Laboratory Information Management System Market Size, Growth, Report 2033

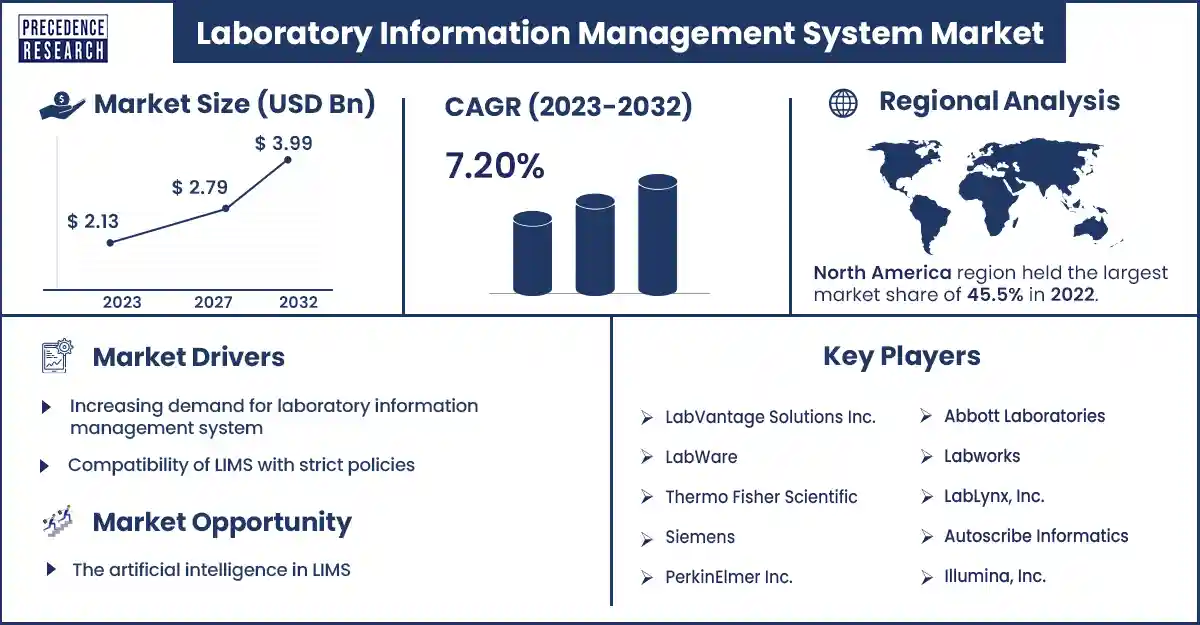

The global laboratory information management system market size surpassed USD 2.13 billion in 2023 and is estimated to attain around USD 3.99 billion by 2032, growing at a CAGR of 7.20% from 2023 to 2032. Technological developments relevant to pharmaceutical laboratories fuel the laboratory information management system market.

Market Overview

The laboratory information management system market deals with industry segments encompassing the implementation, sale, and development of software solutions designed to streamline and manage data management processes and laboratory operations. LIMS provides enhanced regulatory compliance, improved data management, and streamlined workflows, aligning with the developing needs of modern laboratories.

The laboratory information management system is specifically customized to fulfill the needs of laboratories across various industries such as food and beverages, environmental sciences, biotechnology, pharmaceuticals, healthcare, and others. The Maximizing efficiencies and increasing global emphasis on improving laboratory operations are driving the demand for the LIMS market. The increasing demand for scientific data integration solutions ensures data management and the rising popularity of biobanks has led to the adoption of LIMS, which is also estimated to drive market growth.

The process of optimization and improved collaboration to fuel the growth of the laboratory information management system market.

The provision of data and central collection makes a significant contribution to the optimization of laboratory procedures. The well-organized ways of working in the laboratory are ensured by automating core procedures, including report generation and sample processing, which results in a sustainable increase in productivity.

In addition, they improve collaboration in the laboratory with LIMS. Teams don't have to waste time tracking and searching for information in different systems because they can approach everything in a single system. The laboratory information management system makes sure that all the data about measurements and sample processing will not be lost and is always available. All quality assurance guidelines and quality control are thus met and help with retrieval and data storage. These are the major driving factors of the laboratory information management system market.

However, high maintenance costs for smaller laboratories may restrain the laboratory information management systems market. Sustaining and implementing LIMS often requires significant financial investments for ongoing technical support, hardware infrastructure, and software licenses. The staff training, customization, and regular updates contribute to the maintenance expenditures. These costs may restrain organizations and smaller laboratories with insufficient budgets from limiting market penetration and adopting LIMS. As a result, the grasped financial stress of maintaining laboratory information management system solutions becomes a significant challenge and potentially restraining the growth of the market.

