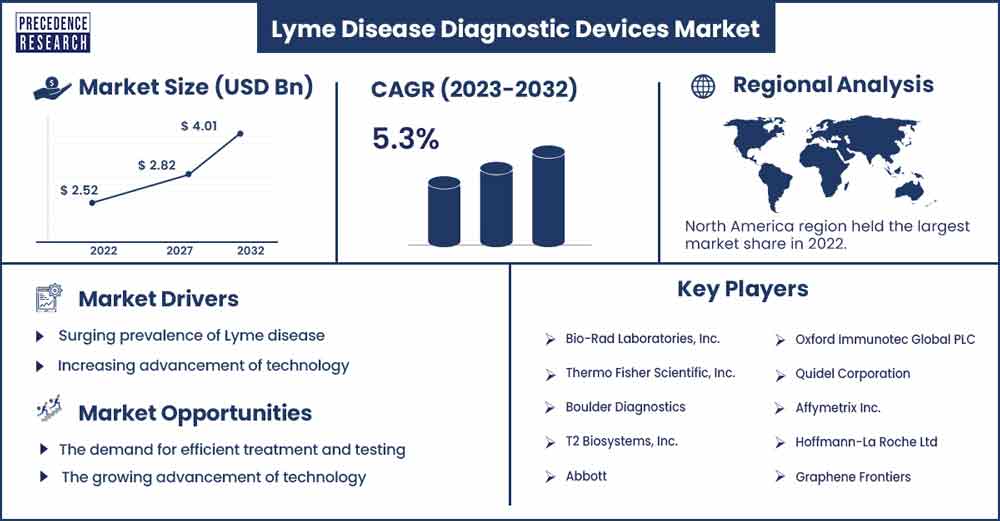

Lyme Disease Diagnostic Devices Market Size To Rise USD 4.01 Bn By 2032

The global lyme disease diagnostic devices market size exceeded USD 2.53 billion in 2023 and is expected to rise to USD 4.01 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

Market Overview

Caused by the bacterium Borrelia burgdorferi, Lyme disease is a vector-borne illness primarily transmitted through the bite of infected black-legged ticks. According to Centres for Disease Control and Prevention (CDC), nearly 30,000 confirmed cases of Lyme disease have been reported in recent years. With an increasing incidence globally, accurate and timely diagnosis is crucial for effective management and treatment. The Lyme disease diagnostic devices market has witnessed significant advancements in recent years, reflecting the growing need for improved diagnostics.

Growing prevalence of lyme disease, particularly in high tick population regions. According to the report published by the National Library of Medicine in November 2023, nearly 40 out of 100,000 people had Lyme disease in the United States alone. There is an increasing demand for efficient diagnostic tools owing to the rising prevalence of lyme disease. Various diagnostic methods are used for lyme disease, including serological, nucleic acid, and culture tests. These tests may detect antibodies produced by the body in response to the infection or the presence of the bacterium itself.

Regional Analysis

North American region is anticipated to hold the most prominent share during the forecast period. The growth of the region is attributed to the surging prevalence of tick-borne diseases and rising initiatives by the government and institutes towards the diagnosis of lyme disease. Growing healthcare infrastructure, along with increasing spending, is expected to fuel the growth of the market. Moreover, an increasing number of manufacturers have expanded diagnostics of lyme disease by detecting microorganisms. The market for lyme disease diagnostics in North America is growing because of these technical developments. Metabolic biomarkers and biosignatures are being found and characterised to enhance diagnosis. Each of these technologies advances the development of therapeutics, which further propels this market's growth in the North American region.

- In July 2022, the United States Food and Drug Administration authorised T2Biosystems, T2Lyme Panel. The T2Lyme Panel is intended to diagnose Lyme disease more accurately in the early stages, perhaps resulting in better patient outcomes and improved management. Using a patient's blood, the T2Lyme Panel detects the microorganisms that cause Lyme disease.

Lyme Disease Diagnostic Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.53 Billion |

| Projected Forecast Revenue by 2032 | USD 4.01 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.3% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surging prevalence of Lyme disease

According to the Centres for Disease control and prevention (CDC), over 30,000 cases of Lyme disease have been reported each year. The cases of Lyme disease are likely to be ten times higher. Most cases of the disease are concentrated in New England. Moreover, the cases of the disease are also spreading over Canada. Growing awareness regarding the spread of tick disease and the need for early detection and treatment is expected to drive the market's growth.

Increasing advancement of technology

Modern diagnostic tools have been developed recently to improve the speed and accuracy of Lyme disease identification. Due to its capacity to identify the genetic makeup of the bacteria that cause Lyme disease, molecular diagnostics—such as PCR and NAATs—have grown in popularity. Moreover, the demand for point-of-care testing has risen significantly, enabling healthcare professionals to diagnose Lyme disease rapidly in diverse settings. POCT devices offer quick results, allowing for immediate intervention and treatment. This is particularly important in regions with high incidences of lyme disease, where a timely diagnosis can prevent the progression of the illness.

Restraints

Lack of awareness

Most of the population is still unaware of the symptoms of lyme disease, which is one of the major factors restraining the growth of the market. Moreover, limited investors are available to create diagnostic technologies for identifying lyme disease. Many of the symptoms, including headache, dizziness, and joint/body pain, are found in other disorders. This makes it challenging to detect lyme illness, further limiting the market growth. Healthcare professionals and the general public may not be sufficiently informed about the prevalence of lyme disease, leading to underutilization of diagnostic tools.

High cost

Lyme disease diagnostic tests are relatively expensive, particularly the more accurate and specialized ones. The primary diagnostic method for lyme disease is a two-tiered serologic testing approach, which involves an initial enzyme immunoassay (EIA) followed by a western blot if the EIA is positive or equivocal. These tests are designed to detect antibodies produced by the body in response to the bacterium Borrelia burgdorferi, which causes lyme disease.

Opportunities

Government initiatives

The cases of lyme disease have been significantly increasing, thus propelling demand for diagnostic devices. The governments of various economies and healthcare organizations increasingly focus on developing advanced diagnostic technologies. Many manufacturers are developing products that align with the goals of public health initiatives, which is further expected to create opportunities for market growth. Furthermore, the government is also focusing on early diagnosis and treatment of Lyme disease.

Point-of-care testing

Surging cases of lyme illness are driving the demand for efficient treatment and testing. The growing advancement of technology is pushing manufacturers towards the innovation of efficient diagnosis. The demand for point-of-care testing devices that provide quick and accurate results and assist in early detection and on-time treatment is driving the growth of the industry. Moreover, developing devices that can be used in primary care settings or even at home can be a lucrative opportunity.

Recent Developments

- In April 2022, Valneva and Pfizer released further encouraging phase 2 data for their Lyme disease vaccine candidate, VLA15. With the new findings, Valneva and Pfizer intended to move on with a Phase 3 clinical study that would follow a primary series vaccination schedule of three doses. The study is anticipated to begin in 2022 and assess VLA15 in adults and paediatric participants who are five years of age and older.

- In April 2023, Abbott Laboratories collaborated with the Climate Amplified Disease and Epidemics Consortium to mitigate the impact of climate on the outbreak of the disease.

- In 2022, the United States Fair Health Organization announced that Lyme disease has been a growing national concern due to its substantial development in the country over the past 15 years.

Major Key Players

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Boulder Diagnostics

- T2 Biosystems, Inc.

- Abbott

- Oxford Immunotec Global PLC

- Quidel Corporation

- Affymetrix Inc.

- Hoffmann-La Roche Ltd

- Graphene Frontiers

Market Segmentation

By Product Type

- Serological Test

- Urine Antigen Tests

- Lymphocytic Transformation Test

- Immunofluorescent Staining

- Nucleic acid Test

By End User

- Hospitals

- Public/Private Laboratories

- Physician’s Office

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1183

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308