Knee Replacement Prosthesis Market 2025 Advances with Digital Orthopedics, Robotics and Smart Knee Implants

Knee Replacement Prosthesis Market Size, Trends, Shares and Top Key Players

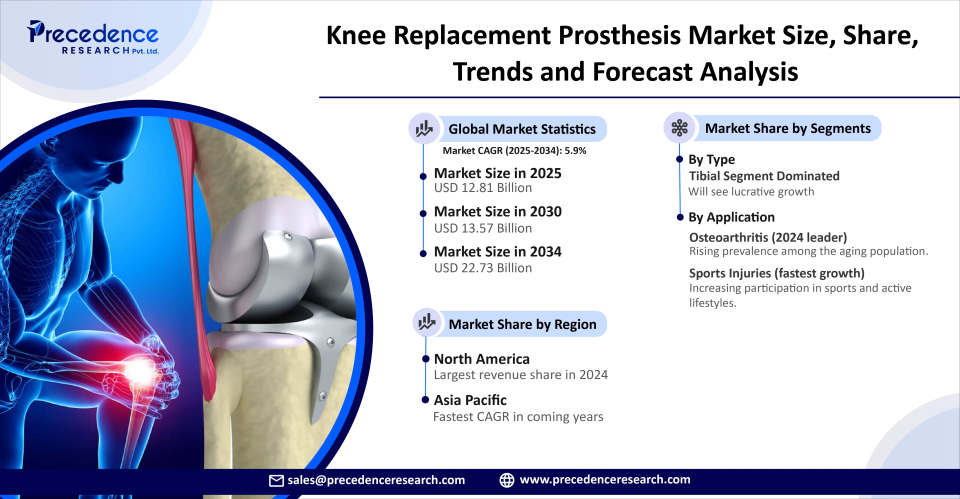

The global knee replacement prosthesis market size was estimated at USD 12.81 billion in 2024 and is anticipated to reach around USD 22.73 billion by 2034, growing at a CAGR of 5.9% from 2025 to 2034. The rising need for knee replacement surgery and related prosthesis is due to different health conditions among adults, like osteoarthritis, rheumatoid arthritis, and post-traumatic arthritis.

Global Outlook

The knee replacement prosthesis market revolves around the applications of a medical device called a prosthesis which aids in the replacement of any missing part of the human body or the regulation of better functioning of body parts. Knee joint replacement surgery uses a metal prosthetic device to replace cartilage and bone which are damaged due to aging and disease. In November 2024, Zimmer Biomet announced the approval from the U.S. Food and Drug Administration (FDA) for an Oxford cementless partial knee implant in the U.S. that will allow surgeons to perform partial knee replacement with improved efficiency and fixation in the operating room with a longer-term survival rate of implant than Oxford Cemented Partial Knee procedure. In April 2025, a London-based start-up called OSSTEC, a developer of regenerative orthopedic implants and expertise in 3D-printed partial knee replacements, raised £2.5m to introduce new 3D printed joint replacement technology.

Market Opportunity

According to UT Southwestern Medical Center researchers and their recent research study conducted in May 2024, robotic total knee replacement proves to improve treatment outcomes but costs more to patients. Total knee replacements are performed using a surgical robot to achieve better outcomes than similar surgeries performed. With the rising aged population, there will be a significant demand for effective and safe total knee replacement surgery, which is also known as total knee arthroscopy.

- In March 2025, Eventum Orthopedics secured £3.8 million to advance successful knee replacement surgeries.

Key Growth Factors

- The most significant advancements are materials like highly cross-linked polyethylene for hip and knee replacement bearing surfaces and the new approaches for total knee replacement surgeries.

- The huge adoption of digital technology and the insertion of robotics favor more accurate execution of surgical techniques.

- The improvements in materials, surgical approaches, and medical techniques are beneficial for hip and knee replacement.

Market Restraint

The common problems faced by some patients after knee replacement surgery are pain, infection, blood clots, implant loosening, clicking sound, nerve damage, and stiffness. There is a need for pain-relief medicines and nonmedical treatments like aromatherapy activity, back rub or massage, showers, breathing, relaxation, changes to the patient’s environment, the use of an ice pack or frozen gel pack, and some other remedies. These factors can add more challenges in front of patients to access, afford, and adapt to new solutions and services.

