Laboratory Information Management Systems Market to Reach USD 4.69 Billion by 2034, Driven by Rising Demand for Operational Efficiency and Regulatory Compliance

Laboratory Information Management Systems Market Size, Trends, Shares and Companies

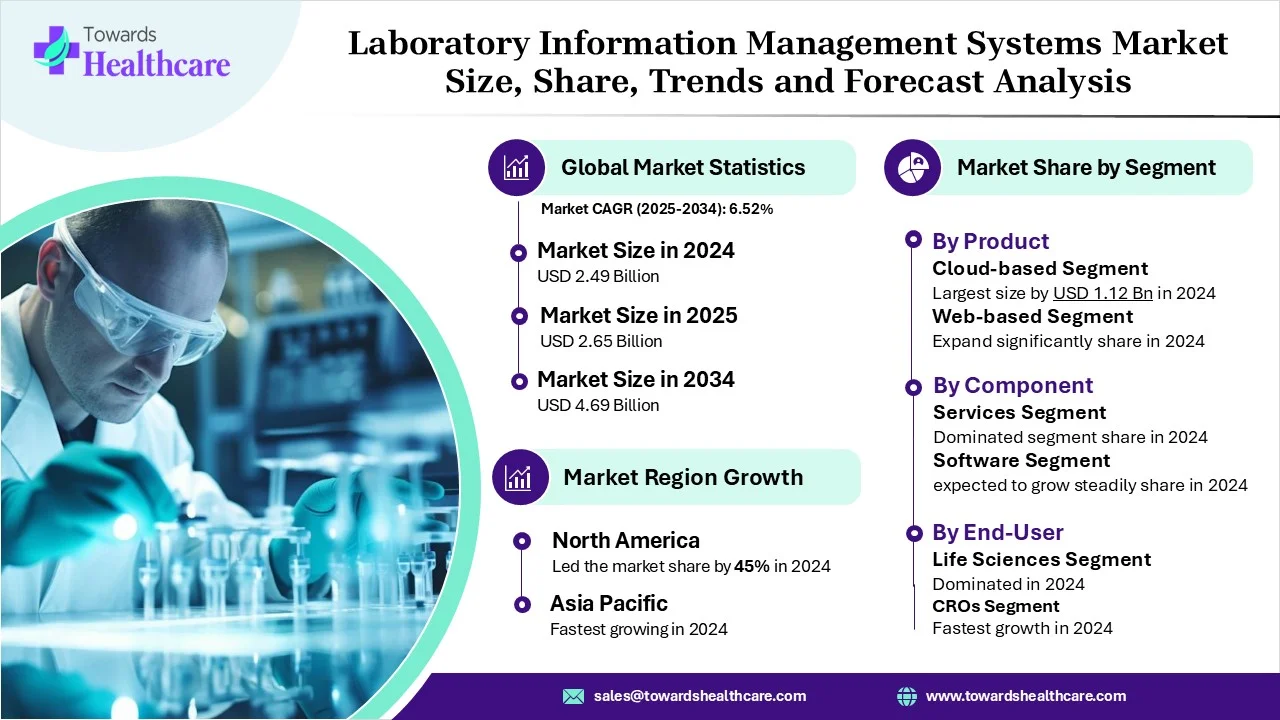

The global laboratory information management systems market size was estimated at USD 2.49 billion in 2024 and is anticipated to reach around USD 4.69 billion by 2034, growing at a CAGR of 6.52% from 2025 to 2034. The laboratory information management system is capable of managing complex data and meets the evolving demand for enhanced operational efficiency and stringent regulatory compliance.

Global Outlook

What are Laboratory Information Management Systems?

The major industrial laboratory workflows require comprehensive and customizable solutions for any kind of laboratory environment. The LIMS can offer excellent features such as data management, accessibility, compliance, security, integration capabilities, scalability, and customization. It provides user-friendly interfaces and displays the best versions. The two popular systems driving the laboratory information management systems market include Healthray LIMS and Bigscal Technologies. They help with advanced data tracking, regulatory compliance tools, user-friendly design, and access on mobile devices. They provide solid support for laboratory workflows through scalability, customization, and resource optimization.

Market Opportunity

What is the Potential of the Market?

LIMS users have access to various support options, including customer service, online documentation, tutorials, and a user forum. The LIMS is mobile-enabled, allowing users to access data and their workflows using smartphones and tablets. This approach is convenient for remotely working people within the laboratory environment or within remote locations. Users who are expanding the laboratory information management systems market can know the benefits and disadvantages of systems due to free trials or demos provided by LIMS vendors. Testing of the system features with team members helps to assess their adaptability in the laboratory’s workflow and requirements.

Key Growth Factors

- The rapid growth of laboratory automation, adoption of cloud-based LIMS, and integration of AI and machine learning supported the expansion of the market.

- The growing life sciences sector, increased outsourcing, digitalization, and stringent regulatory compliance are also the major driving forces in the market.

Market Restraint

What are the Challenges in the Market?

