulator products.

Side effects

The adverse effects associated with immunomodulator drugs are projected to hamper the growth of the global immunomodulators market. Modifying the immune system can lead to infections, autoimmune reactions, or many other adverse effects on the body. As there is a greater risk of infection, the patients must opt for screening for these threats or historical exposure to the viruses associated with these diseases before initiating immunomodulatory treatment, contributing to the cost and duration of the treatment. Moreover, the need for more awareness will likely limit the expansion of the global immunomodulators market during the forecast period.

Opportunities

Increasing R&D activities and healthcare infrastructure

The rapid expansion of the healthcare infrastructure coupled with ongoing research and development activities for immunomodulatory therapies are expected to offer a lucrative opportunity for market growth during the forecast period. The immunomodulators market is witnessing well-established healthcare infrastructure due to an increase in healthcare investment. Therefore, sophisticated healthcare facilities offer effective treatment for chronic diseases and are expected to positively influence the market’s growth.

Technological advancements and growing demand for personalized medicine

The rapid technological advancements in biotechnology have resulted in the development of novel immunomodulatory medications with higher efficiency and relatively fewer side effects. Immunomodulators play an essential role in the concept of personalized medicine as they can be used to target immune responses according to the patient’s unique characteristics. Immunomodulatory drugs have witnessed significant effectiveness in treating health conditions such as various types of cancer, HIV, Crohn’s disease, rheumatoid arthritis, multiple sclerosis, lupus, psoriasis, allergies, and several other chronic diseases. Also, during the treatment of organ transplants, immunosuppressants are extensively used post-transplant to dampen the immune system’s response, which allows the individual’s body to accept the donor organ. These factors are likely to propel the growth of the immunomodulators market during the forecast period.

Recent Developments

- In June 2023, Merck announced the acquisition of the company Prometheus Biosciences, Inc. to strengthen its presence in immunology and deliver high patient value.

- In June 2023, Eli Lilly and Company and DICE Therapeutics, Inc. announced an agreement for Lilly to acquire DICE, a biopharmaceutical company. With the acquisition of DICE Therapeutics, Inc., Eli Lilly and Company to tackle the challenges in finding new and innovative treatments for patients with increasing unmet medical needs. The acquisition will also accelerate innovation for treating autoimmune disease patients.

- In January 2022, in Canada, Sun Pharma launched a dry eye treatment product named CEQUA, a calcineurin inhibitor immunomodulator that uses nano micellar (NCELL) technology to improve the bioavailability and physicochemical stability of cyclosporine to promote the ocular tissue penetration.

Key Market Players

- F. Hoffmann-La Roche Ltd.

- Biogen Inc.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Amgen, Inc.

- Bristol-Myers Squibb Company

- Merck Sharp & Dohme Corp.

- Eli Lilly and Company

- Abbott Laboratories

- Johnson & Johnson

- Pfizer Inc.

Market Segmentation

By Product

- Immunosuppressants

- Immunostimulants

By Application

- Oncology

- Respiratory

- HIV

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3404

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308