Segmental Outlook

Type Insights

The tibial component segment dominates the knee replacement prosthesis market in 2024, owing to the numerous benefits of tibial component, knee replacement prosthesis, and related surgery to enhance joint fixation, prevent loosening of implants, and manage the mobility needs of patients. These components can fix damaged bone and cartilage and serve as smooth articulating surfaces. They potentially restore joint function and provide stability to patients.

Application Insights

The osteoarthritis segment dominated the market in 2024 due to several advantages of knee replacement surgery and prosthesis for people suffering from osteoarthritis condition in achieving pain relief and improved mobility. The advanced joint replacement techniques offer long-term effectiveness and enhance the quality of the patient’s life. Patients receiving these treatments do not need to depend on pain medications due to the potential correction of their knee deformities.

The sports injuries segment is expected to grow at the fastest CAGR in the knee replacement prosthesis market during the forecast period owing to the significant role of joint replacement surgery and medical devices in driving pain relief for sports people and improving knee function stability. These advanced medical technologies hold the potential to enhance the sports performance of athletes or athletes. Advanced implants meet the athletic demands, offer better durability while robotic knee replacement results in faster recovery of sports injuries.

Geographical Outlook

North America

North America dominated the knee replacement prosthesis market owing to the high prevalence of osteoarthritis and large geriatric population. Furthermore, advanced healthcare infrastructure, favorable reimbursement policies, and technological advancements are also driving the regional market’s expansion. Norton Healthcare, situated in Louisville, Kentucky, U.S. makes efforts to explore innovative knee replacement solutions that enhance precision and recovery. Advanced technology is transforming joint surgery for better treatment outcomes. These advancements include robotic assisted surgery, 3D printed custom implants, smart knee implants, augmented reality, and more outpatient surgeries. According to the American College of Surgeons, robotics helps improve the precision and personalization of knee replacement surgery.

In March 2025, Johnson & Johnson MedTech introduced its recent advancements in digital orthopedics at the annual meeting of the American Academy of Orthopedic Surgeons in San Diego, California. These advancements by J&J include data-driven technologies, advanced techniques, and cutting-edge implants across orthopedic specialties.

The U.S.

According to the UC Davis Health orthopedic surgeon named Cassandra Lee, a professor of orthopedic surgery and chief of the Division of Sports Medicine in the U.S., the use of CartiHeal™ Agili-C™ Cartilage Repair Implant assists surgeons to repair knee cartilage and cure knee pain after an injury. In May 2025, a London-based start-up named OSSTEC attracted £2.5 million in funding to develop 3D printing technology that will allow bone fixation and reduce the risk of implant failure.

Asia Pacific

Asia Pacific is expected to emerge at the fastest CAGR in the knee replacement prosthesis market during the forecast period of 2025 to 2034, due to favorable medical policies and healthcare facilities across this region. Ayushmann Bharat Pradhan Mantri Jan Arogya Yojana stands as the largest health insurance scheme in the world provided by the government in terms of coverage. It also provides knee replacement surgery along with benefits such as no out-of-pocket expenses, cashless and paperless treatment, and high-quality care through accredited providers. In August 2025, the Asia Pacific Arthroplasty Society held a meeting that united knee and hip surgeons from across the Asia-Pacific region, including Australia, Malaysia, India, Singapore, and more.

Strategic Moves by Key Players

- In February 2024, Stryker Corporation planned to introduce new joint replacement technology and improvements to its Mako surgical robotic platform by displaying new advancements like Triathlon Hinge and myMako at the annual meeting of the American Academy of Orthopedic Surgeons (AAOS) in San Francisco.

- In March 2025, Smith+Nephew presented its advanced orthopedic reconstruction technologies for knees, hips, robotics, and shoulders at the annual meeting of the American Academy of Orthopedic Surgeons (AAOS).

Knee Replacement Prosthesis Market Companies

- Stryker Corporation

- Zimmer Biomet

- Johnson & Johnson

- Smith+Nephew

- MicroPort Scientific Corporation

- Medacta International

- ConforMIS

- B. Braun Melsungen AG

- Corin Group

- Exactech, Inc.

Segments Covered in the Report

By Type

- Tibial Component

- Femoral Component

- Patella Component

By Application

- Osteoarthritis

- Sports Injuries

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait