Linerless Labels Companies | Forecast by 2034

Linerless Labels Market Growth, Trends and Report Highlights

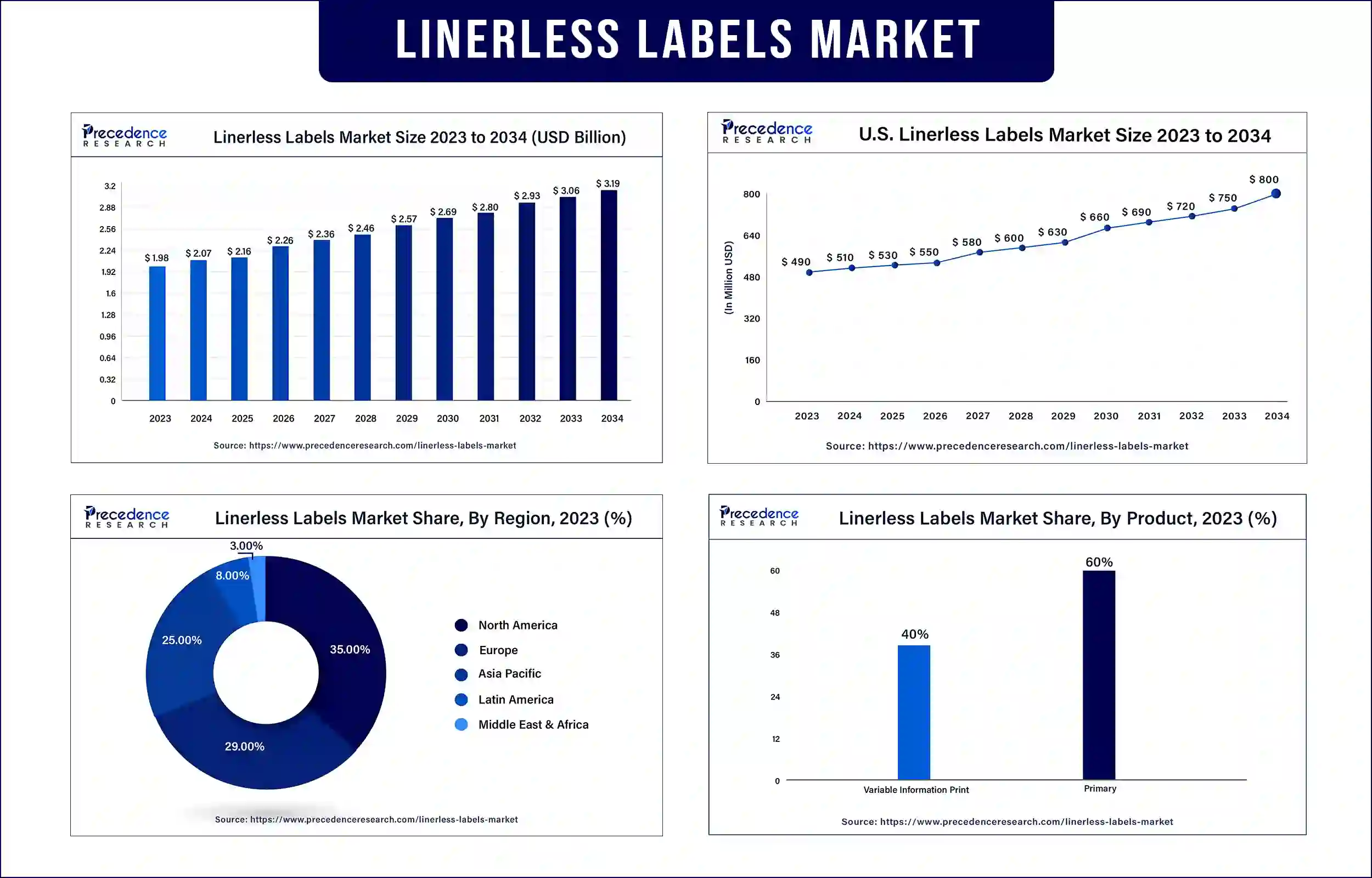

The global linerless labels market size reached USD 1.98 billion in 2023 and is estimated to surpass USD 3.19 billion by 2034, at a CAGR of 4.42% from 2024 to 2034. The benefits of linerless labels include lower shipping costs, high customization, improved manufacturing and productivity efficiency, saved transportation and storage costs, etc., driving the growth of the market.

Market Overview

The linerless labels market refers to buyers and sellers of linerless labels, also called liner-free labels, which are labels that do not have a liner or backing paper. The advantages of linerless labels include eliminating the print headwear, reducing warehousing and transportation costs, eliminating label surface material costs, no backing papers costs, achieving emission reduction and energy saving, saving 30 percent of raw material costs, reducing storage and logistics costs, highly customizable, enhanced manufacturing and productivity efficiency, etc. contributing to the growth of the market.

Linerless Labels Market Trends

- Enhanced operational efficiency: Enhanced operational efficiency includes improved manufacturing and productivity efficiency by reducing waste and landfill use.

- Linerless labels eliminate the liner material costs: Linerless labels eliminate the liner material costs, and they can save 30 percent of raw material costs, which helps the growth of the market.