The major challenges in the laboratory information management systems market are associated with interoperability, based on which a modern LIMS must be able to connect with many other systems. Disorganized, incomplete, and inconsistent laboratory data can result in failure of AI projects. AI models produce unreliable results without standardized data collection processes.

Segmental Outlook

How does the Cloud-based Segment Dominate the Market in 2024?

The cloud-based segment dominated the market in 2024, owing to the utilization of cloud infrastructure to provide cost-efficiency, flexibility, and scalability. They offer scalable pricing, predictable costs, and reduced upfront costs. They support accessibility and collaborations through remote access, enhanced collaboration, and centralized data.

The web-based segment is expected to grow at the fastest CAGR in the laboratory information management systems market during the forecast period due to the strong position of LIMS as an integrated and scalable platform. It provides mobile-friendly operations, remote access, and real-time collaborations. It streamlines workflows, allows AI and ML integration, and improves efficiency and automation.

What made Services the Dominant Segment in the Market in 2024?

The services segment dominated the market in 2024, owing to the assistance of various services in the form of expertise, support, and advanced functionality. The cloud-based and SaaS services manage infrastructure, enable faster deployment, and achieve scalability. They provide operational and workflow support through user training, mentorship, enhanced compliance, and security.

The software segment is estimated to grow at the fastest rate in the laboratory information management systems market during the predicted timeframe due to the rising trends of seamless integration, advanced analytics, and automation. The software systems help in automated data collection, robotics integration, automation, and workflow optimization. They manage data and maintain security with the help of advanced analytics and a centralized data repository.

How did the Life Sciences Segment Dominate the Market in 2024?

The life sciences segment dominated the market in 2024, owing to the increased shift towards cloud-based and SaaS models, driving digital transformation and interoperability. The various laboratories in the life sciences sector are outsourcing the management and optimization of their LIMS to service providers. These services allow laboratories to focus on their core competencies and minimize downtime.

The contract research organization segment is anticipated to grow at a notable rate in the laboratory information management systems market during the upcoming period due to the emerging demand for inventory and resource management, and achieve increased productivity. The LIMS improves collaboration with clients by facilitating real-time access, reporting, enhanced communication, and tailored solutions. The LIMS platforms help CROs with robust security measures such as user authentication, encryption, and role-based access controls.

Geographical Outlook

North America

How does North America Dominate the Market in 2024?

North America dominated the laboratory information management systems market in 2024, owing to increased R&D investments, activities, integration of advanced technologies, digital transformation, and cloud adoption. This regional growth is attributed to the immense growth of pharmaceutical and biotechnology companies and the expansion of clinical research. The government laboratories make efforts to upgrade existing systems or are involved in informatics initiatives. The various federal laboratories and agencies focused on upgrading their own laboratory systems. The government institutions are notable supporters of purchasing LIMS solutions for their own workflow through direct tenders. The government's efforts focus on upgrading national laboratories and new strategic plans for data science at the National Institutes of Health (NIH).

U.S. Market Trends

The Department of Homeland Security (DHS) and the Environmental Protection Agency (EPA) Region 7 are some of the federal agencies that pursue upgrades in LIMS. Certain commercial LIMS initiatives for government laboratories are driven by government and public-sector clients. These projects include STARLIMS LPH 1.0, Xybion LIMS 10.0, LabVantage 8.9, and Scispot's LIMS for Government, which facilitate secure collaboration, optimized resource management, and compliance.

Asia Pacific

What is the Potential of the Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the laboratory information management systems market during the forecast period due to digital transformation in healthcare, investments in life sciences and R&D, and the expansion of contract research organizations. Asian Pacific countries like India are actively engaged in digital health initiatives that impact the adoption of LIMS. The governments launch several programs to advance digital healthcare, which promote the utilization of LIMS technology.

India Market Trends

The Digital India program and the Digital Healthcare Blueprint are supported by government investments that have advanced digital health infrastructure. Certain schemes launched by the Indian government aim to establish an online platform to make healthcare data accessible and interoperable.

Strategic Moves by Key Players

- In March 2025, LabWare displayed the future of laboratory informatics with the expansion of SaaS LIMS. It has expanded the adoption, scaling, and optimization efforts for informatics systems while ensuring efficiency, compliance, and accessibility.

- In February 2024, LabVantage announced the growth of its professional services organization by more than 80% in three years and its expansion globally.

Top Companies in the Market

- Thermo Fisher Scientific Inc.

- LabWare

- LabVantage

- Abbott Informatics

- Agilent Technologies

- Autoscribe Informatics

- Genemod Corporation

- Benchling

- Creliant Software Private Limited

- Scispot

- LabCollector LIMS

Segments covered in the report

By Product

- Cloud-based

- Web-based

- On-premise

By Component

- Software

- Services

By End-use

- Life Sciences

- Contract Research Organization (CRO)

- Petrochemical Refineries & Oil and Gas Industry

- Chemical Industry

- Food and Beverage & Agriculture Industries

- Environmental Testing Laboratories

- Other Industries (Forensics and Metal & Mining Laboratories)

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: https://www.towardshealthcare.com/insights/laboratory-information-management-systems-market-sizing