IoT Microcontroller Market Revenue to Attain USD 16.86 Bn by 2033

IoT Microcontroller Market Revenue and Trends

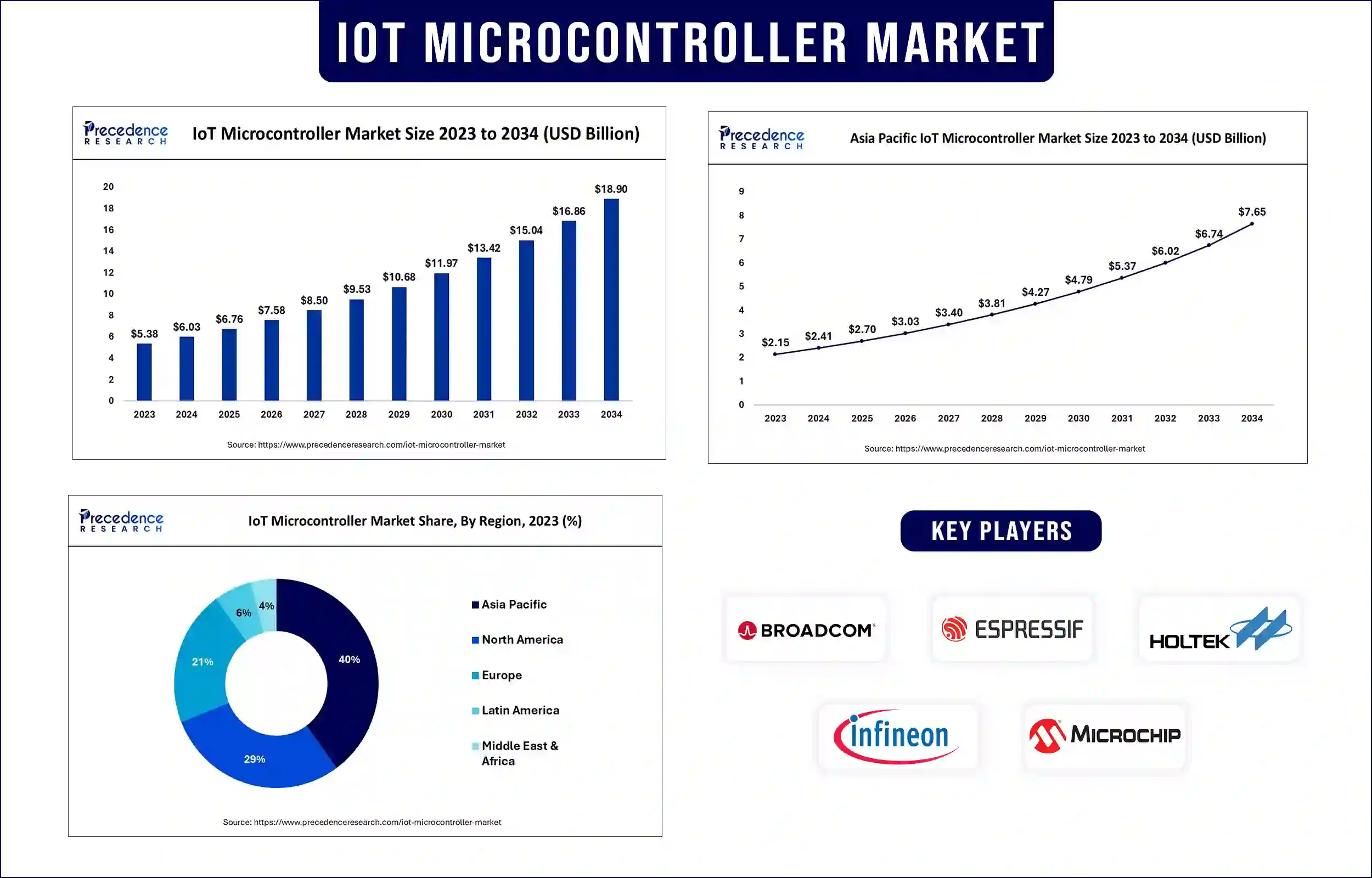

The global IoT microcontroller market revenue was valued at USD 6.03 billion in 2024 and is expected to attain around USD 16.86 billion by 2033, growing at a CAGR of 12.1% during forecast period. The demand for IoT microcontrollers is rising due to the increasing adoption of IoT devices in various industrial applications. The growing awareness among people regarding the importance of saving energy has shifted their focus toward energy-efficient electronic devices, which has further led to innovations in IoT microcontrollers, which are likely to fuel the market in the coming years.

