Industrial Enzymes Market Size to Rise USD 275.11 Bn By 2032

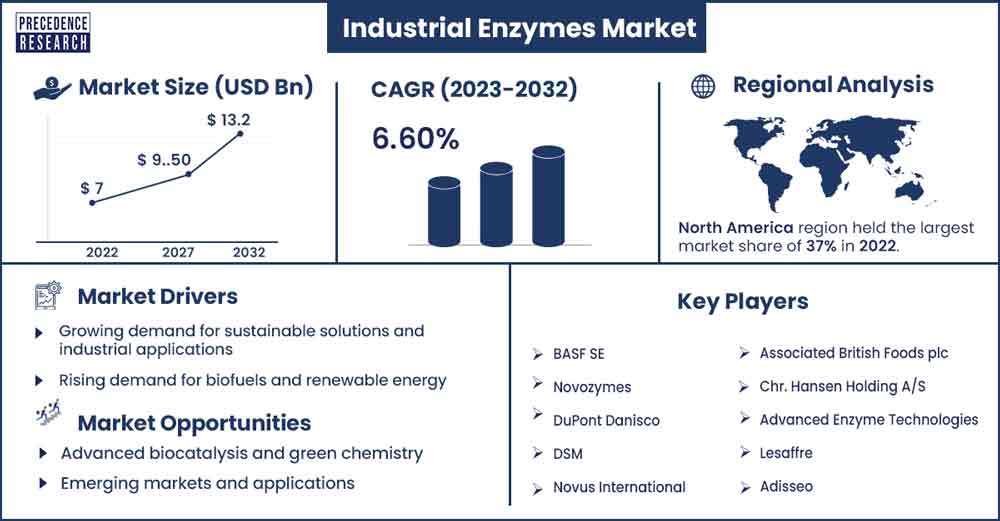

The global industrial enzymes market size surpassed USD 7 billion in 2022 and is expected to rise around USD 13.20 billion by 2032, poised to grow at a CAGR of 6.60% from 2023 to 2032.

Market Overview

The industrial enzymes market is experiencing steady growth and significant diversification across various industries. Industrial enzymes play a crucial role in catalyzing biochemical reactions in industrial processes, thereby improving process efficiency, reducing energy consumption, and enabling environmentally friendly manufacturing practices.

Factors such as increasing demand for sustainable manufacturing solutions, growing awareness about the benefits of enzyme-based processes, and advancements in enzyme engineering and biotechnology were driving market growth. The market encompasses many enzyme types, including amylases, proteases, lipases, cellulases, and carbohydrases. These enzymes find applications across diverse industries such as food and beverages, biofuels, textiles, animal feed, pharmaceuticals, pulp and paper, and wastewater treatment.

Compliance with regulatory standards and requirements governing enzyme safety, efficacy, labeling, and use in industrial processes is essential for manufacturers and end-users. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), and others oversee industrial enzyme safety and regulatory aspects. Despite the growth prospects, the industrial enzymes market faces challenges such as high production costs, limited stability and shelf-life of enzyme products, regulatory complexities, competition from chemical alternatives, and continuous innovation to meet evolving industry needs and preferences.

Regional Snapshots

North America dominated the industrial enzymes market driven by established industries such as food and beverages, biofuels, and pharmaceuticals. The region’s stringent environmental regulations and growing emphasis on sustainable manufacturing practices contribute to adopting enzyme-based solutions. Leading enzyme manufacturers such as DuPont de Nemours, Inc. have a strong presence in North America, catering to diverse industrial sectors. Enzymes find applications across various industries, including food and beverages, biofuels, textiles, and pharmaceuticals. In the food and beverage sector, enzymes are used for brewing, baking, dairy processing, and fruit and vegetable processing.

Europe is a significant industrial enzymes market characterized by stringent regulatory standards, growing consumer demand for sustainable products, and technological advancements in enzyme engineering and biotechnology—major enzyme manufacturers such as Novozymes A/S, BASF SE, Chr. Hansen Holding A/S and A.B. Enzymes GmbH have a strong foothold in the European market, offering a wide range of enzyme solutions. Enzymes are widely used in Europe across industries such as food and beverages, textiles, pulp and paper, and pharmaceuticals. In the textile industry, enzymes are employed for processes such as de-sizing, bio-polishing, and denim finishing.

Asia-Pacific is witnessing rapid industrialization, urbanization, and economic growth, driving demand for industrial enzymes across various sectors. The region’s expanding food and beverage industry and increasing investments in biofuels and textiles fuel market growth. Global enzyme manufacturers have been expanding their presence in Asia-Pacific to tap into the region’s growing market opportunities. Additionally, local enzyme producers are emerging to cater to domestic demand. Enzymes find applications in food and beverage processing, biofuel production, textile manufacturing, and animal feed production in Asia-Pacific. In countries like China and India, enzymes are increasingly used to produce ethanol and biodiesel.

Industrial Enzymes Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 7.43 Billion |

| Projected Forecast Revenue by 2032 | USD 13.20 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.60% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for sustainable solutions and industrial applications

Increasing awareness about environmental sustainability and the need to reduce carbon emissions drive the adoption of enzyme-based solutions in industrial processes, leading to the growth of the industrial enzymes market. Enzymes enable cleaner production methods, reduce energy consumption, minimize waste generation, and offer environmentally friendly alternatives to traditional chemical processes. Industrial enzymes find applications across diverse industries, such as food and beverages, biofuels, textiles, pharmaceuticals, pulp and paper, and wastewater treatment. The versatility of enzymes and their ability to catalyze various biochemical reactions drive demand across multiple sectors, leading to market growth.