Laboratory Information Management System Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.13 Billion |

| Projected Forecast Revenue by 2032 | USD 3.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.20% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The Laboratory Information Management System Market Top Companies

- LABTRACK

- Clinisys Laboratory Solutions

- USAID

- Ovation

- AssayNet

- CloudLIMS.Com

- Computing Solutions, Inc.

- Illumina, Inc.

- Autoscribe Informatics

- LabLynx, Inc.

- Abbott Laboratories

- PerkinElmer Inc.

- Siemens

- Thermo Fisher Scientific

- LabWare

- LabVantage Solutions Inc.

Recent Development by USAID

- In April 2024, to support citizen security in Belize, the United States Agency for International Development and newly developed industries launched a fully functional laboratory information management system. This was an initiative of the InfoSegura project, which helps organizations in Honduras, Guatemala, EI Salvador, Costa Rica, and Belize.

Recent Development by Clinisys Laboratory Solutions

- In March 2024, to accelerate quality and productivity and to future-proof businesses, Clinisys Laboratory Solutions shared the data model and services architecture for SaaS laboratory information management systems. The launched laboratories are Clinisys Public Health Laboratory and Clinical Toxicology Laboratory.

Regional Insights

North America dominated the laboratory information management system market in 2022. The information among the market key payers and increasing demand for digital management of data is estimated to fuel the market growth in North America. The United States and Canada are the emerging countries in North America.

The best LIMS software has developed rapidly in the U.S. LabWare has 14,000 laboratories in 125 countries, and 98% of consumers in the United States are satisfied with it. LabWare laboratory offers compliance, data integrity, efficiency, and productivity. There are various developed LIMS laboratories in the United States, including SciNote, GenoFAB, Cloud LIMS, Clustermarket, LIMSey, Labguru, Apex LIS, CrelioHealth, Wavefront LIMS, Avalon Laboratory System, WeLIMS and many more. The laboratory information management system is also obliged to certain quality standards, including USA, HIPPA, and various ISO standards. These are major factors, and leading laboratories are estimated to drive the LIMS market growth in the United States.

Asia Pacific is estimated to grow fastest in the forecast period. The increasing number of healthcare sectors, huge population residences, and the large amount of data available from laboratories are estimated to drive the laboratory information management system market growth in the Asia Pacific region. India, China, Japan, and South Korea are the emerging countries in the Asia Pacific.

China is the largest and most developed country in terms of laboratory information management systems. In China, Titian Software, a leading sample management software supplier, has launched three installations for its Mosaic sample management software. China represents a major expansion in LIMS. In China, there is a rising number of LIMS offering CROs.

India is also the second-largest growing country in laboratory information management systems in the Asia Pacific. There are developed and top five LIMS systems in India, including Sufalam Solutions, Attune Lab Information System, CrelioHealth Laboratory management software, LabWare software company, and Apex Healthcare. All the LIMS software systems include various features such as QC data transfer, mobile apps for all stakeholders, billing sample registration, home collection, improved patient experience, results entry, sample management, batch manager, results processing, 3rd party interfaces, and workflow management.

Market Potential and Growth Opportunity

The artificial intelligence in LIMS

AI will revolve around overall management and machines, and it is especially growing in the healthcare industry. Utilizing the power of artificial intelligence will develop laboratory operations by minimizing the demand for manual labor. AI-driven laboratory information management systems will automate routine tasks like analysis and data entry. The LIMS also helps humans to focus on more complicated endeavors. This saves time and also reduces errors connected with manual data entry while enhancing report accuracy and data analysis.

Artificial intelligence can also boost LIMS systems by providing modern analytics capacities like predictive analytics. Moreover, AI helps to provide personalized customer services and offers advanced product suggestions to laboratories. By automating notifications, data analysis, and task routines, artificial intelligence-powered systems optimize efficiency and streamline workflows for laboratory personnel. These are major opportunities estimated to drive the growth of the laboratory information management system market in the coming future.

The Laboratory Information Management System News

- In December 2022, for the flagship laboratory information management system, LabVantage Solutions, Inc. Launched Version 8.8, which features multiple upgrades and advances across all components.

- In January 2024, for the public health sector, STARLIMS launched an advanced laboratory information management system and life sciences. Its launch was the first step towards a wider product roadmap that would help develop the industry of laboratory management in the Public Health Domain.

- In October 2023, the first Scientific Data Cloud was launched by Sapio Sciences for the scientists. This advanced scientific data cloud motivates scientists to capitalize on clinical data, development and research fully.

Market Segmentation

By Product

- Web hosted

- Cloud based

- On premise

By Component

- Software

- Services

By Type

- Broads Based LIMS

- Industry Specific LIMS

By End User

- Life Sciences

- Petrochemical refineries

- Food and beverages

- Chemical industry

- Agricultural industry

- CRO

- Environmental testing laboratory

- Other industries

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2051

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308