Advanced technologies driving the market

The advanced technologies use in the linerless labels help the growth of the linerless labels market. Many advanced technology improvements have enhanced their manufacturing process and performance. A few of their advancements include improved end-use performance, eliminated production costs, and increased customization. Advanced technology innovations like IoT (Internet of Things) and AI (Artificial Intelligence) are improving operational efficiencies, reshaping industrial landscapes, and promoting new income streams.

- In January 2024, a new decorative linerless technology named- ‘AD LinerSave Technology’ as the first step in a bid to transform the pressure-sensitive prime labels market was launched by Avery Dennison at Labelexpo Europe 2023.

However, the disadvantages of linerless labels include limited shapes, having to spend many thousand dollars to purchase one, requiring a special printer, etc., which can hamper the growth of the market.

Top Companies in the Linerless Labels Market

- ProMark Label Solutions

- ITW Textpack

- Label Traxx

- SATO Europe

- Lintec Corporation

- Ritrama S.p.A

- NAStar, Inc.

- Skanem AS

- Reflex Labels Ltd.

- Hubergroup Print Solutions

- Lecta Group

- Hub Labels

- Multi-color Corporation

- Avery Dennison Corporation

- R.R. Donnelley & Sons Company

- RAVENWOOD

- CCL Industries

- 3M

- Coveris

- Optimum Group

- UPM Global

- Gipako UAB

Recent Development in the Linerless Labels Market by Lecta Group

| Company Name | Lecta Group |

| Headquarters | Spain |

| Development | In April 2024, a new thermal face stock designed especially for manufacturing linerless labels was launched by Lecta Group. By reducing traditional liner, linerless labels show an important opportunity for improving waste reduction in the labeling industry. This design of Ineris-certified phenol-free top-coated face stock is specifically suited for variable printing and barcode applications in retail and logistic sectors, which offer exceptional quality and high resistance. |

Recent Development in the Linerless Labels Market by Hubergroup Print Solutions

| Company Name | Hubergroup Print Solutions |

| Headquarters | Arlington Heights, United States |

| Development | In September 2024, the three new solvent-based ink series was launched by Hubergroup Print Solutions. It was specially customized to the Asian Market needs for Gecko Gold, Gecko Platinum NT, and Gecko Platinum Plus. |

Recent Development in the Linerless Labels Market by RAVENWOOD

| Company Name | RAVENWOOD |

| Headquarters | Bury St Edmunds, Suffolk |

| Development | In September 2024, the ‘industry-first’ linerless flash label solution was launched by RAVENWOOD. They used linerless labels which are designed for high throughput operations and ensured promotional labels which may be used in real-time at the time of the packaging process without slowing the production line. |

Regional Insights

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. India and China are the leading countries for the growth of the linerless labels market. Linerless label demand is increasing in the Asia Pacific region because of the expanding e-commerce and retail sectors. The increasing government initiatives, rapid urbanization, and industrialization help to the market flow. Increasing industrial applications and sustainable energy projects helps in market development.

- In November 2022, a new sustainable and eco-friendly solution for Thermal Linerless Labels was launched by Loparex India at Labelexpo India 2022. The benefits of Thermal Linerless Labels are zero use of release papers, zero disposal of waste, environmentally friendly, etc.

North America dominated the linerless labels market in 2023. The United States is the leading country for the growth of the market in the North American region. The demand for linerless labels is increasing because of sustainability and cost efficiency reasons. Many retail chains are adopting linerless labels for the packaging of products to minimize environmental footprint and reduce waste. The growth of the market includes the increasing needs of many industries, the use of modern printing technologies, and the rising demand for sustainable labeling solutions.

- In August 2022, increasing the capacity for direct thermal linerless label production by nearly 40% as a direct response to consumer demand was announced by a leading provider of marketing, packaging, print, and supply solutions, R.R. Donnelley & Sons Company (RRD).

Linerless Labels Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 2.07 Billion |

| Market Revenue by 2034 | USD 3.19 Billion |

| CAGR | 4.42% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Opportunity and Growth Potential

Rising infrastructure investment and consumer demand

With the rising infrastructure investment and consumer demand, there is an opportunity for the growth of the linerless labels market in the future. Investment in infrastructure is also important in the private and government sectors and is helpful in modernizing the systems. The increasing consumer demand is another factor in the personalized experience. Companies can gain competitive benefits. Globalization helps expand the market, and it allows companies to tap into improving economies.

- In March 2023, a new AD XeroLinr DT, its DT (direct thermal) linerless label portfolio for Variable Information Printing (VIP) was launched by a leader in global materials science and manufacturing, Avery Dennison Corporation.

Linerless Labels Market News

- In August 2023, the first generation of decorative linerless label solutions named ‘AD LinrSave and LinrConver’ which help to reduce carbon footprint and waste was launched by Avery Dennison. Water is used in packaging production. This solution is allowed by patented micro-perforation technology.

- In April 2024, the thermal labels and printers range was launched by the award-winning UK packaging supplier Kite Packaging. The advantages of linerless labels include enhanced safety and health, eliminating slip and trip hazards, using 40% less paper, flexibility in design and signing, etc.

Market Segmentation

By Product

- Primary

- Variable information print

By Printing Ink

- Water Based

- Solvent Based

- UV Curable

- Other

By End-use

- Food

- Beverage

- Home & Personal Care

- Pharmaceuticals

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5059

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344