Advancements in enzyme engineering and biotechnology

Ongoing advancements in enzyme engineering, protein design, and biotechnology enable the development of novel enzymes with enhanced catalytic activity, stability, and specificity. These innovations expand the scope of enzyme applications and drive the growth of customized enzyme solutions tailored to specific industrial processes and requirements. Regulatory initiatives promoting food safety, environmental protection, and sustainable manufacturing practices drive the adoption of enzyme-based solutions. Enzymes are considered safe and environmentally friendly, making them attractive alternatives to conventional chemical additives and processes.

Rising demand for biofuels and renewable energy

The growing emphasis on reducing dependence on fossil fuels and mitigating climate change drives demand for biofuels derived from renewable biomass feedstocks. Enzymes play a critical role in biofuel production by breaking down complex carbohydrates into fermentable sugars and facilitating ethanol and biodiesel production from biomass sources such as corn, sugarcane, and lignocellulosic feedstocks. Collaboration between enzyme manufacturers, research institutions, and end-users fosters innovation in enzyme technology and accelerates the development of new enzyme products and applications. Technological advancements such as enzyme immobilization, enzyme stabilization, and enzyme recycling further enhance the efficiency and versatility of industrial enzymes, driving industrial enzymes market growth.

Restraints

High cost of enzymes and stability/shelf-life issues

Enzymes are complex biomolecules that require specialized production processes, fermentation facilities, and purification methods. The high cost of enzyme production and purification can make enzyme-based solutions economically unfeasible for some applications, particularly in price-sensitive markets. Enzymes are sensitive to environmental factors such as temperature, pH, and mechanical stress, which can affect their stability and activity under varying process conditions and pose challenges for enzyme manufacturers and end-users. Improving enzyme stability and shelf-life remains an area of focus for research and development efforts.

Regulatory uncertainty and competition from chemical alternatives

Enzyme-based products may require regulatory approval for specific applications, particularly in food and beverage processing, pharmaceuticals, and biofuel production. Regulatory uncertainty, lengthy approval processes, and compliance requirements can hinder market entry and product commercialization. Enzyme manufacturers must navigate complex regulatory landscapes and ensure safety and quality standards compliance.

Enzyme-based solutions face competition from traditional chemical additives and processes in some applications. Chemical alternatives may offer comparable or lower costs, faster reaction rates, and more excellent stability, posing challenges for enzyme adoption. Educating consumers and industry stakeholders about the benefits of enzyme-based solutions and demonstrating their superior performance can help overcome this barrier.

Opportunities

Advanced biocatalysis and green chemistry

The growing emphasis on sustainable manufacturing practices and green chemistry principles drives demand for enzyme-based biocatalysis solutions. Enzymes offer environmentally friendly alternatives to traditional chemical catalysts, enabling cleaner and more efficient chemical processes with reduced energy consumption, lower waste generation, and fewer hazardous by-products. The industrial enzymes market has opportunities to develop novel biocatalysts and enzyme-based technologies for diverse chemical transformations and industrial applications.

Emerging markets and applications

Enzymes find applications across various industries beyond their traditional uses in food and beverage processing, biofuel production, and textiles. Emerging applications such as enzyme-based bioremediation, enzyme-assisted drug synthesis, enzyme-modified materials, and enzyme-based biosensors present new growth opportunities for enzyme manufacturers. Exploring and commercializing enzyme solutions for emerging markets and applications can diversify revenue streams and expand market reach.

Nutraceuticals and functional foods

The growing demand for functional foods, dietary supplements, and nutraceuticals allows enzyme manufacturers to develop enzyme-based ingredients with health-promoting properties. Enzymes such as proteases, lipases, carbohydrases, and phytases enhance the bioavailability, digestibility, and nutritional value of food ingredients and formulations. Enzyme-modified functional ingredients, enzyme-assisted extraction processes, and enzyme-enhanced food products cater to consumer demand for natural, healthy, and functional foods.

Collaboration and partnerships

Collaborative partnerships between enzyme manufacturers, research institutions, academia, and industry stakeholders foster innovation, knowledge exchange, and technology transfer. Strategic collaborations enable access to complementary expertise, resources, and capabilities, accelerating the development and commercialization of novel enzyme-based solutions. Collaborative research projects, joint ventures, and technology licensing agreements facilitate market expansion, product diversification, and competitive advantage in the industrial enzymes market.

Recent Developments

- In October 2023, Curie Co launched an antimicrobial enzyme for replacing petrochemicals with biomaterials. The engineered enzymes do not require new biomanufacturing infrastructure and can be produced in the existing ones. It is a preservative enzyme that can reduce the preservation system.

- In March 2023, Dansico Animal Nutrition and Health launched a new enzyme blend named Axtra PRIME. The aim is to address the issue related to the consumption of high-fiber piglet diets. The enzyme will improve fiber digestion and increase the piglets' performance.

Key Player in the Market

- Lesaffre

- BASF SE

- DuPont Danisco

- Advanced Enzyme Technologies

- Koninklijke DSM N.V.

- Novozymes

- Chr. Hansen Holding A/S

- DSM

- Associated British Foods Plc

- NOVUS INTERNATIONAL

- Adisseo

- BioProcess Algae, LLC

Market Segmentation

By Product

- Carbohydrases

- Amylases

- Cellulase

- Others

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Source

- Plants

- Animals

- Microorganisms

By Application

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Nutraceutical

- Personal Care & Cosmetics

- Wastewater

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1382

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308