Market Overview

An embedded system's microcontroller is a small integrated circuit that controls a single process. On a single chip, a typical microcontroller has a CPU, memory, and input/output (I/O) peripherals. The IoT microcontroller market is estimated to reach $13.03 Bn by 2030.

Because of advances in communications, microelectronics, and information technology, the idea of the Internet of Things (IoT) has been widely applied in a variety of industries, including smart homes, smart cities, automation, consumer electronics, and more. To provide computational capability, microcontrollers or MCUs are frequently utilized on the Internet of Things (IoT) and smart devices.

Wide-ranging IoT applications, including industrial automation, smart appliances, smart grids, and smart cities, are expected to considerably drive the market throughout the projection period. Additionally, the growing acceptance of wearable technology is anticipated to increase market size during the forecast period due to the rising popularity of fitness apps and growing awareness of physical fitness in emerging nations like India, China, and Japan.

Report Highlights

- On the basis of product, the 32 bit segment led the market in 2023 and is expected to make the largest contribution to the IoT microcontroller market in the coming years. The most versatile MCU for Internet of Things applications is 32-bit. It is widely utilized in industrial applications, including factory automation and building automation, processes many peripherals effectively, and is also reasonably priced. These microcontrollers are faster than others because they have the ability to handle arithmetic operations on 32-bit numbers. Because of their broader data bus, they can run functions in fewer instruction cycles. As a result, businesses have been launching 32-bit microcontrollers due to the increasing IoT requirements everywhere.

- The 8 bit segment is projected to be the fastest growing throughout the projection period. 8-bit MCUs are widely used in connected and wearable devices, and the rising adoption of smart wearables significantly boosts the segment.

- On the basis of application, the highest CAGR is projected for the smart homes segment during the forecasted period. Appliances found in the home are included in the smart home category. The demand for safe, secure, and energy-efficient appliances like HVAC and energy management, lighting, and infotainment appliances is increasing due to the advancements in app-controlled smart devices. This trend is anticipated to support the smart home segment’s growth in the coming years.

IoT Microcontroller Market Trends

- Increasing focus on energy efficiency: Over time, the shift toward energy efficiency has increased. Thus, consumers are increasingly demanding batteries that run for longer durations without consuming much energy. Many companies have begun designing microcontrollers that consume less power and have features like sleep modes and power management systems.

- Integration of improved security features into IoT microcontrollers: The increasing number of cybersecurity cases has led to the integration of enhanced security features into IoT microcontrollers to prevent cyber-attacks. Features like tamper detection, hardware-based encryption, and others are being integrated into the IoT microcontrollers while revolutionizing various industries, including healthcare and finance.

- Technological advancements: Advancements in technologies led to the development of IoT technologies. Advanced technologies open the doors for developing innovative sensors and dependable mobile communication, making further development conceivable in the upcoming years. Sensor technology, which is included in IoT devices, will continue to become increasingly affordable, sophisticated, and accessible. This accessibility and affordability will make new sensor applications, such as extensive monitoring and detection, possible.

Regional Insights

Asia Pacific dominated the IoT microcontroller market and is projected to continue its dominance throughout the forecast period. China, India, and Japan together accounted for more than 50% of the market share, which is the main reason behind the region’s dominance. With the growing industrialization in these countries, there is a high demand for smart devices to facilitate industrial automation. In addition to this, rising government efforts and investments in smart city projects further contribute to regional market growth.

IoT Microcontroller Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 6.03 Billion |

| Market Revenue by 2033 | USD 16.86 Billion |

| CAGR | 12.1% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In May 2024, Mindgrove Technologies, an Indian fabless semiconductor design startup, unveiled India’s first commercial high-performance SoC.

- In April 2024, STMicroelectronics, a global high-tech semiconductor manufacturing corporation, introduced its latest microcontrollers to intensify the energy efficiency in electronics.

Segments covered in the report

By Product

- 8 Bit

- 16 Bit

- 32 Bit

By Application

- Industrial Automation

- Smart Homes

- Consumer Electronics

- Smartphones

- Wearables

- Others

- Others (Smart Utility, Smart Transportation& Logistics, Smart Retail, and other enterprise application)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2088

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344